Updated 2/7/2024

One of the best ways to track how management feels about their company is to watch for insider buying or selling. Form 4 can help you determine any trades leadership makes regarding stock options.

With the increase of pay for insiders (C-suite) in the way of stock options, tracking their moves can give you great insight into what insiders think about the strengths or weaknesses of the company.

A note of warning: not all insider buying or selling is a result of some move taken by leadership; it might also be that the manager needs to use a large amount of cash to buy a home or pay for school for one of their kids.

Using Form 4 is not difficult once you know where to find them and how they read the report. Unlike the 10-k, 10-q, or 8-k, Form 4 remains not as well known but can provide valuable insights once you know where to look.

In today’s post, we will discuss:

- What is an SEC Form 4

- What Triggers a Form 4 Filing?

- What Does Code M Mean on Form 4?

- What Can We Learn from a Form 4 Filing?

- Where To Track Form 4 Transactions?

Ok, let’s dive in.

What is the SEC Form 4?

From Investopedia:

“SEC Form 4: Statement of Changes in Beneficial Ownership ” must be filed with the Securities and Exchange Commission (SEC) whenever there is a material change in the holdings of company insiders. Insiders consist of directors and officers of the company and any shareholders owning 10% or more of the co`mpany’s outstanding stock. The forms ask about the reporting person’s relationship to the company and purchases and sales of such equity securities.

The filing of Form 4 relates to Sections 16(a) and 23(a) of the Securities Exchange Act of 1934, as well as Sections 30(h) and 38 of the Investment Company Act of 1940. Disclosure of information required on Form 4 is mandatory and becomes public record upon filing.”

All that tells us is that whenever the CEO, CFO, or any other manager that owns more than 10% of the company’s stock buys or sells any of their shares, they must report on Form 4.

The buying or selling of the shares is often called insider buying or selling. Insider buying or selling remains a big deal as insiders understand the internal goings-on inside the company. They may have information allowing them to use it for their profit.

Recently, in Congress, there has been an investigation into insider selling of stock before the Coronavirus outbreak. Some committee members may have had details allowing them to profit unfairly compared to those of us without the knowledge.

The SEC created Form 4 during the Great Depression to offer some safeguards against insiders of companies from unfairly profiting from the knowledge they possess.

It is such a big deal that criminal fines and penalties could result from failing to report such transactions, as evidenced by the congress members’ scrutiny.

So, what triggers the Form 4 filing? Let’s look at that in the next section.

What Triggers a Form 4 Filing?

Form 4 is a two-page report covering any buy or sell orders insiders place on the open market and any exercising of stock options we mentioned earlier.

Any individual or company must file a Form 4s when a change in holdings of company insiders occurs, i.e., CEO, CFO, COO, and so on.

The filing is related to Forms 3 and 5, which cover insider changes to any company holdings.

The SEC can use these documents, including Form 4, to refer to other government agencies. If investors don’t file within two days of the transactions, an assessment of criminal charges or fines could result.

The SEC uses Form 4 in any investigations or litigations involving federal securities laws.

Individuals or companies file a Form 4 on the SEC.gov website using the EDGAR system that we know and love from our studies of financial reports, such as the 10-k. I won’t go into the nitty-gritty of filing a Form 4; reading the form and understanding its meaning is more important for our purposes.

Let’s move on to Form 4 and discover what it can teach us.

What Does Code M Mean on Form 4?

Now that we understand what Form 4 is and how it works let’s explore the form itself.

The first question is, where do we find Form 4?

Good news! It is the same place you find the annual and quarterly reports on the EDGAR website through the SEC. Instead of looking for a 10-k, you type in a “4” and then hit search, and voila! One note: you do need to change the radial dial in the middle of the page to include ownership, and then Form 4 will pop up.

Now that we know where to find our form, let’s look a little closer at some of the more important sections of Form 4.

