Today, share-based compensation issued to employees continues as one of the more disruptive finance topics, and some C-suite managers have abused their positions.

Those behaviors have led many in Congress to believe that this type of compensation harms investors and employees. The idea of a “golden parachute” remains reviled and looked down on.

In most cases, issuing shares continues as a great way to align both the company and employee interests. And a great way to entice top talent to the company and encourage longer tenure.

Share-based compensation increases, especially among young, upcoming tech companies short on cash but long on potential, have grown exponentially over the last ten years. It is a great way to entice top talent, but accounting for that “real” expense is vague, at best.

Along with the vagaries of accounting, usage in valuation remains an issue. Regardless of the accounting approach, the cost of options impacts a company’s value because employees Will exercise these share-based options someday, which is a cash outlay to the company.

In today’s post, we will learn:

- What is Share-Based Compensation?

- How Do We Value Share-Based Compensation?

- Walking Through Valuing Share-Based Compensation

- Investor Takeaway

Okay, let’s dive in and learn more about valuing share-based compensation in valuation.

What is Share-Based Compensation?

Share-based compensation, also known as stock-based compensation or stock options, each company lists slightly differently in their financial reports are a form of equity investment for the employee.

The company issues options in the form of a right to buy the company’s stock at some point in the future, typically with a vesting period. Once the vesting or waiting period expires, employees can exercise their options and receive their shares.

The value of the options has two effects on the per-share value of the company:

- The first issue is with options already granted, most of which have exercise prices below the current stock price, reducing Facebook’s equity value per share. The lowering of the value is Facebook setting aside a part of its Equity to meet the options’ eventual exercise.

- The second issue persists as Facebook will likely grant options to employees ongoing to reward or compensate employees. These future options further reduce the part of future cash flows that shareholders might receive in the future.

Using options as compensation is nothing new; beginning around the 1970s, the impact was small as a part of management compensation. But in the last decade, companies began a surge in issuing options with the rise in technology firms. And the surge continues highlighting the need to deal with the valuations.

How are the new technology firms different? One way is that management pays closer to stock options than their employee’s salaries primarily because young start-ups generate little cash to entice high-priced talent and long-term potential.

Much of the media focuses on management, but management grants employees these options to encourage employment and longevity.

Another aspect of options is that some smaller companies issue stock options to pay for supplies or operating expenses.

All of this granting of options tie up the company’s Equity because, at some point in the future, they will grant those options, and that cash flow and Equity flow out of the company.

As we can see from the above chart, the new tech uses stock options as a far larger part of its compensation packages, which take up a larger portion of the outstanding shares.

Companies using employee stock options restrict when and how these options can exercise. It is normal, for example, that an employee’s stock options cannot be exercised until they are vested, which means the employee needs to remain with the company for a stated period, typically two to three years.

The most obvious benefit to companies for this type of vesting is increased retention of employees. But another benefit for the company is Facebook won’t face any tax consequences in the year they issue those employee stock options. However, when the employee does exercise their stock options, Facebook allows them to treat the difference between the issue price and exercise price as an employee expense. Beyond decreasing income for investors, it also alters the share-based compensation tax liabilities.

I am not an accountant, and taxes are not my jam, but it is important to understand some benefits beyond the obvious ones. As Charlie Munger says, “show me the incentives, and I will show you the result.”

If you want a deeper dive into share-based compensation, might I recommend the link below to an article by Michael Mauboussin:

A Piece of the Action: Employee Stock Options in the New Economy

How Do We Value Share-Based Compensation?

As we have seen above, many employee options remain in the market, and our first task considers methods to incorporate any effects in value per share of Facebook.

First, let’s look at why they affect per-share value.

So why do options affect the value of Facebook? First, not all options affect value. Any options offered by an investment brokerage such as Schwab do not affect the value of Facebook.

But the employee stock options issued by Facebook affect the company’s value because of the chance the options will exercise either now or in the future.

Because employee options offerings at a fixed price will only exercise when Facebook’s stock price rises above the exercise price. Backing up for a moment, the exercise price is the selling price the employee option gets. For example, if Facebook sells options to its employees at $200 and the price rises above that $200 when the options vest, the employee stands to make a nice return.

When the options vest and employees exercise their options, the company has two options for dealing with them. And neither option is great for shareholders.

- Facebook can issue additional shares to cover the exercising of employee options. And this increases the number of shares outstanding and reduces the per-share value for shareholders. In effect, it is diluting the value per share for shareholders.

- The other option for Facebook is to go out into the marketplace, purchase shares on the open market, and use those shares for the employee stock options. The purchase of stock reduces the cash flows available to shareholders in the future and reduces the value of the Equity today.

There are multiple ways to value a company with share-based compensation.

The first simple option is not the most accurate because it assumes that all options are the same and they are certainly not. It doesn’t account for the difference between restricted or in-the-money options. Restricted options or RSUs vest only once they meet certain requirements, such as earnings per share or profitability ratios. The money options are available once they vest or live once the period ends.

