The reason that I started writing blogs for the Investing for Beginners Website is because I think that there is a major gap between financial literacy for the common person and the financial goals that the common person might have. A lot of times the answer is to get a financial planner, but I am here to teach you how to do your own personal financial planning.

Hiring a financial advisor might not be a bad option for you as long as you know what to ask and you have the correct expectations going in, but for the average person, you can do your own financial planning just as well and completely for free.

When it comes down to it, achieving financial freedom really comes down to two things – eliminating liabilities and increasing assets. I recently did a chapter review of Rich Dad, Poor Dad where he really focuses on the cash flow pattern of a rich person vs. a poor person and the main concept is that eliminating liabilities and increasing assets is the fastest, most effective, and really the only way to get to financial independence.

The logical next question is “how do I eliminate my liabilities and increase my assets?” Well, it’s simple, honestly, but first I want to focus a bit more high-level.

Personally, I think the most important factor related to success is tracking. It’s that simple. I think that you have to track things if you ever want to get better in anything that you do.

If you want to lose weight, which method do you think will be more effective?

Method 1 – you track everything that you eat, you track all of your workouts, you track your weight on the scale, you track everything.

Method 2 – you don’t track anything. You just “eat healthy”, “work out regularly”, and “feel smaller”

Obviously, the first method is the one that will get you better results. When you’re tracking things, you can easily see what is working and what is not and then readjust your plan as needed to make sure that you’re getting good results.

For instance, maybe when you limit your calories, that makes your weight loss stall. Maybe you need to focus more on carbs instead of calories? Or, your weightlifting is more important than hours of cardio?

The point is, you won’t know this unless you’re tracking everything and continuing to monitor what works and what doesn’t work.

Are you onboard yet? No? Ok, fine – more examples for you!

Ok, so where else does tracking make your performance better?

- Sports – tracking stats can help you learn where your weaknesses are

- Work – Tracking the tasks that you get done at certain hours of the day can show you when you’re most efficient and help you become even more efficient by scheduling time in your day to complete critical tasks

- School – tracking your grades throughout the quarter can help you understand where you’re doing well and where you’re not, therefore letting you focus on your weak spots

A real-life example of school is that when I was in college, my worst GPA for each quarter, every single year, was in the fall. Do you know what else is in the fall? FOOTBALL. I spent all day on Saturday and Sunday, and then every night that games were on, watching as much football as I possibly could.

I knew that it was affecting my studying and my grades. Did I do anything about it? No…but at least I knew about it if I wanted to make a change! Lol.

I say that I didn’t do anything, but I actually did. I made sure not to schedule early morning classes and to try to save my easy classes for the fall.

Was that the most responsible thing for me to do? Absolutely not.

Did it improve my GPA, though? Sure, freaking did!

Work smart, not hard, right?

The point is, by me looking at my performance, I could find a way to become a better student. I didn’t take easier classes, I just shifted them around in my schedule.

I still had the same exact classes, but I chose to have two harder quarters and one really easy one to make sure I could still watch football.

I know that sounds ridiculous, and it’s because it is ridiculous, but tracking this gave me better grades by doing nothing more than simply reorganizing my life.

And of course, the best example of how tracking can help you, is with financial planning!

Step 1 – Decrease Liabilities

Decreasing your liabilities is fancy talk for getting rid of your debt. That means paying off cars, mortgages, student loans, whatever. Now, should you pay off a 3% student loan over investing in the market?

I say no, but that’s a personal choice that you have, but you only have that choice if you’re creating a surplus of income at the end of the month and spending less than you make.

So how do you track that?

BUDGET!

There’s a ton of ways you can budget. In excel, on an app, using the envelope method and pen and paper, or any other way that works for you. The best budget is the one that you’re going to stick to. The one that I stuck to, and have put through the ringer for multiple years, updating and refining it along the way, is a tool that you can now use, too, called Doctor Budget.

Doctor Budget will create your monthly post-audit for you and all that you have to do is input your income, download expenses from your credit card/checking account, and then code them each month simply by saying “oh, I spent $20 at Buffalo Wild Wings – I’ll code that as “Eating Out”).

After you do that, Doctor Budget automatically will update your expenses and track how you’re doing against your plan. And the best part of doing it automatically is that you can get updates as often as you want!

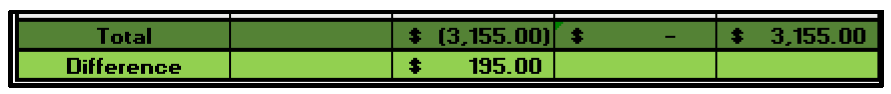

You don’t have to wait until the end of the month to see how you’re doing. You could do it every single day if your heart desired – it’s all about what YOU need. As you can see below, at the end of the month you will have a true-up that shows if you either saved money or overspent, therefore showing if you can put extra money into paying off debt or if your debt burden is getting even deeper!

As you can see in the example above, Doctor Budget will track the difference of your budget and your actual expenses and tell you if you did a good job, or it’s time to pick up that second job…

If you don’t track your expenses and your income, then you’re likely going to end up in debt. I think it’s natural for us to want to spend and live lavishly and easy to get caught up in lifestyle inflation, so if you don’t track your behaviors, then you might create a hurdle that is too large for you to ever jump over.

Step 2 – Increase Assets

You’re probably thinking, “well, a car and a house is an asset…should I buy a second one?” NO!

In my summary of Rich Dad, Poor Dad that focuses on this, Kiyosaki talks about how this is a poor mindset. A house and a car are not an asset unless you’re using it to create wealth. So, a house isn’t an asset because it’s not wealth – it’s your home.

