Many investors look for companies with great dividend yields and distribute great dividends, and REITs are one of the best sources of dividend payers and growers. But what do we know about REIT dividends, and how do they work?

Most investors know REITs first and foremost because of their attractive dividend yields relative to the stock market or bond market.

Dividends over the years contribute to the compounding of your wealth; the S&P 500 has grown around 10% over the last 100 years, and dividends are a big part of that growth, to the tune of approximately 2.5% over that period. Taking advantage of what REIT offers in dividends is a great opportunity to grow our wealth.

REITs and dividends go hand in hand, and learning how they work is essential to invest in these potential wealth compounders successfully. Because of the structure of REITs, dividends have different rules and regulations, and I thought this might be a fantastic opportunity to uncover some of the mysteries surrounding REIT dividends.

In today’s post, we will learn:

Ok, let’s dive in and learn more about REIT dividends.

The Basics of REIT Dividends

With many investors yield-starved in the current lower interest rate environment, many are turning to REITs as a possible refuge. REITs offer high-yield potential with relative stability in both dividend growth and yield.

REITs offer higher dividend yields, often averaging twice those found in common stocks, and some more than 10% or more.

REITs are a great addition to a diversified portfolio and help create a high income. By law, they must distribute at least 90% of their earnings as dividends and capital appreciation from stock gains.

REITs (real estate income trusts) are securities and trade like stocks or bonds in a market. The advantage of REITs is that they allow small investors like us to invest in real estate without the constraints of borrowing money or credit restrictions. Plus, REITs offer far more flexibility than real estate investments in the simple fact that the liquidity REITs offer versus buying a property.

Many different REIT flavors offer dividend payments, such as mall, apartment, office, or retail.

The dividend payments consist of rental income and capital gains from the business operations of the REITs. REITs must pay out 90% or more of their net earnings as dividends or distributions to qualify as securities.

In exchange for those distributions, REITs receive special tax consideration, which unlike normal corporations like Microsoft, REITs pay no corporate taxes on the earnings they pay out as dividends. More on this subject in the next section.

Regardless of its share price or standing in the market, REITs must pay out 90% of their earnings to retain their REIT status.

Ok, let’s talk a little about dividend yields.

As with any stock, a REIT’s current yield reflects its stock price divided by the annual dividend. Now you can take the quarterly dividend and extend that out to an annual dividend by multiplying that dividend by four to arrive at the annual payout.

An example of a dividend yield for a REIT:

