Updated 4/28/2023

“Baby, we were born to run.”

Bruce Springsteen, Born to Run lyrics

With the booming stock market and the focus on exploding revenue growth, run rates and calculating them, plus their uses, is a timely metric to understand.

Every quarter, companies hold earnings calls with analysts, which allow investors to hear from the executives running the show. And get their thoughts on the performance and prospects of the company. In the calls, revenue is a common topic, and one of the terms thrown out is “run rate.”

The metric is simple to calculate, but it is more important to understand its meaning and how to interpret the ratio.

Every company wants to see revenues grow, but many are cyclical. Take restaurants; for example, most make the majority of their revenues cyclically. The holiday season for many is the high season, and basing the whole year’s growth on a few months is not the best, but we will cover more in a moment.

In today’s post, we will learn:

- What is Run Rate?

- How Do You Calculate the Run Rate?

- Why Do Companies Use Run Rates?

- Run Rate Examples from the Real World

- Investor Takeaway

Okay, let’s dive in and learn more about run rates.

What is Run Rate?

The run rate, according to Investopedia:

“The run rate refers to a company’s financial performance based on using current financial information as a predictor of future performance. The run rate functions as an extrapolation of current financial performance and assumes that current conditions will continue.”

The run rate sometimes refers to dilution from company stock option grants, but that is a rabbit hole for another day.

One great aspect of the run rate is that we take the company’s performance and project it into the future by using current financial information.

Any projections based on that information assume no forecasting changes in the future.

Run rates are common among new companies, especially those that have recently finished IPOs. Using a run rate allows investors to project revenues into the future and predict margin improvements and profitability.

Typically, run rates refer to projections based on quarterly numbers, but using a week’s data or month-to-project is also possible. Most projections are annually and are typical for rapidly growing companies, such as Uber, Tesla, Airbnb, Doordash, and Spotify.

Using a run rate also allows investors to understand the size of a new or growing company while putting those revenues in context.

The run rate is often associated with revenues or sales but is possible with any line item you wish to project. For example, if you want to project the company’s gross margin, you can project the revenues and costs to see how the margin might look over the entire year.

How Do You Calculate the Run Rate?

The formula for calculating the run rate is simple:

The run rate looks at information from the company’s financials and extends it over a longer period.

For example, let’s say that Spotify (SPOT) generates revenues of $3,036 million from the quarter ending September 2022. To project those revenues over the period, we multiply that quarterly number by four.

That calculation generates a revenue run rate of:

Spotfiy run rate = $3,036 x 4 = $12,144 million

Pretty simple, huh?

When we use a process like the one from above, we also refer to it as annualizing the data.

Let’s expand on this idea and look at the run rate for Spotify for the costs to examine the company’s gross margin extension.

Spofity costs run rate = $2,286 x 4 = $9,144 million

Now that we have the run rate for the costs, we can look at the projected gross margin for Spotify.

Spotify | Run Rate Projections |

Revenue | $12,144 |

Costs | $9,144 |

Gross profits | $3,000 |

Gross margin | 24.7% |

That is pretty cool and a great way to analyze any company. Seeing the numbers laid out helps make ideas more real while indicating what is possible.

Spotify is not profitable, but its revenues have grown exponentially since its IPO. One way to use these types of projections or calculations is to adjust the margins to see the company’s run rate to become profitable.

We can also take the run-rate projection and calculate a growth rate based on those quarterly numbers. Spotify’s revenues from the year ending 2019 were $7,516 million, and the TTM (trailing twelve number) is $8,557 million. If we take our projected run rate of $9,304 million, we can look at the small sample size to find a growth rate.

Revenues | Growth | Rate vs. 20212 | |

2021 | $9,668 | ||

2022 | $11,727 | $2,059 | 21.8% |

Run Rate | $12,144 | $417 | 3.5% |

What an interesting chart, and if we look at the growth rate of the revenues for Spotify over the last five years, which is a CAGR (compounded annual growth rate) of 19.81%.

