What’s your retirement number? Everyone has different needs, desires, and goals for retirement. Let’s unpack each of those so you can calculate your own retirement number.

Click to jump to a section:

- Find Your Starting Point

- Define Your Retirement Number

- How Much You Need to Meet Your Number

- The 4% Rule for Retirement

- Investing in Dividend Stocks for Retirement Income

Find Your Starting Point

RETIREMENT! Retirement, from the viewpoint of myself and a vast majority of my acquaintances, is something that a lot of people aren’t proactively planning for. You can pretty much narrow it down to one of three different situations:

- You’re proactively planning and have a retirement number

- This might mean you’re actively contributing to a 401K, IRA, high-yield savings account, etc.

- You’re not planning for retirement

- You’re living paycheck to paycheck, spending all of your extra money, or letting it sit in a bank account and earn the ever gracious .01% most savings accounts offer. I don’t want to sound ungrateful, but if I had put $100,000 in that account when I was 25 years old, I would’ve made $400.80 in interest by age 65… Talk about getting rich, quick! (sarcasm).

- You’re late planning for retirement

- You’re starting to save for your retirement number, but you might be late in your career. To quote the generational leader that he is, Lil “Weezy” Wayne says, “Better late than never, but never late is better.” And yes, I know he’s not referring to retirement investing when he says this…but it STILL FITS!

If you’re not planning for retirement, start. If you’re late planning for retirement, amp up your saving. If you are proactively planning for retirement, good, but are you sure you’re saving enough?

Define Your Retirement Number

Ok let’s define your retirement number based on your desired lifestyle.

A good rule of thumb is to try to have a method to replace 70% of your pre-tax income with retirement-funded income.

For instance, if your base salary when you retire is $100,000, you should aim to have $70,000 funded to yourself, each year, of your retirement. If you know that your house will be paid off, you can adjust that down to 60%. If you intend to buy another house, travel frequently, or increase spending, you should adjust that percentage up…considerably.

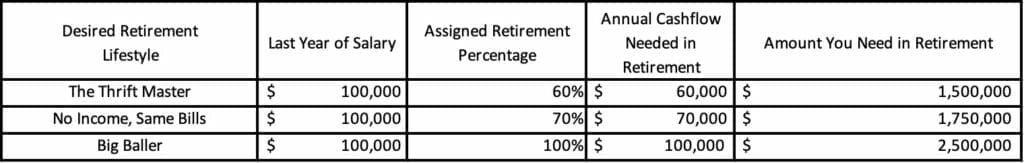

For the purposes of this article, I’m going to use the percentages of:

- 60% (The Thrift Master)

- 70% (No Income, same bills)

- 100% (Big Baller)

To portray the various levels of money needed for a retiree. This is your Assigned Retirement Percentage.

How Much You Need to Meet Your Number

Ok, so you’ve decided on the retirement lifestyle that you desire. The next step is to find out how much money you will need to be able to achieve that value.

Let me introduce to you the 4% rule.

The 4% rule is a rule that allows you to conservatively back into the amount that you will need to retire and maintain that desired lifestyle.

The rule itself is pretty simple. All you need to do is take your Last Year of Salary and multiply it by the Assigned Retirement Percentage based on the Desired Retirement Lifestyle that you’ve picked to get the Yearly Retirement Cashflow Needed. Then take that number and divide it by .04 to get the Total Retirement Money Needed (your retirement number).

Last Year of Salary * Assigned Retirement Percentage / 0.04 = Amount You Need in Retirement

I’ve outlined an example below:

As you can see in the last column, the amount of money needed is drastically impacted by your lifestyle, which is common sense. This number might seem very large, and it is, but it shows the importance of starting to save early.

So now you’re probably thinking, “So Andy is saying if I save $2,500,000 by retirement, I can be a big baller? I just let the money sit there, and then BOOM! There shows up $100,000 each year in my bank account?”

Well, Mr. or Mrs. Reader, you’re actually somewhat correct. Let me explain the concept of the 4% rule…

The 4% Rule for Retirement

The 4% rule was created as a way to help people plan for their retirement. Essentially, the concept is that if you take out 4% of your savings each year, you can survive at least 30 years on that money alone.

William Bengen was very skeptical of this and ran multiple different scenarios for people retiring each quarter between 1926 – 1986. The shortest timeframe of anyone’s money lasting was just over 30 years.

To reiterate, Bengen literally ran the worst possible case in a sixty-year period, and the minimum amount of time that the money lasted was 30 years. Wow.

With that being said, there are some assumptions that go into these scenarios and things that can make your money last longer.

Investing in Dividend Stocks for Retirement Income

It’s encouraged, even more so when in retirement (but also now), to emphasize dividend stocks heavily.

Many stocks, such as the Dividend Aristocrats, have extremely strong yields that allow you to draw on that 4% and maintain your balance even longer.

I have been asked before by other investors, “Why would I want a dividend? I want my company to invest back into their business and keep growing.”

Well…I have two comments to that.

First and foremost, the closer you get to retirement, the more conservative you should be as an investor. Dividends aren’t guaranteed by any means, but investing in companies that are a decent size (must be in S&P 500, meet minimum size and liquidity requirements) and have 25 or more years of growing its dividend is pretty dang close to a sure thing.

So, if you can invest in a company that you start off with essentially a guaranteed return, you’re already ahead of the curve.

Check out this post if you want to learn how to build a dividend portfolio.

And second, please promise to keep this a little secret between you and me. The average annual return from 1991 – 2018 is 1.4% better than the S&P 500 during that same timeframe. Who knew?

Related posts:

- The Key to Using the Rule of 25 to Plan Your Retirement Properly As a young teenager, all you can think about is moving out of your parent’s house. Then as you hit your early twenties, it turns...

- What’s a Reasonable Goal for an Average Retirement? Many of us wonder how we are doing when it comes to retirement savings. It can make us money hungry, not because we are greedy...

- There are Several 401k Alternatives Available to You Are you stressed about your company not offering a 401K retirement plan? Don’t worry, there are tons of 401k alternatives for you to choose from....

- How Much Should I Have Saved by 30? It’s Less Than You Think! Updated 3/27/2024 If you’re wondering, “How much should I have saved by 30?” then let me tell you this—you’re not alone. It’s scary how little...