When I first started investing, I used Robinhood. With $0 commissions on all trades it was hard for me to justify going with anyone else, but now that so many brokerage firms are offering trades without commissions and Robinhood keeps having issues, it’s time to explore some Robinhood alternatives!

Like I mentioned, I was a Robinhood investor when I first started out, and honestly, I really liked it. Robinhood had a lot of pros going for it and I honestly think we all owe Robinhood a huge ‘thank you’ for essentially forcing the industry to move towards $0 trades.

I thought that the platform was sleek and was very functional. I liked that I got my money to trade instantly when I deposited it. I liked that I could trade before and after the normal trading hours which allowed me to make decisions after an earnings announcement. Not saying that it was smart that I would try to ‘trade’ a little, but it’s something that I do with my short-term portfolio, and something that I did like.

I had heard of a lot of people having issues with Robinhood but since I had never had them, I turned a blind eye. That is, until the entire platform crashed one day during the coronavirus. When you’re seeing the market change by 10% or more each day, and I personally have had stocks move by 60%+ in a day, it’s not a good time to lose all ability to be able to purchase and sell stocks.

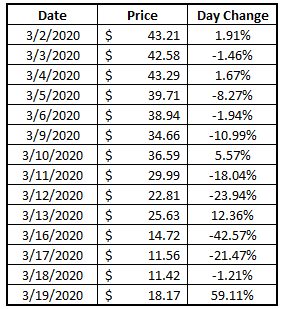

Think I’m kidding about the 60% move? I’m not. On March 19, PFGC increased by 59.11%. Think about this timeline – On March 2nd, Robinhood crashed, and then these are what PFGC did since then:

It was pretty calm for a few days but then all hell broke loose. I was terrified that I might own a stock in Robinhood and then it would crash again. Thankfully, I sold my stock and moved to Fidelity. On 3/9, Robinhood crashed again. PFGC was down nearly 11% that day! I didn’t sell, because I’m really focused on the long-term with PFGC, but I can’t imagine if the app closed a few days later when the stock was down 40%+ and I didn’t even have the option to sell my stock.

If this was 12 months ago, I potentially could’ve looked past the issues with Robinhood for the free trades but guess what, TONS of brokerage firms now are offering free trades, and that was by far the best part about Robinhood.

Andrew and Dave had an entire podcast episode where they go in depth on many of the issues of Robinhood and really, really bad experiences that people have had with it. I have seen some stories on the internet about how people can basically way over leverage themselves and then borrow wayyy more money than they have, lose it all, and be totally SOL.

While I’m not going to necessarily give Robinhood 100% of the blame, I do think they’re at fault.

I almost compare it to those payday loan companies. It’s easy to sit there and say, “well, the person shouldn’t have borrowed at such a high interest” and honestly, that’s what I used to say. But those loans are built to target people that might not understand interest and how big of a hole it can dig.

I think Robinhood attracts a similar crowd by giving you a free $5 stock if you sign up. I mean, come on. Are you actually going to make a decision on your brokerage firm based off of a $5 stock? I hope not.

Now that you can really get free trades anywhere, what is the benefit of Robinhood? Honestly, I don’t think there really is one. I do think that the app is very sleek like I mentioned, but why do you need a sleek app?

Sure, I check my portfolio multiple times/day, but I never actually login to my actual brokerage firm on my phone. I feel that when I keep myself from logging into it on my phone, it’s a little speed bump to keep me from making an impulse decision to buy or sell a stock. So instead, I only logon to Yahoo Finance to see my portfolio.

Robinhood is really setup for someone that wants to day trade. I know that right now day trading is all of the hype since there’s basically nothing else to do during the coronavirus and that’s fine as long as you understand that you very well could lose all of your money doing so.

One of the main faces of day trading right now is Dave Portnoy, and while I personally find him hilarious, I also think that he’s leading people down a dangerous road to their investing journey that might not realize that he’s basically doing it for only entertainment and doesn’t care at all if he loses money. It’s all about getting eyes on him and his company, Barstool Sports.

I personally know of some people that have downloaded Robinhood, because that’s the brokerage app that they’re aware of, and then they day trade on it. I just think it makes it very inviting for people to use Robinhood and then start day trading on it because it’s really the way that the app is constructed, and I know that because I have used it and tried to day trade on it.

My biggest beef with Robinhood is that there isn’t really any sort of education on the app to really teach you how to invest. Like, that alone proves to me that it’s really all about day trading because there is nothing on the app to teach you to become a better investor.

