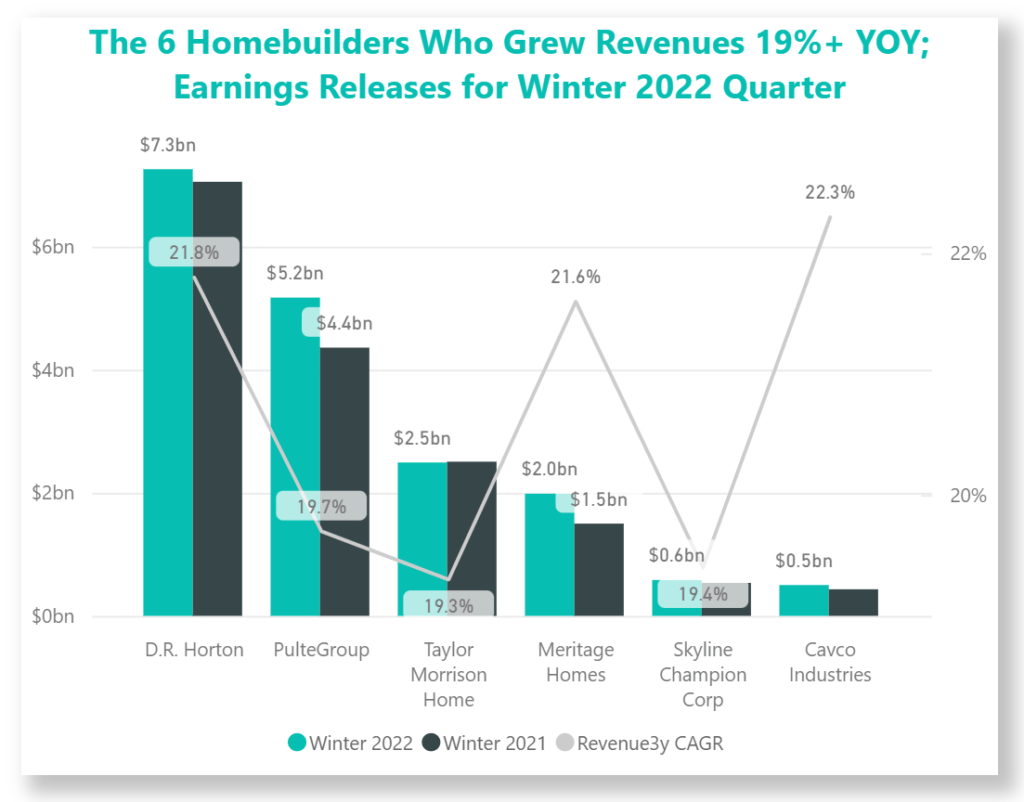

Public financial data collected by investment newsletter provider Sather Research, LLC showed that 6 Publicly Traded Home Builders Grew Total Revenues Over 19% YOY in the October – December Quarter, According to Latest Earnings Releases.

Of the publicly traded home builders who released earnings results in January/February, the following 6 companies grew revenues 19% YOY: D.R. Horton, PulteGroup, Taylor Morrison Home, Meritage Homes, Cavco Industries, and Skyline Champion Corp.

Cavco Industries stood out with the highest growth rate for Winter 2022 revenues at 22.3% followed by D.R. Horton at 21.8%.

The following sections are covered in this report [Click to Skip Ahead]:

- Biggest Publicly Traded Home Builders by Market Share

- Top Homebuilders By Revenue Growth

- Top Homebuilders By Earnings (EPS) Growth

Company revenues, earnings, and stock forecasts covered:

- D.R. Horton (DHI) Stock Forecast

- NVR Inc (NVR) Stock Forecast

- PulteGroup (PHM) Stock Forecast

- Taylor Morrison Home (TMHC) Stock Forecast

- M.D.C. Holdings (MDC) Stock Forecast

- Meritage Homes (MTH) Stock Forecast

This list does not include publicly traded home builders which did not report earnings results in the quarter ending December 2022, which includes large homebuilders such as Lennar, Toll Brothers, NVR, Inc., and KB Home.

| Company | Winter ’22 Revenues | Winter ’21 Revenues | YOY |

| Cavco Industries | $ 500,603,000 | $ 431,714,000 | 22% |

| D.R. Horton | $ 7,257,800,000 | $7,053,400,000 | 22% |

| Meritage Homes | $ 1,984,063,000 | $1,498,813,000 | 22% |

| PulteGroup | $ 5,171,378,000 | $4,358,558,000 | 20% |

| Skyline Champion Corp | $ 582,322,000 | $ 534,690,000 | 19% |

| Taylor Morrison Home | $ 2,492,126,000 | $2,505,422,000 | 19% |

D.R. Horton reported a –40% decrease YOY in Net Sales Orders in the Fiscal Quarter ending December 31, 2022. The company also closed on 13,382 homes for the quarter, with a 27% cancellation rate.

