In these next few chapters of ‘Dual Momentum Investing’ by Gary Antonacci, we really start to key in on some of the fundamentals of momentum investing and why it works, specifically with a focus on Relative Momentum, and why bonds can absolutely ruin any potential gains that you’re seeking to gain..

I previously had talked about some of the very fundamentals of momentum investing and about how being successful is all about preying on the mistakes that others make by letting their behavioral finance tendencies get in the way, but this is more of a summary about the nuts and bolts of momentum investing.

So, what even is relative momentum? Well, relative momentum is the comparison of stocks against their peers while absolute momentum is simply an asset’s excess return.

So, on a very basic level, relative momentum would be if you were to look at all of the stocks in the market over a certain period of time and then track the performance, say the top 25% vs. the bottom 25%. If the top 25% had gained 6% and the bottom had lost 10%, then you’d say that the relative momentum showed an outperformance of 16%.

In this same example, the absolute momentum would 6%, because that’s the amount that the stocks actually returned to the shareholders. Relative momentum is extremely beneficial to know because I am a huge believer in benchmarking your performance as a way to maintain rational, but the absolute momentum is also very important!

If the top sector of stocks was 10% better than the bottom sector, but still had a -2% return, then the relative momentum is 10% and the absolute momentum is -2%. So, what is more important? Obviously, we all want to make money, but I feel that by judging yourself off that benchmark, you really can make sure that you’re setup for success.

Finding Success in the Stock Market

You see, I am a firm believer in business. That sentence might sound ridiculous, so let me explain. I trust the stock market. I trust that the market will go up. It always has (11% on average since 1950) and I think that it always will. So, I don’t care what my absolute returns are. I care about beating the market.

If I can beat it by 2% then I am extremely happy. That means I get 30% returns when the market is up 28% and I’m down 10% when the market is down 12%. I trust the stock market will continue its very long run of continued growth so as long as I am beating the market, then I think that I will continue to grow my portfolio in a massive way over time.

And that’s what makes me really look at momentum investing!

To take it a step further and get more into the weeds, to calculate the relative or absolute momentum of a stock, we look at it over the risk-free rate, or a Treasury Bill. It’s essentially considered a guarantee that we can get this T-Bill rate so investing in equities is simply trying to calculate the opportunity risk. So, a 1% gain could theoretically mean a -1% return vs the risk-free rate if the T-Bill rate is 2% – does that make sense?

Essentially, you’re gauging your alternative and seeing how much you can beat it by.

The key with Antonacci is that he likes to COMBINE relative momentum with absolute momentum. Per some research in 2012 with Moskowitz, they went back and determined that the ideal timeframe of a “look-back period” was 12 months (compared a 1-48 month window) when you used it with a 1-month holding period.

They looked at 58 different assets that were the highest performer over 12 months and then looked at its performance over the next month and every single scenario had a positive absolute momentum, meaning it outperformed the T-Bill or Risk-free rate.

Every. Single. Time.

And I also loved reading that the returns were the strongest when the stock market returns were the most extreme. Do you know why I love that? Because the stock market is super volatile a and as a rational and opportunistic investor, I view volatility as a chance for me to make money in the market.

You see, many people will get in their own way when it comes to investing. In fact, this is something that Antonacci really keys in on that makes me “LOL” and encourages me to be a patient, rational investor.

Let me read you a few facts straight from the book:

- “Over the past 30 years ending in 2013, the S&P 500 had an annual total return of 11.1%, while the average stock mutual fund investor earned only 3.69%.”

- “Around 1.4% of this underperformance was due to mutual fund expenses”

- “Investors making poor timing decisions accounted for much of the remaining 6% of annual underperformance.”

- “The Vanguard S&P 500 Index had a 15-year average annual return of 4.58%, while the average investor in that fund earned only 2.68% annually.”

- “CGM Focus (CGMFX) was the highest-return stock fund from 2000 through 2010.”

- “It had an average annual return of 18.2%, according to Morningstar, beating its closest rival by 3.4%.”

- “During that same time, the fund’s typical shareholder lost 10%!”

Do you know why I love these examples? Because they show how emotional we can be when we’re investing. Trust me, I totally get it. I really do.

You worked hard for this money and don’t want to see it go to waste. Just hold the damn stocks! Stop selling. It’s really not that hard. I mean it is, but it’s also not. You need to know your personality well and if you get too emotional, hire a financial advisor!

If you’re young, maybe try to look at your portfolio daily to become desensitized to this massive market moves. It might seem backwards, but that’s what I talked about doing on the podcast and it worked for me.

You just need to know yourself well and try to make sure that your strategy is something that you can accomplish. Did you know that even if you bought at the worst time possible and sold at the worst time possible that you could still nearly double your money in the market if you just held onto it for 10 years?

That’s pretty legit – but you need to know that history to trust it and keep yourself from making a mistake in the future.

This is exactly what Antonacci is trying to tell us and its why momentum investing works, because most people will not be able to keep their emotions out of their investments, and that creates opportunity for us. I know that none of my readers are like that because we are all super logical, patient, rational investors…right?

RIGHT?!?!

So, back to the momentum train.

The Argument for Combining Relative and Absolute Momentum

Most people will only use relative momentum, and as I discussed, that makes sense to me, but Antonacci really thinks that there’s a great place for it to be combined with absolute momentum as well. He notes that using absolute momentum can provide you better protection for the downside without hurting the upside potential than a fixed-income asset, like a bond, would be able to do.