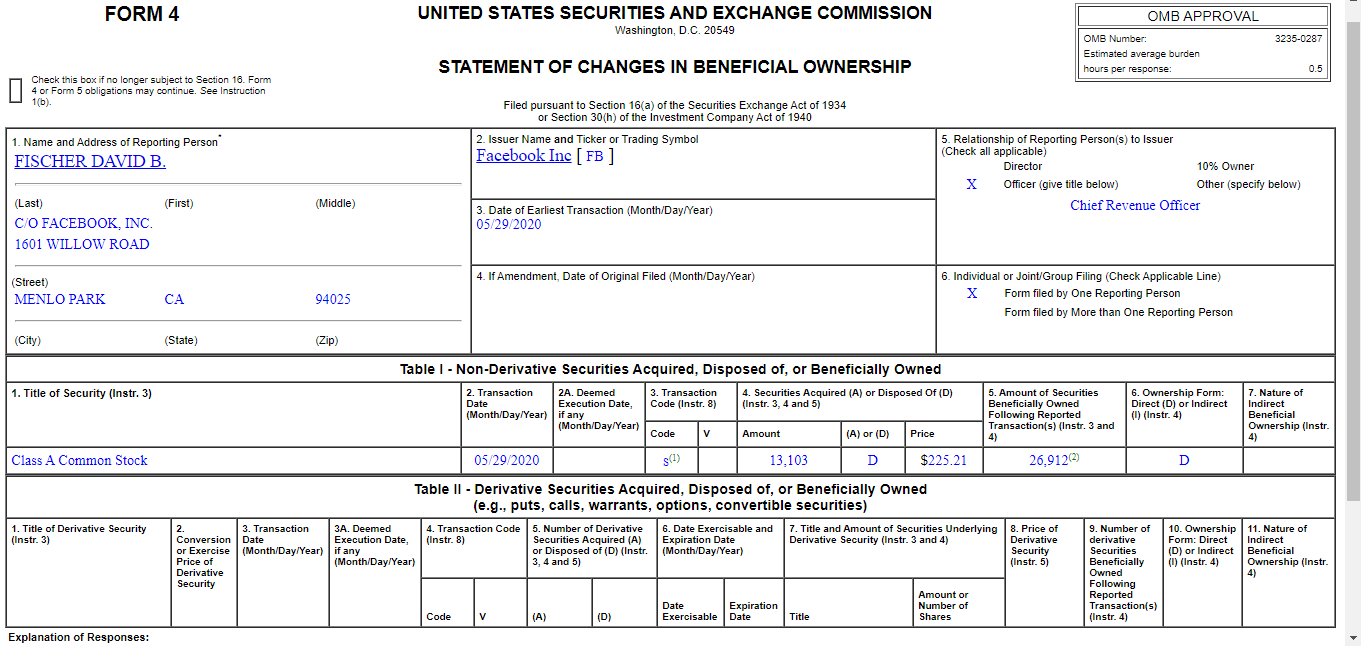

- Section 1 – Name of the owner of the shares

- Section 2 – Company name and ticker symbol

- Section 3 – Date of transaction

- Section 5 – Relationship of the Owner to the Company

- Table 1

- Title of security, i.e., common stock

- Transaction Date

- Transaction Code – more on this in a moment

- Amount of shares purchased or sold

- A or D – means acquired or disposed

- The price paid for the transaction of shares

Ok, let’s break those down a little.

The name and date of the transaction are straightforward. One thing to note is the position held by the person buying or selling the shares. Seeing the CFO buying shares constantly could mean he believes in the company’s financial strength.

The most important section of Form 4 is the table that outlines the buying or selling of the stocks.

In the table, you can see what kind of stocks he transacts. For example, you might see common stock, convertible preferred, and employee stock options. The above are the most common ones you will see, but there can be up to 10,000 types of equities! Don’t worry; the bulk you will encounter will be common stock, employee stock options, and preferred.

You will also notice that it lists the number of shares bought or sold and the dollar amounts of these trades. They are listed as acquired or disposed of, which translates to buy or sell.

