When it comes to the sale and purchase of different securities, there really are two sides – sell side and buy side. The sell side really is something that I think is imperative for an investor to understand because it’s effectively what we’re doing when adding new positions to our portfolio. So, the question is – are you conducting your personal sell side research the way an analyst would?

If you’re overwhelmed just thinking of the term “sell side research” don’t be alarmed. I total get it.

One thing that I have learned in my investing journey is that things are almost never as complicated as they sound. In the grand scheme of things, I have only been investing for a few years and am what many might consider a “newbie”, if that word is even still cool to use…?

Or maybe it never was cool. Whatev.

Essentially what is happening is that there are two sides of the coin:

Investopedia defines them as the following:

Sell Side – The sell-side refers to the part of the financial industry that is involved in the creation, promotion, and sale of stocks, bonds, foreign exchange, and other financial instruments.

Buy Side – These include insurance firms, mutual funds, hedge funds, and pension funds, that buy securities for their own accounts or for investors with the goal of generating a return.

In simple terms, the sell side is made up of banks or advisors that are then selling the equities to the buy side, which is typically investors, hedge funds, etc.

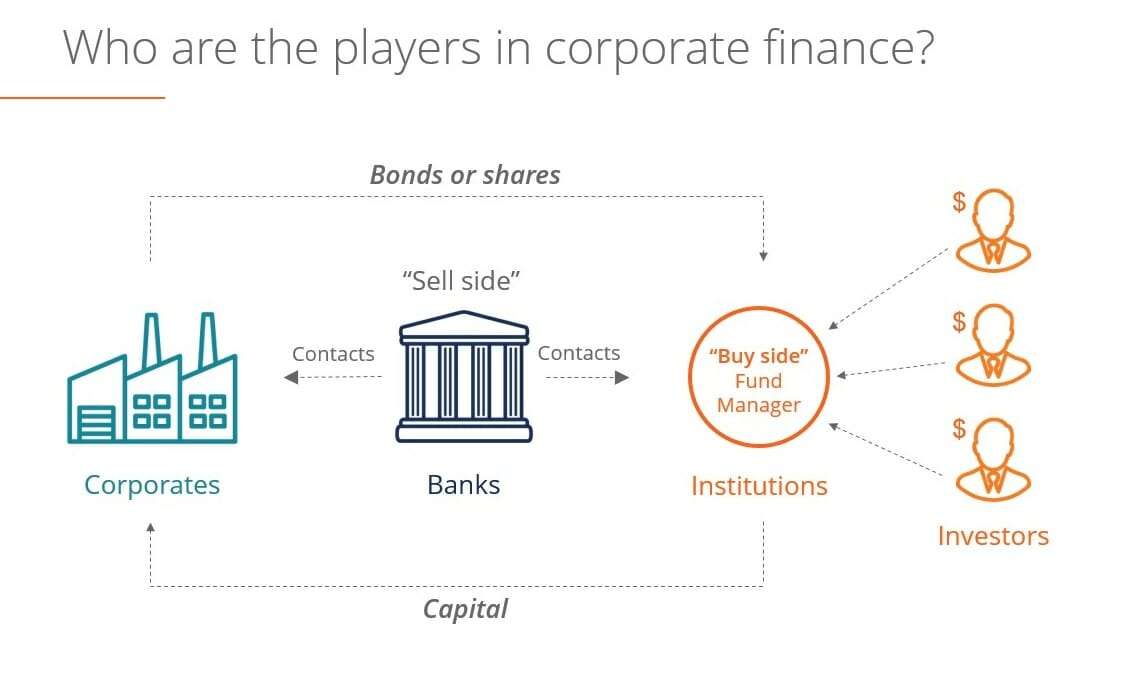

The Corporate Finance Institute created this chart to help show the differences a little more clearly:

As you can see, the sell-side is really the group that is in the middle that is then providing a service and pairing up with corporations and institutions to sell those stocks to companies.

The institutions then are those on the buy-side as they’re pairing their investors with the equities that they have from the sell-side.

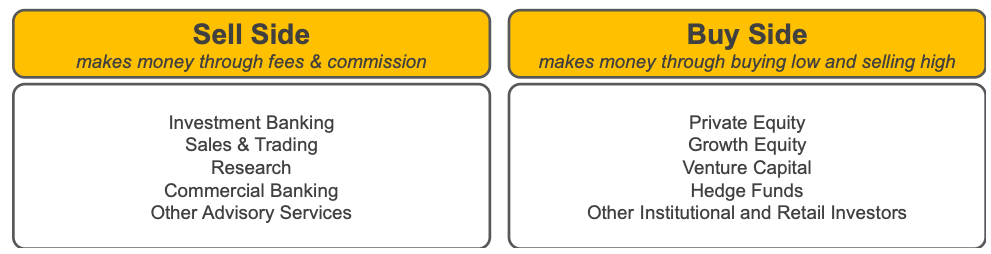

Take a look at this chart from Wall Street Wannabe:

The thing that I really love about the comparison is the part that’s colored that talks about how they make money based on the different side that is taking place. The buy side makes money exactly how you might think – you’re looking to buy equities that are undervalued and then appreciate in value, therefore giving you an opportunity to sell (or hold forever).