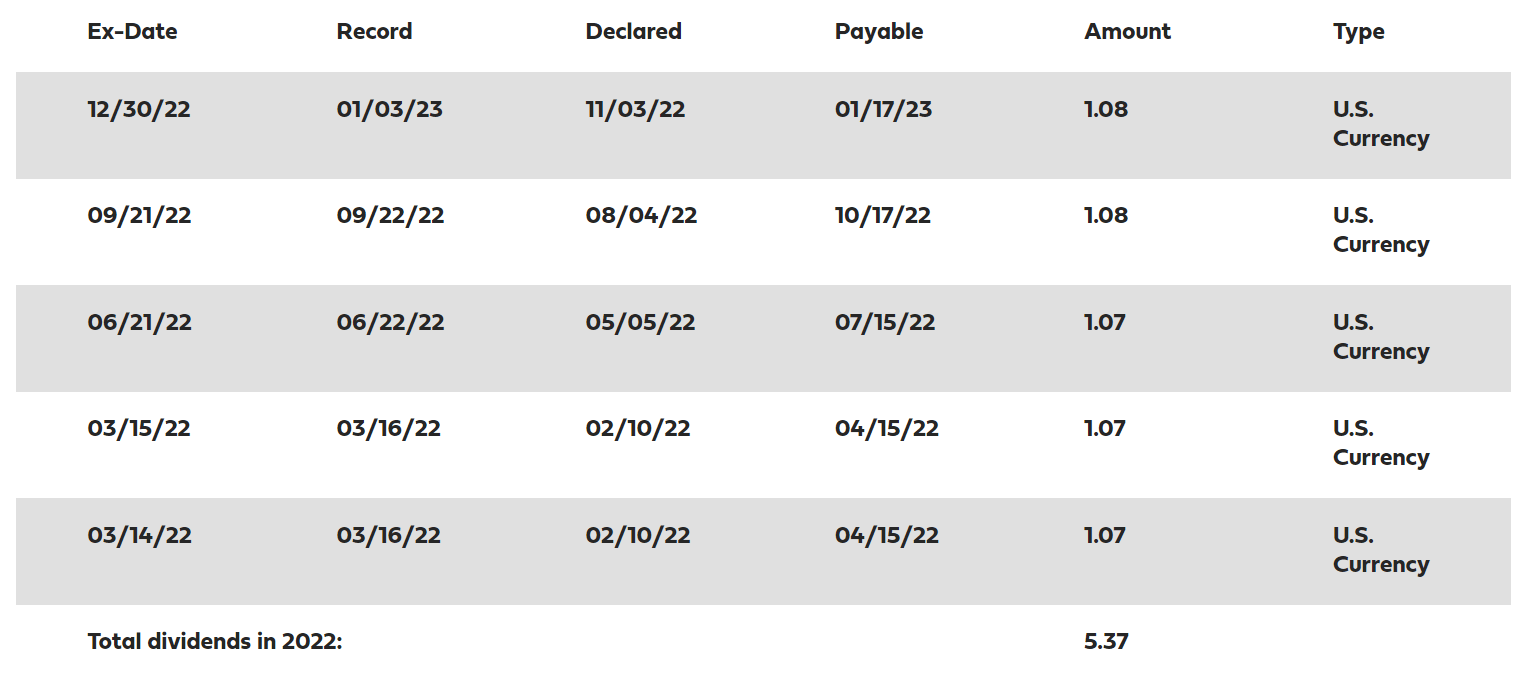

Federal Realty Trust’s current quarterly dividend:

- September 30, 2022 – $1.08 per share

- Current market price November 8, 2022 – $103.98 per share

Federal Realty Trust Dividend Yield – ($1.08 x 4) / $103.98 = 4.15%

Pretty easy calculations give you an idea of the return you can make from the dividend alone. A good exercise is to look at the current yields to see how this stacks up or to track any ongoing trends.

According to Seeking Alpha, Federal Realty’s yield over the last five years is:

- 2021 – 3.13%

- 2020 – 4.96%

- 2019 – 3.22%

- 2018 – 3.42%

- 2017 – 2.98%

Keep in mind some of these yields contain data from PC, or Pre-COVID; as the share price goes, so goes the yield of any company. And with the market downturn in March of 2020, REITs tanked like most of the market, but the real estate sector typically lags behind the rest of the market in both downturns and upturns.

Another great way to consider REIT yields examines the yield on cost. Because many investors hold stocks for multiple years, we should understand the yield on our total cost.

We calculate the yield on cost the same way you do the yield, but instead of looking at your company’s current market price, you insert the current cost on your investment.

By this, I mean if you buy Federal Realty at $100, then the price falls to $70, and you buy more shares at that price; now, your cost of that investment changes. So say your cost on that investment is now $88; you would divide the current annual dividend by $88 instead of the current market price of $75.

Now, your yield on cost would be:

Federal Realty Yield on Cost = $4.32 / $88 = 4.90%

Using this type of quick analysis is a great way to get a feel for what yield you are receiving on your investment. Think of this yield as the minimum return your investment will pay you yearly, regardless of capital appreciation.

REITs and the frequency of payments

A few REITs pay dividends every month; most pay quarterly, as with most common stocks. As we look at dividend yields and yields on costs, we need to multiply our dividend payouts by 12 instead of four to reflect those monthly payments.

Realty Income (O) and STAG Industrial (STAG) are two of the most famous monthly paying REITs. Both Realty and STAG currently pay dividend yields of:

- Realty Income – 3.87%

- STAG Industrial – 4.59%

Now that we understand REITs and their dividends, let’s move on and look at the structure of REIT dividends.

Taxes and REIT Dividends

We know that for REITs to qualify, they must payout at least 90% of their earnings as dividends or taxable income. If a REIT only pays out 90% of its earnings as dividends, it will pay corporate taxes on the remaining retained earnings. The REIT can avoid paying corporate income taxes by distributing its taxable income, including capital gains.

The REIT shareholders then pay their appropriate taxes on any dividend income received. Let’s look at a simple chart to help outline how this might be advantageous for investors based on the following assumptions:

- C-corp and REITs marginal tax rates – 21%

- C-corp and REITs payout ratios – 90%

- Personal marginal tax rate for $40k to $85k – 22%

The above is a simple example, but it illustrates the tax advantage nature of the REIT and how it can better benefit an investor.

