Welcome back to the second of the most anticipated series of all time, HANDY ANDY’S LESSONS! In the first episode of Handy Andy’s Lessons, we talked about starting a dividend portfolio, but now we’re here with a personal finance subject – how to save money WITH credit cards!

Click to jump to a section:

I know it might seem completely backwards that I am saying that you can make money with credit cards, but it’s not. Obviously, credit cards are very dangerous just in general. But they don’t have to be if you focus on fitting them into your personal finances.

I struggled with if I even wanted to write this. The last thing I want to do is have someone who isn’t disciplined go out and get a credit card. But the lessons are too great for me not to share.

So please, make sure that you’re very responsible with your money. Don’t just open up a card and get yourself in debt.

Just because you charge a little piece of plastic doesn’t mean it’s free. You still owe that money and must account for it in your budget. Treat it just the same as cash or a debit card.

If you’re going, “Budget? I don’t have a budget,” you need to stop immediately and get the Doctor Budget tool. It will pay for itself a hundred times over, guaranteed.

I can tell you for a fact that you can use credit cards to your advantage in two major ways to save money, so why delay anymore?

Balance Transfers

You might’ve heard about these before but never understood how they work. Let’s break it down.

Essentially, a balance transfer is when a credit card company says, “Hey Andy, you still have some room on this credit card. Do you want us to loan you some money while you go buy those awesome things you’ve been wanting?”

And then I go, “Sure, credit card company, I’ll take your loan. But instead of buying new things, I am going to pay off my debt!”

So why does this actually work?

I have found that the best time to do this is when your credit card company is running a promotion for 0% APR on balance transfers. I know they do this because I did it in my personal finance journey.

When my wife and I were getting married, we had some wedding debt on a credit card, and we were offered a chance to transfer it all over for 0% interest for 12 months. Of course, the credit card company wanted to make some money, so we were required to pay a 3% fee off the top, but that was it for twelve months, compared to the current situation where we were paying 22%.

Now, I don’t exactly remember the details, but I am going to use some round numbers to show the math and how this can really work out in your favor:

- Current Situation

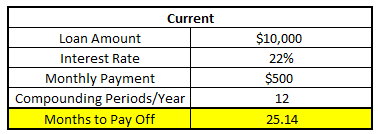

- You have $10,000 on a credit card

- Interest Rate is 22%

- You can afford payments of $500/month

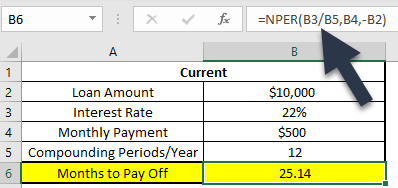

In this current situation, you can see from the screenshot below that it would take you just over 25 months to pay off this debt:

Before I get into the situation of the balance transfer, I want to say that Excel is an awesome tool. If you don’t know how to use it very well, check out some YouTube videos on Excel to try to learn. The types of things you can do are endless, which will make your life easier – guaranteed.

Ok, sorry, I just geek out about Excel.

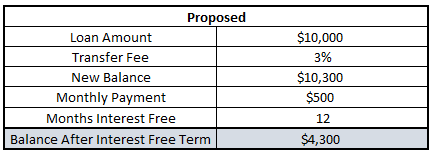

So, in the balance transfer scenario, there are really two different periods of time. The first period is where you’re going to pay for the 3% transfer fee, which is $300 on a $10,000 balance, and then have no interest for a year. This time period is shown below, also in Excel.

As you can see, your balance will spike, but then it will drastically decrease at a very rapid rate because you’re not paying interest that entire year, so 100% of your $500 monthly payment is going to the principal – that’s pretty dang good.

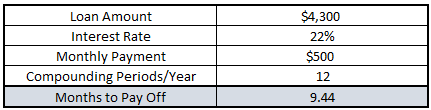

The second time period is where you’re going to pay interest again (assuming 22%) until the balance is paid off, shown below:

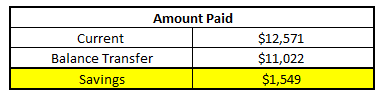

So, you can likely see the difference. The first example took 25.14 months, and the second example only took 21.44 months…that’s a big saving! But how big?

You paid well over $1,500 in additional fees without a balance transfer! All because of continuing to pay an interest rate instead of pausing it.

And before you ask – yes, I included the $300 transfer fee in the Balance Transfer option, which was still much better than the alternative.

Calculate Debt Repayment Period

As with investing, we always talk about the importance of doing the research yourself and making sure that you really understand exactly what is going on. You see, personal finance is just that – personal. If you don’t know the numbers then it’s on you, and only you, and maybe your unlucky family.