Taylor Morrison Home saw Net sales orders decline by -42% YOY, with the number of homes closed declining -11% to 3,797 homes for the quarter.

Meritage Homes saw a 6% YOY increase in average sales price for orders, and a 32% increase in Home closing revenue. The company closed on 4,540 units, representing a 29% year-over-year growth rate on homes closed.

PulteGroup reported an 17% YOY increase in average selling price for its Homebuilding Operations, and closed on 8,848 units for the quarter ending December 31, 2022.

Skyline Champion Corp decreased their U.S. homes sold by -1.4% YOY for the quarter to 5,749 units. They also saw a higher Average selling price per new U.S. home sold by 13.5% YOY.

Cavco Industries announced +15.9% YOY increase in Net factory-built housing revenue per home sold in their quarter ending December 31, 2022. Factory-built homes sold were 4,442 units for the quarter.

Key Takeaway

The deceleration in average selling prices growth for new orders suggest that revenues for next fiscal year could slowdown even as continued pricing power shows sustained strong demand for certain segments of homes.

Both earnings and revenues have grown tremendously for these companies year-over-year despite challenges around increased cancellations and labor and materials shortages.

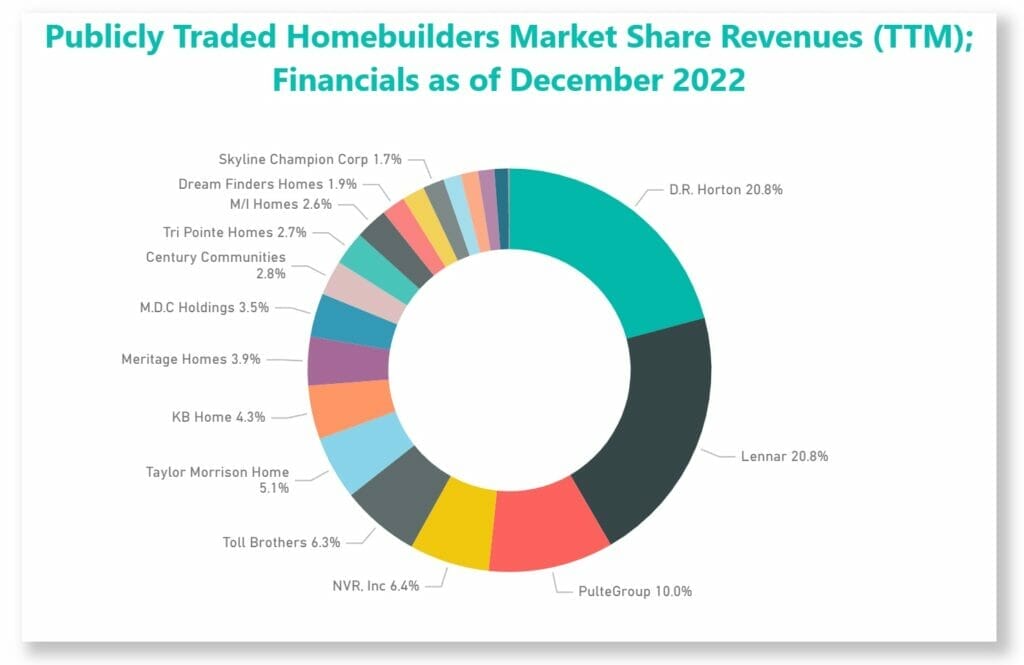

Biggest Publicly Traded Home Builders by Market Share

The next chart displays a complete list of all publicly traded home builders based in the United States, as of the end of December 2022.

