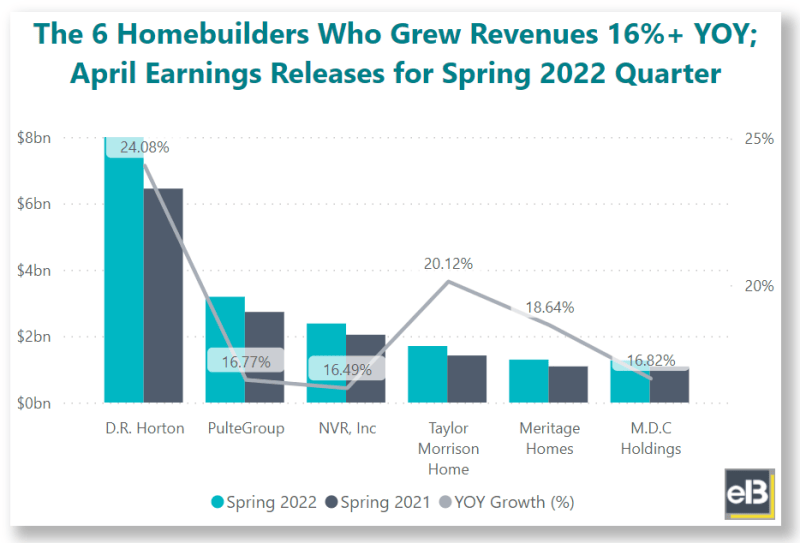

Public financial data collected by investment newsletter provider Sather Research, LLC showed that 6 Publicly Traded Home Builders Grew Total Revenues Over 16% YOY in the January – March Quarter, According to Latest Earnings Releases.

Of the publicly traded home builders who released earnings results in April, the following 6 companies grew revenues 16% YOY: D.R. Horton, NVR Inc, PulteGroup, Taylor Morrison Home, Meritage Homes, and M.D.C. Holdings.

D.R. Horton stood out with the highest growth rate for Spring 2022 revenues at 24.1% followed by Taylor Morrison Home at 20.1%.

The following sections are covered in this report [Click to Skip Ahead]:

- Biggest Publicly Traded Home Builders by Market Share

- Top Homebuilders By Revenue Growth

- Top Homebuilders By Earnings (EPS) Growth

Company revenues, earnings, and stock forecasts covered:

- D.R. Horton (DHI) Stock Forecast

- NVR Inc (NVR) Stock Forecast

- PulteGroup (PHM) Stock Forecast

- Taylor Morrison Home (TMHC) Stock Forecast

- M.D.C. Holdings (MDC) Stock Forecast

- Meritage Homes (MTH) Stock Forecast

This list does not include publicly traded home builders which did not report earnings results in April 2022, which includes large homebuilders such as Lennar, Toll Brothers, Skyline Champion and KB Home.

| Company | Spring ’22 Revenues | Spring ’21 Revenues | YOY |

| D.R. Horton | 7,999,000,000 | 6,446,900,000 | 24.1% |

| NVR, Inc | 2,380,483,000 | 2,043,478,000 | 16.5% |

| PulteGroup | 3,187,615,000 | 2,729,791,000 | 16.8% |

| Taylor Morrison Home | 1,703,124,000 | 1,417,812,000 | 20.1% |

| Meritage Homes | 1,292,780,000 | 1,089,712,000 | 18.6% |

| M.D.C Holdings | 1,269,651,000 | 1,086,881,000 | 16.8% |

D.R. Horton reported a 23% increase YOY in Average Selling Price for its Net Sales Orders in the Fiscal Quarter ending March 31, 2022. The company also closed on 24,340 homes for the quarter.

Taylor Morrison Home increased their home closings revenue by 21% YOY, with a total Average Selling Price increase for Net Sales Orders of 24.2% YOY for the quarter, led by a 27.8% YOY increase in ASP for the West Region.

Meritage Homes saw a 17% YOY increase in average sales price for orders, closing on 2,858 units representing a -1% year-over-year growth rate on homes closed.

PulteGroup reported an 18% YOY increase in average selling price for its Homebuilding Operations, and closed on 6,039 units for the quarter ending March 31, 2022.

M.D.C. Holdings increased their unit deliveries by 3% YOY for the quarter to 2,233 units. They also saw a higher average selling price on net orders by 14% YOY.

