Have you ever heard that the stock market is risky and that you’re going to lose all of your money? I know that I have heard that a billion times and friends, I am here to tell you that it’s just not true. As long as you know your risk appetite and you stick to it, then you’re going to be just fine.

I’m not going to lie – investing can be extremely stressful. If you’re anything like me and you refresh your investing app frequently then you’re going to see it go up and go down; go up and go down, nonstop, over and again. Oh, 5 more minutes is up? Let’s refresh it again!

I was like that when I started investing and while I don’t think that was a healthy habit of mine, I do think that looking at your portfolio daily is a good thing to be honest. So how do you determine your risk appetite?

I think you just really need to do a good self-evaluation of yourself. Can you stomach losing half of your money in the span of a few months? It can absolutely happen.

A stock market crash will happen. It’s not like a “what if”. It’s a guarantee. It’s part of investing. Investing is very volatile but it only becomes risky when humans get involve and start to mess everything up.

Vanguard has a pretty cool risk appetite questionnaire, and I know this sounds ridiculous, but almost think you should ignore the results. I think that the questions are great questions, such as:

- When making a long-term investment, I plan to keep the money invested for …

- From September 2008 through November 2008, stocks lost more than 31%. If I owned a stock investment that lost about 31% in 3 months, I would…

- During market declines, I tend to sell portions of my riskier assets and invest the money in safer assets.

The questions are all multiple choice, but the answers are designed to figure out if you’re going to stash some cash in your bed or if you’re going to go put your lifesavings into something as insane as DOGE.

You see, I went through and answered in the riskiest way that I possibly could have, but I still was told at the end that I should have an asset allocation of 70% stocks and 30% bonds.

Ummm…no.

More like 110% stocks and -30% bonds. I’m so anti-bonds that they call me Blofield…. get it…you know, the #1 villain of James Bond…oh well.

Know Yourself

But the thing is, I am a SUPER risky investor. And I know that I have a ton of time left before I will likely need the money, so I don’t mind taking risks, but you need to know the answers to those questions.

There’s nothing wrong if you know that you don’t have the stomach to handle the extreme volatility of the stock market but you need to make sure that you invest in a way that accurately represents your risk appetite level!

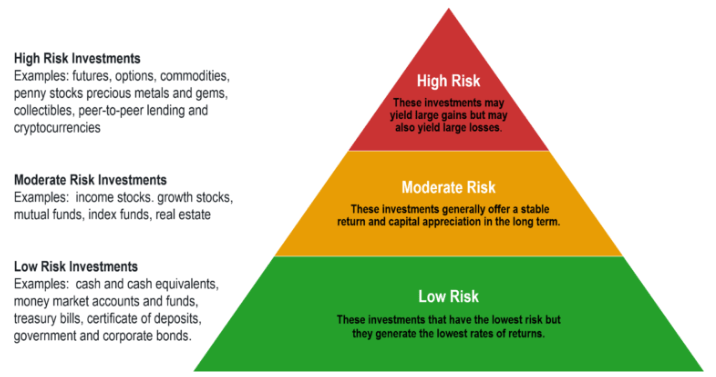

Below is a really simple photo from The Tortoise Mindset to help show the different of the various types of investments in a low risk, moderate risk and high-risk portfolio.

As you can see, the higher the risk, the higher the peak, but also your base is much smaller so you might fall much harder!

I hate losing money as much as anyone. It’s the absolute worst. But there are a few things that keep me sane when I am investing and it allows me to stay a rational investor and maintain a high-risk appetite:

1 – I trust that the stock market will always go up…in the long-term

This is by far the most important one in my opinion. I am extremely number focused so to me, looking at the track record of something is how I gain confidence. I feel like that’s what we do in any situation, right?

- When investing, you’re looking to find how companies have done in the past and then trying to apply it at the future

- When hiring a new employee, you’re hearing about their past experiences, education and knowledge and then trying to see if they’d be a good fit in the future at your company

- When looking for a potential partner, you’re listening to the things that they have done in their life and you can judge if they’re right for you, while you’re also relying on your past experiences to see what you do and do not want in a partner.

All that we can do is think about the past and then try our best to apply it to the future, and this will give us the appetite to take another leap of faith into whatever we’re about to do!

