Being able to attribute the sources of portfolio return is an important aspect in the decision making process surrounding portfolio management. The process of return attribution revolves around comparing portfolio performance to that of a specific benchmark and dissecting which aspects of the portfolio’s many allocation decisions improved or hampered returns.

This lesson will discuss the theory and important uses of return attribution as well as the technical formulas used to attribute portfolio return.

What Return Attribution Can Be Used For?

For institutional investors, such as pension plans and investment funds, the return attribution process can be used for everything from selecting and choosing to retain which 3rd party fund managers, to compensating and retaining internal management.

When making such decisions, it is important that fund managers should only be held accountable for the allocation decisions that are under their control. Managers need to be judged based on portfolio performance against their specific benchmark and the allocation decisions that were responsible for that performance.

For the retail investor, the amount of data needed to properly attribute portfolio return is daunting (especially in terms of micro attribution as will be discussed later).

Nevertheless, the knowledge about what return attribution is and how to calculate it can still help retail investors in their decision making process for their own portfolio in a general estimation sense. Understanding performance attribution can also help retail investors in their decision making process for selecting 3rd party investment funds and asset managers to manage their money.

The Importance of an Appropriate Benchmark

When thinking about return attribution, the benchmark to which the portfolio’s performance is being compared to is of utmost importance.

The benchmark needs to be appropriate based on not only the type of securities that will be invested in (ie. stocks or bonds), but it also needs to be specific in terms of geography (Europe, U.S., or World), firm size (large or small cap), and style (value oriented or growth).

Benchmarks also need to be investable, meaning that they can be easily replicated by the investor if they choose a more passive approach. Outperforming a proper benchmark leads to “true” active return where outperforming an inappropriate benchmark leads to what is referred to as “misfit” active return. It is important to distinguish between the two.

The BIG Picture

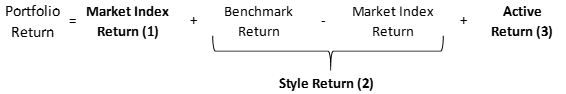

Keeping the importance of an appropriate benchmark top of mind, portfolio returns can be broken down into three main pieces: the Market Index Return, the Style Return, and then Active Return.

As seen below, the Style Return is the difference between the Benchmark Return (ie. Growth or Value index) and the broader market index. What return can be attributed to the chosen portfolio style is separate from a manager’s Active Return. Notably, the choice of which style to pursue is not necessarily the decision of the portfolio manager and their performance, Active Return, should be judged independently.

Side Note: This same equation could be applied for other factors such as geography and firm size in order to analyze whether those decisions positively or negative attributed to return over a broader market index.

Micro Performance Attribution

Once one understands the importance or proper benchmark selection, we can then start to critically attribute the Active Return of the portfolio to the decisions that the portfolio manager is making within the constraints of their defined benchmark.

- Pure Sector Allocation: Attributes performance to the manager’s decisions to hold each sector in the portfolio in a different weight relative to the weight of that sector in the benchmark. The formula first looks at whether the manager was overweight or underweight the sector relative to the benchmark, and then, the formula looks at whether that sector’s return was better or worse than the overall index. It answers the questions of whether the manager made the correct decision in overweighting sectors that outperformed the benchmark.

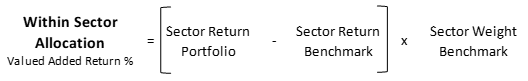

- Within-Sector Selection: Attributes what performance is due solely to security selection decisions by determining whether the manager’s return within a specific sector was better or worse than the sector’s return in the benchmark portfolio. The formula then multiplies this difference in return for the sector by that sectors weight in the benchmark portfolio (uses the benchmark weight as to not take into account weighting decisions of the sector which was covered in #1).

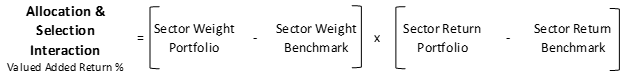

- Allocation/Selection Interaction: Analyzes the joint effect of assigning weights to both sectors and individuals securities. It takes into account the fact that a decision to increase the allocation of a particular security will also increase the weighting of the sector to which that security belongs. The first part of the formula asks if the manager choose to overweight a specific sector, and then, the second part multiplies that allocation difference by the manager’s ability to outperform that sector through their security selection.It answers the question of whether the manager was overweight sectors in which they were also able to outperform.

The Chain of Responsibility – Institutions

Decision making takes place across a number of levels. At the top, there is the investment committee on the board of directors who is tasked with the big decisions such developing return objectives and the asset allocations between stocks, bonds, real estate, or private equity needed to achieve those returns.

At these upper levels of the institution also takes place the decision of whether to invest passively and match the market, or invest actively, with the hope that the potential active return generated over the benchmark return will more than make up for the extra fees associated with active management.

Once these decisions have been made, the organization must then decide whether they should outsource various parts of the total investment portfolio assets to 3rd party managers or whether they should attempt to internalize the investment portfolio by hiring the appropriate resources and expertise to work within the organization.

Decision making, and the returns attributable to each level, then trickle down to the individual portfolio managers and analysts who are tasked with investing their portion of the organizations assets into their stated benchmark (ie. S&P 500) and style (ie. value orientation) which have already been established as their mandate by the higher level decision makers in the institution.

The Chain of Responsibility – Retail Investors

For the retail investor, they are the organization in its entirety and while it might not be obvious at first, they are making all of these decisions from the top of the organization down to the bottom.

Lots of retail investors spend their time focused on the tail end of the chain trying to achieve active return through stock picking. These retail investors should be reminded that they are also choosing what asset classes, geographies, styles, and size firms to allocate their investments to.

Retail investors need to choose an appropriate benchmark, track their returns, and be sure to step back once in a while and look at whether their decisions are working as intended towards their return objective.

Every once in a while the retail investor needs to independently revisit their decision of whether they should invest on their own, invest through active 3rd party funds, employ a discretionary advisor, or invest through a passive low-cost index approach.

At the end of the day, the retail investor is their own judge and jury and understanding return attribution plays a big part in making the correct decisions.

Related posts:

- The Information Ratio – CFA Level 2 An investor’s Information Ratio is a measure of the Active Return that is being achieved per unit of Active Risk. The Information Ratio is important...

- How to Use Jensen’s Alpha to Measure True Investor Performance Updated 1/5/2024 Measuring investment returns continues to be something everyone looks to do when investing in the markets. The search for “alpha,” or market-beating investment...

- ETF & Index Weighting Schemes With ETFs and passive investing continuing to grow in popularity, it is important for investors to understand the various index weighting schemes that our trusted...

- Calculating Portfolio Return Using the 3 Main Methods from the CFA (Level 1) Calculating portfolio return should be an important step in every investor’s routine. Efficient wealth management means to allocate money where it is generating the greatest...