Updated 3/24/2023

Today’s historically low interest rates drive many investors to search for better returns than banks offer today. Many of us looking for safe investments turn to our banks, but with rates low for savings accounts and CD (certified deposits), where will we turn?

Savings bonds from the Treasury might offer a solution, particularly the Series I Bond. The Series I bond is a savings bond offering rates as high as 6.89%, compared to the puny rates offered at Wells Fargo of 0.25%.

Finding safe, secure places for your hard-earned funds is challenging, and for many, turning to your bank is the only choice they are aware of, but today, let’s explore other options to give you choices. I am not pro-savings bonds, but I want to help educate us all to give us choices. Once you have the information, we can make better investment choices.

In today’s post, we will learn:

- What is a Series I Savings Bond Definition?

- What is the Current Interest Rate on an I Bond?

- How Do You Buy an I Bond?

- What Are the Historical Return of I Bonds?

Okay, let’s dive in and learn more about I bonds.

What is a Series I Savings Bond Definition?

A Series I savings bond remains a non-marketable, interest-bearing savings bond issued by the U.S. government. The Series I bond earns a combined fixed interest rate and a variable inflation rate, adjusted semiannually.

Series I bonds intend to give investors a safe return and protection on our purchasing power, protecting against inflation loss.

The Series I bonds are issued electronically, in most cases, but you can purchase paper certificates with a minimum purchase of $50. The savings bonds remain only available through the Treasury Direct and are not bought or sold on the secondary market, like other bonds.

The Treasury Department designed the Series I bonds as a means of low-risk investments for investors. The savings bonds, Series I and Series EE remain non-marketable as part of the U.S Treasury savings bonds series. As mentioned, neither savings bond is available for buying or selling on the secondary market.

Why is this important?

It means that the rates offered and the amount invested in the Series I bonds remain fixed and updated semi-annually. So if you buy a savings bond for $100, you will receive your $100 when the bond matures, plus any interest earned over the investment life.

Other bonds bought or sold on secondary markets move with market fluctuations and face values rising or falling with those market fluctuations.

The Series I bond offers two types of interest:

- The fixed interest rate that is fixed for the life of the bond

- A variable rate tied to the inflation rate that is adjusted twice a year, May and November, and based on changes in changes in the consumer price index (CPI)

Our friends determine the fixed-rate interest rate of the Series I bond at the Secretary of the Treasury, and they announce the rates every six months on the first business day of May and November.

Once they finalize the fixed rate, the rate is applied to all Series I bonds issued in the next six months, with interest compounded semiannually, and the rate does not change over the coming six months.

As with the fixed rate, they calculate the inflation rate on May and November’s first business day based on any consumer price index or CPI changes. They use the CPI to gauge any changes in inflation in the U.S. economy. Once they determine the changes, every bond has the rate applied six months from the bond issuing date.

Let’s move on and find out the current interest rates for a Series I bond.

What is the Current Interest Rate on an I Bond?

The Series I savings bond remains low-risk, with the bonds backed by the U.S. government’s full faith and credit. Another plus, the value of the savings bond can never decline.

The flip side of that low risk remains the lower returns offered than high-rate savings accounts or CDs (certificates of deposit). The higher returns offered by corporate or municipal bonds come with the risk of losing face value; coupon returns will never lose value.

Let’s look at how we can locate the returns we might find for a Series I savings bond.

The first step is to go to Treasury Direct.

Next, we will click the link to proceed to the next page.

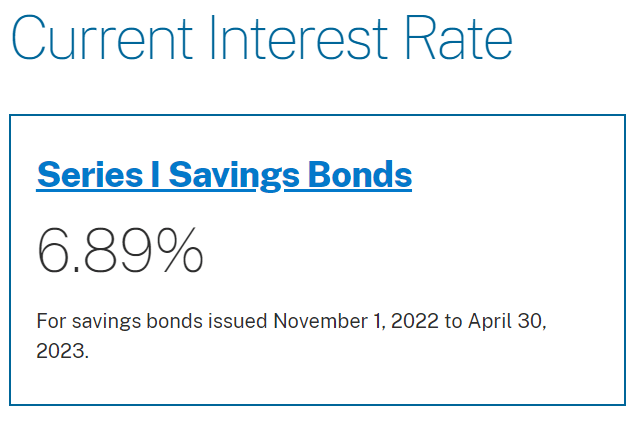

As we can see from above, the Series I savings bond’s current rate is 6.89%, which will be good from November 2022 through April 2023.