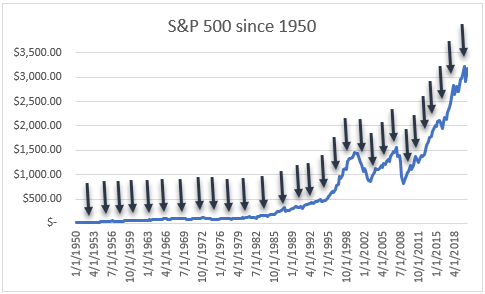

I do the exact same when I’m investing. One of my favorite investing myths that I recently debunked is that the stock market is risky. Well, did you know that the stock market always goes up over time? Or, at least it has in history – I mean, look at all these great buying points throughout the years!

To me, I look at this graph and it tells me that as long as I am focused on buying for the long-term, then I am going to be able to make some money in the market.

Even the few little hiccups that have occurred in 1999, 2008, and even now with the coronavirus, I still know that as long as I am going to hold onto these companies, then the market will likely rebound because that’s what it was always done!

Andrew talked on the podcast episode that as long as you trust that businesses are going to continue to develop and grow, then the market should continue to grow as well. Personally, I think that businesses are just becoming stronger than ever and the technology is adapting so rapidly that even such simple things are being more efficient and beneficial to the consumer.

I mean, grocery shopping alone is an example – you can buy online and pick them up, have them delivered to you, pay with your phone, cut coupons on your phone, search all deals online, or even with the Amazon convenience stores you can literally just walk right out and your account is automatically changed!

As businesses keep adapting, the market will continue to strengthen, so I trust that the market is going to always go up. Having that trust keeps me from feeling a sudden need to sell my stocks when the market has a bit of a hiccup, and this keeps me a sane investor!

And not only will I not sell, but I trust the market so much that when things do dip, I will try to buy even more! That’s taking advantage of the opportunity, but I can only do it because of my risk appetite.

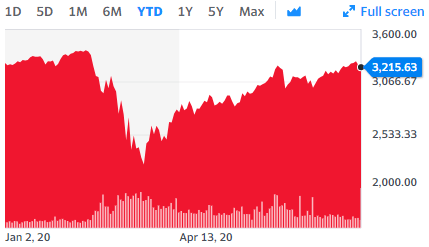

Just looking at the YTD (thru 7/24/2020) chart of the S&P 500 on Yahoo Finance, you can see that there was a pretty big dip due to the coronavirus but things rebounded extremely fast. If you had sold when the dip was occurring and didn’t buy back in, you’d be pretty mad right now. I had the risk appetite to buy more when the market was dropping and now, I can reap the rewards!

If you’re not at that point yet with your risk appetite, don’t worry – we will get you there!

2 – I have made the fatal mistakes that an investor shouldn’t make and have learned from them…and have gained by not making them again

When I first started investing, I was a fool. I did the exact opposite of what I talked about in the topic above. I thought that I was smarter than everyone else and would try to sell on any dip and then buy in at a lower price. You know what actually happened?

I was half right.

I was really good at selling on the dip. I was really bad at buying at a lower price.

I found a way to sell at the bottom and then keep waiting for it to go lower, just for it to keep going up and up and then I’d have a decision to make – just let it go or deal with my FOMO that the stock was going to go to incredible all-time highs and I let one decision compound into another mistake.

More often than not, my FOMO would take over and I’d end up buying back in, just for the stock to inevitably not go up as much as I had anticipated, or maybe even decrease.

For a stock that was at $10 and 1 month later it was still $10, I very well could’ve lost multiple times. I’d sell at $9.75 and then buy back in at $10.25, therefore losing $.50 and the stock did literally nothing over that time.

It might seem insane, but by making these mistakes I learned that I absolutely cannot time the market, so this kept me from getting stressed out about the major dips and kept me from thinking I was invincible when the market was booming. In other words, this taught me to be humble and even keeled, therefore making me very level-headed in my decision making.

It was a long, painful process, but I do think it helped me. I’m not advocating for you to make mistakes – I’m advocating for you to learn from the mistakes that you have already made and to learn from them.

3 – I know my risk appetite/personality and I only invest in that way…and I don’t go any further than that

What I mean by this is that my circle of confidence really is around actually investing in stocks, so I stick to only doing that. I don’t understand crypto at all and honestly, crypto is something that’s even hard for me to wrap my mind around just from a functionality perspective, so I definitely cannot invest in that.

I recently was watching a TV show where someone made an offer to buy a house in bitcoin and I couldn’t even understand how that would work with the prices of bitcoin being so volatile and changing so much even in the same day.

Sure, the value of the dollar changes too, but nothing like the value of a bitcoin will. So, I just completely stay away from that and make sure that I don’t get caught up in the hype.