NVR Inc. announced an average sales price of new orders increase of 13% YOY in their quarter ending March 31, 2022. Settlements were 5,214 units for the quarter.

Key Takeaway

The high increases in average selling prices for new orders suggest that revenues for next fiscal year should continue to grow strongly even if supply chain issues and inflation reduce the profits or affect the speed of new home closings.

Both earnings and revenues have grown tremendously for these companies year-over-year despite challenges around delivering homes, as minor decreases in units closed have not generally affected home builder financials and growth rates over the last several years.

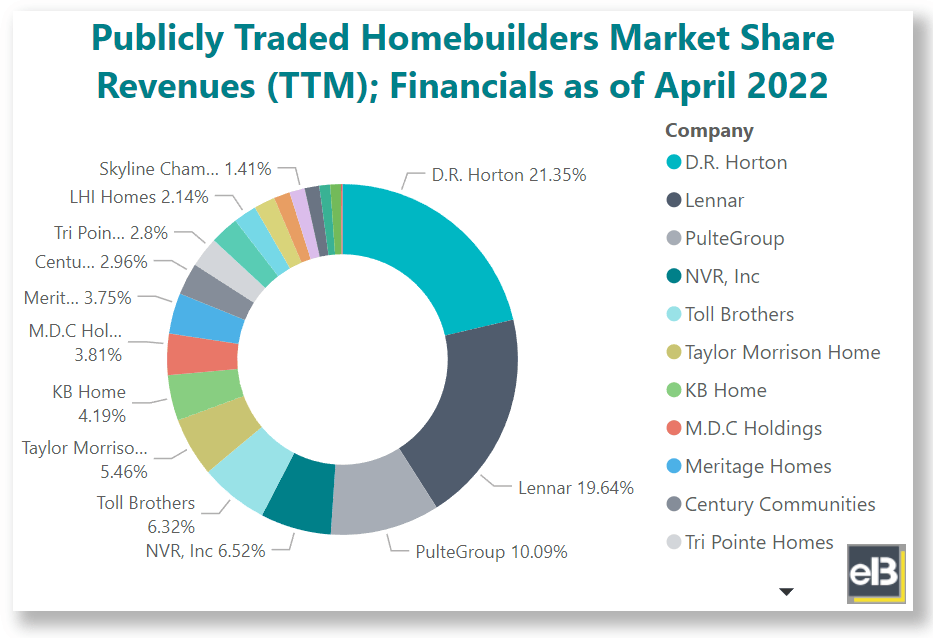

Biggest Publicly Traded Home Builders by Market Share

The next chart displays a complete list of all publicly traded home builders based in the United States, as of the end of April 2022.

The leaders include D.R. Horton with roughly a 21.3% market share, Lennar with 19.6% of the market, and PulteGroup with 10.1% of Trailing Twelve Months (TTM) revenue share of all publicly traded homebuilders.

