Few investors have performed as well as Fidelity’s Peter Lynch. If you’re looking for key insights into the Peter Lynch investment strategy, look to his writing. There are few better options than the great book from Lynch himself, entitled Beating the Street.

Inside this bestselling investing classic, Lynch shared what he called his “25 Golden Rules.”

These were a summary to the major lessons and insights he had over his legendary 13 years managing Magellan.

Before we get into some of those, let’s review some quick highlights from Lynch’s illustrious stock picking career:

- $1,000 in the Magellan Fund in 1977 would be worth $28,000 by Peter Lynch’s retirement in 1990.

- In the first year of operation, Lynch’s portfolio had 41 stocks and a turnover rate of 343%.

- By 1983, the portfolio swelled to 900 stocks, though 90% of the portfolio was concentrated in 200 stocks.

- The number of stocks in the Magellan Fund reached as high as 1,400.

- The stock which made the fund the most money was Fannie Mae, a 5% position which quadrupled in 2 years.

- Lynch had many “10 baggers,” a term he coined to describe a stock which reached a 10x multiple of its original value.

Despite Lynch’s diabolic work ethic and massive trading activity, he stresses in Beating the Street that the average investor can indeed do very well. Even those investing part-time can find success by sticking to a few well-known companies, and managing a prudent investment strategy.

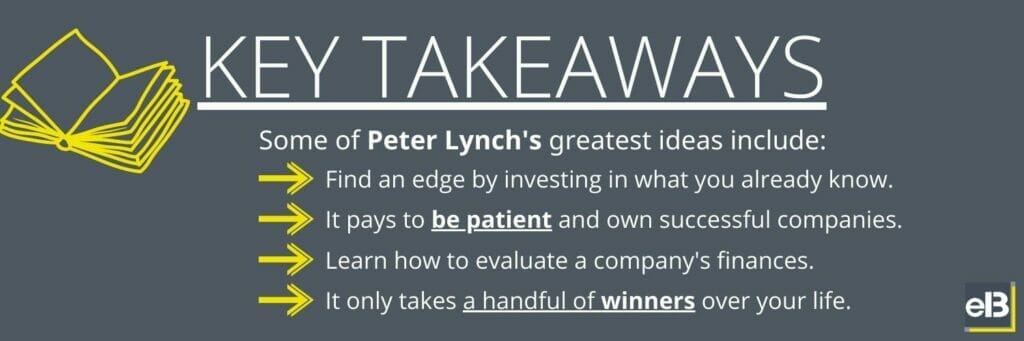

At the end of the book Lynch shares a chapter called “25 Golden Rules.” Let’s look at a few, which can hopefully point you in a direction to learn more and apply it to your own strategy.

- “Your investor’s edge is not something you get from Wall Street. It’s something you already have. You can outperform the experts if you use your edge by investing in companies or industries you already understand.”

This is probably the most central thesis to Peter Lynch’s book. With all of the thousands of businesses on Wall Street, there are bound to be a few where you might have an edge. For whatever reason, you may have more intimate knowledge on a company than the average investor.

Warren Buffett has famously referred to this as a circle of competence. It can come from your own personal work experiences, your interests or passions, or the research you decide to embark on.

What’s great about the stock market is that anybody can play. You can make great returns on your investment whether you investigate stocks for a living, or happen to observe a great business. Either person can make great returns on a business that has all its cylinders clicking.

By staying humble and sticking to what you know, you can do very well for yourself simply by avoiding mistakes of commission. As Buffett’s partner Charlie Munger likes to put it:

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.“

- “Often, there is no correlation between the success of a company’s operations and the success of its stock over a few months or even a few years. In the long term, there is a 100 percent correlation between the success of the company and the success of its stock. This disparity is the key to making money; it pays to be patient, and to own successful companies.”

Wall Street’s loss can be the average investor’s gain. The fact that investors are not bound by performance metrics can give that edge over the average active manager.

Though many people try, no one can reliably guess the direction of individual stocks or even the stock market as a whole.

The best that we can hope for is to partner up with great businesses and let the incredible power of compound interest do its work.

What really makes the stock market great is not that its prices swing so violently up and down. Rather it is that it provides a place for anyone to accumulate part ownership stakes in businesses. These businesses are all working to grow and compound their own earnings.

This becomes most apparent when you zoom out and look at the long term. Most of the time, stock prices eventually catch up with a company’s financial success.

Where you’ll see successful stocks over the long term, you’ll see successful businesses. It’s by owning these companies over the long term that you can increase your chances of steady and compounding returns. That’s how to build sustainable wealth.

- “Never invest in a company without understanding its finances. The biggest losses in stocks come from companies with poor balance sheets. Always look at the balance sheet to see if a company is solvent before you risk your money on it.”

This is a key part of investing that even Lynch admits in his book that can be an obstacle to average investors. Lynch says that if you don’t enjoy learning about businesses, then don’t even think about owning individual stocks. If financial statements bore you to tears, don’t even try picking stocks. Just buy a diversified index fund instead.

Luckily for today’s investor, there are many resources which can teach you how to look at a balance sheet, and what metrics and ratios to learn.

You might be surprised to find out that balance sheets and most accounting are not rocket science. That said, it does take some work to understand how they work.

Yes, you can certainly go super deep into the (endless) weeds with accounting and financial data. I love doing so myself.

