Investing right now is a very scary time with all of the uncertainty that is surrounding the coronavirus. In a recent episode of the Investing for Beginners Podcast, Andrew and Dave opened up the floor to answer some listener questions and there’s one that I really wanted to focus on that discussed the short-term liquidity of a company.

The market is all over the place right now and many businesses are going months, and maybe longer, without any revenue at all. A lot of retailers have completely shut their doors along with all movie theaters, cruises, airlines, etc. Many restaurants are completely closed or doing takeout only.

Example: Lost Revenue from a Pandemic

I went to Chipotle yesterday and there were 20 people waiting outside, social distancing, for their orders to be picked up. People were there for over an hour because the staff was so behind because the staff also was social distancing, meaning less people on the line making your orders. It was insane.

I applaud Chipotle for the steps they’re taking but I also will not be back until it’s normal or I will only order delivery, because it’s not worth me standing outside for an hour, plain and simple.

So, let’s think about Chipotle here – they’re obviously losing sales because people can’t dine in, and they can’t serve customers as fast as they want so they will lose customers, like me, that determined it’s not worth the wait.

And I want to specifically say that I had a bad experience, but it was absolutely not to blame Chipotle, and I actually appreciate waiting longer to know they’re keeping their employees safe, who all had masks on, by the way…but that still doesn’t make it worth my time to wait.

So, if you’re an investor in Chipotle, how do you know if the company is going to be able to stick it through the coronavirus?

Well, the short answer is you want to make sure that Chipotle has enough cash and other assets to cover their liabilities that might come up until things you can get back to normal.

Simple, right?

Andrew and Dave hit on a lot of different ways to be able to find out if a company is poised to be able to handle these tough times and I really want to take a deep dive into a few different points that they mentioned:

Quantitative Factors

As you know, I am a big numbers guy, and I think that there are two great ratios that will help any investor measure a company’s balance sheet health, especially in the short-term:

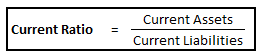

Current Ratio

Essentially, the current ratio will measure the liquidity of a company’s working capital. We’re taking the current assets and dividing it by the current liabilities to strictly show the company’s ability to cover their short-term liabilities, aka their likelihood to survive if something catastrophic happened and no revenue was coming in whatsoever.

If you had asked me how likely this was 6 months ago, I would’ve said that the importance of the current ratio is overblown. If you asked me now, I would say that it couldn’t be more important.

In essence, the higher the current ratio is, the healthier the company is. The goal for current ratio is anything over 2, meaning that the company can adequately cover their short-term liabilities two times over. This might seem high, but I will talk a little bit more about why this is a 2 with the next ratio…

Of course, higher than this is always welcomed as sometimes long-term liabilities can become short-term if the lack of revenue goes on for a while. Or, maybe even it’s no revenue now but severely limited revenue later.

I don’t know about you, but I have zero desire to get on an airplane and rub elbows with someone for a few hours. Going across country? I’d change my plans. Or maybe even drive. Not worth the risk to me, but those are the exact decisions that are going to haunt airlines, hotels, cruise lines, and even restaurants when you think that patrons might be hesitant to go out to eat, or maybe even the restaurants will move tables further apart from one another than normal, meaning less customers.

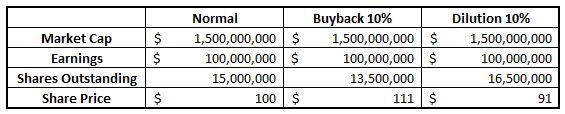

Quick Ratio

The quick ratio is similar to the current ratio in that it also measures the liquidity of the company, but as Cameron said, it’s comparing the “most liquid assets on the balance sheet such as cash, marketable securities, and accounts receivable (A/R) compared to the total current liabilities.”

I distinguish the quick and current ratios by thinking the ‘quick ratio’ is essentially how quick that I can get my money. For this same reason, it’s also called the acid test as “it measures the company’s ability to quickly dissolve/liquidate its liabilities as could be done with acid.”

The main difference is the fact that the quick ratio isn’t taking inventories into account which I think makes a lot of sense. For the most part, your inventory is something that is going to be replenished, right? So, taking inventory into account is like robbing Peter to pay Paul. Don’t account for inventor as an asset if as soon as you sell that inventory you’re going to have to pay for more – that makes no sense.

