Warren Buffett once said, “our favorite holding period is forever”. But is that really true? Should investors plan to hold every stock they buy, forever?

Can investors pick the stocks that beat the market, and hold them forever?

How many stocks actually beat the market “forever”?

These are all questions we will try to answer in this post, using some historical data and simple common sense. This post will cover the following [Click to Skip Ahead]:

- What is a holding period?

- What’s the average holding period?

- Why does holding period matter?

- What does your average holding period mean for your portfolio?

- What’s an ideal average holding period?

- What’s the best holding period for long term investors?

- Why you can’t hold every stock forever

- Should I lock-in gains on my best stocks, or let them ride “forever”?

- Simple reasons to extend your holding period (and not sell)

Without further ado, let’s dive in.

What is a holding period?

Simply stated, a holding period is how long you hold a stock. If you bought a stock in January 2020, and sold it in January 2022, your holding period was 2 years.

What’s the average holding period?

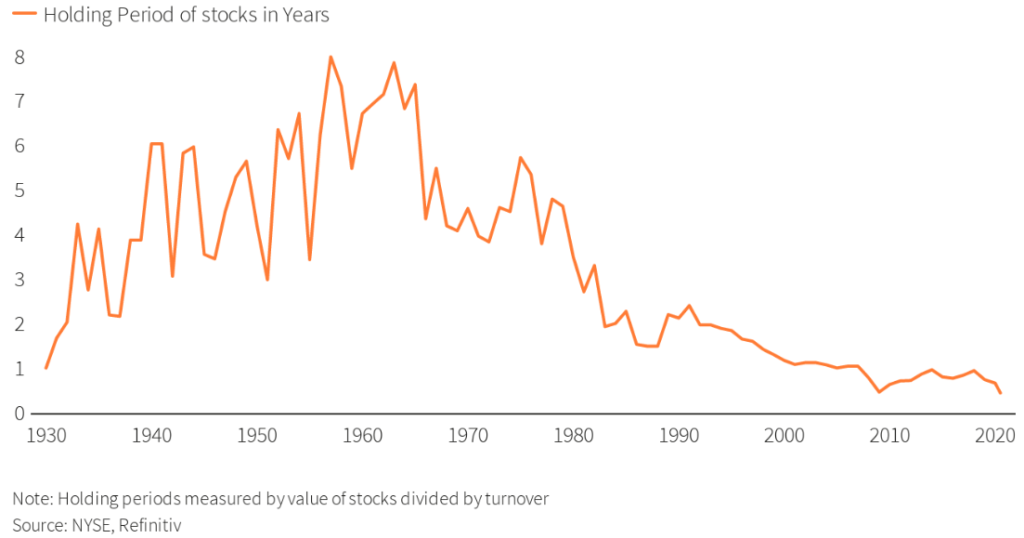

Investors are notorious for having shorter holding periods than they should. Especially lately. In fact, the NYSE and Refinitiv had a compelling chart showing the average holding period for investors by year (in U.S. stocks):

The chart suggests that the average holding period for investors in aggregate in 2020 was less than 1 year. You wonder how much the emergence of ETFs plays into this data. Regardless, I think the data is shocking due to just how low that average is, especially compared to the 50’s and 60’s.

Why does holding period matter?

The fact of the matter is that the stock market is noisy and volatile in the short term. Legendary value investor Benjamin Graham maybe said it best:

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

Benjamin Graham

Suffice to say, if you are holding most of your stocks for a very short while (such as less than 1 year), you are betting on how the market feels about a stock, not how the business is actually performing.

To buy great businesses in the stock market and see your performance rise alongside those businesses, you have to be a long term investor. That’s simply the reality of the stock market.

What does your average holding period mean for your portfolio?

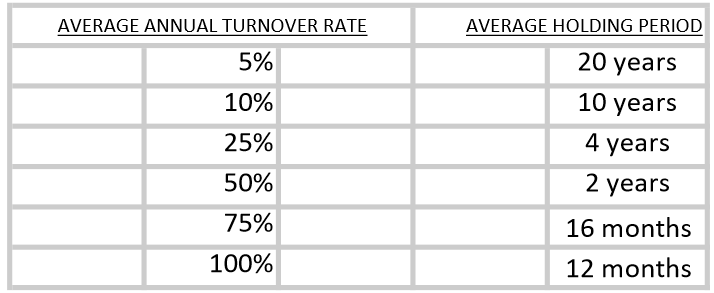

Holding periods and portfolio turnover are closely tied. It’s a simple math problem. The shorter your average holding period, the more portfolio turnover you have, and vice versa.

