If you’re anything like me, then you’ll find yourself watching Shark Tank and wondering what certain terms mean that the sharks are using. Personally, one of the very first terms that I didn’t understand years ago when watching the show, was preferred equity, or preferred stock.

I mean, personally, I think I always prefer stock…and I think that stock should prefer me, too!

Bad joke…I’m sorry.

But what really is preferred stock? Sometimes you’ll hear one of the sharks say that they want preferred equity in the company which is pretty common for a company to give up to their very first investors.

I think the easiest way to understand preferred equity is to first explain what it is not – common equity.

Common equity is what you and I invest in when we buy shares in the stock market. The financial dictionary defines common equity as,

“The amount that all common shareholders have invested in a company. Most importantly, this includes the value of the common shares themselves. However, it also includes retained earnings and additional paid-in capital.”

So, when we go to Fidelity and buy a share of Apple, that is common equity and you are a common equity holder. Now, preferred equity is a little bit different. Financial dictionary defines that as:

“Corporate shares of stock that have greater rights than normal shares. Owners of preferred equity may be entitled to dividends—income—when there is not enough money to pay all shareholders. If the company is liquidated and all assets sold, preferred equity holders will receive their predetermined share before other equity holders.”

In layman’s terms, you’re basically an equity holder that is a little bit more protected than the average shareholder. Now, that certainly sounds like a good ting, but as with anything in life (except for an HSA), there are pros and cons:

Pros of Preferred Equity:

- Protection

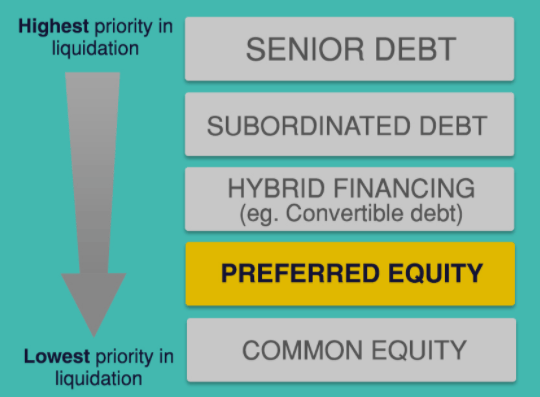

If company were to completely liquidate, the preferred equity has more protection and would be paid out first. The common equity holders are not guaranteed any sort of compensation in this situation and could very likely find themselves losing their entire investment.

Of course, nobody ever enters into an investment with the intent that the company is going to belly up and have to liquidate, but that certainly is something to take into consideration when you’re investing in such a young company. New companies can be so volatile with their revenues and earnings so having that little extra protection if something, like COVID-19, were to happen and really have an adverse effect on the company.

Below is a nice little way to visualize the order that debts/investors were to be paid off if a company did go bankrupt, provided to us by Royal Bank:

- Known/Planned Dividend

Preferred Equity shareholders are paid out guaranteed dividends on a standard schedule which could be monthly, quarterly or annually. Rather than the dividend fluctuating like it does with common equity, the dividend is known well in advance for those preferred equity holders.

This can be a great pro for planning purposes and also because you have an essentially guaranteed timeline that it’s going to take for you to recoup your investment. Now of course crazy things can happen that can keep you from getting that dividend, as with any investment, but having that plan upfront is a major pro.

- Dividend Preference

If a company was in a position where they might not be able to pay out a dividend to their common equity holders, the preferred equity holders still could receive a dividend. This is a major pro for those with preferred equity to essentially have a first “dibs” on that dividend.

A dividend might seem like a bit of a given for some companies that we like to talk about, such as the Dividend Kings, but you have to remember that oftentimes the preferred equity is really a pro for new, young, up-and-coming companies rather than an Johnson & Johnson (JNJ) or 3M (MMM) who have extremely long histories of increasing dividends.