| Company | Revenues (TTM) | Mkt Share |

| D.R. Horton | $ 30,446,300,000 | 21.3% |

| Lennar | $ 28,008,724,000 | 19.6% |

| NVR, Inc | $ 9,296,755,000 | 6.5% |

| PulteGroup | $ 14,384,707,000 | 10.1% |

| Toll Brothers | $ 9,018,066,000 | 6.3% |

| Taylor Morrison Home | $ 7,786,577,000 | 5.5% |

| Skyline Champion Corp | $ 2,016,761,000 | 1.4% |

| Meritage Homes | $ 5,350,394,000 | 3.8% |

| KB Home | $ 5,981,981,000 | 4.2% |

| M.D.C Holdings | $ 5,437,438,000 | 3.8% |

| LHI Homes | $ 3,050,149,000 | 2.1% |

| Cavco Industries | $ 1,428,181,000 | 1.0% |

| Tri Pointe Homes | $ 3,997,513,000 | 2.8% |

| Century Communities | $ 4,224,096,000 | 3.0% |

| Dream Finders Homes | $ 1,923,910,000 | 1.3% |

| M/I Homes | $ 3,777,922,000 | 2.6% |

| Green Brick Partners | $ 1,402,876,000 | 1.0% |

| Beazer Homes USA | $ 2,124,530,000 | 1.5% |

| Legacy Housing Corp | $ 193,701,000 | 0.1% |

| Hovnanian Enterprises | $ 2,773,506,000 | 1.9% |

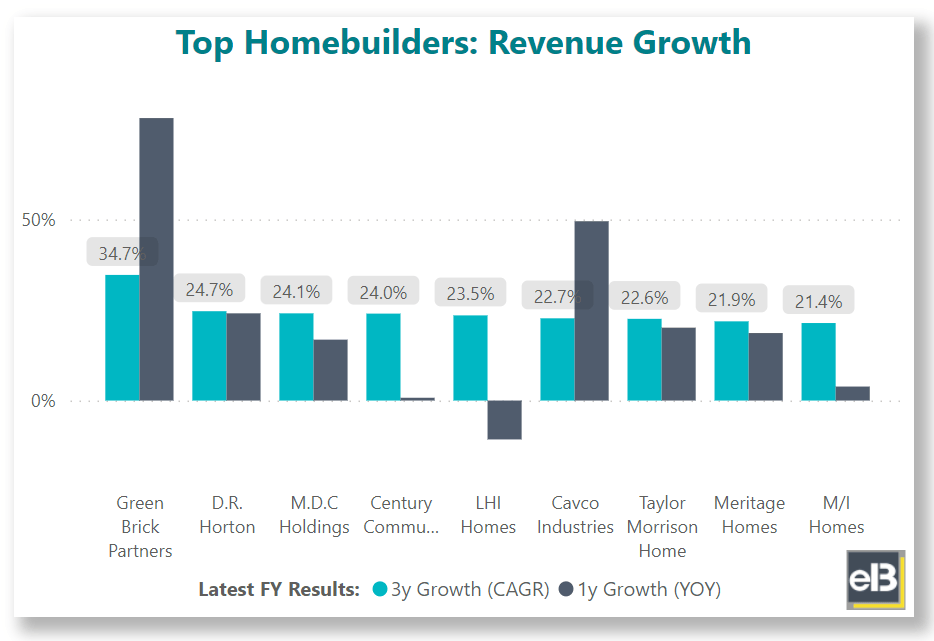

Top Homebuilders By Revenue Growth

Over the last 3 Fiscal Years, no publicly traded homebuilder has grown revenues faster than Green Brick Partners, with a 34.7% annual compounded growth rate.

Green Brick Partners has seen revenues especially boosted in their latest Year-Over-Year fiscal year comparison, growing revenue 78.0% from their Fiscal 2020 to Fiscal 2021.

D.R. Horton makes up the #2 spot with a 24.7% compounded annual growth rate, and M.D.C Holding and Century Communications both recorded compounded annual growth rates around 24% between their latest full Fiscal Year results, and those 3 years prior (“3y CAGR”).