A simple example shows this clearly.

Say you bought 10 stocks with an average holding period of 1 year. To make the math simple, this means on January 2020, you bought 10 stocks, and by January 2021, you sold all 10.

This is a 100% portfolio turnover.

In other words, in a period of 1 year, you “turned over” 100% of your portfolio. Your portfolio turnover will automatically calculate your average holding period, and vice versa. Here’s a helpful chart I created which I like to reference to understand my holding periods and turnover:

What’s an ideal average holding period?

Now we are getting into the meat and potatoes of this discussion. Remember what we said at the top; one of the greatest investors of all-time said that his favorite holding period is forever.

Another great quote by the “Buff dog”:

“If you are not willing to own a stock for 10 years, do not even think about owning it for 10 minutes.”

Warren Buffett

But with investing, especially in the stock market, it can be dangerous to take someone’s opinions too literally. At least without giving it some thought.

The fact of the matter is that your ideal holding period depends on YOU. Your strategy, temperament, and skill determine your performance over the long term—your ideal holding period is simply one part of that.

Jim Simons from Renaissance Technologies has an average holding periods of days and has handily beat the market over decades with his algorithms.

Far more common are successful investors who simply buy and hold stocks for a very long time, with average holding periods of years instead of months or days (like Buffett).

Buffett’s strategy works for him because he simply finds great businesses, and lets those businesses do the work and compounding for him. Because the market is a weighing machine over the long term, the stock prices of these companies follows their success eventually.

I like that approach for myself, and recommend it for basically everyone.

It may be different for you, and that’s okay. But be sure you know that you are following a path that is likely to succeed, and do so consistently and over long periods of time.

What’s the best holding period for long term investors?

If you’ve established you want to hold stocks for years, decades, or maybe “forever” like Buffett, the next challenge is figuring out just how literally you want to take Buffett’s advice.

To do that, let’s first examine Buffett’s track record.

Calculating the turnover for Warren Buffett’s Berkshire Hathaway stock portfolio is not easy. He’s bought and sold a bunch of stocks, over many, many years.

That said, there are two great resources out there we can reference:

- Gurufocus

- 2010 white paper

Data available for free today from Gurufocus calculated the quarterly portfolio turnover for Buffett from 2009 – 2021. If I were to add each quarter’s turnover, and take an average of each annual turnover, it comes out to 12.1%.

The 2010 white paper suggested that from 1977-2010, the average portfolio turnover was below 15% for every year except two, and had a median rate of 2.1%. Taking a visual estimate from this chart from the white paper, the average turnover rate for that time period appeared to be around 4.5%.

These are insanely low turnover rates.

Referencing our table above showing the relationship between holding periods and turnover, we can estimate that Buffett’s average holding period was usually around 10 – 20 years.

While that’s an extremely long time horizon, that’s not quite “forever”.

To be fair to Buffett, his portfolio is still in progress. He very well could continue to hold his stocks as time goes on, lowering turnover and getting the portfolio closer to “forever”. But for investors looking to emulate what Buffett has done these past decades…

We might not go wrong by realistically targeting 10 – 20 year holding periods.

Why you can’t hold every stock forever

There are a few things to remember when it comes to holding stocks, ideally forever.

- A company can’t outperform forever

- Even the best investors make mistakes

- Capitalism is an endless threat to compounding

These challenges can make holding stocks for super long stretches a potentially dangerous way to invest too. After all, we have to examine the risks along with the rewards to every strategy.

1—A company can’t outperform forever

This concept is simple yet often overlooked. Great investments tend to grow faster than the economy.

But think about the long term implications.

If a company continued outgrowing the economy forever, it would one day BE the economy because of compounding (hat tip to Aswath Damodaran for this idea). So, at some point, a company’s growth must mature to at least match the economy’s growth, or lower.

This means no business can outperform the market forever.

