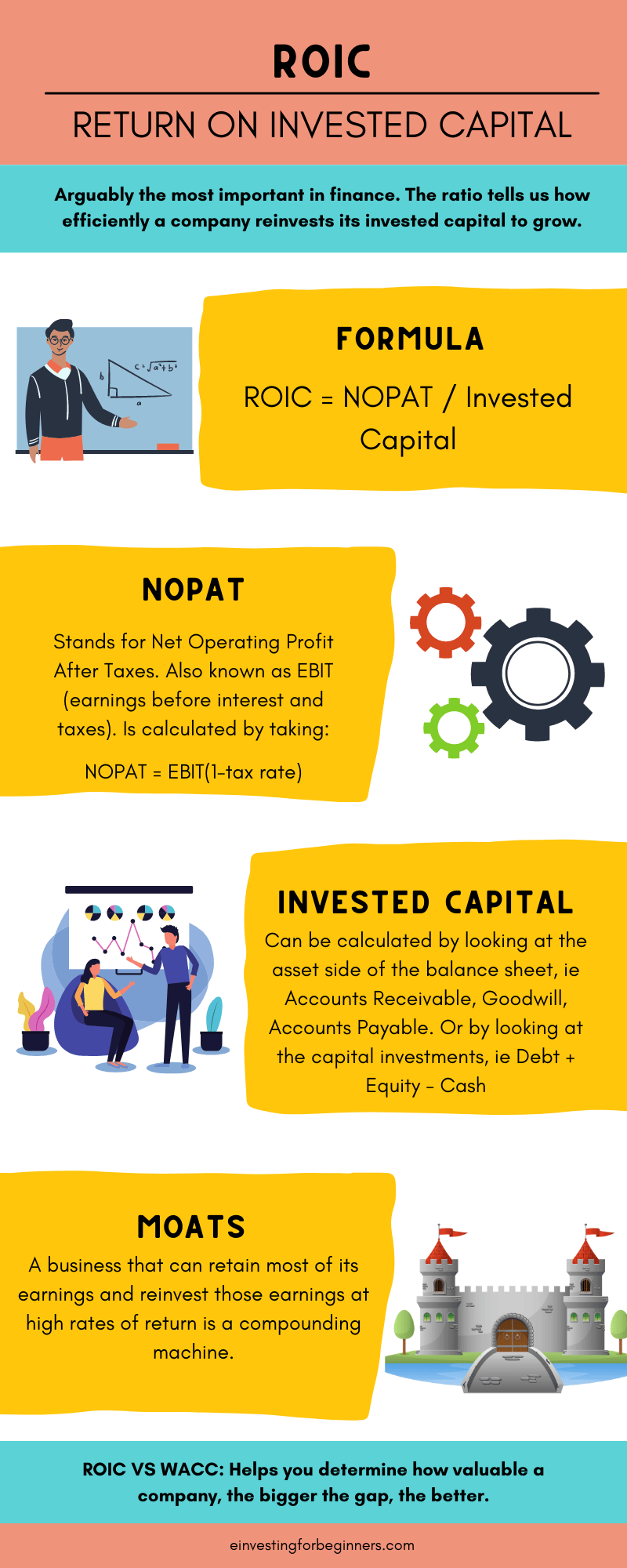

ROIC, short for Return on Invested Capital, is arguably one of the most important metrics in finance.

The ratio compares the Return a company generates, measured as NOPAT, to its Invested Capital found in its balance sheet.

Beginner’s Guide to Finding High ROIC Stocks Anytime You Want

Updated 5/4/2023 Investors target high ROIC stocks for their portfolio because highly efficient companies can sustain higher long-term growth. Companies with a high ROIC tend

Everything to Know about ROIC, with Average ROIC by Industry Data

“A truly great business must have an enduring ‘moat’ that protects excellent returns on invested capital.” –Warren Buffett, 2007 Shareholder Letter Another quote from Buffett

Buffett’s 3 Categories of the Return on Invested Capital Formula

“Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital

How an ROIC Tree Shows a Company’s Growth Drivers and Capital Efficiency

Corporate officers are in the business of allocating capital. The goal for each CEO is to return an attractive return on its capital. All companies

WACC vs. ROIC: Is Shareholder Value Being Created or Destroyed?

Measuring a business’s economic moat is a challenge, but a comparison using several metrics allows us to get an economic moat idea. That comparison is

Lessons from the best minds in finance

Curated weekly. Get links to our favorite content on money, the stock market, personal finance, side hustles, valuation, financial statements, habits, and life hacks dropped to your mailbox every Tuesday… by subscribing to our free newsletter.