If we compare the company’s historical growth rate versus the run rate we are projecting, it looks like it is a realistic projection based on historical performance.

Why Do Companies Use Run Rates?

Companies use run rates for young companies that have only been in business for a short time. Revenue run rate, especially for a company with growing revenues, can be a powerful tool for CEOs to raise funds.

A growing company with growing revenues might use the run rate to generate excitement while raising money. Because the young company might not have a strong or no credit rating, using a revenue run rate tool can help them raise funds to continue operations or growth.

There are a few instances where using the run rate is beneficial:

- For younger companies, using the run rate allows you to project sales numbers and profitability. As you start, it is helpful to project whether you meet your sales targets.

- Another instance is when a growth company’s metrics turn negative to positive. In most instances, early public companies lose money, but as they grow, they start to turn positive over time. Using run rates allows you to put those positive numbers in perspective.

- Suppose there is a fundamental change in the business; for example, if the company shifts its focus to cost-cutting and can grow its profits from $80,000 a year to $120,000. Then projecting the profitability from $320k to $480k a year is a better indicator.

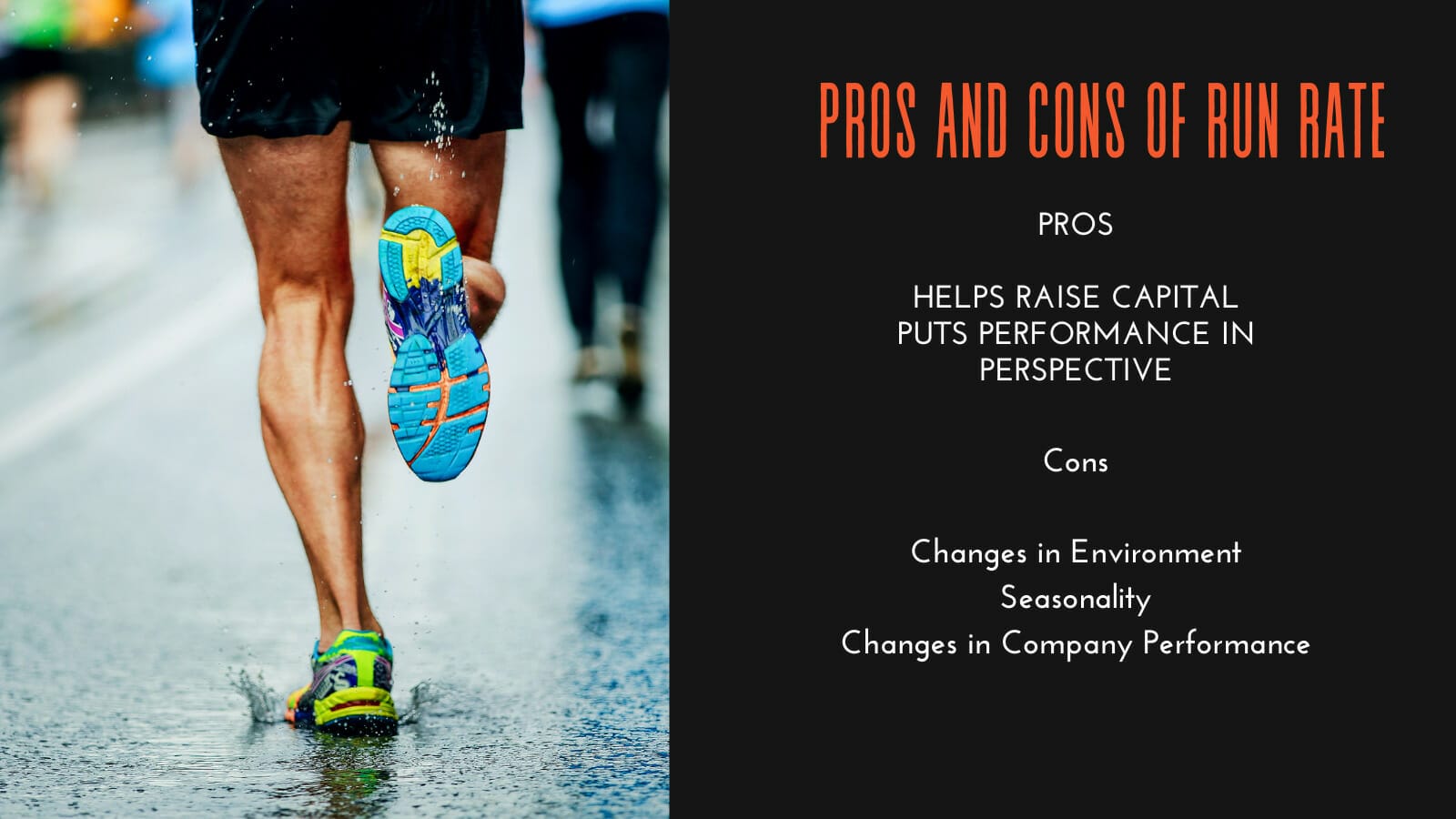

There are benefits and risks to using run rates; let’s look at those next.

Changes in the environment

Using run rates, especially revenue run rates, creates the critical and sometimes unrealistic expectation that nothing will change in the economic environment. It assumes that the conditions that created that revenue growth will continue forever.

Mr. and Mrs. Market are actual maniacs; assuming they will allow everything to continue as before is foolish. The modern markets are unpredictable and erratic, and decisions based on a run rate take a big risk.

Seasonality

Use of the run rates assumes nothing changes in the upcoming environment. And many businesses are seasonal or have seasonal variances.

As I mentioned in the beginning, the restaurant is quite seasonal, and depending on its location in the country has a large bearing on its seasonality. The holiday season for many restaurants is a huge boon for their business; early October thru Mother’s Day is their busiest time.