And to be honest, having things like extended trading hours is really only beneficial to someone that is going to day trade. Like, if you’re investing in a company for many years in the future, why do you need to start trading before the market is open or after the market is closed? Exactly. You don’t.

So, the real question is, “What is my best Robinhood alternative?”

Well, personally, I am a huge fan of Fidelity. I really just fell into Fidelity because that’s where my 401k is for work but I really think that they do an awesome job at continuing to provide in depth education to make me a better investor as well as some great research on stocks.

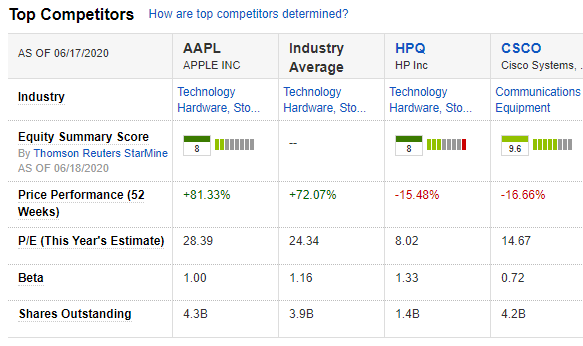

They have a very intuitive stock screener and also gives me the ability to easily compare multiple stocks at the same time. For instance, look at this screenshot below with AAPL:

You have the ability to customize the stocks that you want to compare as well as look at all sorts of factors that might be relevant when you’re trying to evaluate different stocks to buy or even just put on your watch list.

They also have many proprietary ETFs that are completely free, which is rare for a brokerage firm, and while I personally don’t invest in a ton of ETFs, I absolutely do invest in some if it makes sense. It’s nice to have these proprietary ETFs because even if you’re just saving a few percentage points, you can still save a lot of money!

And I think that ETFs are great for many people that either don’t have the time or interest to pick individual stocks and still get great returns compared to it just sitting in a savings account.

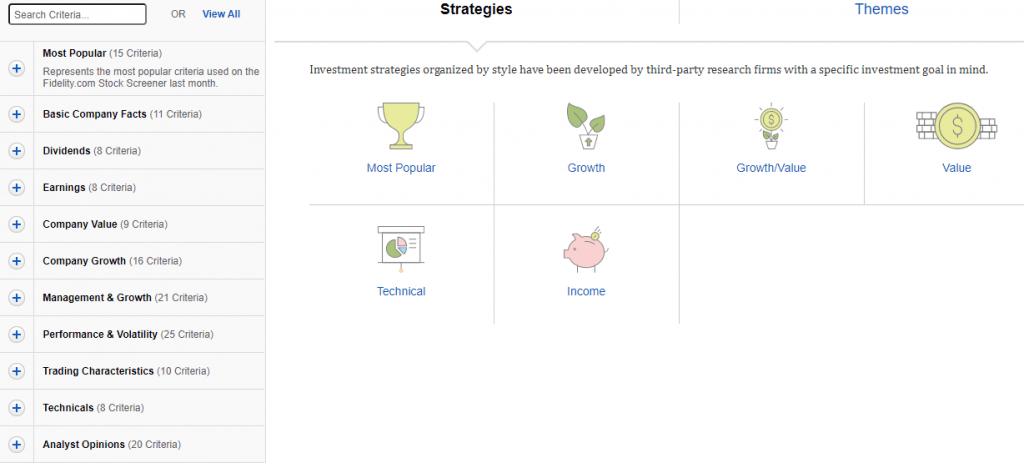

And of course, they have a great stock screener as well. Take a look below!

They give you a ton of different options to actually screen the stock as well as providing some potential screener options for different strategies and themes.

And, with really any real brokerage firm (but not Robinhood), you can get an IRA, HSA, 529, etc. You know, all the great tax-advantaged accounts that you need to take advantage of, and if you’re not, you’re literally flushing money down the drain.

I don’t want to get too far down a rabbit hole, but you really, really need to be taking advantage of these tax advantaged accounts. By having an IRA alone, which is likely the most common tax-advantaged account that I always here people talk about, you’re going to save tons of money compared to if you were just going to put it in your normal brokerage account.

For instance, let’s pretend that you open a Roth IRA. That means you’re going to put money that has already been taxed into this account and then it will build forever, tax free, until you withdrawal it at an age of 59.5 or older. You can withdrawal your principal earlier, but you absolutely don’t have to do that, and I would really recommend that you keep it in there so you keep getting the benefits of compound interest.