| Company | 1y Growth (YOY) | 3y Growth (CAGR) |

| D.R. Horton | 24.1% | 24.7% |

| Taylor Morrison Home | 20.1% | 22.6% |

| Meritage Homes | 18.6% | 21.9% |

| M.D.C Holdings | 16.8% | 24.1% |

| LHI Homes | -10.7% | 23.5% |

| Cavco Industries | 49.5% | 22.7% |

| Century Communities | 0.8% | 24.0% |

| M/I Homes | 3.9% | 21.4% |

| Green Brick Partners | 78.0% | 34.7% |

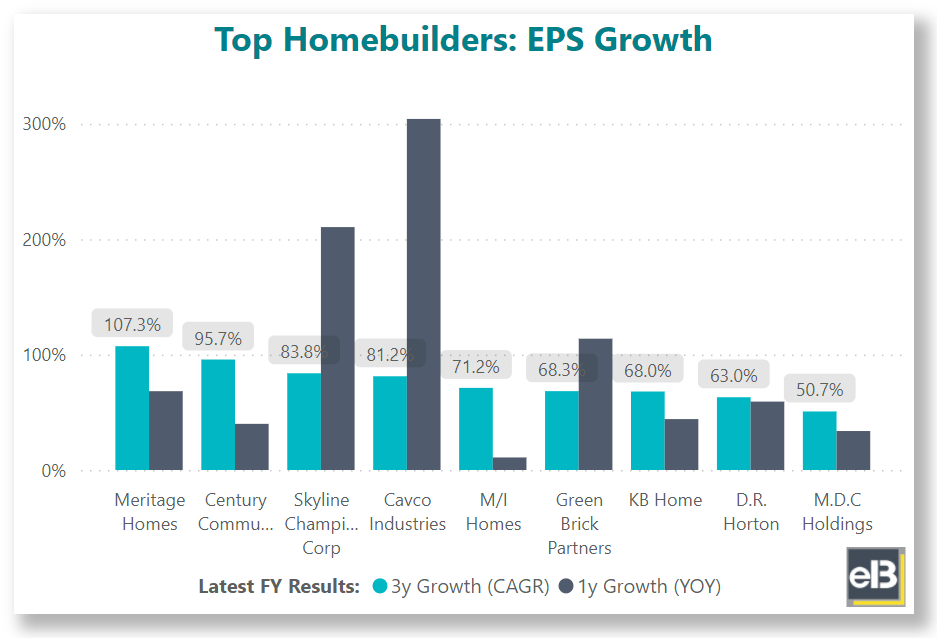

Top Homebuilders By Earnings (EPS) Growth

Over the last 3 fiscal year periods, Meritage Homes had the highest 3-year annual compounded growth rate of 107.3% in earnings per share.

A total of 9 publicly traded homebuilders have recorded compounded annual EPS growth rates of 50%+ in their last 3 Fiscal Years.

Of the group, Cavco Industries had the highest 1-year YOY growth rate of EPS at 304.2%.

The next highest 3-year EPS CAGR companies included Century Communities at 95.7%, Skyline Champion Corp at 83.8%, and Cavco Industries at 81.2%.

| Company | 1y Growth (YOY) | 3y Growth (CAGR) |

| D.R. Horton | 59.3% | 63.0% |

| Skyline Champion Corp | 210.5% | 83.8% |

| Meritage Homes | 68.3% | 107.3% |

| KB Home | 44.1% | 68.0% |

| M.D.C Holdings | 33.8% | 50.7% |

| Cavco Industries | 304.2% | 81.2% |

| Century Communities | 40.0% | 95.7% |

| M/I Homes | 10.9% | 71.2% |

| Green Brick Partners | 113.8% | 68.3% |

Key takeaway: Companies in this list, and homebuilders in general, have historically tended to see high fluctuations in Earnings Per Share (EPS) growth, as the highly cyclical nature of the business can cause margins and revenues to swing more widely than the average company.

D.R. Horton (DHI) Revenue, Earnings, and Stock Forecast

D.R. Horton’s revenue over the latest Trailing Twelve Month period was $30.45 billion. D.R. Horton’s earnings (Net Income) over the latest Trailing Twelve Month period was $5.03 billion.

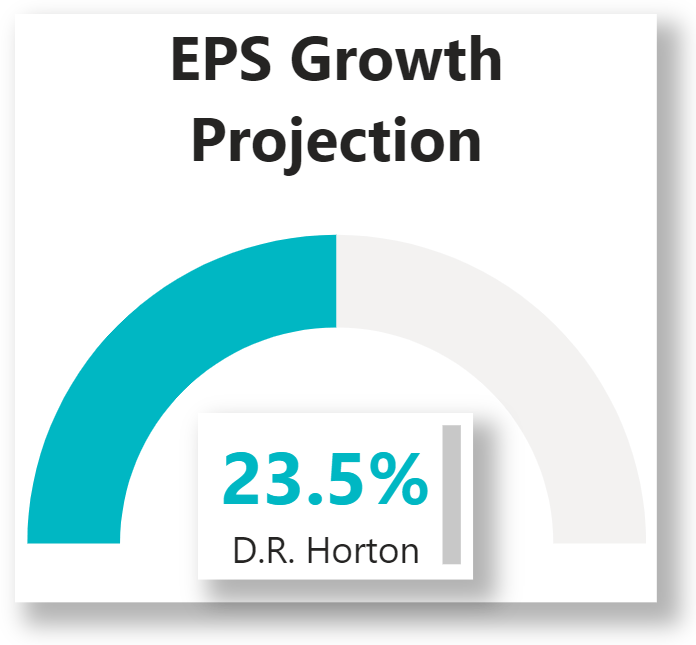

The Wall Street consensus for D.R. Horton’s EPS (earnings per share) projection over the next 12 months is $17.25. D.R. Horton’s TTM (trailing twelve months) Earnings Per Share was $13.97 as of the quarter ending March 31, 2022.

Thus, D.R. Horton is expected to grow earnings per share by 23.5% in the next 12 months based on the consensus of stock market analyst forecasts.

