Let’s be real – Mint is a great app for budgeting but does it actually help you budget? Personally, I got way more from being forced to track my expenses, so that’s why I want to share my printable budget planner!

Are you the type of person that hates anything that has to do with new technology? Maybe someone that is just sick of the way that the world is moving towards people always being on their phones and not able to talk to one another? Honestly, I completely understand.

I am actually one of the culprits in this. I feel like I can’t do anything without looking at my phone. Waiting for the elevator? Phone. See someone I don’t want to talk to? Phone. Sick of looking at my phone? Yep, phone! Lol.

But the thing is that people are just so wrapped up in technology that the forget that there are actually other ways to make things work, too.

And one of those ways is to just go back and do things the old school way. What I mean is to throw technology out the window and do things in a way that you know works. Remember how people used to balance a check book? That’s the type of stuff that I am talking about.

In fact, I was recently talking to Andrew and Dave (yes, I am friends with the famous hosts of the Investing for Beginners podcast) and I was telling them in high school I took a class called, “Life after graduation”.

They taught things like how to cook, sewing, washing clothes, and even balancing a checkbook and creating a budget. It sounds ridiculous but it was honestly one of the most useful classes that I took in high school because I could use it in my everyday life.

Nowadays I prefer to do all of my budgeting with Doctor Budget because I feel like I get a perfect mix of being forced to track my expenses and also the automation so it doesn’t take me all day to do my budget. But I know some of you are much more old school and prefer the tried and true way.

A couple weekends ago I was talking to my dad and he said that him and his wife were considering retiring early and simply living on less than they might’ve otherwise desired. They were trying to decide if it made sense to stop working a couple years early and live smaller or keep working and then enjoy their current retirement lifestyle that they envisioned.

Well, turns out a sticking point was the budget. They don’t have a formal budget now but they would need to have one if they retired early, and the budget process that my dad uses is the envelope method. Literally every single expense that he has will then end up with a receipt inside an envelope.

Now I know some people that take it even further and put cash into those envelopes to make sure that expense is paid for, but I personally think that’s just too far. I think that you can really accomplish this same goal by just using a printable budget planner!

So, I took the Doctor Budget layout and tried to simplify it a little bit into a blank format so if you’re 100% deadest on having a printable budget planner, you can still use Doctor Budget! Just a simpler version!

So, how does it work?

Take a look at the template below:

As you can see, there are really four different sections that you’re going to fill in:

- Month

- “What’s Coming in This Month”

- “Allotted Expenses”

- “Purchases This Month”

Let’s pretend the month is January… the steps would be to fill in the month, and then the dates that you’re expecting paychecks, birthday money, or literally any sort of income. Maybe you’re expecting a nice check from winning your Fantasy Football league – put that in as income!

Then, you would move onto the Allotted Expenses. You’re simply going to put in a list of items that you might expect to spend money on. This might seem easy, but I guarantee you’re going to forget some things. There will be some easy ones like rent/mortgage, groceries and gas for your car, but you’re going to likely forget many others like car maintenance, tolls and home goods!

Personally, I think that unexpected expenses are one of the fastest ways to ruin a budget, so check out these 15 personal budget categories that most people miss to make sure you’re setting yourself up for success.

Once you have your list, you simply will enter in the rest of that chart with the Fixed/Variable information and the ideal budget amount you plan to spend.

Now that your planning phase is completed, it’s time for you to head to the “Purchases This Month” section. As you guessed, now you’re simply just recording all of your expenses that you might have. This might seem cumbersome, but you’re the one that wanted to do things the old-fashioned way!

And let’s be honest, writing down your expenses is the best way to actually learn where your money is going. It’s going to stick in your brain and after getting two coffees at Starbucks every day at $4 each, you’re going to go, “dang, I just spent $240 at Starbucks this month”, but hopefully maybe only a few days in rather than getting all the way to the end of the month!

I know many people that simply use Mint and go, “ok, cool – I spent less than I earned this month.”

Is that your entire goal? Sure, in a simplified way, yes. But spending $10 less isn’t the same as $1000 less. You should be looking for these money sucks that you have in your daily life and trying to find a way to stop them.