Components of a REIT’s common dividend

The REIT dividend consists of three components that allow its tax advantage in nature, taxing the components at different levels.

The three income classifications are:

- Ordinary dividends – individual investors’ tax rate applies

- Capital gains – generally 15%, depending on the current sitting President.

- Returns of capital – nontaxable

Let’s discuss these individually and remember that REITs disclose the tax treatment of each year’s dividends in a press release early in the year, typically late January or early February. The press release reveals each company’s dividend tax treatment on its business website.

For example, from Federal Realty 2022:

Ordinary Dividends

Generally, most common REIT dividends come from ordinary income and are taxed as ordinary income, meaning that the business activities that create the cash flow paid out as dividends to us shareholders were “ordinary.” For example, in the form of rent collection.

So, if we investors receive $1.00 per share in common dividends and are in the 25% ordinary income tax bracket, then we will owe $0.25 of federal taxes on every dollar of REIT dividend we receive.

However, suppose the REIT engages in other transactions, such as selling properties at a gain or loss relative to its purchase cost basis. In that case, the REIT may recognize those gains or losses as long-term capital gains or return of capital, which means those gains or losses and the taxes related to those activities are not in the ordinary tax camp.

Capital Gains

If the REIT sells an asset for more than its book value, or depreciated value, the REIT must recognize capital gains on that sale. The REIT then passes those capital gains to us, the shareholder, by classifying part of the common dividend paid as a capital gain.

Because of the tax status of REITs, the shareholders pay taxes on this portion of dividends, but at our current capital gains tax rate.

Much of the capital gains tax rate will fluctuate depending on who is the sitting President of the U.S., and it is a much-debated rate, which is why it is important to keep an eye out for who wins any given election.

Return of Capital

If a REIT distributes more than its taxable income for IRS purposes, the additional amount paid to the shareholders exceeds 100% of taxable income, classified as a return of capital.

The good news is that the capital of returns doesn’t have taxes at any level. Rather, they help lower our investor’s cost basis on our investment. Capital gains can come into play if and when you sell your REIT shares. And the rate of capital gains you might pay will depend on the length of time in that particular investment.

Returns of capital increase our tax-adjusted current yield and the after-tax total return we realize upon selling our shares.

Dividend Reinvestment Plans (DRIPS)

REITs and dividends go together like bread and peanut butter, utilizing DRIPs to grow your wealth.

Because of the nature of dividends and the yields REITs pay, it makes sense to utilize DRIP plans to grow your wealth by reinvesting those dividends into more shares of that particular REIT.

There is nothing wrong with taking the dividends as a cash payment and paying yourself the cash, but depending on your investment goals and situation, reinvesting those dividends is the best way to grow your wealth.

Many REITs offer the ability to reinvest the dividends through their programs, but you can use the same brokerage you buy your shares to choose to reinvest those dividends.

You can plan on holding the shares for many years (this is the strategy I utilize), but if you are using the REITs to generate retirement income, then, by all means, take the cash and run.

How to Analyze REIT Dividends

As you explore REITs more, you will discover many companies paying excellent yields, and you might wonder, are REIT yields safe?

Avoid “sucker yields,” those that are abnormally high and meant to attract investors but unsustainable at those abnormally elevated levels.

In this section, we will discuss a few approaches to discovering the safety of the dividend yields of any REIT.

Keep in mind: when there is a downturn in the market, many dividend yields, particularly among REITs, might seem “high,” but this is in relation to the current market price, not necessarily because the fundamentals of the business changed.

If you are unfamiliar with a few metrics, such as funds from operations or FFO, please refer to the below post for more information before digging into the following section.

REIT Valuation: Methods, Metrics, and Analysis (Simplified)

Dividend/FFO Payout Ratio

To calculate this ratio, we need the annual payout of the REIT’s dividend plus the funds from the operation, which we can find from the quarterly or annual financial reports.

The dividend/FFO ratio, also known as the FFO payout ratio, tells us about the REIT’s ability to pay its current dividend. We are looking for a ratio of less than one; if it is above that, the dividend is not safe or unsustainable.

For our example, I will use Federal Realty Trust for our examples.

Dividend/FFO Payout Ratio = Dividend per Share / FFO per share

Federal Realty’s current metrics:

- Annual dividend per share – $4.32

- FFO annual per share – $6.32

Plugging the numbers into our formula, we get:

FFO Payout Ratio = $4.32 / $6.32 = 68.35%

It’s pretty simple, huh?