On the other hand, you have the sell side that is making money through fees and commissions. As I mentioned, they’re selling a service to the institutions and investors. They want you to invest because that creates demand, further driving up the share price and theoretically proving their outlook to be correct.

I’m not going to say it’s untruthful or misleading because it’s definitely not, but you just might be getting a little bit of a biased perspective of the outlook of the company rather than a true, unbiased opinion.

An example the buy side would be if a hedge fund was going to add a new position to their portfolio, such as ARKK, a very popular ETF that I just wrote about.

If Cathie Wood wanted to add a new position that was fresh off an IPO or SPAC, then she would work with the sell-side to acquire shares of that company to become part of their ARKK stock holdings.

Then, she would continue to sell her ETF to the public, providing them the ability to get into this new stock as part of the ETF offering that they have,

Typically, the sell side research aspect of investing is primarily made up of investment banks and firms that are performing research on various companies.

Their job is to follow certain companies, typically all within the same industry, and then they will slap a rating on the company that typically says buy, sell, hold, etc., along with a price target for what they think the stock will be priced at in the future, usually 12 months from then.

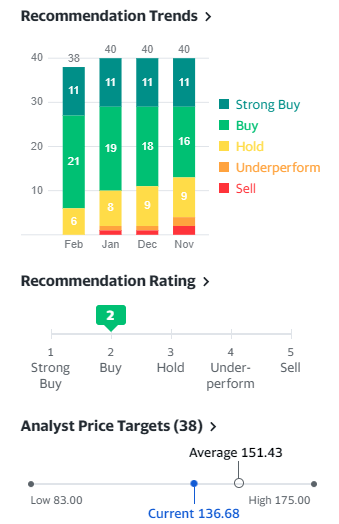

In general, the more popular the company is, the more sell side analysts are going to be reporting on that company. For instance, let’s take a look at Apple on Yahoo Finance.

When you go to the Apple (AAPL) ticker on Yahoo Finance you can see that there are currently 38 different analysts with price targets on the company:

11 of those have AAPL as a strong buy, 21 as a buy, and 6 as a hold.

“Andy, why aren’t any of them showing an underperform or sell?”

Well, it could be one of a few reasons, but the two most likely are:

- Apple is the best company ever, duh, so nobody should ever sell, especially with their rapidly growing dividend

- Sell side analysts have a job, and that job is to sell these companies to institutions and investors. It’s going to take A LOT for them to slap a sell rating on a company because they’re effectively telling people not to spend their money there.

That second point is one that you really should always keep in mind when you’re doing your own investing. If you see a sell rating on a company, that’s always a big red flag to me. Not necessarily in the sense that I’m not going to invest, but I know that if a sell side analyst puts a sell rating out there then they really, really hate the future outlook of that company.

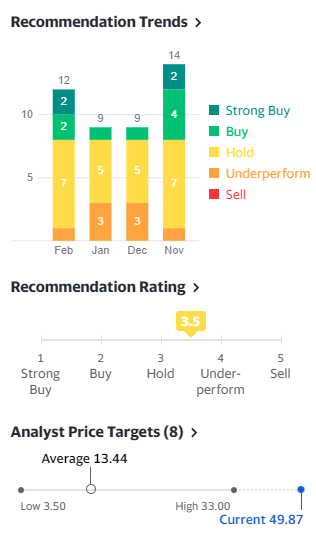

I mean, do you remember all the craziness that was going on with GameStop (GME) in early 2021? The Reddit craze that took the company to $500?

Well, that stock had OVER 100% short interest. Literally people were shorting more shares then shares were available to be bought which is something I truthfully still can’t comprehend.

Everyone thought that stock was going to get crushed, so it should be all sell ratings, right?

Turns out that all but 12 of the ratings were listed as sell.

Otherwise written as literally nobody had a sell rating on GME even though the market thought it was going to crater. Doesn’t that seem jacked up?

Sell side analysts are called that because they’re selling their analysis and equities to investors and institutions, but sometimes it can be biased feedback that you’re getting when you’re looking at your analysis, so buyer beware.