An even bigger one for me is to avoid options. I think that options likely can be a great way for people to invest in the market (or trade really). I admittedly haven’t done a ton of research on them and that’s been purposeful.

Maybe that’s ignorant, but everything that I have heard is that there’s a lot of risk and you can get caught up in them.

I know that I have an addictive personality so if I can avoid something that might help save me from myself, I’m going to do it. It’s not to say that I won’t ever take a look at options but it’s not something that I want to do at this point in my life.

Because I know myself, I am able to protect myself from potential future pitfalls. If I was scared of volatility of the stock market then maybe I would only invest in ETFs, or maybe even consider some fewer volatile investments like CDs or bonds. The key is to know yourself.

A lot of people think that they’re super risky but then when things get tough, they sell. Selling when the market is in a downturn is the worst thing that you can do. You’re essentially buying stocks at full price and then selling them on clearance. Who wants to do that?

We buy low and sell high, right? Selling in a downturn is the exact opposite of that!

Know yourself and then you can properly have your investment strategy deciphered. Until you know yourself, you’re going to just be flying blind and hoping things work out!

4 – Hedge!

This is somewhat similar to #3, but a great way to help increase your risk appetite for investing is to hedge! What do I mean by this?

Well, for instance, up until very recently, I only managed a portion of my accounts. My 401k was with Fidelity and I paid an annual fee for them to manage the account. I didn’t like paying the fee, but I felt like they were doing a pretty good job when I compared the returns to the S&P 500 as a benchmark.

The reason that I did this is because I just flat out didn’t have the full faith in myself to invest our entire lifesavings. It’s not like I was doing anything insane, and honestly, I was still primarily investing in ETFs for the 401k, but I was hedging my bet because I wasn’t completely comfortable with managing 100% of our lifesavings.

My risk appetite didn’t match the task, so I didn’t do it.

Even now that I am managing all of our assets, I still am a little bit uncertain and nervous, but it’s just because it’s so much weight on my shoulders.

I still don’t quite have the experience where I’d be totally comfortable investing 100% in stocks in those accounts, but I know that about myself, and that’s totally ok!

So, I invest 100% in stocks in all accounts except my 401k, and eventually will likely slowly move into more stocks in my 401k as well. I have a speculative account, too, that’s primarily for short-term investing where I like to take more gambles and that helps increase my risk appetite as well as can teach me some great lessons about some fatal flaws that I occasionally will continue to make.

Risk Appetite is a Comfort Measurement

In essence – don’t be afraid to bite off a bit more than you can chew, but make sure it’s literally just a small bite. If you only want to dabble a bit and learn, then maybe only invest 10% of your savings on your own.

Let the rest be managed by an advisor, or someone like Fidelity, or maybe just put a lot into a S&P 500 ETF where as long as you trust the market like I mentioned in #1, then you’re going to be golden!

The point is, don’t be shamed into doing something that you’re not comfortable doing. Feel free to take control of some of your assets because that is absolutely the best way that you can learn about investing and the market. You can do all the reading and listening to podcasts that you want, but until you have some money in the market, it’s all just hypothetical.

So, in summary, along with the four steps that I have, I really want to leave you with a tangible takeaway for a next step – review your investments and try to understand if you’re comfortable with what you’re managing now. If you are, try to start to manage a little more.

If you’re not, maybe stay where you are or even back off some of what you have and put it into an ETF, or even reach out to a financial advisor.

As long as you 100% trust that the market will continue to go up, then putting your money into an ETF will be completely fine over the long-term until you build up that risk appetite and you’re ready for a bigger bite!

Until then, keep doing your thing and continually pushing yourself to get outside of your comfort level because eventually, you’re going to become comfortable investing all of your money on your own.

So comfortable, you’re going to be just like this guy:

Related posts:

- 15 Years to Retirement – Stretch it to 20? Invest in the Stock Market? On Episode 156 of the Investing for Beginners Podcast Andrew and Dave did another one of my favorite episodes of listener question and a great...

- 5 Tips of Investment Advice for Teenagers Got a request for investment advice from a high school senior who reads my blog. Here’s what he asked. “I know I’m very new to...

- Wealth Accumulation in Action in the Stock Market (with practical examples) Winning in the stock market requires the right wealth accumulation mindset, and ironically, most people who build wealth successfully do it with great help from...

- What’s the Tax Rate on my Bonus if I Invest it in the Stock Market? So, you’ve just received a big bonus at work and you’re wondering what you should be doing with it, any quite frankly, you’re worried about...