It’s imperative to know what you’re getting yourself into and also know your limitations. As I started this article, this isn’t very complex by any means, but if you’re not super focused and dedicated to get out of debt then this might simply just open up one more way for you to max out another credit card and make things way worse than they were initially.

But if you are focused and motivated, you can do this as often as the credit card company will keep giving you promotions to do so. Earlier this week, I looked to see if I had a promotion to do this, and I didn’t. I guess I taught them a lesson that I’m actually a responsible credit card user. SORRY!

But as I said, if you don’t know how to do the math yourself, you’ll never really be able to take control of your finances and grab the bull by the horns.

So, before we go too much further, I want to teach you how to do this formula to calculate this yourself. Normally I would provide a calculator, but I want to teach a man to fish today!

All that you need to know are 4 pieces of information – the outstanding balance, the interest rate, your monthly payment and then the frequency of compounding (it’s almost always once/month, so this would mean 12). Then you simply use the NPER function, or Number of Periods, and look at my formula below:

I take the function and then do this:

(Interest Rate/Compounding Periods per Year, Monthly Payment, – Loan Amount).

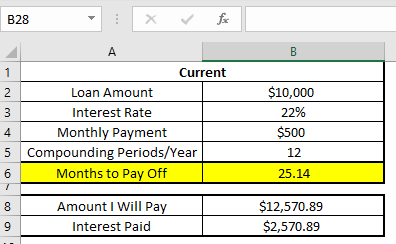

You need to do the negative loan amount because it’s a debt! Then, the rest will calculate on its own. If you want to take it one step further, take the Months to Pay Off and multiply it by the Monthly Payment to see what you will have to pay:

By adding that very simple step and then taking the difference between the Amount I Will Pay and the Balance of $10,000, I can see that I will pay $2,570.89 in interest. Then I can play around with the Monthly Payment to see how things change!

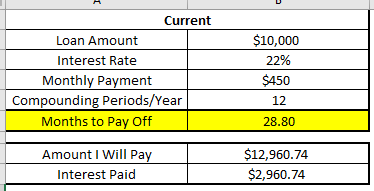

Dropping by $50 to $450/month is going to cost me nearly $3K in interest, or about $400 more! Ouch!

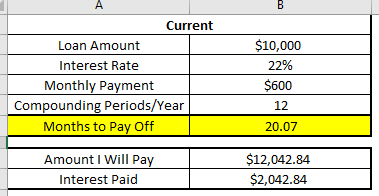

On the contrary, if I were to increase my payments by $100 up to $600/month, I would pay the loan off nearly 5 months faster!

Not only do I save the $400 or so in interest, but now I can take that extra 5 months of no credit card payment and apply it to something else. Maybe something like finding some Dividend Aristocrats of the Future.

This is the mindset that I hope you have, or challenge yourself to have, to get ahead on your personal finance journey. These are the types of thought processes that will set you up for amazing success.

Ok, we’re finally off to #2, believe it or not!

Credit Card Rewards

I know, I know – this likely seems obvious. Of course, we get rewards on our credit cards, and of course, we should use a card that gives us the best rewards possible, but this is more than that.

What do you do when you get your rewards? Do you just blow them on something stupid or do you actually put them to use?

I have three strategies that I like to use with my credit card rewards, in reverse order:

3 – Hold onto them as a savings account for vacation

I know that cash is king, so keeping money out here isn’t the best use of funds. But I also get this weird feeling about having this little safety net. It’s not my money, so seeing it stack up and then using it feels really good. It’s like a reward for paying off my card in time.

Of course, one or two missed payments can wipe out a year of rewards, so never open a credit card just for the rewards. We aren’t playing around with fake money.

Imagine there’s a household where both family members make $50K/year after taxes. They have an awesome savings rate (just keep it out of a savings account!) of 50%. This means they spend $50K/year. Let’s also assume that half of that is fixed and the other half is a variable expense meaning it changes from month to month. That means they have $25K on annual expenses that might go on a credit card.

I know some cards will offer up to 2% cash back, meaning $500 in free money on rewards! Yeah, that won’t get you a vacation, but that might be a plane ticket, a trip to a resort, an extra night or two at a hotel, or that extra fancy dinner and show. It’s free money that can take your trip over the top!

2 – Use it for Christmas Presents

I always did this in college because this was the only way I could afford them, honestly. By saving this money until the end of the year, I would buy my Christmas presents like normal. Then use the cash back, therefore covering my Christmas spending.