That was pretty easy, huh?

Now, the big question is, how does this rate stack up? And what are the ramifications of those rates?

Next, let us compare the current rate of the Series I bond with rates from:

- Savings accounts

- CDs

- Treasury notes

- Series EE savings bonds

- Corporate bond rates

- Municipal bond rates

As best as possible, I will look at similar maturity durations for a benchmark to compare all the rates.

Fixed Income Vehicle | Savings Rates |

Online Bank Savings Account | 3.60% |

Brick & Mortar Savings Account | 0.25% |

CDs Rate – Online Banks 1 year | 4.50% |

CD Rates – Brick and Mortar | 1.49% |

Treasury Bills – Six months | 4.71% |

Series EE Savings Bonds | 1.60% |

Corporate Bond Rates -30 year | 4.88% |

Municipal Bond Rates – 10 year | 2.40% |

Remember that the above rates are from a little digging on the Google machine and are the best comparisons to possible rates.

The savings accounts are the most liquid of the above accounts, with no restrictions on removing your funds. However, to qualify for the higher rates, you must deposit larger funds, for example, at least $25,000, to get the higher rate for the online savings account.

The brick-and-mortar rates are at the base level and improve with more money deposited, but paltry increases at best with 0.25% to 0.50%, respectively.

Banks offer CD rates for one-year deposits with a minimum of $1000 to receive those rates. CDs have some restrictions on liquidity or access to your funds.

To qualify for the higher rates, we need to agree to leave our money in those accounts for the required time. We may need to withdraw the funds anytime, but the withdrawals come with potential penalties. If you withdraw before the allotted time, you might pay a flat fee or lose any accrued interest plus a penalty. Certain banks may waive these fees on certain terms.

Treasury bills and savings accounts remain among the safest investments, but they risk losing face value, and the interest rates remain quite low. Treasury bills trade on the secondary markets and remain subject to the stock market’s volatility.

And finally, the Series EE savings bonds have an extremely long duration, being that the bonds are held to maturity, which is 20 years. While a great long-term option, they may not be the best option for shorter-term investments.

For example, my mother recently discovered a Series EE savings bond that my father bought for me in 1996 for $50. When I submitted it to the Treasury Direct website, I discovered the bond’s value was $195. It was a nice surprise, highlighting the 4% rate offered for over 30 years of investment.

Okay, let’s move on and discover how to buy a Series I bond.

How Do You Buy an I Bond?

First, we will look at the process of buying a Series I bond; then, we will discuss any requirements or restrictions associated with investing in these savings bonds.

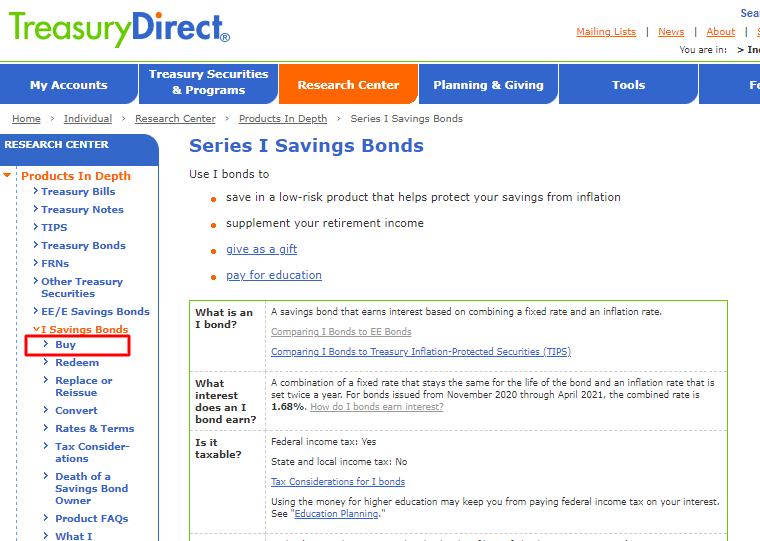

Let’s head back to Treasury Direct to buy a Series I bond.

To purchase a Series I bond, the minimum investment available is $25 online, and you can purchase them for $50 on paper. The maximum purchase available is $10,000 and $5,000 paper each calendar year.