Now, if the company is totally shutting its doors, like a restaurant, sure, you can take out the inventory because I hope they’re not ordering more fresh food to that restaurant until they’re generating revenue again.

In general, my target for a Quick Ratio is anything over 1, meaning that after taking out the inventory, the company can cover their current liabilities with their current assets.

Both the quick and the current ratios are ratios that I will always use when I am running a stock screen.

Qualitative Factors

On top of the quantitative factors that might indicate a company’s short-term strength, I think that Andrew brought up some great qualitative factors.

Hilariously, I actually just wrote an article about an 8-K saying that I didn’t think there was a lot of value to them since you can get most of that information on any sort of stock market publication. While I do think you can get that information there, I would like to formally redact my statement and admit my wrongdoing!

Lol.

An 8-K 100% has its place in the investing world, and I was quick to pile on when I shouldn’t have. Sure, you can get a lot of information from a stock market publication, but it’s different than coming from the source.

A lot of companies are now putting out an 8-K to give some sort of updated guidance on the quarter or the year and I think that it’s great that they’re doing it. That Yahoo Finance article that you read isn’t going to give you all the details that you want – it’s just going to grab the highlights.

The 8-Ks are a great source of more detailed information, and still extremely short (like most are less than 1 page of reading material) that I highly recommend you read. Go to SEC.gov and type in a few of your companies and just see what you find!

But the two questions that Andrew brought up in the podcast episode that stuck out to me, which re both able to be discovered in an 8-K, are below:

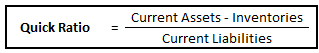

- Is the company diluting shares?

- Are they selling bonds?

If the company is doing either one of these then that means they’re actively finding a way to try to strengthen the long-term position of the company through debt.

Personally, I am very concerned if my shares are being diluted and you should be too! Essentially, the company is issuing more shares to be purchased and you now own less of the company.

As you can see in the hypothetical example below, just as buying back 10% shares would give you a 10% increase on your position, a 10% dilution would take away 10%, theoretically, over time.

Of course, this is not a guaranteed situation as company’s stock price seems to never be completely logical in how it is traded, but in essence, the company is selling shares of their company that didn’t previously exist, to generate more income.

If stock buybacks and dilution doesn’t come naturally, don’t worry. It can take some time, but I always find it very helpful to go through some different examples