In the very beginning of my post I said that the individual investor is their own sell side analyst. I say that because I think that we really need to rely on ourselves to conduct analysis and form our own opinion of what we think the company is going to be worth.

I’m not going to go down a rabbit hole with how to do that because I think there are a million ways to do it as I’ve outlined previously.

The piece that I am more so focused on hammering home is that if all you do is focus on the analysis of a sell side research analyst then you’re going to get some biased feedback. As long as you know that going in, there’s nothing wrong with reading those reports, but I recommend that you start with trying to form your own opinion prior.

For instance, sit down and read a little about the company. Watch some YouTube videos on them. Read the 10K. Put their financials into the Value Trap Indicator.

Try to form your own opinion first because if you don’t do that, you’re going to then have a clouded opinion of the company before you can even think for yourself. This is an error that I have made probably a hundred times when looking at companies.

I have talked about before that I am in a group chat called “Stonks” with some friends and while we mostly just mess around, we do have one friend that makes 100% of his investing decisions based on the price target and the analyst opinions of that company.

Do you know what that has done to his portfolio? It’s basically made him only invest in microcap biotech companies because they’re all covered with sell side research of like four analysts that have some astronomical price target out there just praying that their one drug comes through and solves cancer.

Personally, I think it’s hilarious and fun to watch play out – but I wouldn’t feel this way if it was my money…

You see, when you’re researching a company on your own and then investing into it directly, not only are you doing the sell side research but you’re also conducting the buy side research.

This can either be a really good thing or it can be a really bad one and it solely depends on your discipline as an investor.

If you’re going take the time to learn about the company and effectively put your own rating and price target on the company then I think it’s a great thing. If you’re not, and your investment process is just to pull up Yahoo Finance and check the ratings right before buying, then it’s a very bad thing. Let me explain.

If you’re buying the stock yourself then regardless of the outcome of that decision, whether you buy or not, whether it goes up or down, you learned something. You went through the process and developed your own thesis for what the company was going to do and then made a decision.

Maybe you were right, maybe you were wrong – but you definitely learned something. And chances are, you have less money now then you’ll have in the future, so your mistakes are going to be “cheaper” than if you made this same mistake in 15, 20, or 30 years from now.

Speaking of mistakes… if you just blindly buy a stock based off an analyst, then you have learned nothing. You’re gambling. You took advice to buy something from someone that wants you to buy something…lol.

So, when it goes up or it goes down, you still know nothing. Truthfully, you should hope it goes down so you wake up to the foolishness of this strategy. Because if it works, you’ll think you’re invincible and just keep doing this same process over and over just to eventually find out that it was nothing more than luck.

And remember how I said that you’re likely going to have more money in the future? Yeah, that means that these learning lessons are going to be wayyy more expensive. Not fun.

Summary

Hopefully this review has given you a little bit of a peak behind the curtains of how things work on not only the sell side but also the buy side.

If you don’t have a true investing process and don’t really have the desire to develop one and get in the weeds, that’s perfectly fine – you can still take advantage of the great returns in the stock market.

My advice is rather than directly investing in companies, take part in buying a total stock market ETF just as SPY or MTUM to take advantage of a diversified group of stocks where the sell side research from analysts really has no impact.

On the other hand, if you’re going to be purchasing stocks directly then it’s imperative that you do some sort of research above and beyond just reading the sell side research.

It doesn’t mean you have to do all those boring things like read a 10K (although I highly recommend you do). Start small and let your education snowball.

Listen to some podcasts about different companies. Signup for publications from people that you really trust like Andrew with the Sather Research eLetter, and Dave with Fat Pitch Fundamentals for the more conservative investor.

But remember – if your investments fail, you’re the only one that can be blamed, because you’re the one that either came up with the investment theory or just decided you were going to blindly trust others.

Take some advice from someone that learned the hard way – if you’re going to lose money, might as well learn something by doing it!

But don’t let the fear of losing money scare you away. Losing money in the stock market is much, much less common than making money, especially when you trust your process!

Related posts:

- How To Read Earnings Reports & What To Look For Wall Street and investors do the earnings report season dance every four quarters. But how do we read earnings reports, and what can they tell...

- How To Research Stocks (for Beginners) “Never invest in a business you don’t understand.” So you decided to invest in stocks but don’t know where to start? Think of researching stocks...

- Behavioral Biases 101 – Those Most Common to Average Investors Updated – 11/17/23 To be a truly great investor, you need to be able to recognize and correct your own behavioral biases. This article will...

- 7 Deadly Sins in Behavioral Finance (Common Biases that Investors Face) Behavioral finance biases….where do I begin? This article will present financial pitfalls, some of which I have learned through my own experience. Below are seven behavioral finance...