Portfolio leverage is the classic double-edged sword, magnifying returns to the upside and cutting deep on the downside too. Portfolio leverage needs to be understood and respected before contemplating its use in a portfolio.

It is a tool not necessarily suited for every retail investor’s toolbox and many investment funds will have strict rules about its application contained in the fund’s offering memorandum. That being said, let’s dig into the various forms of portfolio leverage and other important items for investors to note.

Various Forms of Portfolio Leverage

There are three main methods in which leverage can be added to a portfolio. The commonality among them is that all the methods change the systematic risk (ie. market risk) the portfolio is exposed to disproportionately with the amount of an investors own capital being invested. This increase in systematic risk per amount of investor capital in the portfolio can be considered the definition of portfolio leverage. Below are the three main methods to add leverage to a portfolio:

- Borrow from the broker/bank – This is probably the most common way to leverage a portfolio and will be discussed more broadly later. By keeping the amount of investor capital the same and borrowing cash to invest in additional securities, the investor is increasing their exposure to systematic risk/beta. Borrowing can be as simple as making use of the “margin account” from one’s broker but other sources of financing should be considered if they provide cheaper rates of interest and are documented in such a way that the interest expense on the borrowing keeps its tax deductible status.

- Borrow by shorting another security – While this might sounds like a hedge at first glance, what we are talking about here is shorting a lower risk security (such as a bond or low beta stock) to invest in a higher risk security (junk bond or high beta stock). As the additional funds needed to invest in the new security come from the short sale of the lower risk security the amount of investor capital stays the same while the overall systematic risk/beta of the portfolio increases.

- Implied leverage using derivatives –Derivatives provide the possibility to change the risk/beta of the portfolio dramatically using little to no investor capital upfront. For example, one could purchase at-the-money call options maturing in 1-year for a 6% option premium on the notional value of the option. If enough options were purchased so that the notional value approximated the total assets of the unlevered portfolio, the investor would essentially be doubling the systematic beta of the portfolio on the upside for the additional 6% upfront premium paid for with their own capital.

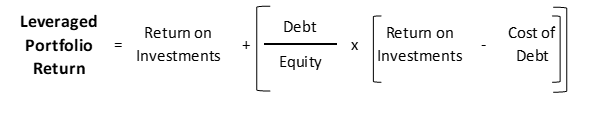

Formula to Calculate Leveraged Portfolio Return

The expected return of a leveraged portfolio, using borrowed money, can be calculated using the formula below. In a leveraged portfolio, the return will be the normal return on investment plus the excess of return on investment minus the cost of debt multiplied by the financial leverage being applied to the investor’s equity capital contributed to the portfolio. The obvious but important thing to understand from this formula is that if the return on investment is not greater than the cost of debt, the use of leverage will result in lower portfolio return.

Side Note: Using this formula and knowing the leveraged portfolio return, cost of debt, and amount of financial leverage used, we can algebraically solve for the portfolio return of the unleveraged portfolio (ie. return on investment). This creates a fair comparison of portfolio manager skill level in selecting securities, before considering the use of leverage.

The Dreaded “Margin Call”

A broker is only willing to lend up to a certain loan-to-value ratio on a portfolio’s assets and it is important for investors to keep this ratio in check or else face the forced liquidation/sale of securities in their account during what is known as receiving a “margin call”. It is common practice for lenders to assign different risk-adjusted value to assets. For example, a broker may view domestic large cap equites at 100% of their value but might assign foreign securities a 75% risk-adjusted value and small cap stocks a 50% risk-adjusted value. The risk-weighted average of the portfolio’s assets then forms the base for the broker to lend against.

It is important for investors and managers to keep the loan-to-value ratio in check and it is prudent to leave enough of a buffer to be able to withstand a worse-case market correction (ie. 50% market decline). One of the most harmful things for long-term portfolio returns would be to receive the dreaded margin call near market bottoms being forced to sell securities at depressed prices.

Applying “Homemade” Leverage to a Specific Company

So far we have talked about applying leverage to the total portfolio but one can also apply leverage to a specific investment. Say for instance that you have found a nicely profitable company with a high return on invested capital, but unfortunately, the company’s management is more conservative than you would like and they keep the company’s financial leverage very low.

In this situation, the investor could still purchase the company’s shares while also borrowing against the position to purchase even more shares on their now leveraged capital. The effect of this process is to manipulate the company’s return on invested capital into the investor’s desired return on equity and cash flows from the amount of capital invested. This process of methodically altering a company’s financial leverage is what is referred to as applying homemade leverage. Theoretically, if the individual investor is able to borrow at the same rate as the company and also shares the same tax rate, the results could be the same.

Related posts:

- Calculating Portfolio Return Using the 3 Main Methods from the CFA (Level 1) Calculating portfolio return should be an important step in every investor’s routine. Efficient wealth management means to allocate money where it is generating the greatest...

- How to Use Return Attribution to Compare Portfolio Return Being able to attribute the sources of portfolio return is an important aspect in the decision making process surrounding portfolio management. The process of return...

- “Diworsification” in Business and Portfolio Management The term “diworsification” was coined by legendary investor Peter Lynch in his book, One up on Wall Street, to describe the over-expansion of a company...

- The 8 Main Types of Investment Risk “If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to...