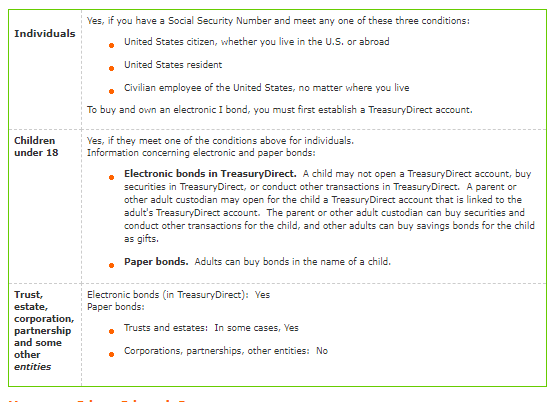

There are a few requirements to purchase a Series I bond from the Treasury Direct website:

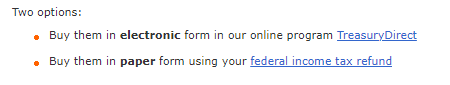

Once we meet those requirements, we look at either option:

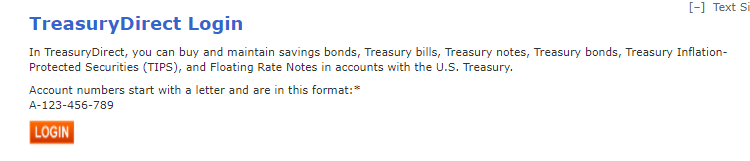

If you don’t have a Treasury Direct account, you must set one up, but it is FREE!

After you have your account setup, you can follow the link to the following page.

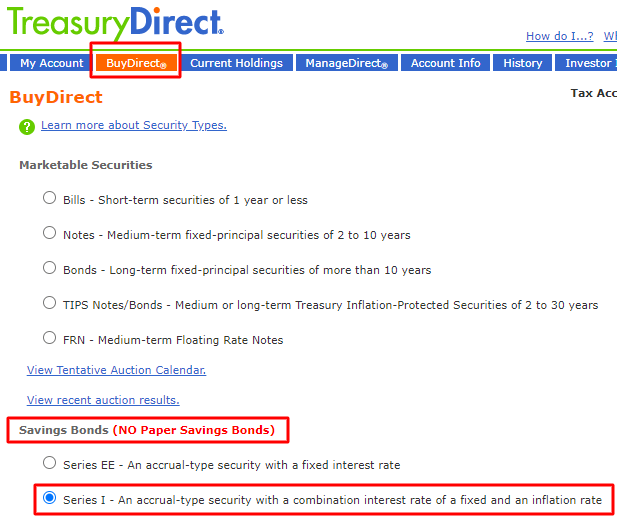

Once logged in, locate the BuyDirect tab, and click the radial under Savings Bonds for Series I.

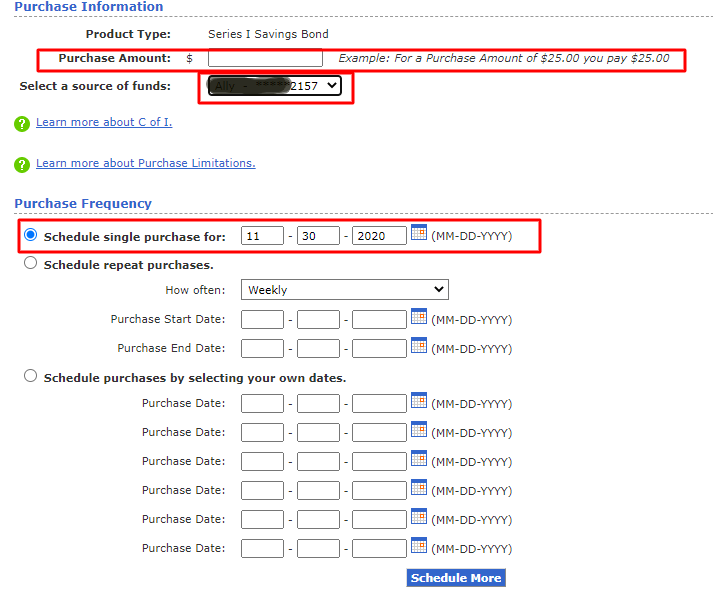

The next page will contain the links and choices to purchase the Series I bonds. Note that we have a box that allows us to purchase the desired amount. The source of funds offers you two choices, your bank account or any funds you hold in your Treasury Direct account.

You can easily transfer funds to the Treasury Direct account from any of your bank accounts or request funds be deposited there from your tax returns, whichever works best for you.

