Are you pumped for this blog post? I hope so! I know that I am extremely pumped to write it and show you all about my plan for retiring at 55…or maybe even earlier!

If you’re like most people and you want to instantly skip to the bottom the bottom of my post to find the secret sauce, let me save you right now – there isn’t one. This is going to be a post about hard work, focus and determination.

Am I going to share some concrete steps that you can take? Of course! But is there some sort of secret that’s going to allow you to live foolishly and then still retire early? Nope, definitely not.

So why waste any more time – let’s go ahead and get going!

1 – Define Your Goal AND Your Why

Knowing your goal AND your why is so incredibly important when you’re getting started on your journey. Simply saying “retire early” is not an actual plan. That’s nothing.

How early? 50? 62? Earlier? Later? Why do you want to retire early? What are you going to do? These are all types of questions that you need to answer.

For instance, my wife and I are aiming to have the option to retire at 55. Not that we will necessarily do that, but if we choose to retire then, we want to be able to. We’d rather plan for it and decide not to retire rather than do the opposite. So, our plan is a little vaguer in the sense of we’re not telling ourselves we’re only working 25 more years as we’re both 30. We’re saying we’re working 25 years and then making a choice.

Our other main financial goal is that we want to own a lake house at some point. We don’t necessarily know where, or what kind of house that might be, but if we have enough saved up at 55, then we could theoretically stop saving for retirement, work a few more years and just bank that money on a lake house – make sense?

It’s all about options.

So, in a sentence, our goal is to have the option to retire at age 55. And our “why” is to be able to spend more time with our family. We want the ability if our son moves 2000 miles away to visit him frequently. And if he has kids, we want to visit even more often to see our grandkids.

Honestly, that’s our mindset. Yes, we want the lake house, but the main goal is to have the ability to be around family and maximize the healthy years that we have in our lives – that simple!

Knowing these goals and our why is what’s going to keep us focused when things get tough. And trust me, they will get tough, so make sure yours is defined as well.

2 – Determine Your Retirement Number

Oh man, time to get into the fun stuff – the numbers! Some of you might roll your eyes about this but this is really what gets me geeking. Admittedly, determining your retirement number is not something that you can just magically know. It’s going to ebb and flow as the years go on. You might be in great, or awful, health by the time that you get older meaning you’re going to need better or worse insurance.

Maybe your family is all near you so you’re not going to pay to travel. Maybe not.

Maybe you want to travel world now, but when you’re older you just want to be a homebody. Maybe the reverse.

The key is to simply take some time to think about what you want and start to back into some sort of number that you can aim for. It can, and will, change. That’s the point. But you must start somewhere.

So, where do you start?

Well, I start with the inverses of the 4% rule. The 4% rule states that you can withdraw 4% of your savings every year and never run out of money, if it’s invested properly. So, the opposite of that means that I need to have 25x my anticipated spending to be able to pull out 4%. Make sense?

Let’s pretend I want to have 50K to spend each year:

- $50K x 25 = $1.25 Million to be saved

- 1.25 Million saved x 4% withdrawn annually = $50K annually

Got it?

But how do we determine how much you’ll need? Well, that’s the fun and difficult part.

What are some of the things that you need to think about?

- Will you have a mortgage?

- Will you move somewhere “warmer”?

- Are you going to downsize?

- Do you plan to travel?

- Do you have family you need to take care of?

- What sort of health will you be in?

- How long will you be retired?

- Do you have expensive hobbies?

These are just a few of the items that I think that you need to know! Personally, I like to use NerdWallet as they have a pretty good retirement calculator.