But as an average investor looking for compounding returns, a superficial knowledge of how a balance sheet works will get you most of the way there. Understanding the simple definitions of assets, liabilities, and equity will help in identifying strong companies tremendously.

- “If you invest $1,000 in a stock, all you can lose is $1,000, but you stand to gain $10,000 or even $50,000 over time if you’re patient. The average person can concentrate on a few good companies, while the fund manager is forced to diversify. By owning too many stocks, you lose this advantage of concentration. It only takes a handful of big winners to make a lifetime of investing worthwhile.”

I hope you don’t gloss over this statement, because it may be one of the most powerful ideas that you come across along your investment journey.

It comes down to simple math. The difference of -100% losses on the downside and (theoretically) unlimited gains on the upside has a huge impact on return.

What you’ll tend to see over time is a small group of stocks which contribute the vast majority of stock market returns of an index. Read this post about overdiversification for more on this idea.

When trying to “beat the street,” it could take just one or two of these outsized winners to propel your portfolio atop market averages. It’s in these stock picks that you have to be vigilant in leaving them alone. Take a page from Peter Lynch’s book with this video on 10 baggers:

Peter Lynch has another saying which Warren Buffett quoted in one of his annual letters. It’s that selling your best stocks and buying your worst performing ones is like “pulling out the flowers and watering the weeds.” That’s why you need to find a great winning business and just sit on it.

The overactivity on Wall Street tends to greatly hinder long term returns for the perpetrators who do it. And it all goes back to what we stated earlier; the magic of the market is not what you think. It’s not about outsmarting the tickers, but rather being part owner of wonderful businesses that are compounding machines.

- A stock-market decline is as routine as a January blizzard in Colorado. If you’re prepared, it can’t hurt you. A decline is a great opportunity to pick up the bargains left behind by investors who are fleeing the storm in panic.

I’ve said that the stock market cycles like the seasons, and that among the greatest lessons during a bear market are that the storm will soon quickly pass.

If overactivity is the investor’s Achilles’ heel, then fear which causes selling is the thorn in the side of the heel.

Without a proper education on the true nature of markets, the average investor doesn’t stand a chance. To earn outsized returns, investors need patience and discipline in holding on during routine stock market declines. It’s not easy; these tend to happen when the world seems to be on the verge of collapse.

Many investors may try to time the market because they believe they can sense when it’s time to stay out of the market. The harsh reality is that a significant part of the gains in a bear-to-bull market come from single day rebounds. Missing even just one of these days could cause an investor to miss out on the entirety of returns for a year! What a missed opportunity, and it happens all the time.

- “Time is on your side when you own shares of superior companies. You can afford to be patient—even if you missed Wal-Mart in the first five years, it was a great stock to own in the next five years. Time is against you when you own options.”

Again, it’s the compounding effect of owning great businesses over long periods of time which lead to the greatest returns for investors.

Basic principles like these can’t be ignored and must be respected.

What I love about this idea was that it wasn’t just Walmart who proved this concept out, but many other great businesses over the decades.

Probably the best example was Coca Cola, which Buffett bought in 1987. At the time, the company was already the king of the United States, and was atop of the stock market for many decades even before Buffett purchased it.

The Coca Cola investment went on to be one of Buffett’s best performing stocks of all-time. It paid his Berkshire Hathaway shareholders literal billions of dollars in dividends over the years.

It’s incredible how a great business can continue to capitalize on its outsized success. Great businesses can continue to compound capital and pay dividends for its shareholders for very long periods of time. This is particularly true when the company has a strong competitive moat. A great moat can provide a powerful franchise and/or pricing power to sustain growth with little reinvestment.

Building a Stock Portfolio Like Peter Lynch

- “In the long run, a portfolio of well-chosen stocks and/or equity mutual funds will always outperform a portfolio of bonds or a money-market account. In the long run, a portfolio of poorly chosen stocks won’t outperform the money left under the mattress.”

If there’s one thing that investors of all stripes and styles can agree on, it’s the superiority of the stock market over other investments. At least over the long term.

Since businesses in a free market economy have the power to grow faster than the money they borrow, the owners of businesses will outperform lenders. At least, versus the returns from the loans themselves.

So if you have a diversified portfolio of stocks with enough exposure to a great economy like the United States’, you’ll get those excess returns.

Add in the compounding effect of those earnings, and you have a brilliant path to wealth which is accessible to anyone. This was the entire point of Peter Lynch’s investment strategy writings in the first place.

For another in-depth breakdown of Peter Lynch’s strategy, with examples of the timeless metrics and stock picking filters you can use today to build a portfolio like him, refer to this video:

Blog post updated: 08/17/22

Related posts:

- What is a Good Number of Stocks to Own? The number of stocks in a portfolio can have a major influence on your ultimate results as an investor. Because of this, every investor must...

- 6 (Hidden Gem) Investment Quotes by Peter Lynch During His Retirement Peter Lynch has one of the best track records on Wall Street of all-time. You may have heard quotes from his best selling books, but...

- Traditional Overdiversification Wisdom is Bunk. 15-20 Stocks= Not Enough. Everything you’ve ever heard about diversification, and overdiversification, is wrong! The conventional wisdom is that any portfolio over 20- 30 stocks is overdiversified. This is...

- The Practical, Ideal Holding Period for the Average Investor Explained Warren Buffett once said, “our favorite holding period is forever”. But is that really true? Should investors plan to hold every stock they buy, forever?...