Updated 2/7/2024

The use of stock-based compensation has grown over the last twenty years, not only among CEOs and other C-suite management but also among the lower tiers of employees. As many of the newer companies become public, the increase of stock-based compensation continues to grow.

It makes sense when you consider it; enticing employees to work harder or stay longer is a smart way to reward them. Treating employees as owners by giving them a stake in the company encourages better performance.

However, the growth of stock-based compensation is not without some controversy, which we will cover in the upcoming post. Many top minds in valuation differ on the accounting approach of stock-based compensation expense and its impact on its value.

“Never, ever, think about something else when you should think about the power of incentives.”

In today’s post, we will learn:

- What is Stock-Based Compensation?

- Why is Stock-Based Compensation an Expense?

- Controversy Around Stock-Based Compensation Expenses

Okay, let’s dive in and learn more about stock-based compensation expenses.

What is Stock-Based Compensation?

In simple terms, stock-based compensation is a company paying employees with shares. The company uses stock options to transfer the shares to the employee.

Often, the shares reward outstanding work; in other cases, it entices employees to remain with the company or reward them for their longevity.

It is also known as Share-Based Compensation or Equity Compensation.

The method is a way to pay the company’s employees, executives, and directors with equity. The most common use of stock-based compensation is a reward beyond their regular pay, salary, and bonus. It also helps align the employees’ interests with those of shareholders like us.

The shares typically tie to some vesting period before the shares are earned or sold for cash.

Equity-based compensation comes in a few different flavors; here are some common flavors:

- Shares

- Restricted Share Units (RSUs)

- Stock Options

- Phantom Shares

- Employee Stock Ownership Plan (ESOP)

RSU – Restricted stock or RSUs are shares employees can receive for hitting performance goals or staying for a certain number of years. They require a certain vesting period, which will vary by company. Employees can receive all vests at one point in time or over the years or drip them at a set amount over a period. Many CEOs receive a large part of their pay in this method.

Stock Options – stock options give the employee the right but not the obligation to buy company shares at an agreed-upon date and price. The employee’s advantage is they can exercise their rights when it works best for them, after the vesting period.

Performance Shares – many companies reward upper management with shares for targets completed. Items include earnings per share, return on equity, or the company’s return compared to competitors.

Employee Stock Ownership Plan – These pay types allow employees to buy shares easily using after-tax payroll breaks. Another benefit of these plans is that they allow the employees to buy the shares at a discount, encouraging more use.

Today, most businesses use this form of compensation to reward their employees. The shares typically vest after a few years, sometimes three years. Meaning the employee does not earn that value until the three years pass. Employees who leave the company before the vesting period lose those shares. Conversely, employees who stay through the vesting period receive their shares. Once the vesting period ends, the employee can hold the shares forever or sell them and take their cash.

When I worked for Wells Fargo, they had an employee match program through our 401k that allowed us to buy company shares at a discount. However, the program didn’t achieve full value until we had worked there for three years.

After three years, they issued shares to me at full value. If I left before that period, I would only receive the partial value of the shares. So, it worked on a sliding scale, for example, on a $50 share price:

- One year – $25

- Two years – $35

- Three years – $50

Why is Stock-Based Compensation An Expense?

From an accounting case, expensing stock-based compensation as an expense and removing it from earnings makes the most sense. The stock-based compensation expense is part of a business’s operating costs.

As I mentioned above, there is some controversy about this employee’s accounting. I will provide more information on the topic in a moment.

In accounting terms, stock-based compensation expense represents a non-cash expense. Accounting adds the expense to the operating cash flow in the cash flow statement. Taking a similar route as depreciation and adding it back improves the operating cash flow because the cash expense is not “actually” paid out.