So, let’s pretend that you invest $6K/year for 30 years and then you want to retire. Regardless if you put your money in a Roth IRA or in a brokerage account, you’re going to have the same amount of money. I’m going to assume you earned an 8% return, while the average for the S&P 500 since 1950 is 11%, which would mean you would end up with about $680K. Not too shabby!

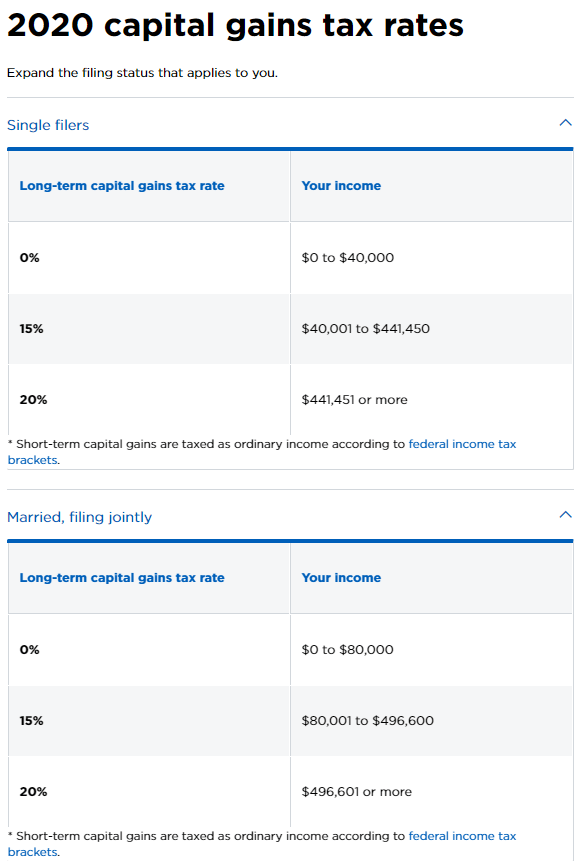

Now you can just take that $680K and run, right? Well, it depends! If you put your money in a Roth IRA then yes, you can go on and do your thang! If you put it in a normal brokerage account, then you can also just take it and run, but come April 15th of the next year, you’re going to owe some pretty serious taxes! The tax rates as of 2020 are listed below per NerdWallet:

I know that Dave really likes to use Schwab quite a bit and Andrew has used Ally in the past but is slowly getting away from them, but if you listen to their podcast episode, you’ll get some more insight from them on why they dislike or like certain firms.

I found a really good article from Investopedia that talks about the pros and cons of many different brokerage firms that is certainly worth checking out. It’s hard to speak on something you’ve never used, so that’s why I’m really wanting to stick to my expertise for Fidelity and Robinhood since I used them both for multiple years, and I encourage you to do research on your own.

At the end of the day, you really just need to create your own checklist for what’s important for you and find a brokerage that checks those items. For me, my list is:

- Do they offer tax-advantaged accounts? I hope that you get just how important that this really is and how if a brokerage firm doesn’t offer this, it should be an instantons deal killer!

- Can I purchase and sell stocks for free? This is very important to me. Many brokerages offer free trades so there is no reason why you should be with one that doesn’t.

- Will I feel supported by the brokerage firm? Not only with customer service but more importantly with the tools and resources that they’re providing to make me a better, more educated investor.

- Can I buy fractional shares? I like this a lot because it allows me to get more money invested into the market at the earliest opportunity possible, and also allows for me to perform my own DRIP without actually having to DRIP. Therefore, I can earn dividends and put it into a different company, regardless of how much I have and then also because it doesn’t cost me anything with the no commissions!

Those are my four major things that I need and Fidelity easily checks the box on each one.

Does Robinhood check the box on everything that you need? Either the answer is ‘no’ or you need to reevaluate your list and get into a tax advantaged account!

Related posts:

- Robinhood DRIP Problems and What Dividend Investors Should Do One of the drawbacks to investing with Robinhood for the dividend investor is that they currently (as of Sept 2018) don’t offer automatic DRIP with...

- Should I Reinvest Dividends? Handy Andy’s Lessons! If you’re asking me, “should dividends be reinvested?” I am telling you that the answer is always a resounding YES! Now, if you’re asking me...

- Beginner’s Guide: 7 Steps to Understanding the Stock Market Updated: 4/06/23 This easy-to-follow beginner’s guide will help you learn how to invest in the stock market. We’ll be leaving out all the confusing Wall...

- Tesla and Apple Did It – Is it Time for a Google Stock Split? Stock splits are a really unique thing nowadays and with so many companies doing it lately, it makes me wonder if it’s also time for...