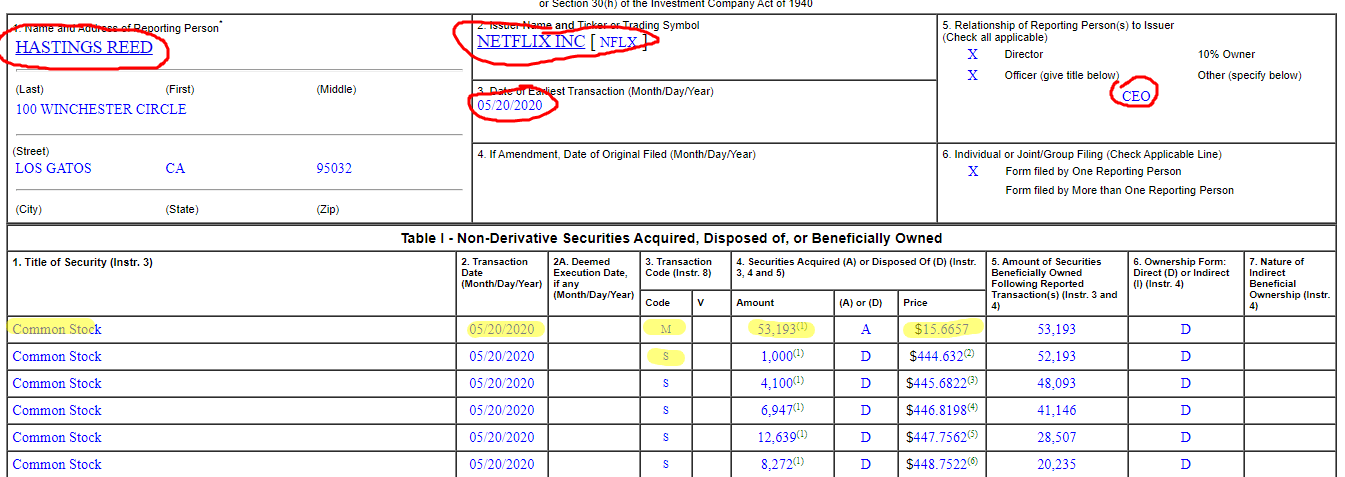

The last item we need to clarify is the transaction code. You see two codes listed on Form 4 from Netflix for Reed Hastings, M and S.

Every Form 4 file contains filed transactions, and the form uses transaction codes to help describe the action taking place.

Remembering that P stands for purchase and S stands for sale is a good starting point for understanding the transaction codes and deciphering insider trading. These are the most common codes you will encounter.

Another code you will encounter is code M, which stands for the exercise or conversion of derivative securities. If that subject interests you, please click the link below for more details on the derivative securities transaction codes.

Derivative Security Transaction Codes

Looking closer at Form 4 from Netflix, we can see that Reed Hastings sold shares of his stock during the time listed on the form other than exercising the derivatives.

What can we derive from that? That is a subject we will tackle next.

What Can We Learn From Reading a Form 4?

The legendary investor Peter Lynch of Fidelity Investments once said, “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.”

Peter Lynch was a staunch believer in fundamental analysis and understanding the company and what it makes and sells before buying. He felt that as a group, who knows a company’s product, management, and prospects better than the company’s leaders?

Investors can benefit legally from insider knowledge by following public databases that track insider buying or selling.

One of the focus points on my stock checklist is studying management, and Warren Buffett discusses his thoughts on management multiple times throughout his Letters to Shareholders.

And what better way to evaluate management than studying their actions regarding their ownership of the company they work for?

Many investors regard tracking insider trading as integral to their company analysis.

Why Is This Important?

Why is buying or selling their shares a big deal?

Generally, insider buying illustrates management’s confidence in their company. Many consider insider buying a bullish sign or a sign that the company’s price will rise in the short term.

Conversely, selling is considered a more bearish sign that management offloads its shares before the company’s price falls.

Studies have shown that being on top of insider transactions represents profitable investments, as insiders tend to beat the market, as expected.

The studies have shown that the odds in favor of more insider buying following more insider buying remain three times greater than the odds of a purchase followed by a sale.

