I am fortunate enough that my 8-5 job offers me a pension, something that is very unique to companies nowadays, but not super uncommon in the oil industry that I work in. Last year, I had a good friend leave the company and he was debating about using a pension withdrawal to fund a down payment on their new home… good idea or not?

Truthfully, at that time I really didn’t have a great grasp on how pensions worked but I knew at a minimum he was going to have to pay tax and I assumed that there was going to be some sort of fees involved, similar to how there are fees if you withdraw your gains from an IRA before the age of 59 ½.

Simply with the understanding that there were going to be fees and tax, I told him that it was a bad decision. And since I wasn’t well-versed on the topic at that time, I said he should talk to his advisor, or even Fidelity who the pension was through, to get their advice as I assumed that he could likely roll it over into a different retirement account to avoid all of those fees and taxes.

But here’s the thing – was my “gut instinct” advice correct? Well, let me first define what a pension is for those that are unaware. Investopedia defines it as “a retirement plan that requires an employer to make contributions to a pool of funds set aside for a worker’s future benefit. The pool of funds is invested on the employee’s behalf, and the earnings on the investments generate income to the worker upon retirement.”

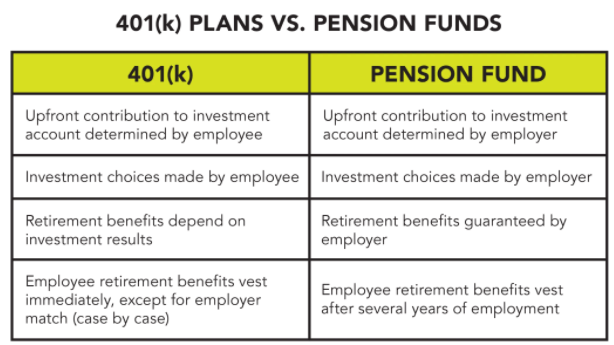

It might sound similar to a matching 401k contribution but there are some major differences between the two as shown in the chart below by ClydeBank Media:

The easiest way to think of it, at least in my eyes, is that your employer is basically giving you a “retention bonus” based on how long you stay with the company. The amount that you get is based off your salary and doesn’t require you to contribute anything, but the longer that you stay with the company and the more you make, the more that they will pay you when you terminate employment.

When you do decide to terminate employment, if you’re of the proper age you can then withdrawal that pension as a lump sum or take monthly payments, as shown below by The Balance Careers:

Now, the benefit obviously is that you’re getting this money basically for free. You’re not having to contribute anything at all to earn it, but there is the downside that you cannot pick your investments at all and it’s automatically invested for you. While that is a con, it’s not nearly a con as not getting free money!

So now that you understand the basics of the pension, it’s important to note that I said you can only withdrawal these funds once you reach the proper age. For a lot of pensions, that age is 55, but some will not be able to be withdrawn on until age 65.

But once you reach your age limit, you basically have two different options to withdraw from your pension – via a lump sum or a monthly payment. Chances are, your pension provider is going to make this information very easy to find, but if not, I highly recommend you reach out to them throughout this decision-making process.

For instance, my pension is with Fidelity and they provide me two different numbers – one is if I started taking the money at age 65 (based on the age I inputted) and then the other would be if I took the lump sum.

They provide me with various calculators so I can go through and make the decision on my own, but I know that it’s something that a lot of people struggle with.

Personally, I think it’s a decision that not only comes down to math but also the psychology of knowing yourself – something that’s extremely important throughout your entire investing journey.

If you’re the type that would take the lump sum and use it to buy a fancy new car, nice golf membership, and some extravagant vacations, then was that a wise decision?

Maybe…maybe not. I would say that it heavily depends on the rest of your investment portfolio. If you’re in a very stable spot and don’t need the pension money to fund your life then sure, use it as you please.

But if the pension funds still don’t get you to your retirement number then maybe you need to think twice about taking the lump sum. Maybe instead take the monthly payments knowing that you’re likely going to use that for reoccurring monthly expenses rather than blowing it all at once and having nothing to show for it.

One very important thing to remember is that the money that is in your pension is going to be pretax dollars so you’re going to pay taxes when you collect your pension.

Your $2000/month might end up only being $1500 after all is said and done and you’ve paid the tax man. Sure, that’s still better than nothing, but again this is imperative for you to remember when you’re doing your financial planning.

Some pensions are actually able to have the first 25% of them taken tax-free, so again, this is something that I would absolutely talk to your pension provider about.

Now believe it or not, there are actually 14 states that won’t tax your pension at all when you withdraw your funds, per Kiplinger. The following states are included in this list:

- Alabama

- Alaska

- Florida

- Hawaii

- Illinois

- Mississippi

- Nevada

- New Hampshire

- Pennsylvania

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Do you know what all of these states have in common? I would never want to live there!

Kidding! Tennessee actually doesn’t sound good. It has that perfect blend of mild winters and not blazing hot summers! But I digress.

