To many people, the terms “Roth” and “Traditional” only apply to their IRA, but I am here to tell you that this is not the case. In fact, you can invest the same way but in your 401k! But the almighty question is always, “which one?” Well, that’s why I created this Roth vs. Traditional 401k calculator!

But first, I want to explain the differences between Roth and Traditional, and they’re very simple…

A Roth account is one where you pay taxes your contributions upfront and then when you go to withdraw that money, you won’t pay any taxes on it.

Traditional on the other hand is the exact opposite – you don’t pay taxes now but you will pay them later on when you withdraw your money.

It’s very important to understand these concepts because I know people that get confused on them very easily. In fact, I recently was talking to a friend that has been investing for years and he said, “should I put my money into my Roth or my 401K?”.

Well…those are two completely different things. Thing of Roth & Traditional as the adjective that describes when you receive the tax-advantage while the 401k or IRA would be the type of account that you’re investing in.

So, you can theoretically have a Roth IRA, Roth 401k, Traditional IRA and a Traditional 401k!

In fact, I have a Roth IRA, Traditional 401k and Roth 401k, but we will get into that later on ?

Another way to think about this is this:

- Roth = Red

- Traditional = Green

- IRA = Apples

- 401k = Grapes

You can have red apples and red grapes, as well as green apples and green grapes. My friend had essentially asked me if he should invest in Red of Grapes…ummm….

Make sense now? It’s imperative to hammer home before we go any further because the differences of the Roth and Traditional tax-advantages are imperative when using this Roth vs. Traditional 401k Calculator.

And it’s important to note as well, that while the calculator is built for 401k usage, you can also use it with some IRA modification…maybe I’ll even show you how!

Now, there are a few major differences between Roth and Traditional Accounts that I want to mention:

Traditional

- Money goes in tax free and gets put to work faster

- Reduces your taxable income

- If you think your tax rate will be lower when you need it, then you will be taxed at a lower rate in the future than you are now, meaning you’ll have more money than if you put it in a Roth.

That last bullet point is really the key difference in my mind. The reduction of taxable income is something that’s imperative to be aware of, especially if you’re on the edge of a tax bracket, but it really boils down to that last bullet when you’re evaluating whether to use Traditional or Roth.

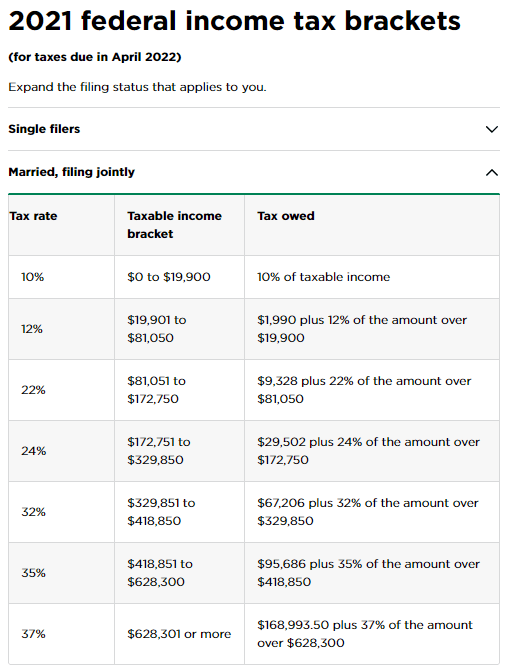

NerdWallet is always on top of their tax bracket information and puts it in a really easy-to-comprehend way. Below is a screenshot showing the 2021 tax brackets for a couple that is married filing jointly:

So, imagine that as a couple you make $81K normally, but you just received a $10K bonus at the end of the year! What an awesome thing, right?

Well, it absolutely 100% is awesome, but you can see that this income will put you over the threshold and will primarily be taxed at the 22% amount rather than the 10% threshold.

Maybe this is enough to make you want to use a traditional account for this money? Maybe not. But it’s something to be aware of!

Roth

- Money goes in after tax but so you know exactly what you have. Every penny in there is yours because you don’t ever have to pay tax again. Peace of mind.

- If you think that you’ll be taxed at a higher rate in the future then this will be better off

Ok, I think that you now have a really good understanding about the differences between Roth and Traditional – now it’s time to get into the nitty gritty!