There are some general rules to follow when tracking insider trading:

- Insider buying continues to be far more significant than insider selling. As I mentioned earlier, insider selling could indicate the need for cash for larger purchases such as real estate, college education funding, paying taxes, etc. We could only consider this a red flag if the management team sells large shares.

- Who’s buying the shares? Most of us would assume that following the chairman, chief financial officer, and vice president is a no-brainer that corresponds to the right answer. However, don’t ignore transactions occurring farther down the food chain. Managers closer to the company’s operations buying shares equals a great vote of confidence.

- Pay attention to the size of the purchase relative to the total holdings; those purchases speak volumes about the confidence in the company. When a CEO buys 250,000 shares when he already owns 500,000, that equals a very bullish signal; if you see a lower-level manager who owns 5000 shares triple his ownership to 15,000 shares, that equates to incredibly bullish.

The following examples illustrate general fundamentals you should follow when tracking insider buying. The behavior of insiders will speak volumes about the trust in the company, and there remains no better way to observe the behavior of your company’s leadership team than their stock ownership behaviors.

Fundamentals of Tracking Insider Buying:

- The size of the trade is important. The dollar value of a buyer equals emphasis. If Bill Gates buys a few shares, it’s not that big of a deal, but if the regional vice president spends a year purchasing shares, pay attention!

- The type of dealing is important; buying exemplifies far more impact than selling shares. The sales of shares indicate a cash flow issue for the seller; they need cash for a large purchase, and liquidating their shares remains easier than taking out a loan.

- Pay attention to the number of insiders buying or selling; the best scenario involves two or more insiders buying shares in a compressed period.

- The price paid for the transaction is important, as you would expect that insiders would buy when the price was low and sell when the price was high. Pay attention to when the transactions occurred and the selling price; if the price significantly differs from the current price, wait for more insider buying to confirm the behavior.

- Insiders tend to be early in their transactions, especially when buying shares.

Okay, now that we know how to read Form 4 and have some general rules for tracking transactions, where do we find the data to follow these transactions?

Where To Track Form 4 Transactions?

Several websites offer the ability to track the insider activity of any company they are following:

All the above sites provide free access to search for companies and their insider activity.

Another opportunity to track any financial forms filed by your company is to sign up for RSS alerts on the SEC.gov website. A radial dial allows you to sign up for alerts to your feed for any company you follow. As a side note, this is a great way to be aware of when your company files a 10-k, 10-q, or 8-k.

Final Thoughts

The Form 4 is a straightforward filing that allows the average investor to get insight into the stock transactions of the management of any public company that they are following.

Using the form to your advantage to find companies that management has enough confidence to invest their money back into the company is an extremely bullish signal.

A whole sector of the investment community tracks these transactions closely, which is a major factor in their analysis of companies.

When I am considering buying a company, one of the checkboxes on my list is to see if any insiders are buying or selling shares. Assessing management is difficult, especially without direct access. Using Form 4 gives a little insight into what management thinks about the company’s prospects.

That is going to wrap up our discussion on Form 4 today.

Thank you for reading this post. I hope you find value in it to use on your investing journey.

If I can further assist, please don’t hesitate to reach out.

Until next time.

Take care and stay safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Insider Ownership Legalese Made Simple: How to Investigate It Yourself Depending on the public company, the insider ownership situation can be simple or very complex. Publicly traded corporations can divvy up ownership through 1 class,...

- Related Party Transactions Explained With Simple Examples (and in 10-k’s) Corporate structures for public corporations can get confusing, between the various affiliates and subsidiaries that a company might hold. Then throw ownership stakes into the...

- How Schedule 13d Filings Can Help Investors Find Undervalued Stock Ideas There are two main stock market strategies where reading schedule 13D filings is essential to success: portfolio cloning and deep value investing. In this post...

- What is a Form 8-K? The Beginner Investor’s Guide Have you ever seen a form 8-K? Chances are, the answer is no, unless you have been investing for a little while and paying close...