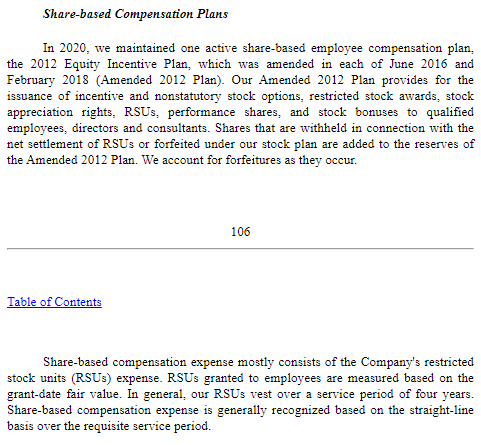

Example of Share-Based Compensation: Facebook

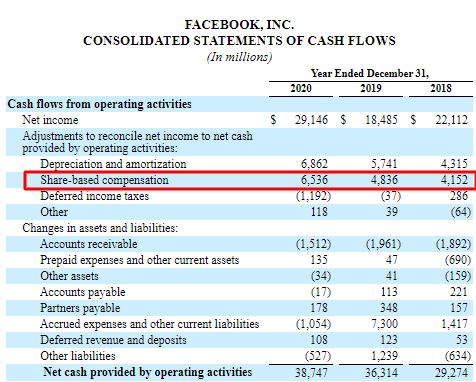

Let’s look at an example from Facebook’s cash flow statement.

As we can see from above, Facebook issued:

- $6.5 billion in share-based compensation in 2020

- $4.8 billion in share-based compensation in 2019

- $4.1 billion in share-based compensation in 2018

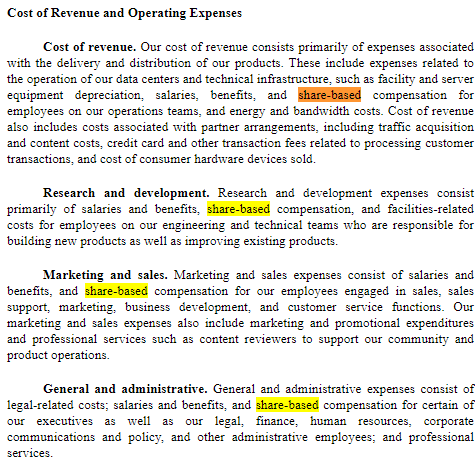

From an income point of view, the expense for share-based compensation includes any costs of revenue or operations. Below are a few excerpts from Facebook’s latest 10-k 2020 to outline how the company accounts for this expense.

From the above excerpt, we can see the expenses scattered throughout the company’s different line items, helping to encourage performance and pay Facebook’s employees.

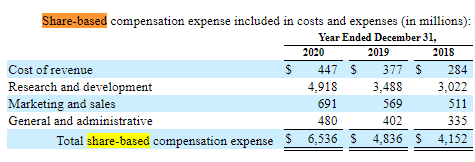

Below is a breakdown of each line item from the income statement and how their share-based compensation impacts each business sector. A note about the chart below: not all companies break it down that granularly, which is nice to see. As a tech company, you would expect to see R&D as the largest recipient of share-based compensation because new tech drives a company like Facebook.

Next, we see from the 10-k how the company has an Incentive Plan authorized by the board of directors for Facebook. This shows us how much of a part of the compensation for Facebook is, helping them attract top talent.

As we work through the share-based compensation accounting, we should probably talk about a few benefits and disadvantages.

A few advantages for the company:

- Creates incentives for employees to help improve performance and encourage continued employment with vesting time frames.

- Aligns shareholders’ and employees’ interests, working towards prosperity and a rise in share price and value.

- It doesn’t require cash upfront for the company to hire and retain top talent. Those shares can rise quickly, creating a lot of wealth for the holders of the options.

A few disadvantages of share based compensation:

- It dilutes the ownership of existing shareholders by increasing the number of shares outstanding.

- If prices are falling, the ability to attract talent diminishes because there is less value in the long term.

Another benefit for the company that isn’t discussed much is the impact on Facebook’s taxes, for example.