If it’s something you absolutely love every day and use, then keep spending it. But if you don’t care about coffee and are spending $240/month…just go buy Folgers. An entire container of grounds is $6 and lasts at least 2 weeks. So, $12 over $240…that seems like an easy choice to me.

But you’ll only notice this because you’re actually tracking your expenses, which is why I get the need to want to write them down.

Just like when you were learning to spell – you wrote the word out. Why? Because it takes time to write a word letter-by-letter vs. typing 60 words/minute like some of us do! (I have no idea how fast I type)

So, that’s why tracking your expenses is the best way to actually learn about your lifestyle!

Ok – your budget is planned and your expenses have been inputted – now what do you do?

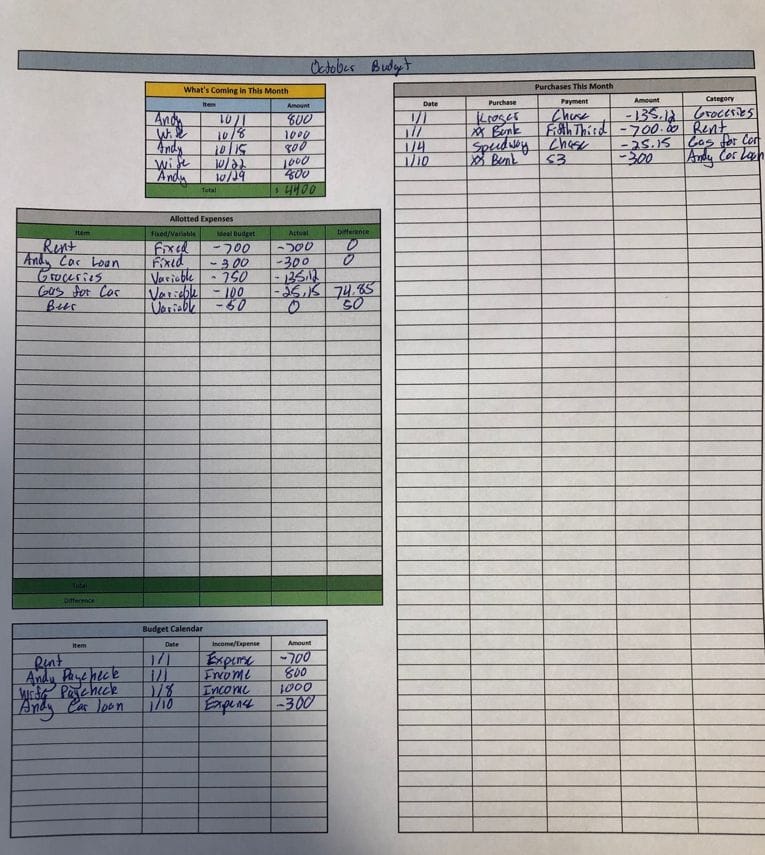

Well, let’s take a look at my sample budget below:

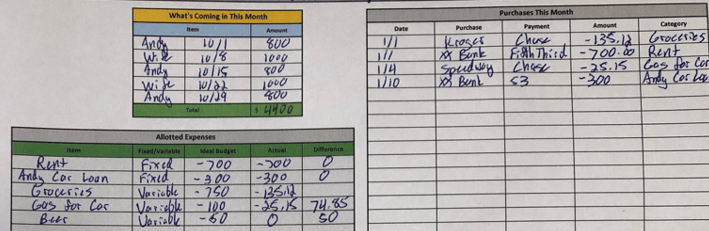

But you can see that I have added in the Month at the very top:

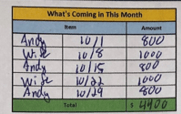

I also then have added in all the income for myself and my wife:

As you can see, it’s broken down by the person, date, and amount. This is very helpful when it comes to the planning process because you know when your money is coming in each month.

I also will include things like birthdays if you get a certain amount every birthday, tax returns, bonuses, etc. It’s important to have planned out all of your income before you get it so you know where it’s going to keep you on track rather than making an impulse purchase on something you don’t need.