To start using the calculator, you will need to know the following information:

- Current Salary

- Contribution % – this is the amount that you plan to invest

- Employer Match %

- Annual Raise % – this is obviously not a guarantee and more of an assumption

- Growth Rate – this is also an assumption but I like to use 8% as a conservative estimate given the S&P 500 has returned 10% or more over time

- Current Tax Rate – just use that tax chart that I provided previously

- Future Tax Rate – whatever you think might happen!

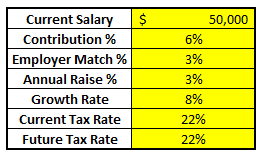

When you know that information, you will simply enter it into the spreadsheet. For the purposes of this example, I am going to assume the following:

- Current Salary – $50K

- Contribution % – 6%

- Employer Match % – 3% (I am saying that the employer matches 50% of what you contribute)

- Annual Raise % – 3%

- Growth Rate – 8%

- Current Tax Rate – 22%

- Future Tax Rate – 22%

This is how it looks in the calculator:

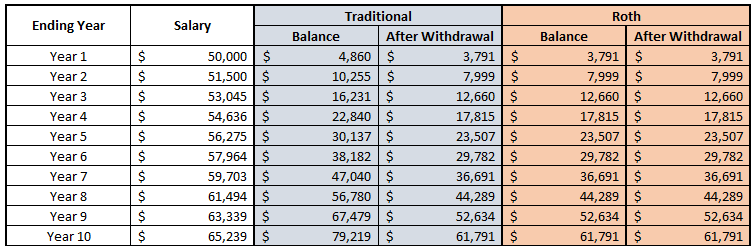

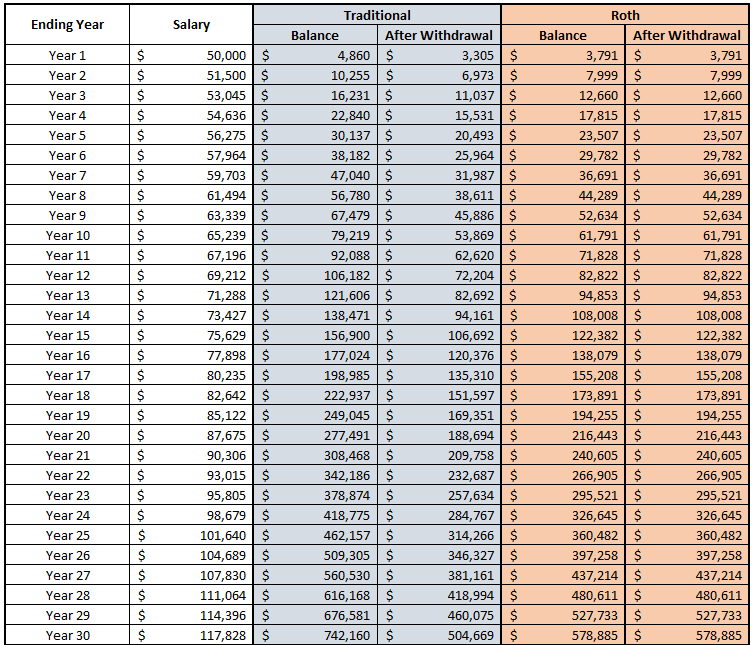

The next steps are just to simply look at the returns that you would have each year! Below shows the first 10 years of performance:

As you can see, I each year shows the salary increasing by 3% per the number that I put in. If you’re anything like me, you’re immediately going to go right to the bottom to see the balance, but let’s take a step back and look at the top of this first.

You can see that both the Traditional and Roth categories have two sections under them – “Balance” and “After Withdrawal”. The reason I have it written that way is because the “Balance” is what you’re going to see in your account while the “After Withdrawal” is the amount that you will have after you pull it out and pay taxes.

In this case, the Traditional “After Withdrawal” section is 22% under the balance per the “Current Tax Rate” that we established.

For the Roth, the “After Withdrawal” is the exact same as the “Balance” because we already paid taxes on the front end!

Another thing that you’ll notice is that the “After Withdrawal” amounts are the exact same which makes sense considering we’re using the same tax rate assumptions for both current and in the future.