The other method uses an option pricing model. Using the following model, we have Facebook’s current value per share and the option’s time premium. After finding the value, we subtract the value from the equity value and divide the number by outstanding shares. Therefore, allowing us to find the “correct” value per share.

Additional valuing share-based compensation methods are not optimal; if you want a deeper dive into those methods, check out this link.

Walking Through Valuing Share-Based Compensation

We will use Facebook (FB) as our guinea pig for our walkthrough and reference data from the most current 10-k, dated 12-31-2022.

To illustrate the options’ valuation, we will use a traditional DCF (discounted cash flow) model. We take the revenues and subtract out the operating costs, taxes, and reinvestment needs to find our free cash flows to the firm. If all of this is unfamiliar to you, please refer to our post on discounted cash flows here.

Once we have our cash flows, we will discount those cash flows back to the present using a discount rate. And now we have all those steps accomplished, we subtract out the debt and cash and find the Equity for Facebook value. Finally, we find the share-based compensation or employee options value.

We look at the equity’s value because there are two claims on that Equity:

- Shareholders

- The claim of the employee options

This means we need to subtract the value of the employee options from the company’s value to determine their value to shareholders.

The first step is to search through the 10-k or most recent financial statement, looking for share-based compensation, employee, or stock options. Unfortunately, standardized terminology doesn’t exist, so searching remains a challenge. My favorite way to search is to use the CTRL F function, which allows you to type in a phrase and search.

Typically, we will find information about the employee options in the notes sections of the financials below the main financial statements, such as an income statement.

In Facebook’s case, it lists the info under Note 14—Stockholders’ Equity on page 115.

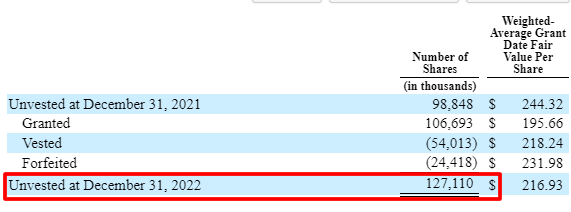

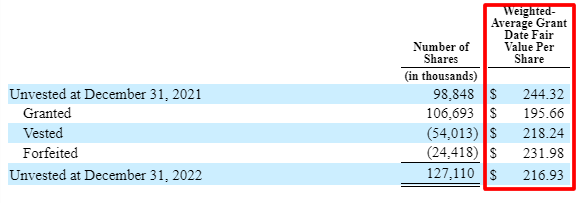

The first number we will look for is the number of options still outstanding.

As we can see from above, the total amount of unvested shares at the end of the period is 127,110 thousand.

The next important number is the weighted average exercise price.

So the average exercise price is $216.93, which, when the options vest, the employee can exercise their options to buy Facebook shares at $216.93. Let’s put that into dollars to highlight the strength of offering this to employees.

Let’s say you own 100 employee options of Facebook, and when they become vested, you opt to acquire your shares at $216.93. You now own $21,693 in Facebook shares, and then you choose to turn around and sell those 100 shares at the current market price of $179, valued at $17,900. You would lose $3,793 for a cool 17.48% of your money!

Back to valuing those options, on with the next step in gathering data.

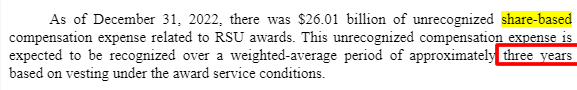

We need the following data to find the weighted average vesting period. Sometimes the companies will list the numbers in the chart with the other information, but they spell out the data in a statement below the table in Facebook’s case. Unfortunately, you might have to search to locate the information, but companies will document the info.

As we can see from the statement above, the average period is three years.

The final number we need is the standard deviation of the stock price, and to arrive at the number, we can find the input sometimes in the financials by using our CTRL-F function.

But in Facebook’s case, I refer back to Professor Damodaran’s website listing the details under tools. For our purposes, I will refer to the free cash flow to the firm spreadsheet we will use in the rest of the explanation.

Once we have downloaded the above spreadsheet, it’s free and customizable; we can finish valuing the share-based compensation.

The spreadsheet will do all the heavy lifting regarding the math; we only need the inputs to plug into the spreadsheet.