“excess tax benefits recognized from share-based compensation decreased our provision for income taxes by $656 million and our effective tax rate by two percentage points as compared to the tax rate without such benefits.”

The company also mentions later that the tax rate will increase if the share price falls below the share-based compensation grant price.

So, there is a most definite benefit to Facebook on the tax front: increasing its bottom line.

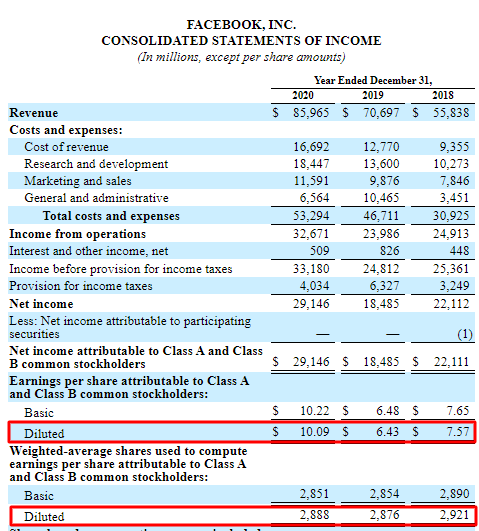

While the expense doesn’t require cash up front, it does increase the shares outstanding, which drives down the earnings per share.

The above picture outlines how the increase in shares outstanding impacts the company’s earnings per share—affecting the company’s share price because Wall Street focuses intensely on earnings.

The Controversy Around Share-Based Compensation Expense

Before uncovering some controversies around this expense, let’s examine the history briefly. In the early 1990s, young tech companies with major cash flow issues started accelerating the idea of issuing share-based compensation to attract employees.

Some accounting rules around the expense allowed companies to grant stock options to employees and show no cost by adding back to cash flow as a non-cash expense. Not surprisingly, companies treat the stock options like free money and pass it around like candy, especially top executives.

When exercising the options later, the companies report a large extraordinary expense, illustrating the disparity between Facebook’s price when granting and exercising shares. And not to mention the impact of taxes, as we explored with Facebook.

After twenty years, share-based compensation is now a permanent part of the corporate world, but much confusion remains.

For the next discussion, I want to use the words of Professor Damodaran:

“1. Is it an expense?

This is an easy one. Of course! If you look at why and where companies use stock-based awards, it is used early in a company’s life cycle to compensate employees. As Warren Buffet is famously quoted as saying, “If options aren’t a form of compensation, what are they? If compensation isn’t an expense, what is it? And if expenses should not go into the calculation of earnings, where should they go?”

The timing of the expense is also clear. It is at the time of the grant, and arguments that use uncertainty about whether these options will be exercised in the future to justify not expensing them are specious. We are uncertain about almost everything that has to do with the future, but that does not stop us (or should not stop us) from making our best estimates when we encounter them.

2. Is it a capital or operating expense?

This is trickier since it depends on who gets the options and their function at the company in question. In the case of Twitter, for instance, the bulk of the options were granted to employees in the R&D department:

An argument can be made that R&D expense is a capital expense, not an operating one, and should be treated as such. I concur with the sentiment (though I don’t know the classification system Twitter used to determine the breakdown of stock-based compensation). And I did capitalize R&D expenses in my Twitter valuation. However, that does not give you a license to add back the expense since capitalizing it will result in an asset that must be depreciated; see this paper that I have on capitalizing R&D if you are interested. Thus, if Twitter wanted to use this rationale, it should have added back the R&D portion of the stock-based compensation and subtracted the depreciation on the synthetic asset it created.

