In Section 5, Part B of the book, “The Essays of Warren Buffett”, Buffett talks about how they support sensible stock repurchases but not greenmail. This is a very short section, but there are some very tangible share buyback benefits if the shares are bought back responsibly instead of bought back in a greenmail sort of fashion.

When I first read this chapter I had absolutely no idea what greenmail was, and if you don’t understand either, then I recommend checking out this article by Investopedia where they explain the term and give a few examples.

In summary, greenmail is when a company, or even an individual, essentially forces their way into making the company have to buyback shares at a higher price.

For example, a company or individual might slowly buy their way into a company to garner a significant ownership of the company and then essentially blackmail the company to get their way. In the Investopedia article that I referenced, they give the example with Goodyear tires where a gentleman named Sir James Goldsmith bought 11.5% of Goodyear at an average cost of $42/share, then filed plans to finance a takeover of the company with the SEC, before eventually settling with Goodyear where they would buy back the shares at $50/share.

So, he essentially forced his way into getting the company to buy back their own shares at $8 more than he had purchased them just to make sure that it remained their own company. Ruthless, dirty, immoral – these are all terms that come to my mind, but hey, to each their own.

In a sense, I almost compare this to activist investor companies such as what happened with Whole Foods when they were essentially forced to sell to Amazon. Jana, an activist investor company, bought an 8% share in Whole Foods at a share price around $30 and then made their opinions known to the public that Whole Foods should try to sell and immediately after they sold to Amazon, they sold off their shares around $40/share.

I know that it’s not exactly the same thing, and definitely not as forceful, but these activist investors really do take similar processes as seen in these greenmail situations.

Buffett has notoriously been on the record saying that he loves share repurchases as long as the company is making sure that they’re truly buying those shares back at a price that’s undervalued to the intrinsic value of the company. As a shareholder, you should absolutely love this for many reasons!

The Straight Cash Reason

So, what is the main reason you should welcome share buybacks as a current shareholder?

Straight cash, homie.

So, I’ll be honest – I am a die-hard Green Bay Packers fan, but anytime I get a chance to use this quote from former Minnesota Vikings player, Randy Moss, I do. The video here is him talking about how he pays for his fines, but it still fits…I think.

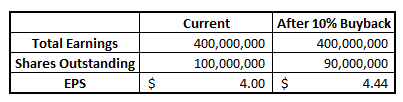

Ok – so I really digressed right there. But for real, the #1 reason that you should welcome the buybacks is for the cash value purposes. For instance, if a company has been generating $4 in Earnings/Share (EPS) and then they go out any buyback 10% of the outstanding shares that the company has, there is now only 90% of the original shares outstanding.

So, you should theoretically expect an increase on your share value now, right? Agreed! Let me show you the math:

Does that make sense? EPS is very commonly used in the market as a way to normalize the earnings when comparing companies, but you can see in this example that the EPS grew by 10% simply by the company having 10% less shares.

While this is great for a current shareholder, you should make sure that you’re not being deceived into buying a company that has decreasing earnings, but their EPS is going up simply due to share buybacks.

Andrew wrote an in-depth article that might be worth checking out to help better understand share buybacks and their impact!

The Breath of Confidence Reason

When a company is buying back shares, it tells you that they think that their company is undervalued. Yes, all CEOs and management teams likely think that their companies are always undervalued, but that doesn’t mean that they actually are.

Share buybacks can show faith to the market that the company is still poised for long periods of sustained growth and that the public is missing their chance to buy in. Often times you’ll see a company’s stock price shoot up when a share buyback program is announced despite it likely being complete or near complete when the company actually announces it.

This occurs simply because of the faith that the company is showing in themselves.

Now of course, every coin has a flipside, and the flipside here is if the company is buying back shares when the company isn’t actually undervalued. That should be a sign to you, as the investor, that the management might be a little too optimistic and it’s causing them to miss out on other opportunities such as potential M&A’s that they could be making instead of buying back shares.

Sometimes, companies will also buyback shares because they simply don’t know what else to do with the money. This is obviously not a good sign from management. Maybe it’s time to consider your position in the stock and if you still see the long-term value there and trust the management.

In general, if you hold a position in a company that is buying back shares then it is likely a good thing, because we as investors that listen to The Investing for Beginners Podcast and readers of the Investing for Beginners Blog only invest in stocks that are significantly undervalued against their intrinsic value, right? RIGHT?!

Right.

Share buybacks are somewhat of a polarizing topic for me because I think at face value, they’re a fantastic thing, but I also think that they can be used to cover up bad trends from company and slightly declining earnings. Is it deception on behalf of the company?

No, I wouldn’t go that far by any means. But it might be something that you don’t notice as a new investor.

This is why we put the podcasts and blogs out – we want to help you!

I am very vocal about encouraging you to do the research on your own so you truly understand what you’re investing in, but if you’re not numerically savvy then there’s still a better option than just investing in index funds completely – Andrew has an amazing tool called the Value Trap Indicator where he will give you the data so you don’t have to dig into the numbers on your own as much.

Yes, you’re still going to need to know the terms and different ratios that are important to you, but this is a major head start in the right direction!

So, at the end of the day – share buybacks have some great, tangible benefits to you as a current shareholder, but you need to make sure that the company has the right intentions and that they’re buying back shares that truly are undervalued – I mean, you would never buy shares of an overvalued company, so hopefully you wouldn’t invest in a company that is buying back overvalued shares, either!

Related posts:

- Here’s the Optimal Dividend Policy According to Warren Buffett As I continue to read (and fall in love with) The Essays of Warren Buffett I can’t help but urge you to buy this book...

- What Buybacks King, Henry Singleton, Can Teach Us About Capital Allocation Before Warren Buffett and his special conglomerate, the compounding machine Berkshire Hathaway, there was a CEO of Teledyne called Henry Singleton—who pioneered prudent capital allocation...

- Warren Buffett’s Special Situation Investing – A Best Kept Secret Some of the greatest value investors of all-time have used special situation investing to attain superior returns in the stock market. The average investor can...

- Does Good Earnings Guidance Lead to High Returns [Real-Life Case Studies] If you’re addicted to checking your portfolio multiple times a day, and I personally don’t think that’s a bad thing as long as you have...