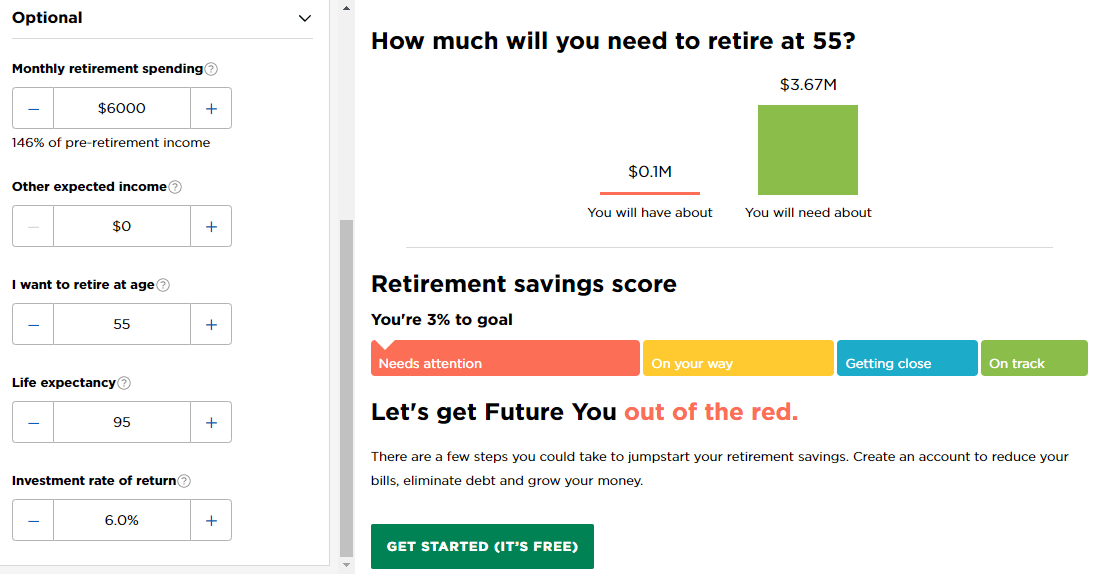

Below are my estimates in the calculator for what I anticipate spending:

If I can sum this up in one word, it’s conservative.

No, I don’t think we will spend $6K each year.

No, I don’t think I’m going to quit work at age 55 and never generate another dollar again.

No, I don’t think I will average 6% returns when the stock market averages 10% annually.

But guess what – I am under promising and hopefully overperforming!

And guess what – this is just a generic assessment, but I am only 30. As things get closer, I can mentally prepare and readjust, but I now have a goal that I need to be aiming for – $3.67 million by age 55. Let’s get it!

3 – Find Tangible Ways to Expand Your Budget Surplus

Expanding your budget surplus is the quickest way that you’re going to be able to retire early and it’s what I have really, really cracked down in my personal life.

Your Budget surplus, or deficit, is simply your Income – Spending.

That’s it. If you make $2000/month and spend $1500, you have a $500 budget surplus. If you make $5000 and spend $6000, you have a $1000 budget deficit.

It boils down to the phrase, “spend less than you make”. Makes sense, right? But how can you actually increase this surplus? Well, you have two options:

Decrease Your Spending

A lot of people talk smack on decreasing your spending but truthfully, I think that’s dumb. Their argument is built around the fact that you can only cut your expenses a certain amount before you’re at the absolute bare bones.

I 100% agree with that. But the thing that they don’t hit on is that I can literally start cutting my expenses today! Like this very second.

You normally eat out for lunch? Pack.

You go out on the weekends? Stay in one night.

You need a new pair of shoes? Check TJ Maxx or a discount store prior to just splurging at your normal shoe store.

There are tons of ways you can cut your expenses. I won’t go into all of them because I have done that before but for me, personally, living a minimalist lifestyle is the fastest way to increase your budget surplus.

Once you have that mastered, then you can move onto #2, but not before then. If you don’t get a grip on your spending, no matter how much you make it will never be enough. You’ll always find a way to blow it.

Increase Your Income

This is the fun one because the amount that you can increase your income is limitless! There’s literally no amount that you can’t earn.

Look for any sort of side hustle, get a raise, maybe even job hop! Again, I won’t list all my ideas here because I’ve done this previously but the fact of the matter is that once your spending is locked, 100% of any incremental income can be saved.

Think about this situation – you currently spend $4K/month and earn $4400. Not bad! You’re saving 9% of your income. Not great, but not bad.

Let’s say you pack lunch, cut cable and stay in just two total nights/month – that right there can easily be $500/month. So, now your spending is $3500! Now you’re saving $900, or 20% each month.

