Facing reality when you are broke is the only way you will get out. Being broke can be temporary if you accept your situation and work really hard to break out of it.

As someone who waited tables for 3 years after graduating with a master’s degree, I’ve had to live broke for a while. It’s help me come up with some money saving tips along the way.

Note: This is a guest post collaboration from Frugal Kam. She’s got excellent tips on saving money and is an expert at living way below her means by keeping expenses low.

Whether you are just starting out in the real world, or have felt stuck and broke for a while, implementing any of these tips should save you money.

Be encouraged when you are able to save.

Then, find a way to break out of your current lifestyle by doing things differently.

Strive to also increase your income.

It might not always be fun to talk about the basics of finance, but we have to start there.

Stop the bleeding!

If you’re paying late fees on credit cards, or paying overdraft fees on your checking account, that needs to stop ASAP.

You will never get things fixed if you’re constantly bleeding out of every paycheck from preventable fees.

I know it can be hard depending on how broke you are, but you have to stop the cycle somehow.

Promise yourself you will stop the bleeding by using these tips. Then, stick to the plan. Once you’ve fixed this first step, getting out of being broke will be much easier and doable.

Now, how can we all save some money even when broke?

First, let’s start with the expenses we all deal with regularly, such as food. Getting a grip on these will make a noticeable difference in saving you money and really help you survive through it.

1– Buy groceries when they are on sale. Utilize manager specials

Most grocery stores will have promotional sales on items all the time. Items that are not selling well or just need to be cleared will be put on sale often.

Snatching these at the right time really adds up!

Staying flexible on when to buy certain foods really helps with getting the best deals at the grocery store.

If you are meal planning, try and let your dinner for that night be a flexible choice. You can buy meat that is on manager special and cook it that same day so it doesn’t spoil.

When comparing prices at the grocery store, use the “per oz” (or per unit) price. You can usually find it in the corner of a price sign.

Comparing by units will help to make sure you’re actually saving money on an item if buying it in bulk. Sometimes you won’t get any savings for buying in bulk and instead will just be spending more, so stay alert for that.

2– Meal plan before hitting the grocery store

Though you want to be flexible for promotional sales, also go in to the grocery store with a plan.

NEVER go grocery shopping when you’re hungry. That’s when your willpower will be the lowest!

You don’t want to spend money on junk food you don’t need or expensive food that suddenly looks so appetizing. So don’t go hungry!

Also, try meal planning. Plan your cooking based on what’s on sale by looking at the store’s website or app. A little preparation can go a long way, and it really adds up over time.

3– Use coupons (and easy rewards programs)!

I don’t really coupon clip, but you can still save money this way with different apps.

For example, I shop at a grocery chain called Food Lion. They have an app where you can activate coupons which are automatically applied at checkout. I just go in there and load all of them to my card, and when I make the purchase, I get easy savings.

Food Lion also has a nice reward program called Shop & Earn Rewards. With this, you get cash applied to your purchase when you reach a monthly level of spend on a category.

You might not want to intentionally spend more to get these rebates, but you could share the rewards program with someone else. With the help of a spouse or roommate, you can both earn rewards like these faster and more often.

4– Download free cash back apps

Just like you can use an app for coupons, you can also find cash back opportunities on an app called Ibotta. It works for groceries or household items.

Simply look at the different cash back offers on the app and add them to your account. Then purchase the items which were featured and upload your receipt to the app. You will get cash back for qualifying purchases within 24 hours.

It’s really that simple, and you can use the cash back for gift cards or as cash to your checking account. You can use my referral code “aqvwsww” to get $10 the first time you submit your receipt to Ibotta.

Another cash back app called Rakuten works on online shopping purchases.

Instead of buying your favorite clothes or electronics on stores’ websites, login to Rakuten first. Search the store inside of Rakuten, and click on the store. It will bring you to the store website and log your purchase. Any shopping cart which you finish inside of their platform will automatically give you cash back.

You can get up to $30 for signing up and making a purchase with my special link here: https://www.rakuten.com/r/KIMBER13247?eeid=44747

Saving on Living Expenses

5– Save on your electric bill

You might not realize that there are many ways to save on your electric bill, even small things which can make a big impact month after month. Here’s an example of some of the best (for the whole list click here):

- Save on heating with a heated vest or space heater

- Save on cooling by moving your TV to a cooler downstairs room

- Turn down the maximum temperature on your water heater

- Only do full loads for laundry and the dishwasher

6– Get a roommate

This suggestion might give an unpleasant gut reaction at first, but think about it. How much fun is it to live alone when you are broke, when getting a roommate could help you save enough money to get out of being broke?

It can be humbling to get a roommate, and maybe inconvenient, but guess what? Being broke is both of those things as well.

Think of your financial situation over the long run.

Be smart with who you pick as a roommate, but also be willing to live with the annoyances and inconveniences knowing that it’s temporary while you improve your living situation for the better.

Along these same lines, see about sharing streaming or cable bills with roommates or friends. As I write this, Netflix does allow multiple users on a single account, and is something to look into.

7– Pick a place to live that’s close to your job

With gas prices all over the place all across the country, it can be very helpful to your monthly budget if you can keep from putting gas in your car as much as you can.

If you find yourself looking for a new place soon, try seeing if the places close to your work are a similar price to your other alternatives.

You might even think about finding a comparable job closer to wherever you work now instead.