3. Is it a non-cash expense?

Many equity research analysts seem to think so, but their judgment on several fundamental valuation issues remains questionable. Let’s be clear on what it is not. It is not an expense like depreciation, which is non-cash and should be added back to cash flow. It is closer in spirit to in-kind compensation than non-cash compensation. To explain my reasoning, let me use an analogy. Let’s assume you own and run a business with an overall value of $100 million and generate $10 million in annual income. Let’s assume that you hire me as your manager and that my compensation is $1 million and that rather than pay me with cash, you give me 1% of the business as compensation (1% of $100 million is $ 1 million). While you may maintain the fiction that this is a non-cash expense and that your income is still $10 million, you are now entitled to only 99% of that income in perpetuity. In effect, your share of the business is worth less, and it will get even smaller over time if you continue to compensate me with equity.”

He expresses his ideas far better than I could, and I think he lays out his ideas quite well. The basic gist is that share-based compensation impacts the company’s value, and as analysts or stock pickers, we need to account for the impact.

Another great stock valuation, Michael Mauboussin, has shared papers discussing share-based compensation and its impact on companies’ value.

He pointed out in a recent paper that:

“Stock-based compensation ends up being 15% to 20% of cash flow from operations, and for the S&P 500 tech sector, and the smaller businesses, the worse the share-based compensation expense impact is on the company.”

Beyond valuation, share-based compensation can impact the misalignment of incentives, such as the explosion of share-based compensation in CEO salaries. The increase in stock-based compensation has led to sketchy behavior from some leaders of extremely large companies.

Share-Based Compensation Scandals

For example, McDonald’s, Caterpillar, and Boeing recently got in hot water because the former CEOs played a little game with accounting to manipulate share prices and increase those prices by granting excessive stock options. Then, they manipulated the earnings to juice the share prices and cashed out their options, becoming rich while diluting earnings for shareholders.

It was shady stuff, and they were found out and subsequently fired, but they had already exercised their golden parachutes.

However, the outcry about the exorbitant CEO salaries stems from issuing share-based compensation and the value of those shares.

Charlie Munger has spoken many times about the power of incentives and has some pretty fantastic ideas that help explain why we do some things. Check out the article outlining Charlie’s ideas.

Investor Takeaway

When using a discounted cash flow to value a company, as an analyst or stock picker, we must decide what to do with the share-based compensation expense. Depending on your view on the expense, you add the expense back to the company’s cash flow, which will grow your valuation. You can also follow Professor Damodaran’s idea and exclude the expense from the earnings or cash flows, decreasing your company’s value.

We need to account for the outstanding balance of share options, considering they currently have a balance of $16.3 billion outstanding share options in the case of Facebook. The expense is a real cost in cash when employees exercise their options.

To account for the claim on the company’s equity, we need to net out the value from its equity and divide the expense by the actual outstanding shares, not the diluted shares.

It might seem we are double-counting the value of the options by reducing it from the earnings or cash flows and reducing our company’s equity. But we are not because if the company stops issuing share-based compensation at some point, we can stop reducing the impact on earnings. And then, after exercising all the shares, we can stop the reduction of equity.

The outcome of all the accounting and decisions we make when valuing a company regarding share-based compensation expense is lowering the company’s value. In effect, accounting for the expense is another way of creating a margin of safety if our guesses are way off.

Next, value the stock options and use them in a discounted cash flow.

And with that, we will wrap up our discussion for today.

As always, thank you for taking the time to read the post today, and I hope you find something of value in your investing journey.

If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Meta is Now a Value Investment at 10.4x P/E after its 67% Decline! With the S&P down 16% from 52-week highs, the correction in the market is starting to get me excited about stock valuations again and putting...

- How to: Excess Return Model for Valuing Financial Stocks Valuing banks, insurance companies, and investment banks are among the more difficult challenges in valuing any business. Most investors opt for relative valuations that use...

- The 3 Inputs for the Cost of Equity Formula Updated 12/19/2023 The value of any financial asset is the present value of its future cash flows discounted to the present. That is the basis...

- Cash Flow Statement: The Final Stage of a 3-Part Financial Model Forecasting the cash flow statement is the final stage in developing a 3-statement financial model in what was a linked and iterative process. The figures...