Cons of Preferred Equity:

- Lack of Voting Rights

This might not seem like a big deal but it honestly really is. I know that I will receive emails from my brokerage, Fidelity, that would invite me to vote on certain items for companies that I owned common stock in, and truthfully, I never would. One time I opened the link and it was like 50 pages of lawyer language and I realized two things:

1 – My vote didn’t actually matter (don’t have this mindset in political elections, though!) because I owned so few shares in the grand scheme of things

2 – I really didn’t care enough to read it

That might sound bad, but when combined with #1, it just wasn’t worth the hour it was going to take me to vote on something that my vote wouldn’t change. But again, this was with a very large, well-established company.

When you’re a preferred equity holder then it’s likely in a very small company. Decisions when these companies are so young can completely change the trajectory of the company and they’re so incredibly important. To be an early investor with no input in the direction of the company from a voting perspective can be a very bad situation to be in.

I think it really depends on your mindset and your intent for how involved you want to be, but if you’re investing in a company early on, I personally would want to have the respective voting power for the investment that I put in.

- Known/Planned Dividend

Just as this can be a pro, it can also be a con. Having a known/planned dividend protects your downside but it also caps your upside. You won’t have as low of lows such as with missing a dividend, but if the company grows like crazy then you’re still going to be getting your stable dividend and not capitalizing on the outrageous gains that the company is realizing.

It’s a risk, really. I watched a video that recommended you think about preferred equity more as a bond than when it comes to the dividend because of the known, stable payout that you’ll earn. To me, that made a ton of sense, and there are certainly pros and cons to that piece in itself!

- Lack of Dividend Growth

This probably could be assumed in the ‘Known/Planned Dividend’ section, but I specifically wanted to call this out. It is very unlikely for preferred stock to have major, if any, growth in the dividend. On the contrary, a common equity position is likely going to consistently grow, especially if the company is large and wants to become a Dividend Aristocrat or a Dividend King because they require 25 or 50 years, respectively, of consecutive years of dividend growth.

Now, you’re likely going to have a higher baseline of dividend at the very beginning, and it very well could always be higher than the company pays out, but that really just is a risk/reward type of decision that you have to make.

I’m thinking that you likely understand some of the major differences between preferred equity and common equity now, so the question is, how can this information actually be utilized in your investing process?

Well, believe it or not, you actually have the ability to purchase preferred equity. It’s not something that I do, personally, but I can certainly see the attraction of doing that. So, how would you do that?

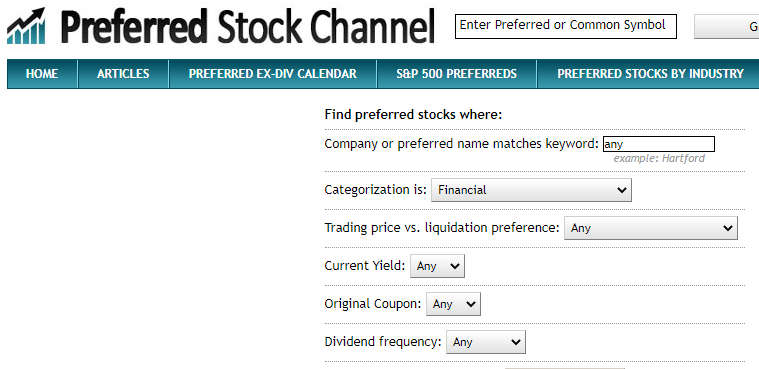

There are many different positions that you can take and directly invest in preferred stock to take advantage of these planned dividends. The Preferred Stock Channel actually gives you the ability to screen for these stocks that meet various criteria, as shown below.

In this example, the only thing that I filtered by was finding those that were in the Financial industry:

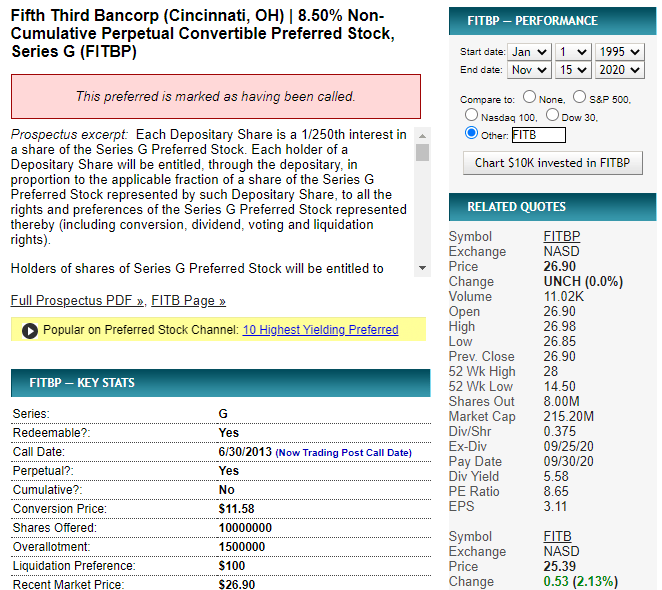

When you do this, you get a list of companies that you can then investigate further. One of which that I decided to randomly click on was Fifth Third Bancorp (FITBP):

Honestly, this website really is pretty cool to have this all-inclusive way to view these different preferred stocks and look at some of the important quantitative data that you might want to know prior to investing.

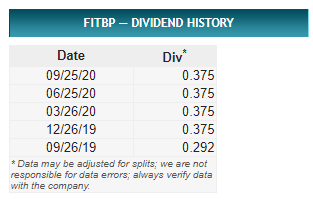

Chances are, if you’re investing in preferred stock, the most important thing that you probably want to know is the dividend, right? As you can see, it has been the same since December 2019:

The current dividend yield for this preferred stock is 5.58% which is about 2.5X what you’re going to get investing in the S&P 500, so definitely a significant increase!

Now of course, it’s always important to remember that total return is more important than the dividend yield because if your dividend is 5.58% but the share price drops 10%, then you just lost money. So please, always, always, always make sure that you’re looking at the total return as well!

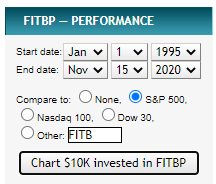

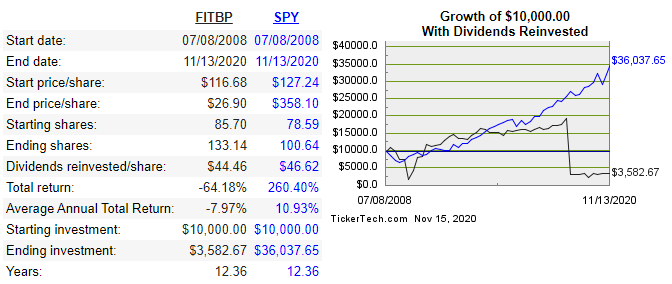

The preferred stock channel actually gives you the ability to compare the performance of these various stocks to the S&P 500 over history which I think is a super useful tool.

You can see below that I checked to compare to the S&P 500 over time because I think that the S&P 500 is the most accurate benchmark for someone to use:

When I do this, the results might be pretty surprising! Note that this includes reinvesting dividends which is something that you absolutely should be doing:

SPY, which is an index for the S&P 500, absolutely crushes FITBP. I mean, it’s not even close. That performance of FITBP just absolutely got destroyed towards the latter half of this investing period since 2008.

Honestly, that huge drop off that is really in a straight line makes me think that maybe there was something funky that happened and potentially did some sort of a stock split. When I look at some publications, the pricing of the stock only goes back to 2019, so it’s really making me curious.

If I personally was going to invest in preferred stock, I think that I would start out in an ETF. The reason that I do this is because when I am just starting to really dabble into something new, I like to start with an ETF to get me a little bit of exposure and then it allows me an opportunity to learn with some money in play, but it being less risky since it’s spread amongst many different companies.