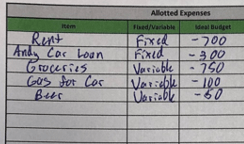

The third step is to input some of your planned expenses for the month as I have done here:

Again, bad handwriting, but you can see how I have listed the various categories and marked if it’s fixed/variable and then the “ideal budget” or the amount that I wish to spend. Of course, the fixed items should be perfectly aligned with what you actually spend as you’re paying the same amount for rent each month.

Maybe one month I would decide to pay more on my car loan, meaning I owed $300 but paid $400. That’s going to show that I overspent but in reality, it’s actually a great thing because I am paying off my debt sooner than required.

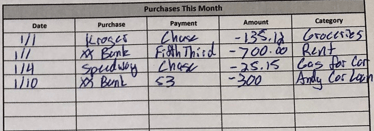

The fourth step is to add in the purchases that I make each month:

As you can see, I listed the date, the purchase, the payment, the amount and then the category. The purchase and category might seem similar but I like to break it down to track further.

For instance, “Groceries” could be at many different places so it’s nice to see what was at Meijer, which is our weekly shopping trip, and what might have been at Kroger, an impulse purchase or something we just stopped in quickly to grab.

The Payment is just the method that was used to pay, so it could be a type of credit card (I have Visa), a bank account (I put Fifth Third & 53 – they’re the same in my mind, 53 is just faster to write), cash, Venmo, PayPal, or any other method! It’s important to really keep track of all your different payment methods so you keep on track.

Personally, it’s hard for me to keep track of my spending with cash because I forget about it at the end of the month when I use it, so that’s a great benefit of using a Printable Budget Planner that I can track much faster and make a part of my every day spending.

That’s also why whenever I get cash for a gift or anything, I immediately put it in my bank account so that I have an electronic trail of where that money goes!

The final step is to add up your various categories. Like I said, this can be cumbersome. Maybe you highlight the items and then cross them out. But this is why I love Doctor Budget because it automatically adds up the categories to give you totals but you’re still forced to type them into the expenses, therefore manually tracking and learning about your spending.

You can see that I started to add up the totals of what I had spent and then put it into the “Actual” section below:

While this does work really well, the hard part is that the actual now has a handwritten number in it that cannot be erased (unless you use pencil, I suppose). This could be annoying and a potential reason to go with Doctor Budget if you’re using your budget daily, but maybe you can just scan the paper sheets so you can track it day-by-day.

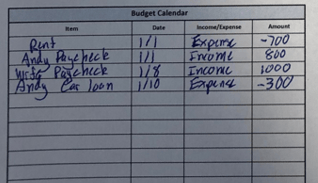

The very last thing that I snuck in at the very end is one of my favorite tools that I do look at daily – a budget calendar! The budget calendar allows me to plan out my fixed expenses and my income to make sure that I have enough money in the bank to pay off my bills.

At the beginning of the month I will list all the dates that income and expenses are expected to hit our bank account as shown below:

As you can see, I have rent and my paycheck both coming out on 1/1. Personally, when this happens, I always make sure that I list the expense first because I want to make sure that I have $700 in my account in case rent is pulled out before I get my paycheck. I don’t want to get hit with an overdraft fee just because of the timing of the rent/paycheck hitting the account.

I really think that a budget calendar is one of the best ways to keep your goals front and center and to stay focused on staying on track with your budget. It takes literally 15 seconds to look at it daily and you get a little “high” from paying your bills on time and seeing leftover cash in your account.

This, combined with a great budget, are going to set you up for success.

If you’re more of the technology lover that wants to automate this, you can get Doctor Budget here for only $29. And either way, even if you already have a budget, you should definitely be using a budget calendar to optimize your cash flow planning!

Related posts:

- The Best Budget Planner Online Today (That’s Also the Simplest to Use) This blog post is something that is really near and dear to my heart. I truly think that so many people are in debt because...

- Budgeting for Beginners: An Easy 5-Step Plan to Making a Budget in Excel One of the most common things that I hear from people is, “I don’t have any money.” The advice from most personal finance people is “just...

- If You Forget These Personal Budget Categories, Your Budget WILL FAIL! The easiest way to fail on your personal budget is to not plan. That’s it – that’s how to fail. Or, maybe you plan but...

- 7 Ways to Prioritize Saving with a Budget Calendar Have you ever heard of a budget calendar? Personally, I use one nearly every single day of the week and it saves me a ton...