As investors trying to beat the market, should we really hold stocks forever then?

There are, of course, many benefits to holding stocks for the very long term. Not only to performance, but because of taxes and how hard it can be to find great opportunities.

But just like you don’t want to be too stubborn in your thinking, you also don’t want to be too open-minded, which is why the idea of holding a stock forever might not be the best decision for your portfolio.

It’s all about balance.

2—Even the best investors make mistakes

Looking at Buffett’s phenomenal track record, we can see that even he has been wrong on companies. One of my favorite stories that he laments about was Dexter Shoes.

Dexter Shoes turned into a dumpster fire for Berkshire simply because Buffett ended up being wrong about the company.

Buffett had found success in other consumer consumables such as the razor blades that Gillette sold. He figured that shoes wear out like razor blades do, and that Dexter would find great long term success as an excellent operator. Unfortunately, shoes manufactured abroad swiftly took share from American producers, and this investment turned into a lemon for Buffett.

Lesson learned; even an expert in business models can fail to see how competitive forces will eventually destroy a company’s moat (and business model).

If even the best investors make mistakes, obviously we will make mistakes too.

There’s no shame in selling a stock early because you made a mistake—just make sure that it truly was a mistake in judgment and not a mistake simply because the market “voted” the stock downwards.

3—Capitalism is an endless threat to compounding

Dexter Shoe was once a great company which saw its profits evaporate as cheaper producing competitors stole their lunch.

Similarly, all businesses have competitors and future threats which will try and steal their lunch.

To make matters worse, it’s usually the best and fastest growing businesses which will have the fiercest competition.

This is why it’s important for a company to have a “moat”, or competitive advantage. But a moat must be very strong, and able to last through time, as competitors constantly try to make better products and services.

With maintaining a moat being such a hard challenge, it’s only natural that businesses will tend to see their moat erode over time.

Like a law of numbers, the more time goes by, the more businesses will see their moat erode.

That’s fine; as investors we should want to ride easy profits as long as we can, but be flexible to see when that’s no longer the case.

Cameron wrote a great post on our blog about industry life cycles, which is well worth the read. Both companies and industries will tend to see their markets eventually mature and decline, simply because of the brutal nature of capitalism.

That all said, we also shouldn’t panic at any sign of weakness.

Maybe none better than Warren Buffett and Coca Cola showed that a company can ride the “steady Eddy” profits stage for DECADES. Consider that Coca Cola was founded in 1892; even 95 years later it was far from being “matured” and produced fabulous compounding for Buffett.

Should I lock-in gains on my best stocks, or let them ride “forever”?

I think the toughest question for investors is when to sell good stocks.

It seems to be easier to recognize when a company is going south; their financials will often signal decay for years down the line.

Much harder is the eternal struggle of taking profits now versus “letting it ride”.

Another legendary investor, Peter Lynch, also had strong words about holding good stocks. He, like Buffett, was a strong advocate for letting the companies do the compounding for you over the very long term. Lynch had this to say on selling:

“Selling your winners and holding your losers is like cutting the flowers and watering the weeds.”

Peter Lynch

Those are words of wisdom that I think all buy-and-hold investors should strongly heed.

But is there greater upside in selling stocks that shoot up in value?

This is an idea that particularly gives me pause when the market enters bear market territory. Especially as a value investor.

A good value investor should probably buy more defensive stocks during a stock market peak, and more cyclical stocks during a bear market, when those stocks are cheap.

Where it can get confusing is when you mix this advice with buying and holding “forever”, because how can you benefit from your defensive stock picks if you don’t sell them when the market is down? I’ll attempt to show an example using some simple math over the long term.

Simple reasons to extend your holding period (and not sell)

Let’s establish a few facts before we get to some nitty gritty math.