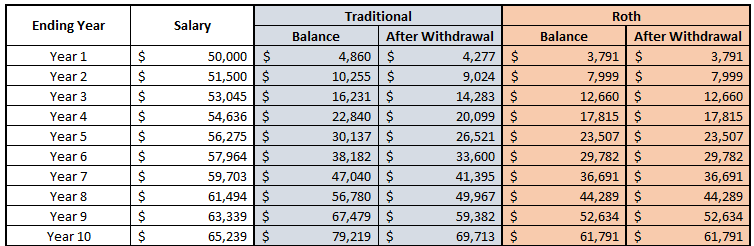

“But Andy, I think it’s apparent that tax rates are going to go up in the future!”

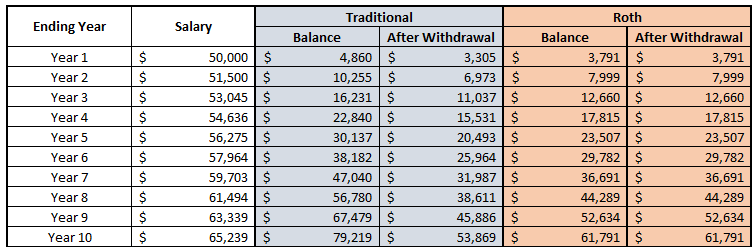

Ok, change them! What do you think they’ll go to – say, tack on another 10%? Check it out!

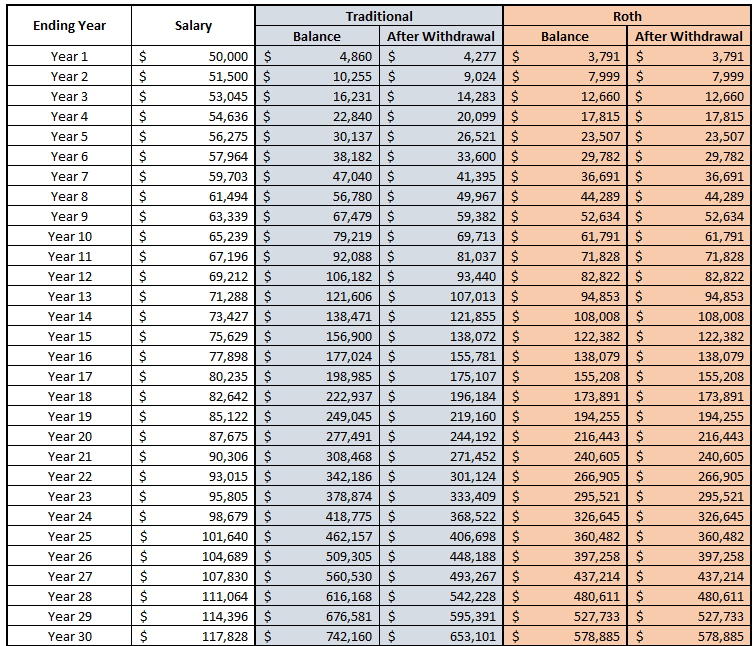

When you do that, you can see that the Traditional is now much worse than the Roth, which makes sense if you’re paying 10% more in taxes. The difference might not seem like a drastic amount being only $8K, but that outperformance by the Roth becomes much more prevalent the longer that the timeframe is.

For instance, lets pretend that you’re 30 and plan to retire at 60 – how does it look then?

That small outperformance by the Roth options now has turned into $74K! Now, that’s a pretty major difference solely because of the type of account that you chose.

Literally, that’s it. It’s not about picking better stocks, avoiding fees, Dollar Cost Average investing, long vs. short-term capital gains, nothing! It’s simply just picking the right option between Roth and Traditional.

No Pressure!

“But Andy, sure I think taxes are going to go up but when I actually start withdrawing this money, I am going to be in retirement! AKA, I am not going to have any true income coming in so while the normal tax brackets will be higher, mine will be way lower!”

Great point! It sounds like you should probably put this information into the calculator!

Let’s just assume that the tax rate will drop 10% now since we increased 10% in the previous example. Remember, this is the beauty of the calculator – you can use it however you want!

Below shows the first 10 years!

Now tis time we can see that the Traditional outperforms the Roth by about $8K on the nose! The exact opposite of the previous example. But what about after 30 years?

