The rise of exchange traded funds (ETF) have made the landscape of investment products much more competitive but there are still far too many investors out there paying inappropriately high management fees!

Investment products with high management fees can have a detrimental impact on retirement returns as they will diminish the compounding effect of wealth. Paying appropriate management fees could mean the difference between retiring at 55 or 70 years old! In our example with a 30 year portfolio, the lowest management fee portfolio ends up a whopping 41.5% richer!

This article will drill into investor’s minds the importance of being knowledgeable about the level of management fees they are paying and when higher fees might be justified. We will talk about some of the new and best investment products available (ETFs) in contrast to the pitfalls of dinosaur products (mutual funds) in the new low cost investment products landscape.

The Impact of Management Fees on Compounding

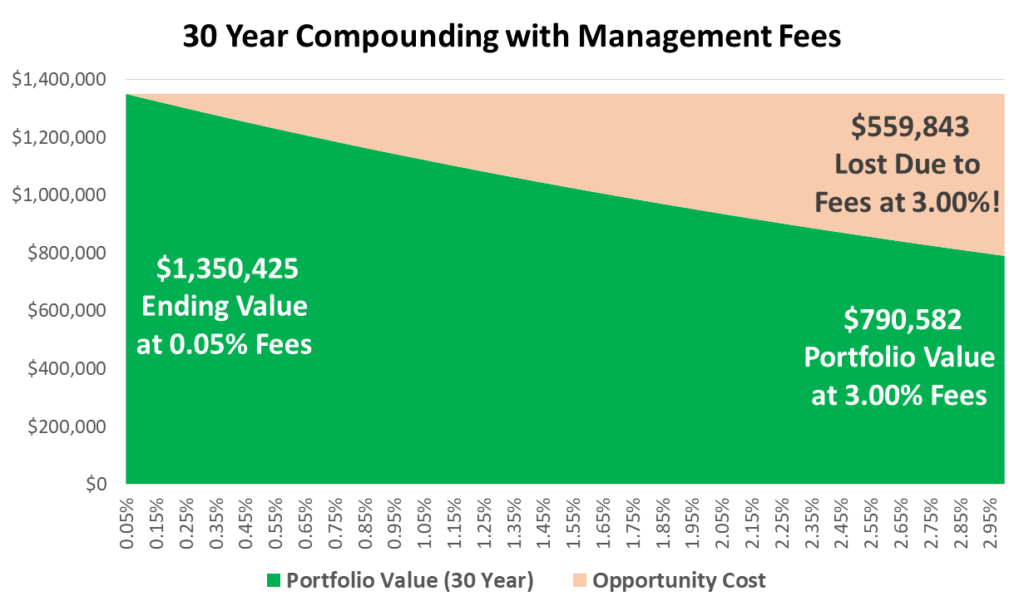

When we talk about 0.5% management fees, or even 3%, it might sound insignificant, but this adds up to difference of hundreds of thousands of dollars when it comes time for retirement. The below graph highlights what a portfolio would look like compounding for 30 years with $10,000 per year of contributions in different management fee scenarios.

The difference is staggering as we move along the curve with the ending portfolio value in 30 years dropping from $1,350,425 to $790,852 meaning that $559,843 has been lost to fees! This represents 41.5% of your retirement portfolio being spent on fees!

What Level of Management Fees Should I be Paying?

Management fees, often referred to as management expense ratio (MER), can range from as low as 0.05% on some broad market S&P 500 ETF products to up 2.5% for some old school mutual funds. Unfortunately, many workplace 401Ks (RRSPs up in Canada) only offer mutual funds in that private investment product environment that have more expensive MERs and not the cheaper publically available ETFs investors can hold in their brokerage accounts. However, investors can still look to choose the lowest management fee passive mutual fund products in their 401K/RRSP to help maximize the compounding effect on their investment portfolio.

One of my personal favorite low-cost ETF products is Vanguard’s flagship S&P 500 EFT (VOO) which has a MER 0.03% (only 3 basis points!). The competition for the lowest MER on S&P 500 ETFs has gotten fierce over the past couple decades with the first comer SPDR S&P 500 ETF (SPY) being priced out from its 0.09% MER. Vanguard is also a great low cost provider of mutual funds and has been driving competition in the industry for decades even before ETFs.

It’s interesting to note that given how important management fees are to citizen’s retirement, government agencies around the world such as the Canadian Securities Administrators are going as far as to regulate fee maximums and stop practices such as upfront sales commissions which are very costly to investors as these fees occur at the beginning of the compounding process. Investors who are knowledgeable and aware of fees can make wise investment fund product choices regardless of government regulations in their country helping to protect them.

Higher management fees are appropriate for more active products where actual decision making is being made by portfolio managers in an attempt to beat their benchmark index. That being said, the investment fund and management team should have a track record and proven strategy for outperforming the market. History shows that high management fees can be hard to justify…

There is no free lunch in efficient market theory and lower cost ETFs will capture the systemic risk of the market that really drives long-term return. For active higher fee investment products, long-term outperformance over their benchmark is rare. History shows performance does not justify the fees due to high-fee funds tending to be active in stocks with low operating profitability and high investment rates, characteristics associated with low expected returns.

What is “Closet Indexing?”

When presumably active fund managers (who charge high fees!) have a historical performance distribution that is very similar to the benchmark, this is referred to as “closet indexing.” In closet indexing, the manager is secretly just allocating investments to mimic the benchmark index that they are judged against. Investors should only be willing to pay higher fees for actual active management as passive investments can be had for 0.03% management fees as highlighted earlier when mentioning Vanguard’s S&P 500 flagship fund (VOO).

Closet indexing happens because active fund managers can regrettably sometimes fall prey to the behavioral bias referred to as the “prudence trap.” The prudence trap is a behavioral bias that describes decision makers being too cautious when making decisions that could potentially be expensive or damaging to their career. This means managers and investment committees tend to herd to similar investments and not go out of line with the allocation of the benchmark. While this may imply better risk management by keeping a close allocation to the benchmark, why pay higher fees for a benchmark return and risk profile you can get for cheaper with ETFs?

Practical Side Note: Investors should take a close look at the products their advisor has them invested in to see if they are paying high fees for what is really a passive product. Taking a general look at the performance chart compared to the benchmark will quickly be able to give you an idea if the fund manager is secretly a “Closet Indexer.”

Investor Takeaway

Management fees can have a hugely material effect on the value of your retirement portfolio. The difference between 0.05% fees on the lowest cost ETFs and 3.0% on some mutual fund products can mean 41.5% of its ending value! In our example with $10,000 annual contributions over 30 years, this meant paying $559,843 in fees that could have helped you retire earlier.

Related posts:

- What are the Different Types of Mutual Funds, and What do They Mean? Mutual funds are a great vehicle for growing your money. Keep reading to find out more about them and what types of mutual funds may...

- How to Choose the Right ETF Updated 10/27/2023 With more than 2,000 ETFs or exchange-traded funds available in the U.S. alone, choosing the right ETF might seem like picking out the...

- Active and Passive Portfolio Management: Pros and Cons [for Average Investors] Updated: 5/23/2023 There are two major ways to manage an investment portfolio. Active portfolio management means actively buying and selling stocks regularly. Passive portfolio management...

- How Tactical Asset Allocation Works – (With Example Portfolios) Asset allocation is arguably more important than which stocks you pick. For most investors, focusing on your asset allocation is a lot more important than...