NVR Inc (NVR) Revenue, Earnings, and Stock Forecast

NVR’s revenue over the latest Trailing Twelve Month period was $9.3 billion. NVR’s earnings (Net Income) over the latest Trailing Twelve Month period was $1.4 billion.

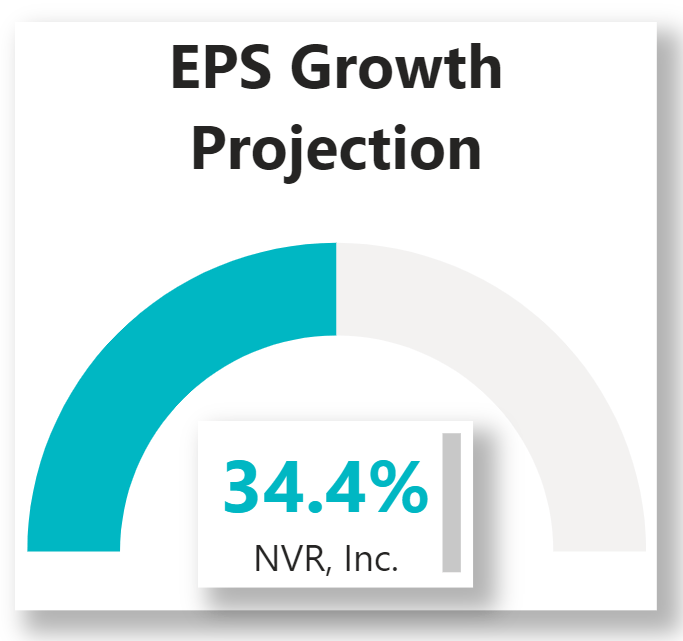

The Wall Street consensus for NVR’s EPS (earnings per share) projection over the next 12 months is $503.50. NVR’s TTM (trailing twelve months) Earnings Per Share was $374.49 as of the quarter ending March 31, 2022.

Thus, NVR is expected to grow earnings per share by 34.4% in the next 12 months based on the consensus of stock market analyst forecasts.

PulteGroup (PHM) Revenue, Earnings, and Stock Forecast

Pulte’s revenue over the latest Trailing Twelve Month period was $14.38 billion. Pulte’s earnings (Net Income) over the latest Trailing Twelve Month period was $2.10 billion.

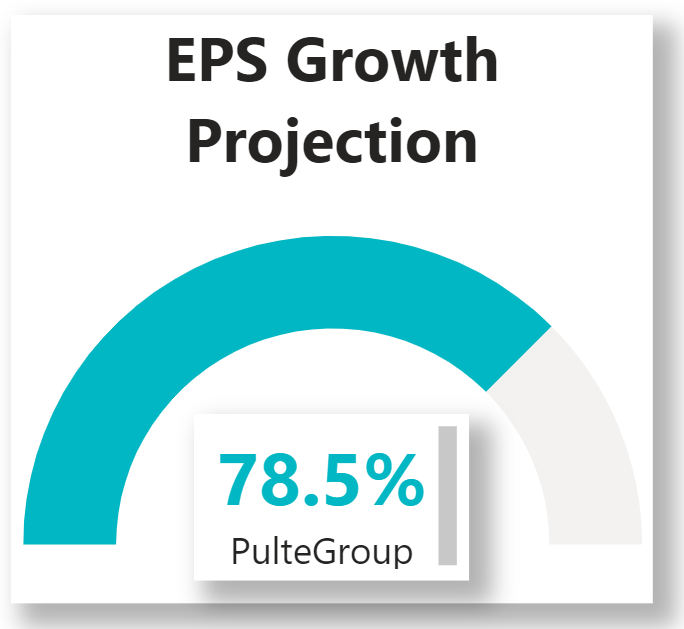

The Wall Street consensus for Pulte’s EPS (earnings per share) projection over the next 12 months is $11.53. Pulte’s TTM (trailing twelve months) Earnings Per Share was $6.46 as of the quarter ending March 31, 2022.

Thus, PulteGroup is expected to grow earnings per share by 78.5% in the next 12 months based on the consensus of stock market analyst forecasts.

Taylor Morrison Home (TMHC) Revenue, Earnings, and Stock Forecast

Taylor Morrison Home’s revenue over the latest Trailing Twelve Month period was $7.79 billion. The company’s earnings (Net Income) over the latest Trailing Twelve Month period was $741.7 million.