That outperformance of the Traditional 401k is $74K – the exact same outperformance as the example I did where the Roth was advantaged. Maybe it’s because I used a 10% difference in the tax rate in both assumptions….

As with many things in personal finance, it really comes down to your own personal situation and then what you think the future is going to look like, and that’s why I made this 401k calculator which you can download FOR FREE!

In general, if you think that you’re going to be in a higher tax bracket when you start withdrawing money from your 401k, you’d be better off putting it into the Roth and paying the tax now to avoid a higher tax later.

If you think the opposite and feel that you’ll be in a lower tax bracket later in life, you should want to put it into a Traditional 401k and pay the taxes later in life when they’re going to be lower.

It’s really a gut feel based on what you think you’re going to need later in life.

What do I do, you ask?

Well, I hedge my bets and do a little bit of both! I have two main retirement accounts – a 401k and an IRA.

50% of my 401k contributions are via the Roth and 50% are via the Traditional method. I do that because I really don’t know what my situation is going to be like in 30 years so I’d rather hedge my bets and know that 50% will be the right call and 50% will be wrong, rather than taking the purely speculative gamble that I am going to be right and guess which account that I will use.

Now when it comes to my IRA, that is actually 100% via Roth. The reason that I do that is because there’s actually a little secret about retirement investing and truthfully, it’s applicable to the 401k as well.

You see, the 401k contribution limit in 2021 is $19,500 and the IRA limit is $6K. Personally, I only put enough into my 401k to max out my employer match because I like to be a stock picker and my 401k only allows me to invest in mutual funds and company stock.

So, once I’ve maxed out my 401k employer match, which is nowhere close to $19,500, I will then max out my IRA. The max amount that you can invest in your IRA is $6K, regardless if that’s pretax dollars or after tax.

I can actually invest “more” in my IRA by picking the Roth than I could if I was doing Traditional because 100% of my $6K has already had the taxes paid. But, if I put $6K in on a pretax basis, then I’m really only investing whatever is leftover after taxes – make sense?

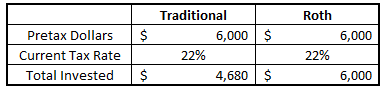

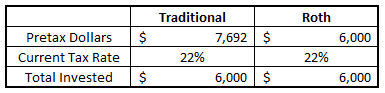

Let’s look at the two examples below where I am going to assume, I am currently in the 22% tax bracket:

As you can see, in this example where both are maxed out, one person is investing $4,680 where the other is investing $6K. The difference is that since you already paid taxes in the Roth, you’re getting the benefit of that full $6K while in the Traditional, you’re not.

To explain even further, a 22% tax rate means that $7,692 of pretax dollars is equivalent to $6K in after-tax:

That’s the reason why I love Roth – I can basically squeeze even more into this tax advantaged account vs. anyone using a Traditional can.

Now, this example is with an IRA but the same exact thing applies to a 401k if you’re maxing out your $19,500 annual contribution. I do not do that as I have said, but you best believe that if I ever get to that point, I am most likely going to switch my 50/50 ratio over to more Roth so I can cram even more money into my 401k.

Now that you understand the difference between Traditional and Roth, it’s time to start finding some great stocks! If you’re stressed out thinking about that – don’t be.

Just take a look at this free, comprehensive investing PDF to get you on your path to Financial Freedom!

Related posts:

- IRA vs 401k, Roth vs Traditional – Retirement Accounts Made Simple You decided to open a 401k. Finally! A smart decision today. But now they want to stump you with some investing jargon. Do you want traditional?...

- Maximize Your Tax Savings with This Amazing Traditional IRA Calculator 401k’s are OLD NEWS! Kidding…kinda…not really. Personally, I am a huge fan of the IRA and think that everyone should be utilizing them whenever they...

- The Requirements and Steps to Using a Mega Backdoor Roth IRA Chances are, you might be familiar with the term ‘Backdoor Roth IRA’, but what if I told you that there was a MEGA Backdoor Roth...

- Use this FREE 401k Loan Calculator to See if a 401k Loan is Right For You! I’ve made it well-known in the past that I had borrowed from my 401k to help payoff some higher debt in the past and I...