The leaders include D.R. Horton with roughly a 20.8% market share, Lennar with 20.8% of the market as well, and PulteGroup with 10.0% of Trailing Twelve Months (TTM) revenue share of all publicly traded homebuilders.

| Company | Revenues (TTM in thousands) | Mkt Share |

| D.R. Horton | $ 33,684,300 | 20.8% |

| Lennar | $ 33,671,010 | 20.8% |

| PulteGroup | $ 16,228,995 | 10.0% |

| NVR, Inc | $ 10,326,770 | 6.4% |

| Toll Brothers | $ 10,264,646 | 6.3% |

| Taylor Morrison Home | $ 8,224,917 | 5.1% |

| KB Home | $ 6,903,776 | 4.3% |

| Meritage Homes | $ 6,268,727 | 3.9% |

| M.D.C Holdings | $ 5,717,987 | 3.5% |

| Century Communities | $ 4,505,916 | 2.8% |

| Tri Pointe Homes | $ 4,348,533 | 2.7% |

| M/I Homes | $ 4,131,393 | 2.6% |

| Dream Finders Homes | $ 3,094,959 | 1.9% |

| Hovnanian Enterprises | $ 2,922,231 | 1.8% |

| Skyline Champion Corp | $ 2,753,145 | 1.7% |

| Beazer Homes USA | $ 2,307,767 | 1.4% |

| Legacy Housing Corp | $ 2,304,455 | 1.4% |

| Cavco Industries | $ 2,171,812 | 1.3% |

| Green Brick Partners | $ 1,778,955 | 1.1% |

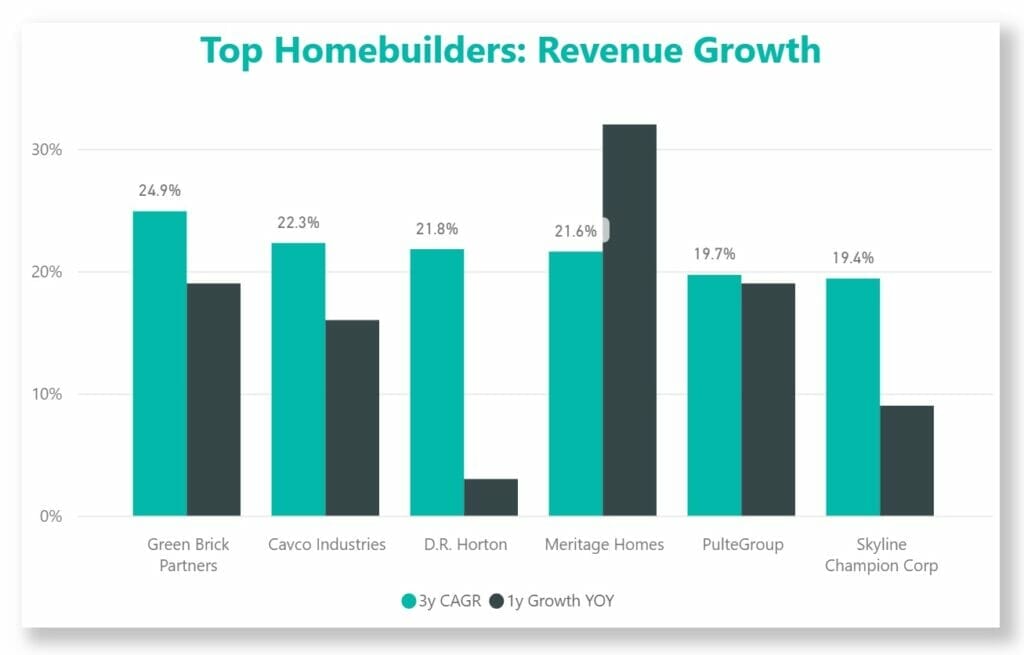

Top Homebuilders By Revenue Growth

Over the last 3 Fiscal Years, no publicly traded homebuilder has grown quarterly revenues faster than Green Brick Partners, with a 24.9% annual compounded growth rate.

Meritage Homes has also greatly boosted revenues in their latest Year-Over-Year quarterly comparison, growing revenue 32% from 2021 to 2022.

Cavco Industries makes up the #2 spot with a 22.3% compounded annual growth rate, and D.R. Horton and Meritage Homes both recorded compounded annual growth rates around 21% between their latest quarterly results, and those 3 years prior (“3y CAGR”).

