We spend a lot of time talking about saving and investing for retirement but one topic that we don’t touch on much is the importance of saving for your short-term financial goals. Well, I’m here to show you how to do that and that the value of investing early will pay dividends for you in the future!

I feel like I can speak pretty well on this topic because I was in this exact situation recently. Just a few years ago, my wife and I lived in Lincoln Park, a very expensive neighborhood of Chicago, and we were paying out the you-know-what in rent each month.

In addition to that, we had only been out of college for a few years so we had student loan debt, credit card debt (because we were dumb), car loans and others!

PLUS, I was saving for an engagement ring, which then led to us saving for a wedding, and we were also saving for a home as my company moves us every couple of years and we wanted to buy a house in our next location.

In short – we had no money and we needed to pay off what we owed as well as trying to save for what we wanted.

It was really, really tough.

The first thing that you absolutely have to do is cut your expenses. While there is a finite amount that you can cut your expenses, it is absolutely the easiest and quickest way to create additional money in your cash flow.

Those 4 different streaming services + cable + HBO that you have? Cut them! What about that meal delivery kit that you have? Cut it! You can just grocery shop. The $200/month you spend on clothes? STOP BUYING THEM! That crazy car payment? Look at options for a cheaper car!

The thing is, a lot of your variable expenses can all be cut instantly, but the first step is for you to even know where you’re actually blowing your money. My recommendation is to take advantage of Doctor Budget because it allows you to download your expenses from the credit card/bank website and then customize a budget plan to fit your lifestyle.

Once you can actually cut your expenses, you’re going to increase your cash surplus or at least cut your spending deficit, therefore giving you more opportunity to save!

Next we’re off to increasing income!

Push for a raise, get a side hustle, sell anything that you don’t use, do absolutely anything that you can try to increase your income! The ability to increase your income is limitless so do not hesitate to take the bull by the horns and find a way to increase your income.

While this isn’t the first step, I think that this is the most important step that someone should take solely because the amount of income that you can make is limitless.

So, let’s now pretend that you have your expenses cut as far as you absolutely can and now that your income is skyrocketing – what do you do next?

Well, you start to save, dummy. I’ll be honest – my personal rule of thumb has always been that any sort of expense that is upcoming in three years or less should go into a high yield savings account, but I want to actually test out this hypothesis. What does the data tell us?

Well, the first thing that the data tells us is that the stock market is extremely volatile, but that it is not risky! You see, the S&P 500 has returned 11% on average since 1950, so it’s really hard to say that anything is risky if you’re getting those types of returns over such a long period of time. But like I said, it is absolutely volatile!

You can see these super crazy time periods such as a year that has gone up 70% or an individual month that has dropped 30%! You can lose your butt pretty dang quickly if you’re not prepared for some of the negative outcomes that can come about so you really, really need to make sure that you’re prepared.

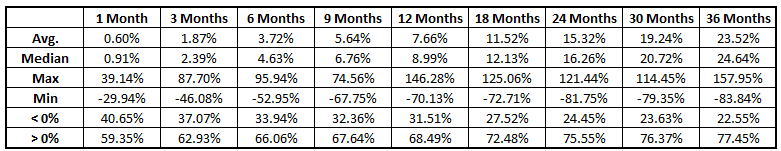

I grabbed the S&P 500 data back to 1928 and looked at the monthly returns for if you were to buy the S&P 500 and then sell it at 1, 3, 6, 9, 12, 18, 24, 30 and 36 months into the future. In other words, I wanted to completely test my “3-year rule” and to see if I was doing the right thing, by the numbers.

I think that before we even really get into the data, we need to think about what we should be looking for. In my eyes, there’s really two different mindsets that are somewhat related but also completely different from one another, and that would be making money and not losing money.

Of course, if you make money then you’re not losing money, but those are very different mindsets and could change your investing strategy. Let me help explain:

If you’re looking to “save” and build up your emergency fund, then you likely should be hoping to just not lose money, or at least that’s my philosophy. The reason that I have my emergency fund is for emergencies. I don’t have it as an investment vehicle to get me to retire early or anything like that.

My entire goal is for it to be there if I need it so that I won’t have to go into debt and I have some cash to protect myself and my family. In this case, all I care about is the safety and making sure the funds that I saved are still there.

On the other hand, let’s say that maybe I was saving for a new car. I don’t need a new car now or even in a couple years but I would like to get a new one. In this case, maybe you’re ok with being a little bit riskier. You’re ok if you’re investment loses a little bit because you want to take the risk of making some cash and then being able to buy that new car faster.

Both of these situations are very short-term in regards to the amount of time that it will take for you to accumulate the funds that you need but they could have very different investing strategies, so you need to make sure that you know exactly what your main goal is before you try to develop a strategy to meet.