I took the numbers from the annual report to calculate the ratio, but you can just as easily use your favorite financial website, such as Seeking Alpha, which does post REIT metrics such as FFO.

Let’s compare the FFO payout ratio for Federal Realty over a few years.

- 2021 – 76.48%

- 2020 – 96.34%

- 2019 – 67.09%

As we can see, Federal Realty has a good track record of paying a safe dividend based on the above ratio.

Debt-to-Market Cap

REITs can improve the safety of its dividend by managing the company’s debt load managing its operations. Common dividends occupy a junior position on the company’s cash flow, which means that the company is obligated to pay its interest and principal payments before its dividend.

So, the less debt the company carries, the more likely it will be able to pay its dividend. We will explore a couple of metrics to examine the debt load concerning its dividend safety.

The first metric is the debt-to-market cap of the company. To calculate this metric, we will need two pieces of information. The first is the company’s total debt, which we will locate on the company’s balance sheet under the liability section of the company’s 10-K, or 10-Q.

The other number we need is the market cap, which you can find by either searching for the number from your favorite financial website or by taking the number of outstanding shares from the income statement and multiplying those shares by the current market price.

Again, going back to Federal Realty, we find:

- Shares outstanding – 79.0

- Current market price – $103.46

- Total debt – $4,443

A note: all the numbers listed above are in millions unless otherwise stated.

Ok, let’s plug all those numbers into our formula.

Debt-to-Market Cap = $4,443 / ($4,443 + (79 x $103.46)) = 35.22%

Debt-to-Gross Book Value

Because the market price can fluctuate wildly from day to day, the debt-to-market cap is not always the best single metric to analyze the debt load of a REIT; another metric that is usually companion with the above ratio is the debt-to-gross book value metric.

We can calculate the gross book value by totaling all asset values on the balance sheet, subtracting any goodwill or intangibles, and adding any accumulated depreciation and amortization. We will generally find the depreciation figures in the financial footnotes.

When looking at this metric and analyzing the debt load of any REIT, we want to find our company with a ratio of less than 50%.

Let’s return to our friend, Federal Realty, to help us calculate this ratio.

We already have our debt number from the above calculation. Total assets can be found on the balance sheet.

- Debt – $4,443

- Total assets – $8,217

In the case of Federal Realty, the company already nets out the deprecation from our total assets.

Debt-to-gross book value = $4,443 / $8,217 = 54.07%

Let’s look at the ratio over a few years to see if the above number is current or an aberration.

- 2021 – 55%

- 2020 – 58%

- 2019 – 52%

- 2018 – 51%

Interestingly, it appears that Federal Realty carries a higher debt-to-book value ratio and might bear watching as we analyze the company.

The current debt ratio for REITs, according to Nareit, is 37% for equity REITs.

Final Thoughts

Dividends are the bread and butter of REIT investors, and determining the safety of those dividends is paramount for all REIT investors.

Many of the metrics we use for common stocks apply to REITs, but a few specific metrics, such as the FFO payout ratio and debt-to-gross book value, are tailored specifically for REITs.

The dividend yields for REITs are among the best you can find for any investor. Understanding the tax implications for our returns, our total overall returns, and how the taxes impact those returns are all important to know.

Investing in REITs is a great way to diversify our portfolios. With the additional benefit of liquidity REITs offer, they are a great way to get your foot in the door in relation to buying real estate.

With that, we are going to wrap up our discussion today.

As always, thank you for taking the time to read this post, and I hope you find something of value on your investing journey.

If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- The 2 Main Types of REITs and Their Risks and Rewards REITs remain a key consideration when contemplating diversifying your portfolio. REIT, which stands for real estate investment trust, offers the ability to invest in real...

- REITs Valuation: Methods, Metrics, and Analysis (Simplified) Updated 2/7/2024 Investing in real estate is one of the classic asset allocations investors must choose, but not everyone has or wants to own physical...

- The Big Guide to Little Dividends Dividends are one of the best ways companies can return value to shareholders. Share buybacks have become all the rage in the investing world, pushing...

- Net Asset Value Model: A Valuable Tool for Finding the Intrinsic Value of a REIT Real estate investment trusts, or REITs own, manage, and finance income-producing properties. By law, these businesses must distribute at least 90% of their profits to...