The most common way that he likes to implement the use of absolute momentum is almost as an “add on” to relative momentum. So, he will use relative momentum to find the best performing stocks over that 12-month look back period and then “apply absolute momentum as a trend-following filter by seeing if the excess return of our selected asset has been positive or negative over the preceding year.”

If the trend is up, then they will proceed to purchase that asset and invest in it for the next 30 days. If the trend is negative, meaning that the total return is approaching 0 (or less) then they will choose to forego that stock and instead invest in a short to intermediate term fixed income asset, like a bond or a CD, until the trend turns positive.

Basically, this use of absolute momentum is simply a protection tool that they’re using to try to keep them from getting a negative return. Just because a -2% performance is better than -4%, Antonacci is basically saying that by using these momentum trends, you can then potentially identify if you can get a small positive return with a fixed-income asset rather than letting the momentum drag you down.

Honestly, this was pretty in depth, and I’ve read the chapter now three times and things are starting to click, so feel free to check out the book and read for yourself if you think that would be beneficial. I didn’t really, truly understand the process until I started actually writing it out, but it does make a ton of sense now!

We Don’t Need No Stinkin’ Bonds

One thing that I absolutely love about these few chapters is that Antonacci is literally telling us that because of the way that we can use absolute momentum, there is basically no need for bonds, unless the absolute momentum is negative which is not common. I mean, he is so anti-bonds that he even titled a subsection in Chapter 5 as, “Bonds? We don’t need no stinkin’ bonds”.

Preach.

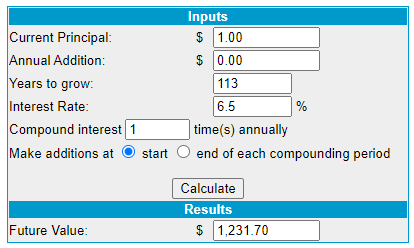

Antonacci goes on to talk about how the average annualized real return, meaning after inflation, from 1900 – 2013 was just 1.9%! That might not sound awful until you realize that the average annualize real return from stocks was 6.5%.

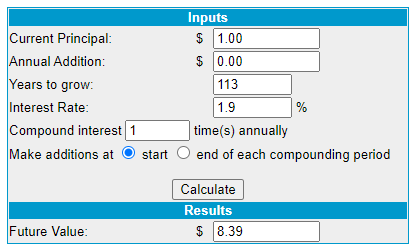

Do you know what the difference of 1.9% and 6.5% would have after 113 years of investing?

If you invested $1 into a bond in 1990, you would then have $8.39 in 2013 after inflation.

If you did the same into the market earning 6.5% after inflation, do you know what your total would be?

$1,231.70.

So yeah, I would say that’s a considerable amount. It might seem obvious that we should invest in stocks, but if that’s the case, then why do we all put our money into bonds right when we retire, or maybe even prior to that? Are you going to die when you retire? Or 3 years after? Likely the answer is no!

You’re statistically going to live well into your late 70’s and if you’re my age, then you’re going to live until your mid 80’s based off the trend that things go. So, you need your money to last many more decades.

Don’t believe me? The proof is in the pudding.

Many people will use bonds as a safe haven for investing but the thing is, stocks and bonds have been positively correlated 70% of the time since 1973. So, you’re not really protecting yourself. You’re limiting your downside, sure, but you’re also limiting your upside, and when the market historically has gone up year after year, you’re just hurting yourself way more than helping.

I don’t want to keep hammering on this too hard, but even Warren Buffett thinks that putting your money in bonds is dangerous. Take a look at this powerful quote:

“They are among the most dangerous of assets. Over the past century these instruments have destroyed the purchasing power of investors in many countries, even as these holders continued to receive timely payments of interest and principal…. Right now, bonds should come with a warning label.”

That’s pretty powerful stuff.

As I know most of us are value-investors, or should I say value-investors at one point (I am on the fence with all this momentum talk lol; but I really think there’s a place for both), hearing something like this from Warren Buffett really resonates.

I still think that Buffett is the GOAT investor despite what Dave Portnoy says so it’s hard not to agree with him on this point.

I don’t know about you all, but I am super intrigued with continuing this process of understanding momentum investing. I feel like with these last few chapters we finally really started to get into the meat and bones of the process with relative momentum and absolute momentum.

So, what’s next?

“In the next chapter, we will put all the pieces together and see what dual momentum can really do for us.”

Are you excited? I’m like a kid on Christmas morning!

Related posts:

- Global Equities Momentum (40y Track Record Outperforming the S&P 500) Updated 10/12/2023 Did you get tired reading that title? If so, I’m sorry – but I wanted you to know that this entire article is...

- Value Shmalue – Welcome to Dual Momentum Investing! (Ch. Review) Lately I’ve been taking a deep dive momentum stocks and I have going down a major momentum stock rabbit hole since then, so I figured,...

- What the Data Tells Us About Momentum Stocks: Are They Good Buys? As a new investor, it can be really easy to get caught up into defining what sort of investor are you – growth? Value? Momentum?...

- Want to Beat the Stock Market? Let’s Get Those Momentum Funds at Work! Updated 1/22/2024 If you ask me, one of the biggest secrets to investors is the way that ETFs can be used to their benefit to...