Trusting someone to help you plan your future is a big decision, and it’s important to understand the right questions to ask a financial advisor to ensure it’s the right decision for you.

The post will cover the many factors to asking the right questions of your potential financial advisor. Hopefully, this will dispel some of the confusion around hiring a financial advisor and what it can entail.

Click to jump to a section:

- Why is Having a Financial Advisor Looked Down On?

- How to Make the Right Decision Regarding a Financial Advisor

- The 16 Questions You Should Ask a Financial Advisor Before Hiring One

- Summary

Why is Having a Financial Advisor Looked Down On?

Unfortunately, in my time actively listening, reading and experiencing the various financial community podcasts, blogs and forums, it seems like having a financial advisor is almost a bad thing.

It’s almost an assumption that all financial advisors are evil and only looking after themselves and that if you need one, you’re viewed as unintelligent or beneath others. I’m not going to lie – it absolutely disgusts me for a few different reasons:

- Not all financial advisors are out there looking to pull a quick one over on you to benefit themselves only

- Hiring a financial advisor doesn’t mean you’re dumb. If anything, it means the exact opposite. Most likely, you’ve hired them for one of three reasons:

- You don’t have the time to manage your finances

- Personally, I can’t even fathom this. But to be fair, that’s my ignorance. There are people out there with too much else going on to do this. And quite possibly, they might make more money spending their time doing other things or think there’s greater value in doing other things.

- You’re not confident in your financial understanding and consistency

- Can you think of literally any other time when hiring someone to help you out in an area where you might lack awareness is considered a bad thing? Me neither, but sometimes people give it that bad rap.

- You are confident in your knowledge, but you want to bounce your ideas off someone and trust their expertise as it is their job.

- This is 100% respectable. Why would you not want to trust a professional to have your best interest in mind and to help you reach your goals?

- You don’t have the time to manage your finances

In my opinion, I think a lot of the bad rap in the finance community regarding financial advisors might come from people that have heard of others that had bad experiences. Or, maybe they’ve even worked in that environment and had bad experiences in the space.

That’s great, and it’s ok to be skeptical, but I am here to say that not all financial advisors are out to get you. However, some are. Some will try to take advantage and pull one over on you. Some financial advisors ONLY have their best interest in mind and will feed you lies so that they can collect that big commission check.

How to Make the Right Decision Regarding a Financial Advisor

So, what can you do?

First, take the time to learn about financial independence, investing, saving, budgeting, and all of the other catchy terms and methodologies on your own.

Your situation will not worsen by trying to take the bull by the horns and learn on your own.

Worst case, you’re more knowledgeable when you hire a financial advisor and can assist, challenge, and brainstorm with your advisor. Best case, you find out that you don’t even need one.

If you want to dive further into whether you should use a financial advisor, read this post.

But for the sake of this post, let’s assume that you still think you want an advisor.

The 16 Questions You Should Ask a Financial Advisor Before Hiring One

So now that you’ve decided to hire a financial advisor, maybe you fall into one of the three categories above. Maybe there’s a completely different reason that you want an advisor.

What is the best path forward? You’ve found someone to speak with and have a meeting set up – let me guide you through a questionnaire to interview your advisor and make sure that they’re a fit for you:

1. How and when do you get paid?

If you’re being charged a commission, that is an immediate red flag. Commission is something that is offered to incentivize a sale, not incentivize the well-being of the individual.

If you could make $5,000 by selling the customer a GREAT product or $10,000 by selling the customer a good product, which would you choose? I bet 99% of you are saying you would sell them a great product. Well, I think you’re all liars.

But unfortunately for you, it doesn’t matter what you would pick – it’s what the advisor would pick. I would rather have a great product and, for that reason, focus on an advisor with fee-based costs.

2. What are my costs?

This is so incredibly important. The primary concern with a financial advisor are costs that you don’t pay if you invest for yourself.

You need to understand exactly what you’re paying and why you’re paying it. Is it a flat fee? Is it a subscription? Is it performance-based?

A very clear outline of your costs needs to be a focal point. PS – free…yeah, that’s not a good thing. Nobody works for free. If they say they are working for free, they’re probably not. Another red flag in my eyes.

3. Are you a fiduciary?

Fiduciary is defined as “involving trust, especially with regard to the relationship between a trustee and a beneficiary.” Does that sound like something you would want? I know it’s what I would want.