Honestly, since I usually got cash and gift cards for Christmas, it was almost like a double win.

All it was was a little planning and focus to not touch that money. I knew that if I touched that money, it would mean that come December, I likely would be struggling a lot. I knew I would have to pick between going out with my friends when I was back home or buying my family Christmas gifts. That wasn’t a choice I wanted to make, so I planned for it.

Simple concept, really.

1 – Look for promos!

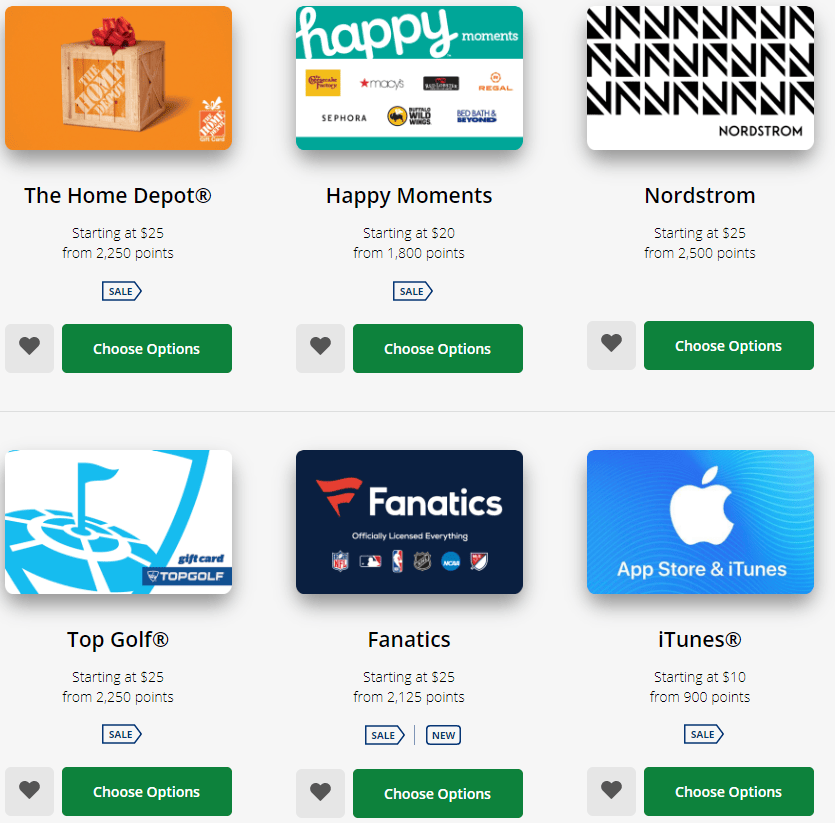

Find something you will spend normally, and then look for a promo. For instance, Chase frequently offers discounted gift cards on their website.

Last year, I needed to buy a lawn mower because we had just moved from an apartment in Chicago to a house in Ohio. I was going to get it at Lowe’s, so I waited until it was on sale. I then used a 10% off coupon that I bought from Amazon and used the gift cards that I earned with my rewards.

So, a $400 mower turned into this:

- On sale for $350

- 10% off coupon from Amazon that cost me $2 or so

- Used $300 of Cash Back Rewards that I got for 10% off, so it only cost me $270 in rewards

So, again, by planning I saved $50 on the sale, $35 with my coupon and then I saved another $30 by using the on-sale gift cards, and even those are debatably free money! It was quite the win.

The points with Chase are 100 points = $1, so you can see the on-sale items below:

They’re all 10% off or so, but simply by me looking at these first, I can take even more advantage than I might be able to normally, and these are just very few sales amounts!

Have you noticed that planning is really the key takeaway here? That’s all it is. Personal finance is nothing more than planning; if you fail to plan, you plan to fail.

Don’t be that person.

Related posts:

- A Deeper Look at all of the Credit Card Pros and Cons that Exist We now live in a world where most people solely use credit cards, cash is a blast from the past. Check out these credit card...

- Credit Cards? Pshh. Let’s Break Down the Debit Card Advantages and Disadvantages In the personal finance community, there are many varying opinions on all topics imaginable. And as you might anticipate, some of them can get pretty...

- Understanding all the Visa Perks on Different Credit Card Options With so many different credit card options available, it’s important to weigh all the possibilities. Check out the Visa perks on these different cards and...

- 5 Disadvantages of Credit Cards to Be Aware Of Prior to Opening One! “Wait – Andy, are you telling me that there actually are disadvantages of credit cards?” Yes, I certainly am. I know that sounds facetious, and...