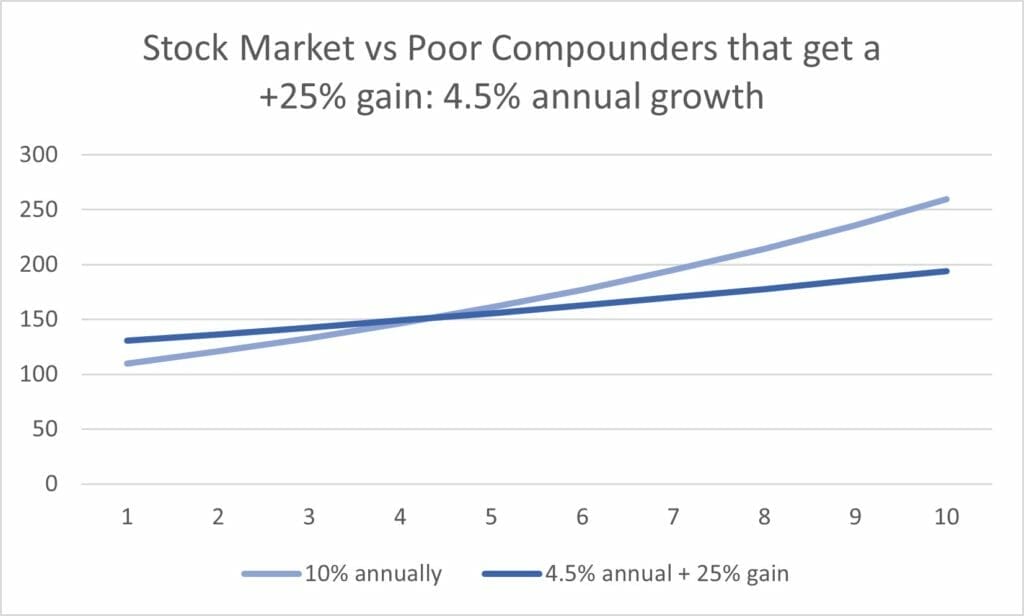

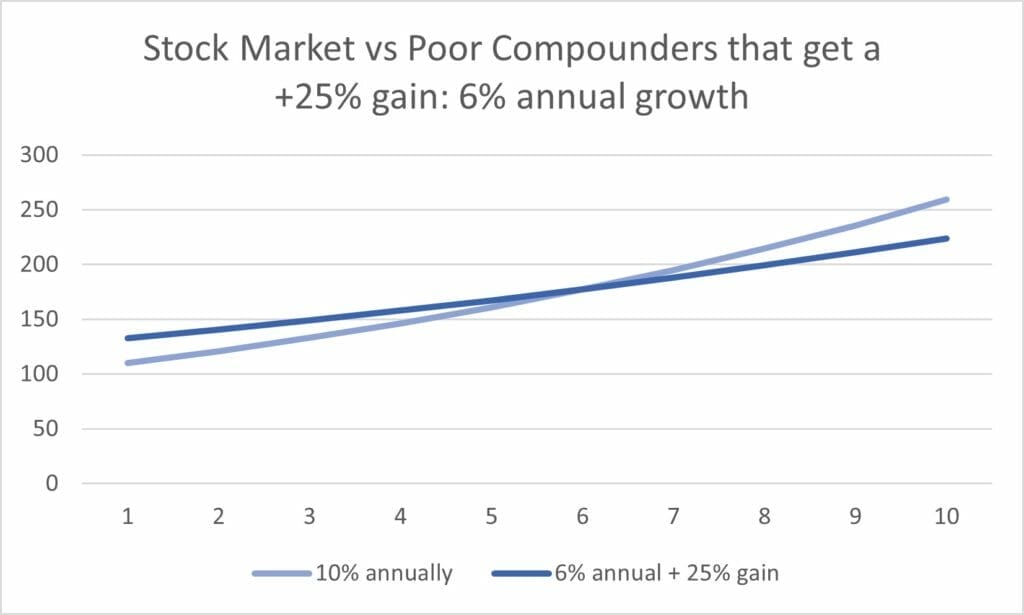

First, the stock market has been averaging around 10% a year return over almost 100 years, once you include reinvested dividends.

What’s interesting is that a stock could underperform this benchmark for YEARS, and still beat the market! In fact, a simple +25% gain can have a massive impact on your total return from any stock you buy.

These +25% gains might happen more frequently than you’d think. For example, when a company is bought by another company (through M&A, or mergers & acquisitions), the average premium paid is 25%.

So, if you’re holding a stock, and it gets acquired, that’s an easy +25% gain. A similar thing tends to happen if a company goes private.

There can also be other reasons; a stock or sector can simply get trendy.