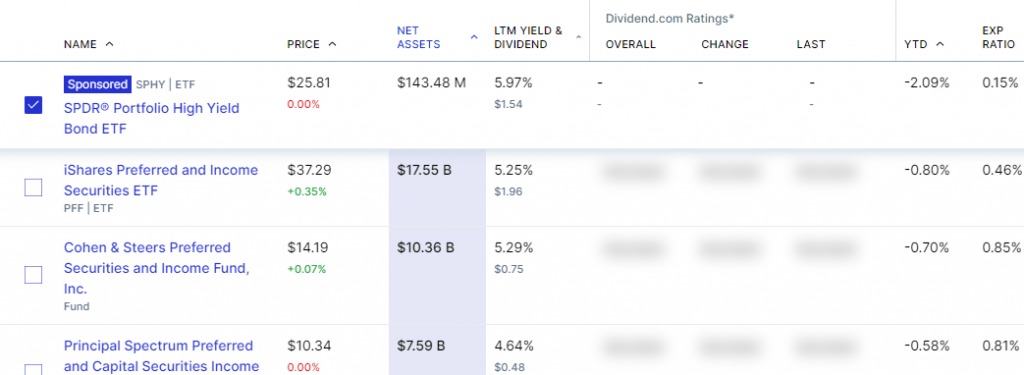

Turns out that Dividend.com has a ranking of 46 different preferred equity ETFs that you can invest in:

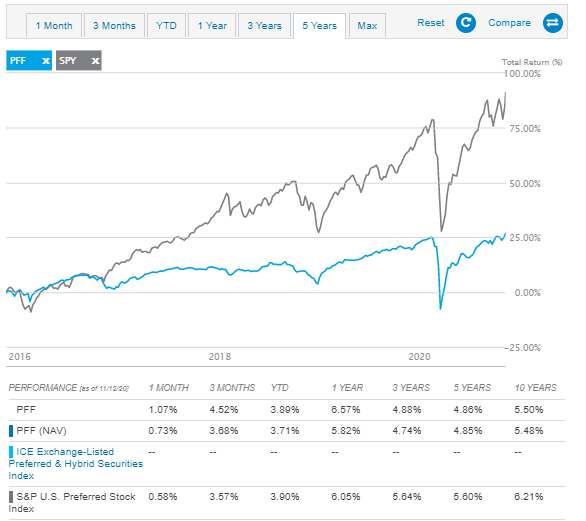

I know that not everyone will want to invest this way, but I think that starting with an ETF is really just a good baseline. My favorite way to evaluate ETFs is on ETF.com, so when I do that with the first result of PFF (note that the actual first result is sponsored and not preferred equity) I can see some of the following data.

You can see that since 2016, the S&P 500 has outperformed this ETF significantly:

The question that I would ask is that although you’re using this and benchmarking it to the S&P 500, is your goal to outperform the S&P 500? Chances are, if you’re investing in preferred equity, you’re more so focused on the income-generation aspect of it than you are the growth.

It’s obviously important to make sure that you’re not losing money but if you’re in retirement age and looking to remove that dividend from your investment to live off of, then the total return might be a little bit less important to you.

I totally understand that side of it but I do want to urge you to think about the total return as I mentioned before. Some people get so wrapped up in dividends that they miss the big picture. If your total return is greater in a normal ETF or stock rather than a high-dividend payer, you’re better in that normal investment.

Don’t solely focus on the dividend but rather think of it as a cherry on top. Yes, I am a HUGE dividend fan because I think it really epitomizes compound interest, but don’t step over dollars to pick up pennies. AKA focus on that total return more than just the dividend, because guess what, you can sell your stocks to generate income just as you can from living off the dividend.

As long as you’re taking out 4% or less each year, history shows that you’re going to be just fine, no matter where that 4% actually comes from, and that you’ll never run out of money!

Related posts:

- Using Motif Investing to Build a Great Dividend Portfolio Motif Investing isn’t just a great tool for saving money investing but it can also help you find the best stocks for your needs. This...

- Some of the Greatest Multibagger Stocks Snagged by Famous Investors Have you ever heard of the term ‘ multibagger’ before? If you haven’t, then you probably haven’t had any multibagger stocks! Don’t worry, neither have...

- Dividends Are Old and Boring. Why Does Apple Pay a Dividend? Updated 10/16/23 One of my favorite stocks, and likely a favorite of many others, is Apple (AAPL). Apple just seems to be a company that...

- Succeed with Dividend Growth Investing by Analyzing a Stock’s Growth In a recent episode of the Investing for Beginners Podcast, Andrew and Dave broke down how to analyze a stock’s potential by using dividend growth...