| Company | 3y Growth (CAGR) | 1y Growth (YOY) |

| Green Brick Partners | 24.9% | 19.0% |

| Cavco Industries | 22.3% | 16.0% |

| D.R. Horton | 21.8% | 3.0% |

| Meritage Homes | 21.6% | 32.0% |

| PulteGroup | 19.7% | 19.0% |

| Skyline Champion Corp | 19.4% | 9.0% |

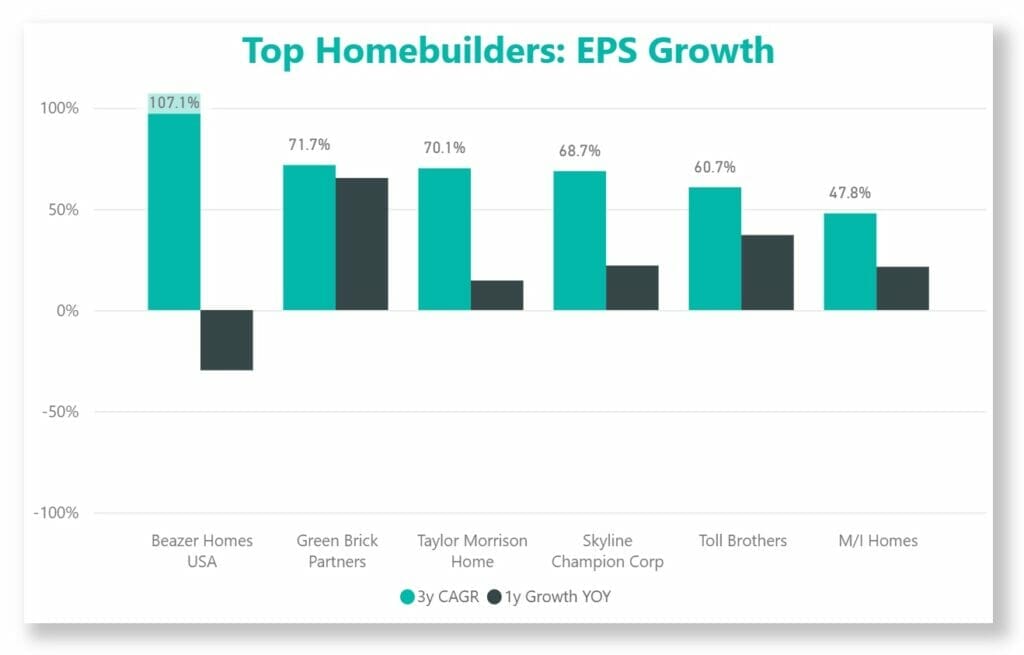

Top Homebuilders By Earnings (EPS) Growth

Over the last 3 fiscal year periods, Beazer Homes USA had the highest 3-year annual compounded growth rate of 107.1% in earnings per share.

A total of 5 publicly traded homebuilders have recorded compounded annual EPS growth rates of 50%+ in their last 3 Fiscal Years.

Of the group, Green Brick Partners had the highest 1-year YOY growth rate of EPS at 65%.

The highest 3-year EPS CAGR companies included Green Brick Partners at 71.7%, Taylor Morrison Home at 70.1%, and Skyline Champion Corp at 68.7%.

| Company | 3y Growth (CAGR) | 1y Growth (YOY) |

| Beazer Homes USA | 107.1% | -30% |

| Green Brick Partners | 71.7% | 65% |

| Taylor Morrison Home | 70.1% | 15% |

| Skyline Champion Corp | 68.7% | 22% |

| Toll Brothers | 60.7% | 37% |

| M/I Homes | 47.8% | 21% |

Key takeaway: Companies in this list, and homebuilders in general, have historically tended to see high fluctuations in Earnings Per Share (EPS) growth, as the highly cyclical nature of the business can cause margins and revenues to swing more widely than the average company.

Homebuilders Revenue, Earnings and Stock Forecast (By Company; Quarter ending December 2022)

| Company | YOY EPS Forecast |

|---|---|

| D.R. Horton | -52.4% |

| NVR, Inc. | -23.7% |

| PulteGroup | -1.1% |

| Taylor Morrison | -8.3% |

| M.D.C. Holdings | -72.8% |

| Meritage Homes | -56.0% |

D.R. Horton (DHI) Revenue, Earnings, and Stock Forecast

D.R. Horton’s revenue over the latest Trailing Twelve Month period was $33.68 billion. D.R. Horton’s earnings (Net Income) over the latest Trailing Twelve Month period was $5.67 billion.

The Wall Street consensus for D.R. Horton’s EPS (earnings per share) projection for the next quarter is $1.92. D.R. Horton’s TTM (trailing twelve months) Earnings Per Share was $16.13 as of the quarter ending December 31, 2022.

D.R. Horton is expected to see a contraction in earnings per share of -52.4% YOY in the next quarter based on the consensus of stock market analyst forecasts.