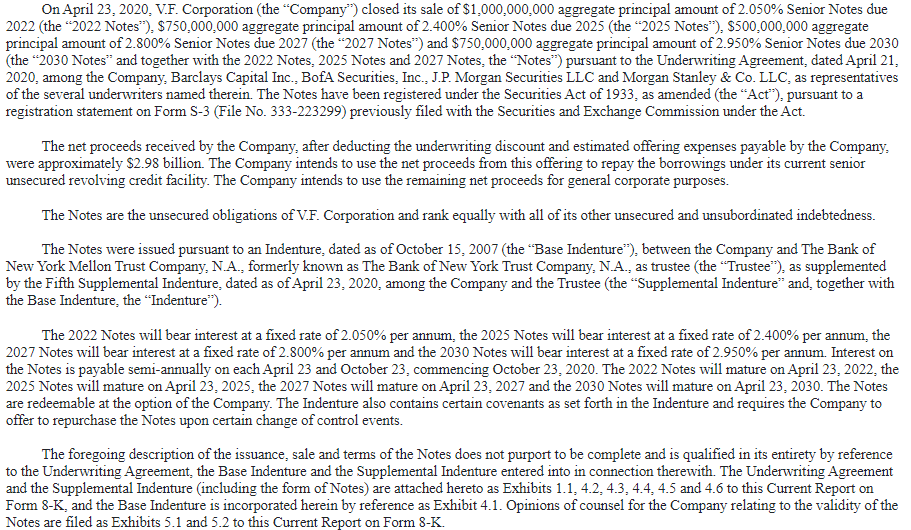

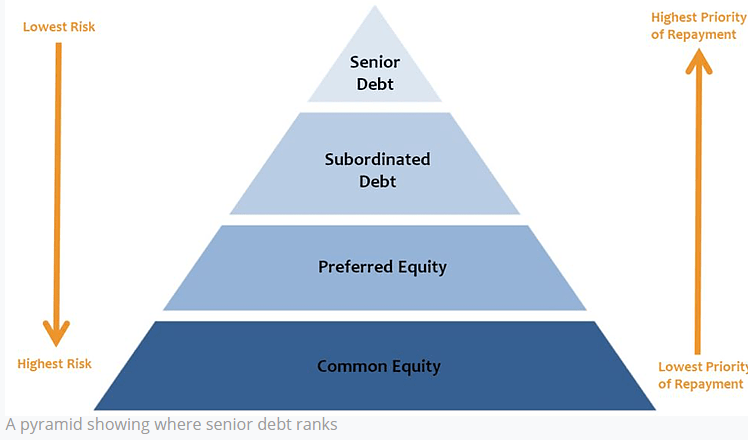

The other option that I mentioned is if the company is selling bonds, or perhaps senior notes. You might be wondering what the heck senior notes are, and to be honest, I was too until all of this coronavirus news started occurring. It’s things that I just never knew as I didn’t come from a financial background, but things that are great to know, especially as an active investor.

Essentially, senior notes are debt that a company is taking on that has a very, very high priority of being paid if the company was to go bankrupt. This isn’t terribly concerning to me as an investor, much less concerning than share dilution, but it does mean that, yet another form of debt has leapfrogged us in the line of recouping any value if the company was to go bankrupt.

The Corporate Finance Institute put out a really good graph to show where investors, or ‘common equity’, would fall into the pecking order if a company was going to go broke. Spoiler – it’s not good! And this isn’t the bottom of the pyramid type of good like the bottom of the food pyramid is…

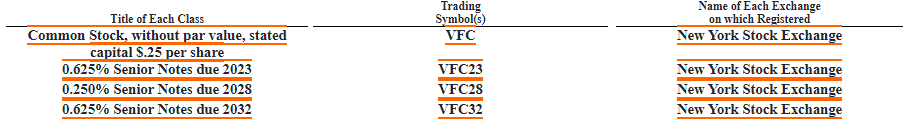

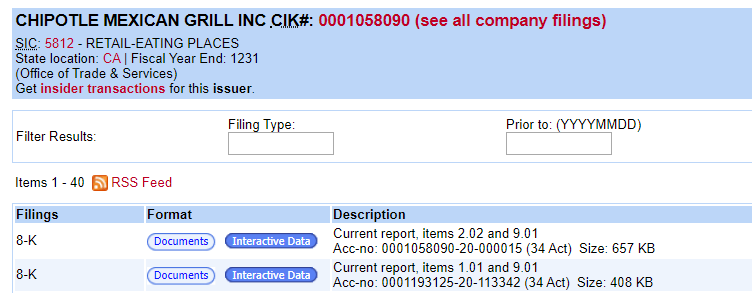

If you go to SEC.gov and type in the company that you want to view, you can see their 8-K. Below are a couple screenshots that I took from SEC.gov regarding the V.F. Corporation 8-K that was recently announced where they were closing their sale of senior notes:

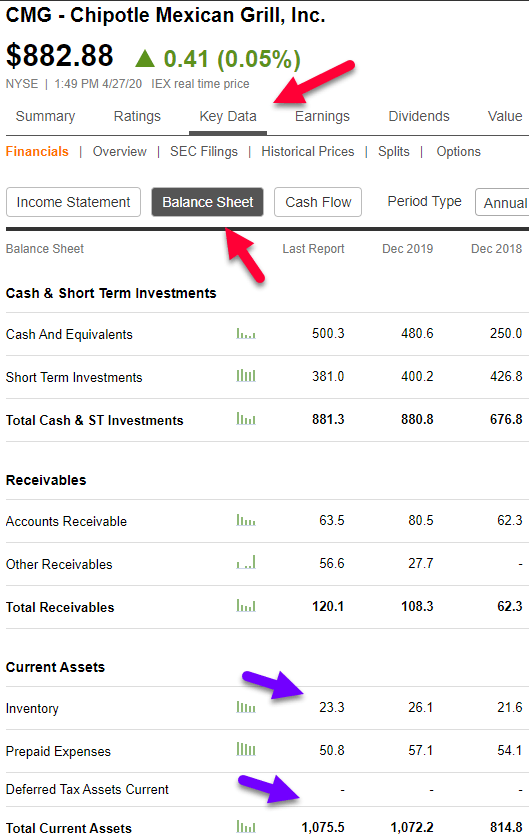

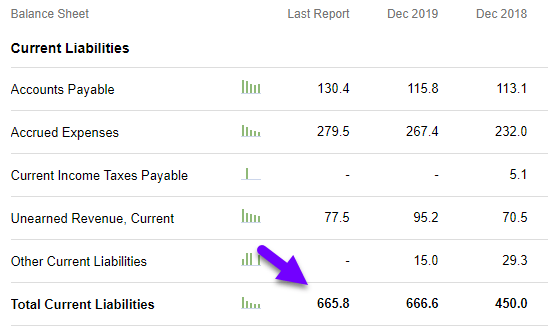

So, how do we apply all of this information then? Well, I talked about Chipotle, so let’s start with their quantitative ratios. I went to Seeking Alpha and typed in CMG to get the Chipotle information. Then went to ‘Key Data’ and ‘Balance Sheet’ and ended up here:

I put red arrows on the different areas that you need to click to help guide you and then I put blue arrows to get you the appropriate numbers that you need to find! Essentially, it’s three different numbers:

- Current Assets – $1,075.5 Million

- Inventory – $23.3 Million

- Current Liabilities – $665.8 Million

So, let’s do the math:

Current Ratio = Current Assets/Current Liabilities = $1,075.5/$665.8 = 1.62. The goal here, as I mentioned, is over 2, so that is not quite ideal.

Quick Ratio = (Current Assets – Inventory)/Current Liabilities = ($1,075.5 – $23.3)/$665.8 = 1.58. That’s a great quick ratio!

Now, onto the qualitative data! You can also stay on Seeking Alpha if you’d like but I prefer to go to SEC.gov so I can get it from the source!

Oh, look! There are two recent 8-Ks out, indicating significant news:

When I click on the ‘interactive Data’ tab, I can then find the following by clicking ‘8 K’ once again:

Do you know what these two announcements mean to me about the liquidity of Chipotle? Absolutely nothing, and that’s exactly how I want it to be!

So, overall, Chipotle isn’t announcing any sort of note or debt issuings, they’re not diluting shares, their current ratio is a little bit low, but their Quick Ratio is high, which in this environment, I find equally as important if not more important. The two ratios are very similar with the exception of Inventory, and with Chipotle being right in the middle, I would trust the short-term liquidity of them if push came to shove.

I also am thinking about some more qualitative data such as how they could further reduce inventory if needed, lay off workers, and sell locations if they absolutely had to, but selling stores is more long-term focused. And then again, I don’t think their demand or revenue will ever go to 0. Chipotle has a cult-like following, as I experienced with the crowd standing outside, and now that so many places are delivering, I think that this is a delivery proof type of meal – it won’t get soggy, cold (half the ingredients are already cold), or stale.

So, would I invest in Chipotle? It’s still wayyyy too early to tell. All that I’ve evaluated is if I think I would keep them in my portfolio during the coronavirus, and to that question, the answer is a definitive YES!

Related posts:

- Short-Term Debt: Evaluating Financial Strength and Cash-Generating Growth Updated 2/7/2024 Short-term debt and current liabilities are often combined into the same bucket. When calculating a company’s debt-to-equity ratio, most investors use the total...

- Ratio Analysis: Easy Way for All Investors to Determine Company Health Using ratios for analysis is a time-honored tradition in finance. These ratios can help you compare your company and your performance to others in your...

- Why Inventory Turns Are Key in Evaluating a Company’s Gross Margin Business strategy is not binary. High gross margins are good, but just because they are higher doesn’t always mean a company has a better strategy....

- How the Altman Z-Score Formula Can Help Avoid Crippling Bankruptcies In this post, you’re going to learn precisely how to use the Altman Z-score formula to avoid companies on the verge of bankruptcy. This guide...