Think about how much you spend in gas to drive to work every week, and think about how much you could save by either living close to your work or getting a similar job close to where you live now. This can really add up, especially if gas prices go higher over time.

8– Take the bus when you can

If you’ve never taken the bus before, think about doing it now. It goes to that similar idea of considering the tradeoff of being inconvenienced versus saving money.

How much money you could save from taking the bus will really depend on the bus routes in your area and how far the bus can take you, and how expensive current gas prices are.

But if you do the planning, you may be surprised how much you can save, especially if it lets you get away with not having a car (which saves on insurance, gas, maintenance, and of course the car payment).

9– Get cash back on gas purchases

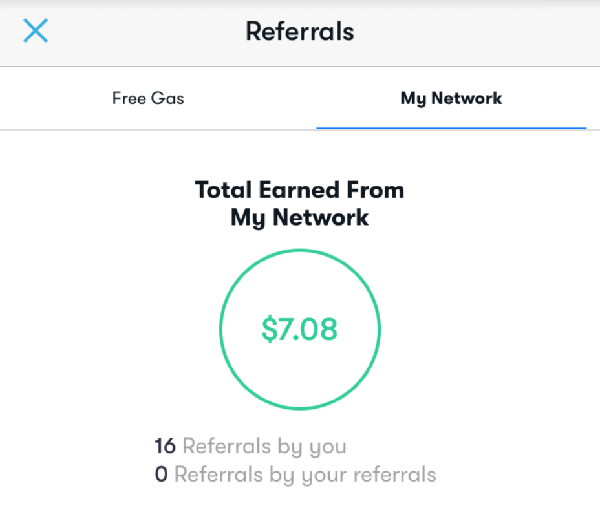

If you can’t get away from spending money on gas for your car, try using an app called Upside.

With this app you claim an offer on a gas station, fill up your tank, and then get cash back with every purchase!

How much you get back will depend on how much a gas station is offering at any time. Some days are more than others, but it’s definitely worth an extra couple minutes’ drive to earn $1, $2, or even $5 cash back on a purchase.

Like the other cash back apps, you can get the money in a gift card or transferred to your bank after reaching a certain threshold.

For a free (BONUS) 15 cents back per gallon on your first fill-up, use my invite code “Y5CHE”.

10– If you’re itching to get a pet, don’t!

Pets are notoriously expensive, and that’s even before factoring in any veterinarian bills as they get older and maybe need procedures.

Even regular check-ups at the vet can get pricey, and you’ll have expenses such as:

- Flea and tick prevention

- Pills for preventing heartworm

- Grooming bills

- Dental bills if you don’t brush their teeth (for dogs)

- Special foods if they develop an allergy (seriously!)

Instead of taking on a new responsibility, especially when you are broke, why not offer to pet sit for a friend?

Or, if your friends have unfriendly pets, make an account on Rover and pet sit for others and get paid to do it!

Saying no to a pet now doesn’t mean saying no forever, it just means “not right now” as you’re getting out of your situation.

Saving with Good Habits

Here’s some rapid fire tips, which can add up as they reduce or limit repeating purchases.

11. Make your own coffee (in a traditional coffee maker)

12. Drink water instead of juices, sodas, or alcohol

13. Re-wear jeans and sweaters so you don’t have to do laundry as much

14. Buy cheaper items instead of quality ones. Worry about making great long term purchases later, make due with what you can when you are broke.

15. Donate your hair for free haircuts (depending on the salon)

16. Paint your own nails and wear makeup minimally

17. Find free or cheap hobbies, like running or reading

18. Instead of going out to dinner, go on walks for girls’ nights (or dates). Similarly, have coffee instead of dinner or drinks.

Finally (and Maybe Most Importantly)…

Spend more time working and less time entertaining yourself. Getting out of being broke is hard work, but is so very worth it.

Don’t feel sorry for yourself just because your timeline is different than other people’s.

There are more broke people out there, living paycheck-to-paycheck, than you might think!

Focus on cutting your expenses as much as you can, and working as much as you can to earn enough money to pay off debt or improve your situation.

Use your time wisely!

Spend an afternoon every 1-2 weeks just applying for jobs and updating your resume. Follow-up at the places you apply to. Hiring managers can get swamped with resumes; showing initiative and following up can really work!

Even when it seems like you can’t get that better job that you want, just keep applying. It took me 3 years until I got that first stepping stone job that helped me launch a career.

Whether starting brand new or getting a late start on a career, it pays to be persistent. Don’t give up, and don’t accept failure as permanent.

Keep working on these tips, and keep trying for better. You can do it!

And you will thank yourself later.

Updated: 11/04/2022

Related posts:

- 11 Grocery List Items You Can Buy Online to Save $100s on your Budget Do you know if you’re being overcharged at the grocery store? With the advent of online shopping, there are things you probably buy at the...

- Helpful Tips and Habits for When You Are Broke Every single person has a different philosophy when it comes to saving or spending money. Some people are penny pinchers and can save a ton...

- Saving on Gas for Your Car is Easy with These 2 Simple Tips! With gas prices and inflation starting to get out of control in 2022, we could all use some simple tips for saving on gas with...

- Figuring Out the Right Amount to Spend on Groceries Each Month Are you trying to figure out where all your money is going each month? Is one of your biggest spending categories at the grocery store?...