One of my favorite places to get investing information has always been Seeking Alpha, but I feel like more and more nowadays, people just are so focused on getting clicks that the actual quality of the information that is shared drops rapidly by the day! I’m not saying Seeking Alpha is sacrificing quality, and quite honestly, I’m really saying the exact opposite, because there are two Seeking Alpha authors that I really, really trust!

I can’t speak for you, but COVID has been making me feel “some type of way” as the kids say. It’s got me stressed, anxious, and generally looking for excitement in new ways since sports essentially hadn’t existed until recently and I can’t go do anything – and all these feelings have been making me a less disciplined investor.

In weird times like this, I try to focus even more on the basics and go back to the sources of information that I trust the most, and the two authors from Seeking Alpha that I trust the most are two that you are also super familiar with – Andrew Sather and Dave Ahern!

You likely know Andrew and Dave from the Investing for Beginners podcast, the Investing for Beginners blog, or maybe you’ve used some of their products like the VTI, the Sather Research Letter, or even the BRAND NEW Fat Pitch Fundamentals, but there’s a reason you keep coming back – they’re knowledgeable, aren’t going to feed you BS, and will give you the truth.

It’s that simple!

You see it on the podcast frequently – they will challenge each other and sometimes just disagree, and that’s good! I love the differing opinions and their areas of expertise and you see it translate into their articles on Seeking Alpha.

Usually once a week or so I will search both of their names and look at some of the recent articles that have been put out. Andrew has a really great understanding of some of the tech companies from his different work experiences and education.

Two of his very popular articles are on tech companies as you might imagine, Amazon and Cisco.

Now, the unfortunate thing about Seeking Alpha is that you have to pay $240/year or $30/month, but I actually think that can be perceived as a good thing.

When I was living in Chicago, we had to pay $10/month to park on the street based off the zone that we lived in. At first, I thought this was super annoying, but what it did was keep people that didn’t live in that zone from parking there overnight.

In other words, paying $10/month protected the parking spots in our neighborhood which were definitely a hot commodity.

I think Seeking Alpha is the same way. By paying monthly, Seeking Alpha can then retain the top talent and keep getting great articles that have trustworthy, unbiased information, and that’s exactly what Andrew and Dave provide.

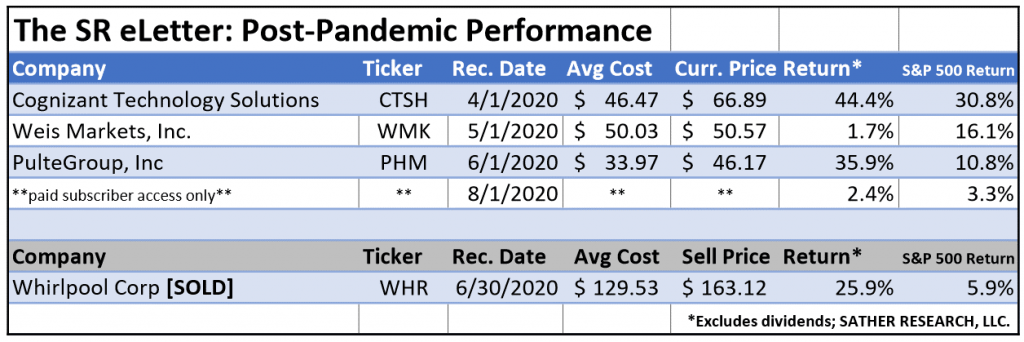

Andrew doesn’t normally talk specifics on his real money portfolio, as it’s for paid subscribers, but he did so simply to show some of the value of staying a rational investor in this weird, weird world.

His performance has been absolutely insane and it’s something that you need to really think about!

Of the 5 companies, 4 have returned 25.9% or better, all freaking crushing the S&P 500:

And what I really love is that these are not the big tech type companies that you might think would give you these returns. Andrew is sticking to his roots of finding value companies that are undervalued vs. their intrinsic value and investing with a margin of safety.

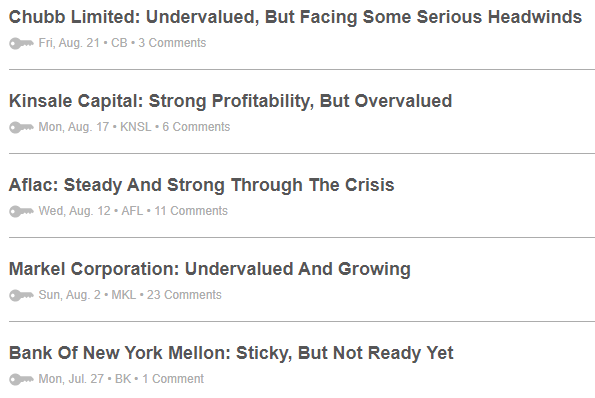

Like Andrew, Dave also has his own area of expertise – the banking sector. Dave has worked in that sector before and it’s evident when you hear him talk about the companies and how he comes to his valuations on the businesses. A lot of his articles are “locked” for paid subscribers, but you also can view these for a free trial period before making the decision to pay as I mentioned previously.

One of my favorite articles that Dave wrote talked about Owner Earnings, which is one of Warren Buffett’s favorite formulas. He does a really good job by breaking it down into a way that’s so easy to understand that even a beginner can comprehend it.

He did the exact same thing with an example of the dividend discount model and specifically wrote it for beginners.

If you don’t know what that model is or are feeling stressed simply by the name – don’t be. He really breaks it down into a simple way to comprehend with many examples of how to actually implement it in your investing journey.

You can see below on some of the topics that Dave has written about and if any spark your eye, go out and get the free trial and read them!

I also love that when you search for an author, you can filter on their articles based off the stock ticker that they’re writing on:

MSFT sound familiar? That was the first stock that Dave ever bought. Yeah, you could say he made the right move on that one!

The thing that I really like with Dave is that he ACTIVELY tries to grow his circle of competence as he talked about in the podcast.

It’s easy for us all to invest in what we know, but it’s just as important if not more to push ourselves outside of that comfort zone to try to learn about new companies and sectors.

If we don’t do that, we’re going to miss out on a ton of great opportunities simply because we didn’t even know they were opportunities.

At the end of the day, this is why I recommend Seeking Alpha as one of my Passive Research methods of finding great new companies. There are great authors there, with Andrew and Dave being #1 and #1 in my opinion (but the others are good, too), and you can really get some great, unbiased information that will truly help you in your investing journey.

Related posts:

- Top Investment Publications for Serious Stock Pickers (It’s a Short List!) If you listened to Episode 154 of the Investing for Beginners Podcast and you’re anything like me, some of the things that Andrew and Dave...

- The Top Stock Analysis Tools for the Average Investor in 2019 In one of the recent Investing for Beginners Podcast episodes (Episode 117), Andrew and Dave breakdown some extremely useful Stock Analysis Tools that they have...

- How to Find Investment Ideas with Free Stock Screeners and Websites Today I will show you some easy ways to find great investment ideas. These ideas will help you grow your wealth; best of all, they...

- 3 Simple Steps to Use Stock Market Analysis Tools to Find Great Companies The most common question that I get from new investors is “how do I find stocks to invest in?” Unfortunately, that’s not a simple question...