A second house, however, IS an asset IF you’re using it to generate income.

Rental property? Asset.

Family living there for free. Liability.

That simple!

So, what is an asset then? Well, as I mentioned, it’s something that is continuing to create income for you. So, that can be real estate, new businesses, investing, intellectual property, or anything else that’s going to allow you to stack dat ca$h.

The one that I want to key in on more is investing…because, come on, you’re on the Investing for Beginners Website! So, there’s a ton of ways to create assets with various investing tools including an IRA, 401K, brokerage account, 529 for your kids, HSA for your health, and many others.

But just simply investing isn’t necessarily creating an asset…you need to do it well! And how do you do that? You learn, try, TRACK and then adjust your game plan. The key here, as always, is tracking.

I always track ALL of my investments. I have an excel spreadsheet that tracks when I bought the stock, when I sold it, the amounts, the values, and then I can see how my positions have done throughout my entire investing journey. Now, of course, I know that this is really in depth and nerdy, so lucky for you, there are easier ways to do it, too.

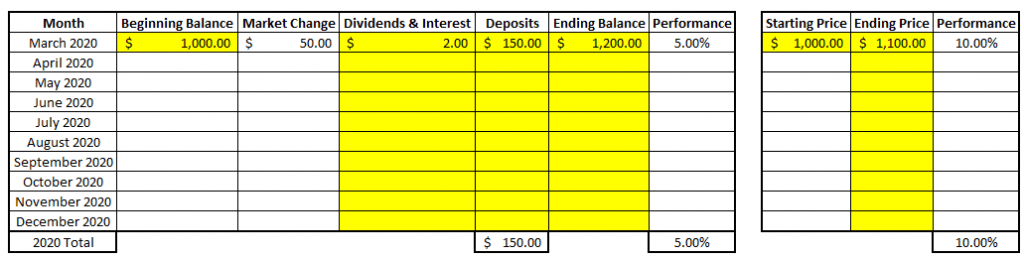

If you don’t want to get into the weeds and track each stock, you can simply track it on your investing platform. I’ve included a simple spreadsheet for you to download if you’d like where all you have to do is input your balances at the end of the month, dividends, and then your monthly deposits into the account to see how you did. In addition to that, the right chart is where you can input the starting/ending price of a benchmark that you want to compare yourself against.

Personally, I like to use the S&P 500 as a benchmark because I think it’s the best overall representation of the market.

In summary, it really comes down to one word – tracking! Sure, it’s great to make a 20% return, but if the market made 25%, then did you actually do well? Nope. You underperformed by 5%, but you would never know that if you weren’t tracking it.

So, now that you hopefully understand how the budget and investing are so important in increasing your assets and declining liabilities, what are you honestly even doing this for? Well, financial independence, right? Of course!

The best way to get to financial independence is to create assets, and I like to track this by creating a Savings Rate Tracker.

The FIRE (Financial Independence, Retire Early) Community often talks about the importance of your Savings Rate and you’ll hear numbers anywhere from 40-70%. While that’s great, there’s also pre-tax and post-tax, which are pretty dang important. If you pay 25% in taxes, then the absolute most that you can save on a pre-tax basis is already down to 75%, right?

My opinion is that it’s dumb to get caught up in the semantics. Find what works for you and then implement that. Again, as I’ve mentioned before, I am a huge numbers and excel nerd, so I track a pre-tax, post-tax and then an average in Excel so I can see a few different looks to make sure that my savings look to be on track so I can retire when I want to retire.

I was thinking about giving you a sneak peak into how I do this in my budget currently but I decided not to…if you buy the Doctor Budget spreadsheet (for a one-time cost of only $29, I might add) then this might be a new addition that will be coming to you soon…?

And of course, all future additions come to you for free!

But at the end of the day, I hope you can see how important tracking is when it comes to personal financial planning. It’s everything!

These are just a few things that I track to make sure my goals are on track. I also track all of my debts and interest rates to make sure I’m paying them down in a timely manner. I also have a Net Worth tracker to watch that number tick up each month (except for this dang coronavirus stock market crash killing some of my investments lol.)

Tracking and personal financial planning come hand in hand – you likely will not be able to have one without the other unless you just make stupid amounts of money and don’t live like that, but let’s be honest, most of us are not like that. You’re on the investing for Beginners website because you’re actively seeking to better your life, so do it.

Two action items from this post to find a new way to start tracking your personal financial planning:

1 – If you’re not tracking your expenses, you HAVE to start there with either Doctor Budget or another tool. It’s a must.

2 – If your expenses are being tracked, start tracking something else, even if small. Maybe it’s investment performance, or savings rate, net worth tracker, or maybe something much simpler like just the amount you’re saving each month. It can be as simple or complex if you want it.

When I write my blog posts, I go in with the goal of getting you to have specific takeaways at the end of the post to implement in your life, so do it.

I will thank you, but that doesn’t matter – your future self and your family will thank you as well, and that means much, much more!

Related posts:

- If You Forget These Personal Budget Categories, Your Budget WILL FAIL! The easiest way to fail on your personal budget is to not plan. That’s it – that’s how to fail. Or, maybe you plan but...

- How to Utilize an Every Dollar Budget to Reach Financial Independence! Before you get too far into this blog post, I just want to let you know that you should buckle up because I am absolutely...

- Apps? Excel? NO – I need a PRINTABLE Budget Planner! Let’s be real – Mint is a great app for budgeting but does it actually help you budget? Personally, I got way more from being...

- 7 Ways to Prioritize Saving with a Budget Calendar Have you ever heard of a budget calendar? Personally, I use one nearly every single day of the week and it saves me a ton...