A fiduciary is required to do what they believe is in the client’s best interest. Well, an advisor that isn’t a fiduciary isn’t required to do so. In other words, they can push a product or service that gets them a higher commission even if they know it won’t perform as well.

You want a financial advisor to be focused on your financial performance above all else. A fiduciary is a must-have.

4. How have you handled the market during COVID?

We all know the market has struggled due to supply chain issues related to COVID. However, it is important to know how your potential advisor has made out through the drop.

Have they managed not to drop as far as the market? Have they altered their strategies in the short-term to account for challenges in different sectors?

This will give you a good idea of how adaptable they are, and whether they are actually a better performer than other options in a worst-case scenario.

5. What services do you provide?

Do they offer investment management, financial planning, personal finance, etc.? Exactly what is being offered to you? You might not need or want all of this advice – but you’re likely paying for it. Take the time to find someone offering exactly what you need.

In addition, a financial advisor can be very helpful if you want help with other aspects of your financial advice outside of investing. In this case, make sure they can assist you in the ways you need.

6. Do I fit in with your current clientele?

Who cares, right? WRONG. Ideally, you will match the characteristics of your potential advisors’ current clientele. Why, you ask? Well – it’s simple, really.

Your potential advisor is already familiar with what you’re looking for. It’s not uncharted territory for them.

You have multiple case studies of how this advisor’s recommendations have performed. Just ask for some references.

7. What is your approach?

This is very important and goes along with the current clientele question. Your advisor should align with your best interests. Do not get this confused with them having to agree with all of your desires, though.

You hired them for a reason – their expertise.

Be free to give suggestions and challenge their thoughts, but listen to what they say. You hired them. It’s their career. If you did your homework on the front end when hiring them, you should trust them to have your best interest in mind.

Personally, I am at the age that I want to be as aggressive as humanly possible and invest 100% in stocks (I’d be 110% if I could be). However, if I hired an investor that I really, really trusted and they had a legit case for me not to be investing this heavily in stocks, I would trust them. If I didn’t, then why did I hire them?

Again, not saying that the advisor should always get the final say, but listen to their experience.

8. What is your experience?

Speaking of experience, what is their experience? Have they ever experienced a recession? Are they fresh out of school? Are they middle-aged but new to the industry? What makes them more knowledgable than yourself?

9. How does our relationship work?

Will I be working with you only or with a team? Is it constant, open communication? Will we have annual meetings? Quarterly? All of these types of questions need to be addressed before signing an advisor.

Communication between an advisor and client is key to having a successful relationship. Lives change and evolve, along with goals. An advisor needs to be aware of these goals as they change.

10. How will you measure success?

If you measure success by beating the market and your advisor measures success by minimizing risk, then, well, your “win-win” territory is when the market is going down, but your portfolio isn’t going down as rapidly. I’m not sure about you, but when I think of “win-win,” I don’t necessarily think of this as the ideal situation. Yes, losing less money is a good thing, and I take a lot of pride in it, but if that’s not your expectation of success, then it might not be the right match for you.

11. What are reasonable expectations for me?

This also goes hand in hand with measuring success. You need to know what can be expected. If you do not understand the goals of your advisor, then is it really fair to be upset if your goals aren’t met? Your goals need to be aligned, and your expectations need to be in sync with one another.

12. Why should I choose you over another financial advisor?

Let the advisor tell you why they’re better. Why are they worth that fee? What can they provide you? After all, you’re the one with the money, and they’re the one interviewing for the opportunity to provide you with a service.

13. What licenses, credentials or certifications do you have?

Is your potential advisor qualified? Do they have any certifications or degrees that will give them a leg up when managing your money? I certainly hope so. I don’t want someone that used to work at GameStop that took a weekend class to be my new financial advisor. I need to be shown that they’ve spent time learning about ways to help me succeed.

14. Can I see a sample financial plan?

This should be an easy give! They should LOVE this question. It’s their chance to tout what they do and show you how they can provide value. If they’re not willing to offer this up…. major red flag.

15. How have your clients’ portfolios typically performed?

This question goes hand in hand with expectations. Past results best predict future behavior. Take a look at some of their clients’ portfolios in bull markets and bear markets. What about looking at different ages? Do you see the advisor with a “one size fits all” type of approach, or does it seem to ‘flex’ a bit based on the client?

16. How many clients do you serve?

Not only will this give you a look at how respectable the advisor is, but it will tell you how much time they might have for you without directly asking for it. Do you want someone who is constantly busy but manages many accounts, so you trust their judgment and history? Or do you want someone that’s more hands-on and doesn’t have as many accounts, and can give you that personal touch?