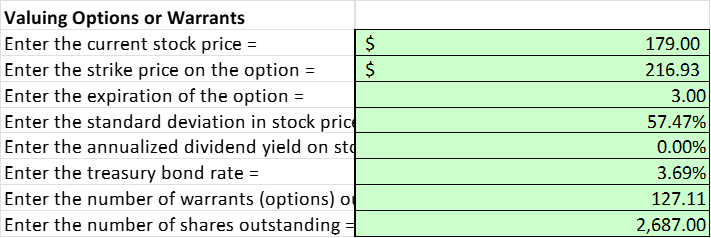

As we can see, it has the following:

- Strike price or the weighted average price of $216.93

- Vesting period or expiration of options at three years

- T-bill rate of 3.69%, which is the current 10-year T-bill

- The current stock price of $179

- Standard deviation we gathered from the related tab on the spreadsheet

- Any dividends the company might pay, in Facebook’s case, equals zero

- The total number of options outstanding we gathered first from the 10-k

- And the total number of shares outstanding, also from the 10-k

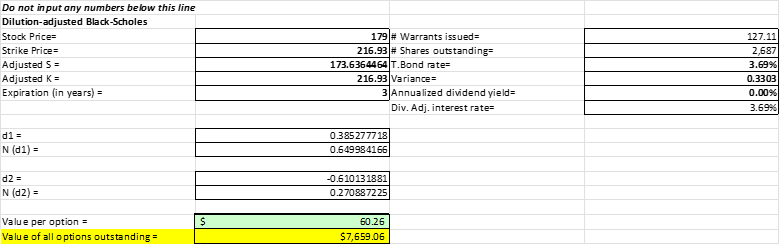

After plugging in all the necessary inputs, the spreadsheet does the calculations for us to find the value of those outstanding options, which in Facebook’s case:

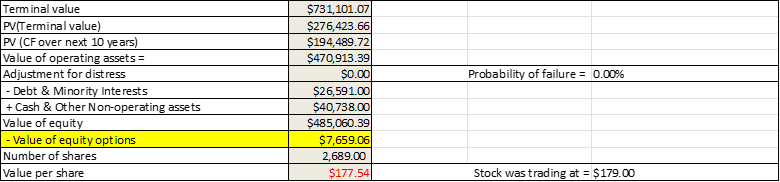

Next, we subtract the highlighted number from Facebook’s equity value to find our per-share value.

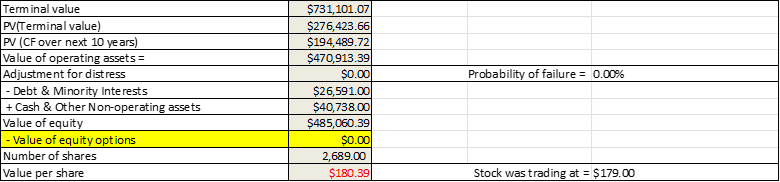

To illustrate the impact on Facebook’s value, if we remove that line item from the calculations, we see the price per share increase:

We see the price increase from $177.54 to $180.39, an increase of almost 1.3%, not a big adjustment, but worth noting because the result could throw off our margin of safety.

The above result helps illustrate the importance of share-based compensation on Facebook’s equity value. And to not including the information in any calculation could lead to a misjudgment of Facebook’s value.

Investor Takeaway

The price we pay matters a lot, and attempting accuracy when doing any intrinsic valuation remains important. Including items such as taxes, reinvestments, and operating costs are obvious. Not as obvious is including the impact of outstanding employee options.

Employee options impact Facebook’s valuation as real costs, as seen from the above valuation, like any other such as interest expenses or the cost to produce a car. Therefore, it is important to include share-based compensation in our valuation because of impacting the value of our shareholders’ equity.

Another benefit is helping to give us a more conservative number, especially with low-interest rates, which elevate valuations, giving us another margin of safety.

I didn’t include any actual math or formulas to calculate the value of the employee options because they get a little convoluted in print; applying Professor Damodarans’ makes calculations easier. If that floats your boat, I suggest reading the cell formulas to figure out the higher math.

But for determining the intrinsic value of Facebook, utilizing the spreadsheet is more helpful, and thinking about the bigger picture is another benefit of using tools like his spreadsheet.

I take no credit for creating the spreadsheet and the valuation example, and not meant for investment advice, only as a teaching tool. The inputs for the final value are only estimates.

Including share-based compensation as a line item in the valuations is a minor part of finding the value but an important consideration. Employee options have a real cost and should adjust the equity value of any company you value.

With that, we will wrap up our discussion on share-based compensation and its impact on valuation.

As always, thank you for taking the time to read this post, and I hope you find something of value in your investing journey. If I can be of any further assistance, please don’t hesitate to let me know.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Stock Based Compensation Expense and FCF Explained In a Simple Way Edited 3/24/2023 Accounting for stock based compensation expense can be tough. The numbers don’t always line up from the income statement to the cash flow...

- Balance Sheet Item: Book Value of Equity and Its Individual Components Updated 6/24/2023 “Price is what you pay; value is what you get.” A company’s evaluation involves determining the value of its assets, liabilities, and equity....

- Inconsistency with Shares Outstanding in Company 10-K Annual Reports There are a few obstacles that can come up when using fundamental analysis to find stocks with both a solid business model and an adequate...

- Depreciation Expense: How to Decode Updated 8/7/2023 Depreciation is an accounting term that has a big impact on a company’s future profitability. It is a controversial topic because, as Warren...