Therefore, projecting a revenue run rate for a business such as Darden based on the Olive Garden’s revenues during the fourth quarter or December will overestimate the year’s revenues.

Another great example is Target, Walmart, and Amazon during the holiday season. When it occurs in October now, that period from Black Friday to the New Year is a tremendous revenue driver for all three businesses. If we project the year’s revenues based on that period, we will overestimate by quite a lot.

Changes in company performance

As with seasonality, any company performance changes are not considered with run rates. For example, companies like Apple and Microsoft see revenue growth when they release new products like the iPhone and Xbox.

If we calculate a run rate using the quarter that Apple releases a new iPhone, we risk skewing our data and overstating the run rate.

Run Rate Examples from the Real World

Let’s look at some of the run rates for a few select companies to see how it might work within the context of the run rate timing.

For example, we can estimate revenue run rates based on seasonality or special situations.

First up, let’s look at Walmart (WMT).

Walmart outlines its quarterly results in its annual report in the notes section.

Let’s project the company’s revenues based on the second-quarter revenues and the fourth-quarter revenues for a comparison.

Walmart Run Rate | Q Revenues x 4 | Run Rate |

2nd Quarter Revenue | $128,028 x 4 | $512,112 |

4th Quarter Revenue | $138,793 x 4 | $555,172 |

I took all the above numbers from the 10-k for the year ending 2022.

First, the actual annual sales for Walmart at year’s end was $514,405 million. So, the second quarter projection was quite close to the actual output.

Next, if we look at the fourth quarter projection and analyze its relationship to the actual revenues, we see that the company would have 7.9% higher than the actual result.

That is a big number and an eight percent growth in one quarter, especially for a mammoth company like Walmart. And we can see how that would throw off our calculations if we assumed an eight percent increase for the year.

Okay, now let’s look at some revenue run rates for some of the newer businesses in the market.