17. What has been your biggest mistake that you’ve made since being a financial investor?

“What is your biggest weakness?” Have you ever had that question in an interview? Oh, only about 100% of the time?

Yes, I want to hear how the advisor learned from their mistake…but I REALLY want to hear about how bad the mistake was. I want to see if they’re being honest or trying to be clever and show that their biggest mistake was positive, like, “I drove a customer away because I bothered them too much about making sure I was meeting their needs.” Bogus.

I want to hear them say, “I was too risky and lost my customer 30% when the market was down 12%, and by the time it rebounded, the trust and credibility were gone.” That shows me honesty. That gives them credibility in my book because they’re willing to be truthful. If I am ok with that potential outcome, for the risk of the inverse of gaining 30% when the market is up 12%, then maybe that’s a “biggest mistake” that I can handle.

Summary

All in all, financial advisors can be a great asset if you take the time to do the homework on the front end. I really advise (ha….) you to consider it if you think that it’s something that you need.

I highly encourage that you don’t immediately dive into this. Try to learn on your own and see what you can take care of on your own. I think it’s incredibly important and rewarding to be 100% in charge of your own financials if you feel like you have the tools to do so.

If you don’t, look around – there’s a ton of blogs and podcasts to take advantage of, such as this one that you are reading. It’s truly what got me into investing and helping set up myself and my family for retirement, even though we have a long time until we get to that point.

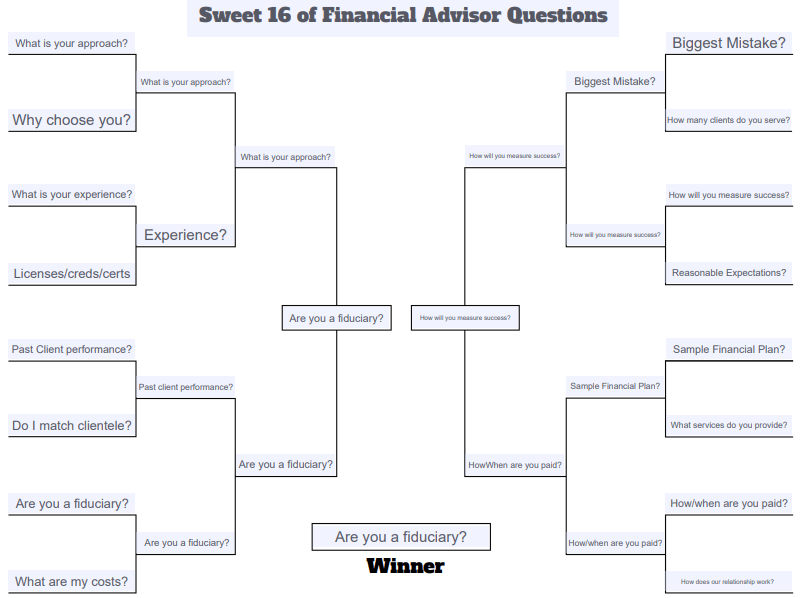

I know that I included a lot of questions to ask a financial advisor, and maybe it seems overwhelming, so I’ve narrowed it down (below) to the questions that I think are the most important.

Best Questions to Ask a Financial Advisor

As you can see, my winning question was if the advisor is a fiduciary, and it’s really pretty simple. If the advisor is a fiduciary and they truly have your best interests at heart, then I think that’s the number one hurdle to overcome. Chances are they have the training and the experience, can adapt to your desired philosophy, and can adjust how often they work with you. All of the questions are very important, but this is the “golden rule” of hiring a financial advisor.

Related posts:

- Easy Steps to Implement the 5 Laws of Gold from ‘The Richest Man in Babylon’ One of the things that I hated the most when I was first starting my financial freedom journey was that there was soooo much information,...

- 4 Tips to Strengthen Your Risk Appetite for Investing in the Stock Market Have you ever heard that the stock market is risky and that you’re going to lose all of your money? I know that I have...

- 7 Simple Tips to Avoid Lifestyle Creep Have you ever found yourself being a victim to lifestyle creep? It might seem like a ridiculous thing but it’s most definitely not. Fortunately for...

- What Cashing out a 401K can cost you Need money now? Cashing out a 401K is an option, but not the first option you should consider when liquidating assets. All of us, at...