NVR Inc (NVR) Revenue, Earnings, and Stock Forecast

NVR’s revenue over the latest Trailing Twelve Month period was $10.58 billion. NVR’s earnings (Net Income) over the latest Trailing Twelve Month period was $1.73 billion.

The Wall Street consensus for NVR’s EPS (earnings per share) projection for the next quarter is $88.96. NVR’s TTM (trailing twelve months) Earnings Per Share was $492.33 as of the quarter ending December 31, 2022.

NVR Inc is expected to see a contraction in earnings per share of -23.7% YOY in the next quarter based on the consensus of stock market analyst forecasts.

PulteGroup (PHM) Revenue, Earnings, and Stock Forecast

Pulte’s revenue over the latest Trailing Twelve Month period was $16.23 billion. Pulte’s earnings (Net Income) over the latest Trailing Twelve Month period was $2.60 billion.

The Wall Street consensus for Pulte’s EPS (earnings per share) projection for the next quarter is $1.81. Pulte’s TTM (trailing twelve months) Earnings Per Share was $11.20 as of the quarter ending December 31, 2022.

PulteGroup is expected to see a contraction in earnings per share of -1.1% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Taylor Morrison Home (TMHC) Revenue, Earnings, and Stock Forecast

Taylor Morrison Home’s revenue over the latest Trailing Twelve Month period was $8.22 billion. Taylor Morrison Home’s earnings (Net Income) over the latest Trailing Twelve Month period was $1.05 billion.

The Wall Street consensus for Taylor Morrison Home’s EPS (earnings per share) projection for the next quarter is $1.32. Taylor Morrison Home’s TTM (trailing twelve months) Earnings Per Share was $9.12 as of the quarter ending December 31, 2022.

Taylor Morrison Home Corp is expected to see a contraction in earnings per share of -8.3% YOY in the next quarter based on the consensus of stock market analyst forecasts.

M.D.C. Holdings (MDC) Revenue, Earnings, and Stock Forecast

M.D.C. Holdings’ revenue over the latest Trailing Twelve Month period was $5.72 billion. M.D.C. Holdings’ earnings (Net Income) over the latest Trailing Twelve Month period was $559.4 million.

The Wall Street consensus for M.D.C. Holdings’ EPS (earnings per share) projection for the next quarter is $0.55. M.D.C. Holdings’ TTM (trailing twelve months) Earnings Per Share was $7.68 as of the quarter ending December 31, 2022.

M.D.C. Holdings is expected to see a contraction in earnings per share of -72.8% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Meritage Homes (MTH) Revenue, Earnings, and Stock Forecast

Meritage Homes’ revenue over the latest Trailing Twelve Month period was $6.29 billion. Meritage Homes’ earnings (Net Income) over the latest Trailing Twelve Month period was $992.2 million.

The Wall Street consensus for Meritage Homes’ EPS (earnings per share) projection for the next quarter is $2.55. Meritage Homes’ TTM (trailing twelve months) Earnings Per Share was $26.75 as of the quarter ending December 31, 2022.

Meritage Homes Corp is expected to see a contraction in earnings per share of -56.0% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Methodology

All data was sourced from publicly available filings and releases, and processed by investment newsletter provider Sather Research, LLC.

Stock forecasts and analyst consensus EPS growth estimates were sourced from data provided by Seeking Alpha.

Contact Andrew Sather at [email protected] for any further commentary, concerns, questions, or feedback. Alternatively, you can get in touch with the company during business hours through our contact page, or call 888-978-1348 from Monday – Friday; 9AM EST – 5:00 PM EST.

Related posts:

- Publicly Traded Home Builders Report: Spring 2022 Results Public financial data collected by investment newsletter provider Sather Research, LLC showed that 6 Publicly Traded Home Builders Grew Total Revenues Over 16% YOY in...

- AT&T (T) 10Q Summary First Quarter 2020 AT&T 10Q Summary First Quarter 2020 AT&T Inc announced its first-quarter earnings on April 20, 2020. What follows is a summary you can read to...

- Berkshire Hathaway 10Q Summary First Quarter 2020 Berkshire Hathaway reported its first-quarter earnings on May 2, 2020. This report is a summary of those first-quarter results and will not attempt any analysis...

- Pulte Group 10Q Summary of First Quarter 2020 Pulte Group (PHM) announced its first-quarter earnings of 2020 on April 23, 2020. The following report will be present a summary of those results; there...