But let’s now say that you decide to drive Uber for just 5 hours each week making $12/hour, or $60/week. That then becomes $240/month, and that’s 100% able to be saved, so now you’re spending $3500, making $4640, and saving $1140 for a savings rate of 25%! That’s amazing!

That’s the type of simple moves you can make to essentially triple your savings rate. But the real question is, once you have this extra money, what do you do with it?

4 – Determine Your Financial Order of Operations

This step is soooo important and so many people ignore it. You need to have a predetermined pecking order of what you’re going to do when you receive extra money. It doesn’t have to be anything complex, but what is the absolute most important for you?

For instance, mine is below:

- Max out 401k company match

- Max out HSA

- Contribute $X/paycheck to a 529 for our son

- Contribute $X/paycheck to our Non-Emergency Major Purchases fund

- Max out Roth IRA

- If any excess money, put into the savings account or a brokerage account

As you can see, #1 is me avoiding the biggest 401k mistake you can make, and then 2, 3 and 5 all include taking advantage of a tax-advantaged account. #4 is in there but truthfully, it can fluctuate determining the balance that we have in the account. And that’s the point! This doesn’t have to be set in stone, but you need to have a general idea.

If you don’t have a plan, when you get that extra $2K bonus, tax return, stimulus, or anything else, you’re going to blow it.

Why not take that money and just invest it all? It’s because you’re just not prepared, plain and simple. Let’s fix that!

5 – Frontload Your Investments

This is a big one that I think so many people miss. Remember how I talked about the lake house that my wife and I want to have someday? Well, the way that we plan to get there is to frontload our investments.

We only have one kid right now and live well below our means – let’s do everything we can to save as much as humanly possible so we can save even less later in life.

We know that with more kids, a bigger house, college, etc., our expenses are going to go up. I don’t want to plan to save X/year because I know that my expenses are going to be a lot higher later in life.

I mean, daycare alone is the equivalent to BOTH of us maxing out our IRA’s each year, and we’re not even on the expensive end…

So not maxing those out right now is nothing but an excuse. Saving as much as humanly possible early on in life will open the door for tons of opportunities later. Imagine this situation:

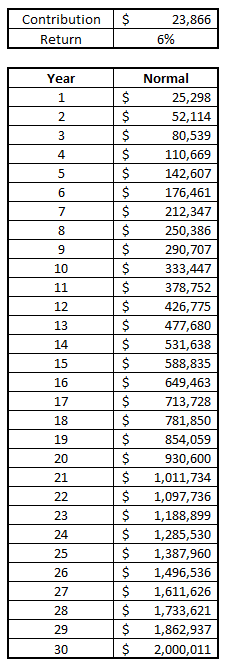

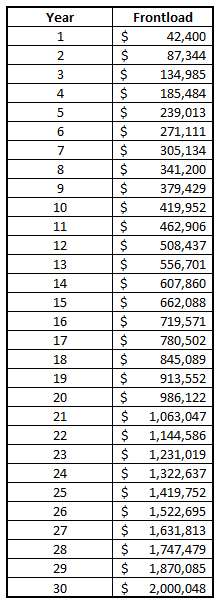

I want to retire in 30 years with $2 million and I currently have $0 (this is all made up). Using a very conservative estimate for 6% return/year (S&P 500 is 10%), I would need to invest $23,866/year:

In total, I invested $715,980 over these 30 years ($23,866*30 years). But, what if somehow, I was able to really crank my investing up for just the first 5 years. In those first five years I invested $40K instead of the $23,866. To reach that same $2 million goal in 30 years, I would only need to save $16,752 the remaining 25 years!

That means my total that I had to save among the 30 years was $618,800, or nearly $100K less to get the same amount in 30 years!

If somehow, I could’ve saved $40K for the first 10 years, years 11-30 would only need to have $5,330 invested! That means my total among the 30 years would’ve been $533,250 – about $180K under the amount needed if I had invested the same each year.

You see why it’s important to frontload? Hoping it’s obvious ?