Company | Quarter | Revenue x 4 | Run Rate | TTM |

Snowflake | Jan23 | $589 | $2,356 | $2,066 |

Uber | Dec22 | $8,607 | $43,428 | $31,877 |

Salesforce | Dec22 | $8,384 | $33,536 | $31,352 |

Dec22 | $76,048 | $304,192 | $282,836 | |

Amazon | Dec22 | $149,204 | $596,816 | $513,983 |

Meta | Dec22 | $32,165 | $128,660 | $116,609 |

Microsoft | Mar23 | $52,857 | $211,428 | $207,591 |

Looking at a chart like the above is an interesting exercise because we can see in the chart companies that are growing revenues beyond the last twelve months, at least on a projected basis.

For “growing” businesses like Snowflake, Uber, Salesforce, and Beyond Meat, the prime directive is that, except for Salesforce, the businesses have yet to profit.

Let’s look deeper at Uber to understand how much they need to grow their revenues to achieve profitability..

Uber’s gross profit margin for the quarter ending September 2020 was 48.42, and the quarterly revenue was $3,129. If we assume the company has fixed costs, and those don’t accelerate at the same rate as the revenues. Then we need a certain size revenue run rate to achieve profitability.

The biggest issue for Uber is overcoming its SG&A expenses; if those are normalized, the company can become profitable.

So the CAGR or annualized revenues for Uber currently is 38.5% over the last four years. If we increase the quarterly revenue by 38.5% and then calculate the run rate for it, we can see if that is enough to make it profitable.

Run rate = $3,129 x 38.5% + $3,129 x 4 = $17,334.66

Now, we can look at the total costs and expenses:

- Costs – $6,579

- Operating expenses – $11,360

- Total expenses – $17,939

Now, comparing the run rate for revenues and the expenses, we can see that we are coming up a bit short, but it is in the ballpark.

Now, several questions leap to mind. First, is 38.5% revenue growth reasonable to expect? Second, will the costs remain fixed or in a related state that is better controlled than revenue creation?

The answer is, I don’t know, and that is okay; we will not have every answer in the book. But the better question is whether we think those assumptions are reasonable.

In my mind, the revenue number is HUGE! But it is based on historical trends that the company has achieved. So that is in the realm of possibilities, but controlling costs and fixing is a far bigger gray area for Uber.

Investor Takeaway

Calculating run rates is a simple process, and it is a great exercise to see how on track the company is for any sales projections it offers.

Building models based on the run rates of the different line items is also a great practice for valuations and projections for profitability. Many growth investors focus on top-line growth, but having an overall picture is the best.

By utilizing a run rate on items such as expenses, you get a better sense of the company’s operations and the management’s control of those expenses and costs.

One of the bullish theses I have heard about Uber, for example, is once the company establishes its base, the fixed costs of its infrastructure or platform will stabilize, allowing for profitability to occur.

All of that is contingent on continued revenue growth because of the nature of Uber’s business as a tech company. The margin expectations rival Microsoft and Facebook, which are 25 to 35% net income margins.

Using run rates on any line item from the financials you choose is a great way to look at companies’ projections. Focusing on the different sections will help give you a better sense of the business’s interrelations.

With that, we will wrap up our discussion on run rates.

As always, thank you for taking the time to read today’s post, and I hope you find something of value in your investing journey.

If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- Simple Income Statement Structure Breakdown (by Each Component) Updated 8/7/2023 The income statement is the first of the big three financial documents that all public companies must file. But what do we know...

- Financial Shenanigans: 6 Ways to Analyze Financial Reports for Fraud Question for you? Do you think companies practice to deceive investors by practicing financial shenanigans or intentionally set up financial statements to deceive investors? Unfortunately,...

- Deferred Revenue: Debit or Credit and its Flow Through the Financials Basic accounting for public companies can get confusing with different terms that mean the same thing (like deferred and unearned revenue), vs opaque definitions (such...

- Capitalizing R&D Expenses: How to Do It and Its Effect on Valuation Updated 5/29/2023 Most valuation models begin with earnings to arrive at the cash flows, and when using this method, we assume that the earnings stem...