Trying to scrape up the money needed to put money down on a house can be so incredibly hard, especially if you haven’t been planning for it that long or that it’s your first home. One option that many people don’t consider, or at least don’t use, is a piggyback loan.

I talked a little bit about piggyback loans and their usefulness previously when I was comparing multiple different down payment options, but I think that it really deserves a bit more of its own spotlight.

So, what even is a piggyback loan?

Well, it’s simple – you simply will put down 10% as a down payment for the home, take out a mortgage on 80%, and then takeout a second loan/mortgage on the remaining 10%.

You might immediately be thinking, “Andy, I do not want a second MORTGAGE! Simply the sound of that sounds awful.”

I’ll be honest – I do not disagree with you one bit. It does sound awful. But it’s really just another loan to be honest and while I do think that simply taking on tons of loans is absolutely not the right way to live your life, I do think that there can be some major value.

You might also be thinking, “Ok, well why would I not just put down 10% and then take out a mortgage for the remaining 90%?” Well, the issue with that is you have to pay the dreaded Private Mortgage Insurance, or PMI.

Essentially what PMI does is it protects the lender if you’re going to default on what you owe. It’s common for you to owe monthly PMI payments until you hit a total of 20% of the house being paid off so that is not an ideal situation.

Not to mention, PMI can typically be about 1% of the total home value on an annual basis, so if you bought a house that cost you $100K, then you would pay $1,000 every year, or $83.33 in PMI.

PMI is literally just a waste of money that is getting flushed down the toilet, just as interest is on a second mortgage – so, rather than let the term “second mortgage” get in the way of you making the best financial decision, let’s walk through a real-life example:

My wife and I were living in Chicago and we had an opportunity to move to a small town in Ohio for my work and she was going to be able to work from home for her company in Chicago.

We wanted to buy a home but you know, Chicago is super freaking expensive, so while we could easily make monthly payments for an expensive house, if we were going to put 20% down on a house then it was really going to stretch us.

So, we had a decision to make:

- Use a piggyback loan

- Take a mortgage on 90% and then pay PMI

- Stretch to pay the full 20% down

Do you know what I did? You’re dang right – I ran the numbers. Because that’s the only thing that matters in a decision like this.

So, let’s take a look at some various scenarios to see which might make the most sense. Of course, putting down 20% is ideal to avoid the extra interest and also

I remember that when we were getting quotes for the second mortgage that the interest rate was about 3% above the other mortgage, so I am going to assume 3% for a mortgage rate and then 6% for the second mortgage.

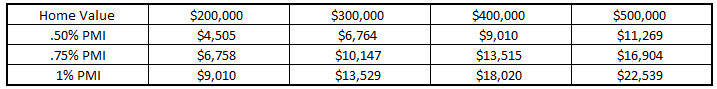

Also, I recall that PMI would typically range anywhere from .5% – 1% of the home value on an annual basis, so I will take a look at three different options in that range at .5%, .75% and 1%.

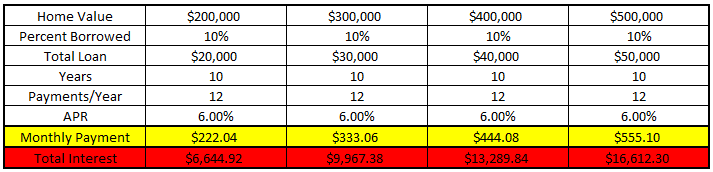

Let’s take a look at how things would shake out! I used a simple formula in Excel to calculate the interest that I would have to pay with the second mortgage and I would highly recommend that you do the exact same! When I did this for various housing costs, I received the following outcomes:

As you can see, I looked at four different housing options amongst a $200,000 – $500,000 pricing rang in increments of $100,000. I assumed 10% as the amount borrowed for the second mortgage and then a term of 10 years, similar to the term that I was quoted when looking at this option. And as I mentioned, the 6% APR as mortgage rates are in the 3% range currently.

I highlighted in red the total interest paid throughout the course of the loan so you know exactly what you will have essentially wasted in interest. On the other hand, we have the PMI option.

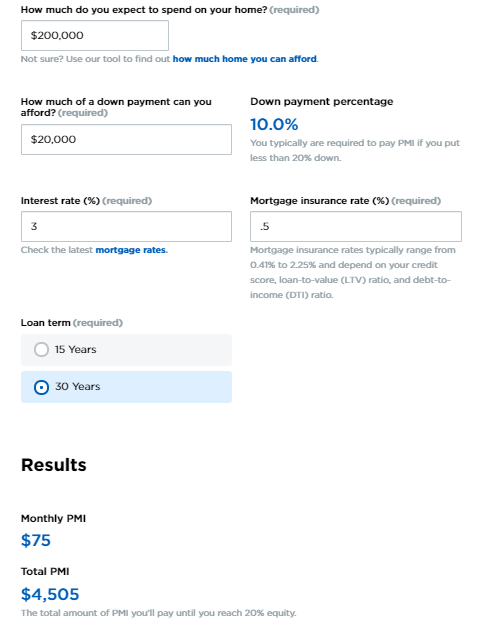

To calculate this, I simply went to a NerdWallet PMI calculator and inputted the information that it asks for. For instance, if I wanted to see the $200,000 house with a .5% PMI rate, I would input the information as follows:

Once you do this, you can easily see that the monthly PMI payment is $75 and the annual cost is $4,505. I was so incredibly nice to run the numbers for you (sarcasm) and summarized them for you in a table below:

As you can see, the second mortgage is a cheaper option for any of the homes as long as you’re paying a PMI that is .75% or over, and that is extremely likely to happen.

So, as long as your PMI rate is .75% or more, you need to go with the second mortgage.

It might seem like this was an overwhelmingly easy process to do…and that’s because it was! All that you need to do is run the math anytime that you’re going to make a big decision like this and this math is by no means complex.

To be nice, I even added a column to the Piggyback Loan example that I listed above so if you download the Piggyback Loan Calculator, then you can easily calculate the math in your own real-life example.

The thing is, regardless of what sort of loan that you take out, you still need to make sure that you have some significant savings built up. If you’re struggling with that, don’t worry – I can help you with that as well!

Related posts:

- Use this FREE 401k Loan Calculator to See if a 401k Loan is Right For You! I’ve made it well-known in the past that I had borrowed from my 401k to help payoff some higher debt in the past and I...

- Comparing Compound Interest from Paying Student Loans vs Investing If you listened to the most recent episode of the Investing for Beginners Podcast with Andrew and Dave, then you heard them both GO IN...

- Mortgage Refinancing Analysis – Easy Template Included! With interest rates at historically low levels across the U.S. and much of the globe, now might be a great time for homeowners to refinance...

- Cost of Debt Calculator for Stocks and Personal Finances (Excel) The Cost of Debt that a company has is essentially how efficient a company is at paying off their debt. Having a cost of debt calculator...