Notice also the ability to schedule purchases on a schedule, either of your choosing or a preset schedule.

Once you have purchased the bonds, the monies will transfer, and then your bonds will be available on your Treasury Direct website.

Okay, now that we understand the process of buying a Series I bond, let’s discuss some of the qualifications and rules associated with this investment.

First, when you buy a Series I bond for $50, you receive a $50 bond; unlike the Treasury bills sold on the secondary market, you get what you pay for in Series I bonds.

Bond interest is added monthly and paid upon cashing out the bond.

The Series I bond has a minimum of one-year ownership, with the total interest-earning period lasting 30 years or until you cash them.

There are some early withdrawal penalties:

- If redeemed before five years, we forfeit any interest from the previous three months

- If redeemed after five years, no penalties occur

Next, we must discuss some special considerations regarding the Series I bonds interest and taxes.

Interest income earned on a Series I bond is taxable at the federal level but not at the state or local levels. The Series I bond is a zero-coupon bond, which means that the bond pays zero interest during the bond’s life.

Instead, adding back the interest to the bond’s value and the interest compounds on itself, meaning that the interest earns interest. When the bondholder sells the bond, we have two choices, cash method or accrual method.

Under the cash method, our taxes apply only when we redeem the bonds. For example, if a taxpayer holds the bond for eight years before the taxpayer sells will only be taxed at the time of selling the Series I bond.

Under the accrual method, the taxes apply to the interest earned every year.

However, the Series I bond will sometimes be tax-free from federal taxes if used to pay for higher education.

What are the Historical Returns on I Bonds?

The rates for Series I bonds have followed the same path that most interest rates have recently had a slow, gradual decline. The I bond’s current composite rate level is 6.89%, with a fixed rate of 0.40% and the inflation rate of 3.24%.

With the Fed fixing rates as low as they are, the I bond will have a low historical context, considering 2008, the fixed rate for the Series I bond was 3.40%, and the composite rate for the same period was 5.11%.

That small example shows that inflation hasn’t budged much, but the fixed rates are low. And the interest rates going forward are not expected to rise substantially anytime soon.

I came across a chart that showcases the fixed rates plus the composite rates for Series I bonds from September 1998 to the present.

History of Fixed Rates for Series I savings bonds

If we compare the Series I bond’s current annual rate, it computes to 6.89% annually, and then if we look at the rate offered for the Series EE bond, which computes to 3.5% annually. We can see that both offer better rates than the current rate of the 30-year Treasury bond of 3.69%.

The I bond’s rates compare favorably to any of the online CD rates offered today, but keep in mind that those rates change every six months, which means the rates could drop.

Due to the Fed’s recently announced goal of improving inflation, the Series I bond will remain an attractive alternative to CDs. With rates continuing to remain low for the upcoming time horizon, CDs will likely struggle to see rates improve, where if inflation grows, the I bond will benefit from those increases.

Final Thoughts

With interest rates at historic lows, exploring the different savers’ options is good. Not everyone is comfortable with the risks associated with the stock market. The returns from stock investing are superior, but not everyone can stomach the volatility.

Enter the Series I savings bond as a possible “riskless” investment. Every investment faces some risk; in the case of a Series I bond, it is the risk of losing out on a better investment. With the longer duration required for an investment in Series I bonds, other opportunities may arise that offer better returns.

The bottom line, the savings bonds offered through Treasury Direct offer some advantages as well as some disadvantages. The best bet for any investor is to weigh the risks associated with any investment and determine what works best for their situation.

Savings accounts with brick-and-mortar banks are abysmal, and investors should avoid them as a long-term solution for fixed income; there are far better opportunities out there. I hope this article helps spark investment in time searching for other choices to enhance your investments.

With that, we will wrap up our discussion regarding the Series I saving bond.

As always, I appreciate you taking the time to read this post, and I hope you find something of value on your investing journey.

If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- Investment Terms Everyone Should Know Updated 9/3/2023 If you are new to investing, all the terms and jargon might seem overwhelming. But today’s post will help you learn some of...

- Commercial Paper For Beginners “The commercial paper, when that dries up, you know, that’s just like sucking the blood out of the economic body of the United States.” Howard...

- The 8 Main Types of Investment Risk “If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to...

- Beginner’s Guide to Total Current Assets You can use total current assets to assess a company’s financial standing. Today’s post will teach us the formulas to use and what to do...