If you know anything about me, I am all about doing literally every single thing possible to try to decrease my tax bill, especially when it comes to my retirement investments. The last thing that I want to do is have taxes uncontrollably skyrocket after I have retired, so anything that I can control to minimize the amount that I have to pay the government and maximize the amount that I can keep, is a great deal for me.

“Andy – you said you were going to talk about the outcome of your friend…so do it!”

RIGHT! I almost forgot.

So, my friend took my #1 piece of advice and he reached out to his pension provider and also his financial advisor, which you should absolutely do if you have one.

But he decided that the option that made the most sense was to transfer his pension into a Traditional IRA. Currently, he had only been investing into a 401k and a Roth IRA, but because the pension had pretax dollars, he wanted to put it in a Traditional IRA to avoid having to pay any taxes on it.

Quick side note – if any of this is confusing, you can take a look here to understand the Roth vs. Traditional discussion a little bit better.

By doing so, it was a super simple transaction. All that he had to do was reach out to the brokerage firm where he was opening the Traditional IRA and they did the rest for him. They contacted the pension provider, which in this case was Fidelity, and they transferred it for him.

I mean – the brokerage where the IRA is will be getting a lot more money to invest – why would they not want to make it easy on you?

Once this was done it was business as usual for him as he could invest it in anyway that he saw fit.

Now, one important thing to note is that a rollover into your IRA does not affect your contribution that year.

For instance, if you were to roll over $20K from your pension into an IRA, you can still contribute up to $6K as that is the maximum contribution amount in 2021. The way that I view it is that those pension funds were already getting a tax-advantage. By moving them from the pension to the IRA, you’re not scheming the system and getting an extra tax-advantage or anything. You’re literally just changing accounts.

Now, I’d be lying if I say that my friend didn’t heavily consider just cashing out his pension. In fact, I reached out to him this week just to get some more details on it and he said he was literally one weak moment away from just cashing it out.

He said that he would’ve had to pay a pretty hefty fee as well as the tax penalty, but he couldn’t recall the exact amount.

NerdWallet says that they have found that if you don’t meet a very specific list of criteria then you can be susceptible to paying up to 55% tax!

How insane is that? Your $40K pension is now worth $18K. Honestly, I can think of very few situations where it would make sense to do this.

However, if you meet one of the following criteria, then you can withdraw your pension without having to pay that massive tax charge.

- You’re in very poor health

- Have a serious medical condition

- You have been given less than 1 year to live

Those are pretty extreme situations and are the only ones that will let you withdraw your pension early without those crazy taxes.

Another major pitfall that some people fall into is that they will go out and hire a company to help them get their pension. In all actuality, all that these companies will do is they will charge you a massive fee of up to 30% just to provide you with the same end-result that you would’ve ended up with regardless.

And worst case, some of these companies are super sketchy and will actually just keep your pension funds and make it nearly impossible for you to recoup them.

Scary, right?

The more that I looked into pensions, the more unanswered questions that I had. The one thing that I really walked away with was somewhat humbling – the need to lean on others with more expertise.

There are a lot of things that I think we all might feel confident in – budgeting, paying off debt, picking investments, or whatever else might fall into your area of expertise. But maybe there’s something that you don’t feel confident in – budgeting, paying off debt, picking investments or something else.

It’s ok to lean on others with more expertise and experience! Personally, for my own situation with my pension, I know that I cannot affect anything. I am going to keep having funds contributed into it whether I like it or not.

And I am not going to be faced with a situation like this for quite some time, so it’s really a moot point for me. So, why spend the excessive amount of brainpower reading and understanding every single minute detail of the pension when there’s literally nothing that I can affect?

I like to think of this as the concept of “paralysis by analysis”. Instead of spending so much time analyzing every single thing possible, think about the things that you truly can control and then go from there.

If you’re close to being in the situation where you need to decide what to do with your pension, call your pension provider and your financial advisor (if you have one). Talk to other coworkers that have had experience with this and might be able to even help you out a little bit before you call in the big guns.

Even if you just talk to your coworker to get a general understanding, that’s going to help you comprehend better and maybe thick of some of those “step 2 questions” that you might not have thought of had your first conversation been with a professional.

Personally, I know that I am many years off from having to understand what to do with my pension, so for the time being, I’m going to focus on more important things that I can actually control like increasing my income and picking great performing stocks!

Related posts:

- Important HSA Rollover Rules: How to Utilize them Efficiently Have you found yourself in a situation where you might need to rollover your HSA? If so, no worries! There are a few HSA rollover...

- Comparing Past Annuity Rates to Interest Rates… Good Investment? If you have been investing for some time then you have likely heard of annuities, and even more likely is that you have likely heard...

- IRA vs 401k, Roth vs Traditional – Retirement Accounts Made Simple You decided to open a 401k. Finally! A smart decision today. But now they want to stump you with some investing jargon. Do you want traditional?...

- I’m Getting a New Job – Will I Lose My 401K from my Previous Employer? Changing jobs can be a scary thing. It’s hard to leave what you know for the potential opportunity, and downside, of the unknown of changing...