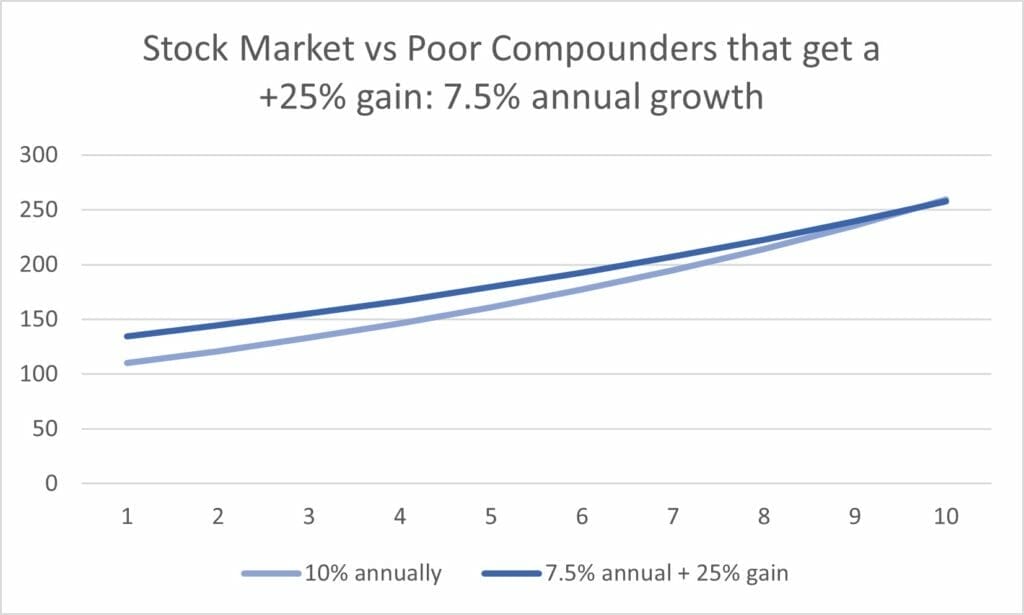

Now, consider these simple illustrations of the difference between a “below average” stock compared to the market average. With each of these, you’ll see the difference in compounding between a stock that does relatively poorly yet gets a +25% jump, versus a hypothetical stock market compounding at a steady 10% per year.

Notice how long it takes for the 10% compounded return to catch up.

In other words, a stock returning only 4.5% a year can continue at this pace for 5 years until a sudden +25% gain would not beat the market. Similarly, a stock returning only 6% a year could do this for 6.5 years; for the stock returning 7.5% per year, the market wouldn’t “catch up” until year 10.

These are huge stretches of time where an underperforming stock can still catch up with a sudden gain, which happens often in the market!

Take all of this into account when deciding your holding periods:

- Finding “forever” stocks is hard

- If you’ve found one, ride it out for years even if it underperforms for a little while

- Don’t give up on underperforming stocks too soon

Even a matured, boring stock with little growth prospects could easily return an investor 4.5% per year. It could be done by keeping up its sales growth with inflation at 2%, and paying a dividend at 2%, and buying back shares for 0.5% EPS growth.

A slow compounder like this still has a decent chance to beat the market over the long run, if you are patient and there’s some catalyst to push its price up +25%.

To me, unless a business is obviously dying and/or a really poor compounder, you might just consider holding for a long time. Many wonderful things can happen when you buy and hold great companies for the long term.

Related posts:

- What’s a Good Portfolio Turnover Ratio for the Average Investor? Portfolio turnover refers to the frequency of buys and sells in an investment portfolio. In general, a lower portfolio turnover ratio is better, if you...

- 5 Golden (Mindset) Tips to Success for the Lifelong Investor When it gets down to it, we are all lifelong investors. As long as you have a 401k, you are a lifelong investor. As long...

- What is a Good Number of Stocks to Own? The number of stocks in a portfolio can have a major influence on your ultimate results as an investor. Because of this, every investor must...

- Traditional Overdiversification Wisdom is Bunk. 15-20 Stocks= Not Enough. Everything you’ve ever heard about diversification, and overdiversification, is wrong! The conventional wisdom is that any portfolio over 20- 30 stocks is overdiversified. This is...