Valuing a company using the residual income method is an interesting technique not many retail investors are aware of which is covered in CFA Level 2. Value investors will enjoy the residual income method because of its starting point at book value before going on to add the present value of expected residual income.

This article will discuss the logic and calculations behind the residual income valuation method while also using a real-life example with global beverage giant Coke.

Before we jump into the valuation method, we need to first establish what residual income and equity charge are. The figures can be calculated on a per share level or as a company total but for use in a stock valuation, the per share figure is more meaningful to investors and is what we will focus on in our examples with Coke.

What is Residual Income?

Residual income is the amount of earnings left over after paying for the opportunity cost of equity capital (also referred to as equity charge). Shareholders need to be compensated for the risk their capital is taking on and the “residual” income is what is left over after taking this into account.

And What is Equity Charge?

The opportunity cost of equity represented in monetary terms can be referred to as equity charge. Equity charge can be thought of as being similar to interest expense, which is charged on the amount of debt outstanding based on the cost of debt capital; but instead equity charge is related to equity capital (book value) and is based on the amount of equity capital in the business and the cost of equity.

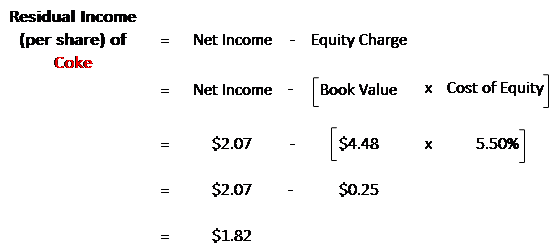

Example with Coke

We will start our valuation example with Coke by first calculating its residual income on a per share level. We will use Coke’s 2019 diluted earnings per share of $2.07, book value per share of $4.89, and cost of equity of 5.5% as calculated for the starting example of IFB’s financial model template. As can be seen below, plugging these inputs into the formula, Coke had a residual income of $1.82 per share given the calculated $0.25 per share equity charge.

Valuation with Residual Income

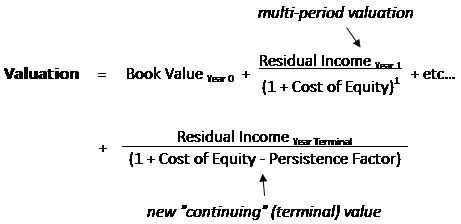

Now that we have laid out an understanding of residual income and equity charge, we can start to look at how company valuation with these figures works. Residual income valuations can be done in a multi-period format with different residual incomes calculated for each year, a single-stage valuation, and a multi-period valuation with a “persistence factor” applied to the continuing residual income.

All the residual income valuations start at the current book value and then add the present value of multiple periods of residual income. The higher the return on equity is compared to the cost of equity capital, the more significant the present value of residual income will be in the valuation. Now let’s discuss the different valuation types.

Multi-Period Residual Income Valuation

Starting with the current book value of equity, the residual income for each year is calculated and then present valued using the cost of equity. The formula below stops at two years but there can be any number of years.

Single-Stage Residual Income Valuation

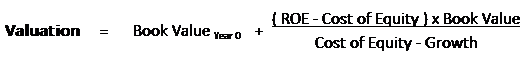

The valuation starts with book value and then adds in the present value of residual income through one terminal value calculation. The formula is reminiscent of a dividend discount model (DDM) and Gordon Growth Model but instead of dividends, the formula is looking at residual income. Residual income is established in the formula by taking return on equity less cost of equity capital and then multiplying it by book value.

Side Note: If return on equity equals the cost of equity capital, then residual income is zero and the valuation is equal to book value.

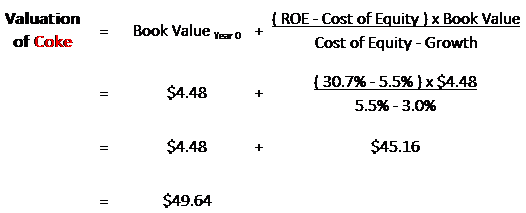

Example with Coke

Continuing our example with Coke, we will conduct a valuation using the single-stage residual income method. In addition to the inputs used in our first example, we will use Coke’s 10 year average ROE of 30.7% and a 3% growth rate to reflect Coke growing alongside global GDP. As can be seen below, this valuation comes out to $49.64 per share.

Continuing Value with “Persistence” Factor

The final valuation formula adjusts the previous multi-period formula by adding a continuing value (similar to terminal value) which incorporates a persistence factor. The persistence factor attempts to capture competitive forces which will drive return on equity down towards cost of equity capital over the long-term as new entrants will look to compete in any market that offers high returns.

The persistence factor ranges between 0 and 1 with 1 representing a business with a perfect economic moat that will persist into the future. The persistence factor can be estimated taking into account the competitive forces in the industry. The addition of the persistence factor is the residual income valuation equivalent to the DDM’s H-Model as it adjusts from a high return period to a lower return period.

Takeaway on Residual Income

Residual income valuation methods are a great way to value a business all focused on book value, return on equity and the cost of equity. Being able to adjust the valuation for a business’s economic moat through the persistence factor is a powerful tool. Remember that if return on equity equals the cost of equity capital, then residual income is zero and the valuation is equal to book value.

The residual income method is also one of the six valuation metrics used in IFB’s financial model and valuation template! For investors interested in a pre-built financial model where they can punch in the financial data of any company of interest, they should check it out!

Related posts:

- The H-Model Discovered – CFA Level 2 As a type of Dividend Discount Model (DDM), the H-Model is a valuation tool that has its core methodology based on discounted cash flows, which...

- Explaining the DCF Valuation Model with a Simple Example Updated 9/15/2023 Discounted Cash Flow (DCF) valuation remains a fundamental value investing model. Using a DCF continues as one of the best ways to calculate...

- DCF for Bank Valuation: Step-by-Step Guide with Real-Life Examples Updated 3/6/2024 Did you know that the financial industry makes up $8.81 trillion of the stock market cap, which is 13% of the market and...

- Inflation in a DCF Valuation: Use Nominal Cash Flows Only Does inflation impact a DCF valuation? How? We need to go back to the basics of a DCF valuation to understand the answers to these...