But alas, let’s finally get to the data! This is what I found:

I broke down each of the time periods that I mentioned above by looking at the average, median, max, min and then a percentage breakdown of the frequency that this timeframe resulted in a positive or a negative gain.

As you can see, the longer time period that you look at, the more that the data will skew towards a positive outcome rather than a negative outcome. Since the market historically has gone up 11% YOY, as I mentioned previously, this would make a ton of sense, and is also why I would always recommend lump sum investing instead of dollar cost averaging your way into the market once you determine your strategy.

To really interpret this data, I am going to think about the same exact situations that I posed earlier with the emergency fund and with saving for a new car.

With an emergency fund, the timeframe can be anywhere from 1 second – never, so that is literally the worst thing possible because you really don’t know how things are going to play out and when you’ll need this money.

So, in my opinion, I would NEVER invest my emergency fund in the market. I would either put it in a savings account, or MAYBE a CD if you absolutely felt compelled, but even that is a bit too risky for me. And not risky in the way that you might lose money, but risky in the way that you might need it and not have it because it’s tied up in a CD.

So, what about the car scenario? This is my breakdown – would I invest in the following time periods to buy a new car?

- 1 Month – No. The average/median return is under 1%, so if I had $10,000 then I would be looking to make $100. The potential risk is that I lose money, which happens about 40% of the time, so I would just hold off for one month in this case. I am so close to being able to afford this new card that I can practically taste it!

- 3 Months – Same scenario here – also a no. 37% of the time I am losing money and that’s just a huge no for me, especially when I am talking about an average/median gain of about 2-2.5%.

- 6 Months – Also a no and for the same reasons as noted above.

- 9 Months – Also a no and for the same reasons as noted above. We’re now starting to get into the point in time where I might be willing to invest IF I was also willing to wait for longer to get the car. For instance, if I was on pace for 9 months but willing to go to 18 months, then maybe I would be willing to do it, but it would certainly be a gamble.

- 12 Months – Also a no/maybe and for the same reasons as noted above.

- 18 Months – This is finally the point in time where I would feel confident investing as the negative percentage is just over ¼ of the time. Not only does that mean that I will have more than I started with about ¾ of the time, the average amount that I would have is 11.52%, not including dividends, and the mean is about 60 points higher coming in just over 12%. That means that my $10K would be about $11,200 before dividends, so let’s just say about $11.5K assuming a dividend yield of 2%, which is the S&P 500 average currently. To me, it’s worth the risk at this point.

- 24 Months – Similar to the comment above, it’s worth the risk, but even more so now with the longer time horizon.

- 30 Months – Ditto my comment on 24 months.

So, to summarize the data, it really just comes down to your own personal timeline, risk tolerance and need for the money. Emergency Fund? Never going in. A new car when I already have a great working car? Maybe down as early as 9 months potentially! If I didn’t have a car at all and needed one in the immediate future? Then similar to the emergency fund, the answer is never!

If you don’t truly understand the ‘why’ then you’re never going to actually be able to find the investing strategy that works for you, and that really is the foundation of personal finance.

You absolutely can use the stock market to invest for your short-term financial goals as long as you know that ‘why’ that I keep hammering on. If you don’t know it then you’re going to be in deep trouble from the get-go.

I encourage you to do exactly what I just did if you want to try to invest for your short-term goals, so let me boil it down in 4 simple steps:

- Cut your expenses

- Increase your income

- Determine the ‘why’ for your short-term financial goal

- Decide on your risk tolerance and timeline

- Choose an appropriate investing strategy

If you can follow those five simple steps then you’re going to be golden. It’s really not that different than any other sort of investing so I really encourage you to try to define your ‘why’ for anything you do financially, like ever. Having that ‘why’ is what is going to turn those things from dreams into goals into reality.

Don’t wait around – start now! Every year, month, week or day that you wait is costing you money. Don’t believe me? I promise I’m telling you the truth – the sooner you start, the richer that you and your family will be!

Related posts:

- 6 Must-Follow Wealth Creation Steps to so You Can Retire Early Do you find yourself in a situation where you’re having no issues living within your means, but you’re really not just getting close to financial...

- Handy Andy’s Lessons: 3 Methods to Save Money from Your Salary I often hear that people can’t save money because they have none. For many people, this likely isn’t true. Instead, they likely don’t have the proper...

- So You Bought a New Car…That Might’ve Been a Great Financial Decision After All! I have frequently been told that buying a new car is a huge financial mistake but honestly, sometimes I wonder if that actually is the...

- Hey Andy – Help Me, I’m Poor! Have you ever just opened up your bank account and felt absolutely helpless? I have. Maybe you’re sitting there thinking, “Help me, I’m poor!” Regardless...