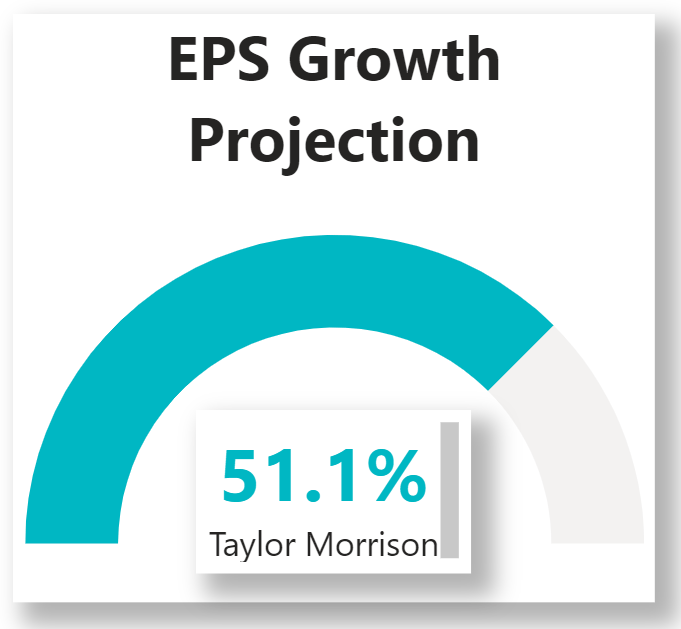

The Wall Street consensus for Taylor Morrison Home’s EPS (earnings per share) projection over the next 12 months is $8.93. The company’s TTM (trailing twelve months) Earnings Per Share was $5.91 as of the quarter ending March 31, 2022.

Thus, Taylor Morrison Homes is expected to grow earnings per share by 51.1% in the next 12 months based on the consensus of stock market analyst forecasts.

M.D.C. Holdings (MDC) Revenue, Earnings, and Stock Forecast

M.D.C. Holdings’ revenue over the latest Trailing Twelve Month period was $5.44 billion. The company’s earnings (Net Income) over the latest Trailing Twelve Month period was $611.4 million.

The Wall Street consensus for M.D.C. Holdings’ EPS (earnings per share) projection over the next 12 months is $11.34. The company’s TTM (trailing twelve months) Earnings Per Share was $7.83 as of the quarter ending March 31, 2022.

Thus, M.D.C. Holdings is expected to grow earnings per share by 44.8% in the next 12 months based on the consensus of stock market analyst forecasts.

Meritage Homes (MTH) Revenue, Earnings, and Stock Forecast

Meritage Homes’ revenue over the latest Trailing Twelve Month period was $5.35 billion. The company’s earnings (Net Income) over the latest Trailing Twelve Month period was $822.9 million.

The Wall Street consensus for Meritage Homes’ EPS (earnings per share) projection over the next 12 months is $25.71. The company’s TTM (trailing twelve months) Earnings Per Share was $21.64 as of the quarter ending March 31, 2022.

Thus, Meritage Homes is expected to grow earnings per share by 18.8% in the next 12 months based on the consensus of stock market analyst forecasts.

Methodology

All data was sourced from publicly available filings and releases, and processed by investment newsletter provider Sather Research, LLC.

Stock forecasts and analyst consensus EPS growth estimates were sourced from data provided by finviz.

Contact Andrew Sather at [email protected] for any further commentary, concerns, questions, or feedback. Alternatively, you can get in touch with the company during business hours through our contact page, or call 888-978-1348 from Monday – Friday; 9AM EST – 5:00 PM EST.

Related posts:

- Cisco 10Q Summary Third Quarter 2020 Cisco reported quarter ending results for April 25, 2020, on May 13, 2020. The following report is a summary of those results, no opinion on...

- Pulte Group 10Q Summary of First Quarter 2020 Pulte Group (PHM) announced its first-quarter earnings of 2020 on April 23, 2020. The following report will be present a summary of those results; there...

- Kontoor Brands (KTB) 10Q Summary for First Quarter 2020 Kontoor Brands (KTB) announced its first-quarter results on May 7, 2020. The following report will be a summary of those results for the first quarter....

- Moody’s Corporation 10Q Summary of First-quarter 2020 Moody’s Corporation (MCO) announced results for the first quarter of 2020 on April 30, 2020. The following report is a summary of those results for...