6 – Plan – Do – Check – Adjust

This is one that has been hammered into my brain, both in my 8-5 and with my personal finance journey.

Plan – do it – check how you’re doing – adjust the plan

That simple.

If you plan to save $500/month to max out your IRA, regardless if it’s Traditional or Roth, then you need to be checking to see how you’re doing DURING that first month. You need to have a plan going in.

Maybe your plan is to contribute $300 during your first paycheck in the first half to the month and then $200 in the back half because you have more bills then. Well, if you find yourself only putting in $150 in the first half then you’re likely trending to miss your goal.

You planned, you failed – now it’s time to adjust your actions to stay on track!

This is very important as life is not static – things change! So should your financial independence plan!

7 – Be Opportunistic

This is one of my favorite ones. When an opportunity arises, pounce! Maybe that’s by having a rainy-day fund so when the market drops be 20%, you can liquidate that to invest at cheaper prices.

Maybe it means when you get a bonus at work of $2K, you give yourself $100 to spend and take the other $19000 to your retirement accounts. You have a budget already, hopefully, and you weren’t banking on this money, so why spend it? Take this money and help to frontload a goal of yours to get ahead…sound familiar, right?

Maybe that means that when you get a 5% raise, you’re going save 4% of that. Like above, you’re doing just fine with your current salary. Plan to put 4% of that somewhere else.

If your current savings rate is 15% then adding another 4% is going to be a whole lot more impactful than just adding the full 5% to your budget to buy a nicer car or some other unnecessary expense.

Be aggressive – when you see blood in the water…attack!

8 – Keep It Front of Mind

I do this literally daily with my budget calendar. Every single day I open my Doctor Budget spreadsheet and see what expenses hit my account. Then I cross them off the list and go on with my day.

I have trained my brain to get this emotional “high” from paying bills and investing the rest. It’s probably borderline unhealthy, but it keeps me super focused on my goals and keeps me motivated. My wife and I have a goal to move into a nicer home in the near future and I used to be tracking our progress for saving the down payment on a monthly basis – I just updated it to track it weekly for the sole purpose of “keeping my head in the game” on a more frequent basis.

You need to know yourself – for me, it’s keeping constant eyes on the goal and the progress, and I think it can work for a lot of you as well!

9 – Allow Flexibility

Never budget 100% of your life because life is not 100% static. Allow some flex in there.

Build in a miscellaneous budget. Save for things that you can do to treat yourself. Allow for fun.

My wife and I both got a bonus from work and while we saved or donated over 90% of it, we took just under 10% and put it into our “vacation fund”.

We have been financially grinding for years and when we get a bonus, from our work performance, we want to reward ourselves a little bit. It won’t pay for a vacation in entirety, but when we go on a trip this year, it’s nice to know that we’ve already planned for these funds to be spent.

And if for whatever reason we don’t use them, then we can deplete that fund and get to our down payment goal even faster! It’s much better to do that than to be in a situation where you have nothing saved and you or your spouse is dying of a need to get away, and you feel stuck because of your other financial goals.

To put it simply, plan for some fun in there too and be flexible! What’s better – hitting a goal in 5 years and hating your life or 5 years and 2 months and having a little fun in there? Seems simple to me!

Summary

If you can follow these steps, you’re going to be destined for success! We’re planning to have the ability to be retiring at 55 and we think you can as well! It just takes a little bit of planning, hard work and dedication. Even if you don’t have a ton of money, start investing now because even those small investments will add up!

Related posts:

- 5 Tangible Steps for You to Increase Income to the MAX! As you likely know, there are really two different ways for anyone to save money – you either have to cut your expenses of increase...

- Beginner’s Guide: Becoming Financially Independent & Retiring Early The following is a guest post from Amber Tree Leaves. He started investing 15 years ago and works in the financial industry now. He is...

- What’s a Reasonable Goal for an Average Retirement? Many of us wonder how we are doing when it comes to retirement savings. It can make us money hungry, not because we are greedy...

- 6 Must-Follow Wealth Creation Steps to so You Can Retire Early Do you find yourself in a situation where you’re having no issues living within your means, but you’re really not just getting close to financial...