Don’t let friends call you cheap because you are good at saving money. Here are some frugal tips that won’t change your life, and save you some cash.

Before I get going, I want to start by saying there is a big difference in being frugal and being cheap. Today I want to give you some frugal tips that help you save some money, but I don’t want to give you the expectation I’m going to teach you to be cheap.

To me, there is a huge difference. Being frugal is trying to find alternative ways to supplement what you have with a cheaper option. Being cheap is just going without or withholding money from someone because you want to keep it.

Unfortunately, I have those grandparents who are cheap and still only tip 10 percent at a restaurant. Truthfully, they don’t know better and don’t do it on purpose, but anytime I’m going out with them I make sure to have some cash to leave behind.

I’m not going to ask you to walk up to a manager and ask for a discount on an item just to see what they say, but I’m going to give you some ideas and habits to adapt to that can save you money long-term, and not change the quality of your life.

We all know someone that spends every dime they make (and more possibly), and we also know someone that won’t spend any of their hard-earned money and they just want to save everything. Neither is a healthy strategy, but finding the perfect balance following some of these frugal tips can make life much easier to enjoy.

Start A Budget:

One of the best frugal tips I can give you is to start a budget. I don’t care if you are trying to save more money per month, a budget is a necessary item for every single person in the world if you ask me.

Think about it, how do you plan for things if you don’t know how much money is coming in, and how much money is going out every single month?

You can keep it as simple as money in and money out each month. This will at least let you know if you are making more than you are spending, but I would recommend digging deeper. A budget is only as good as the effort you put into building it.

To really get value and have the ability to cut costs, you need as much detail as possible. For my budget, I have nearly 20 categories that include: car payment, mortgage, cable and Wi-Fi, entertainment, groceries, eating out, kids’ expenses, and utilities. You can tailor a budget to your needs and pick the categories that work best for you, but the more categories and details, the better.

I use this frugal tip to save my family a lot of money. A prime example would be the grocery store. I may see that last month we spent $1,000 (or $200 a week) at the grocery store. I can challenge my wife (who does most of the shopping) to spend no more than $180 a week to save the family $80 per month.

Again, I’m not telling you to go without, but you’d be amazed at how much you can save with a budget because you realize all the waste you are spending.

I started my budget about five years ago (three years later than I should have), and I can promise you it has saved me thousands. The first month I started to budget, I realized I was paying $8.99 a month for satellite radio in a car I no longer had. Yep, over $100 a year I had been spending and not even using it.

Of all the frugal tips I give, please remember to start a budget no matter what.

Utilize Auto Transfers:

Frugal tips can often lead to a little bit of additional work. You may have to create a budget or monitor what you spend in order to effectively save some money. However, I do have one tip that is a very minimal amount of work, and that is the auto-transfer feature in your online banking.

Remember, pay yourself first, and then live off the rest. Often if you try to just move what you “saved” for the month to your savings account, you’ll find a good reason to spend it. If you transfer a set amount to your savings at the beginning of the month, you can then adjust the monthly budget off your remaining income.

For the first six months, I had a budget I was paying myself at the end of the month with what I had left. I often had $120, or maybe $180 left at the end of a month because of various expenses.

Then one month I set up an auto-transfer on the second of the month. It automatically pulled $250 from my checking and put it into my savings. The first couple of months I had to adjust and was pushing it towards the end of the month, but now it’s just become a habit for me. I know exactly how much I’m going to save each month.

This strategy also makes it much easier when you want to give your savings a raise. It’s hard right now because inflation is so high and eating up additional funds, but I try to increase it by $25 every six months if at all possible.

Increasing is great, but don’t forget, you can also change this to less if needed. We all have varying circumstances that arise, and this can also be looked at as slush fund money, which is also an added benefit. Just three months ago, my daughter had a tooth removed and it cost me $800 out of pocket. For that month, I skipped the savings and put it towards the doctor’s bill.

Shopping Off-Brands:

Before I get too far into this, some of you are going to call me out that this is indeed being cheap, but one of the best frugal tips I have learned is to shop the off brands at the supermarket. FULL DISCLOSURE: this is not okay for all items.

I still need my Charmin toilet paper, Kellogg’s Frosted Flakes, and Diet Pepsi, but there are a few items that you will never know the difference if you try. I hate myself right now for sounding like my own mother 20 years ago trying to feed me off-brand chips.

In my house, nutri-grain bars, bread, milk, mac and cheese cups (I go through about 40 of these a week with two kids), cheese, and ice cream are all store brands. There are a ton of other items in my house, but these are the ones that instantly come to mind.

The mac and cheese cups I buy of a store brand are 50 cents less per individual cup compared to a Kraft brand. I legit go through 40 a month, or $20 in savings just in one food item. I’m not saying you are going to become a millionaire with this practice, but every small amount adds up and with inflation so high, a five percent reduction in the weekly grocery bill can add up quickly.

Prepare Meals at Home:

Keeping things close to the grocery store, the biggest tip I can give you to help save money is to eat at home. Listen, I’ve been on both sides of this. I was a DINK (double income with no kids) for three years. My wife and I ate out constantly, and I still had time to work out whenever I wanted so I didn’t gain weight (that much anyway).

I also travel a fair amount for work and get to eat out for that as well. It becomes a chore, and then you start to constantly feel miserable after huge meals. Just try eating at home. The average meal at home is anywhere from 10 to 25 percent of the cost of eating out, especially if you want to have an adult beverage that has outrageous markups.

I promise I’m not being cheap. My family still enjoys eating out and it’s a practice we do at least once a week. But, by cutting back on eating out, not only are we eating healthier, we now really look forward to going out to eat on a Friday or Saturday night with the kids.

If you’re 25 and single, you’re laughing at me right now. If you’re 35 and have a couple of kids, you totally get it. Your grocery bill will go up, but it still won’t be nearly as expensive as eating out five or six times in a week.

Utilize Marketplace:

When it comes to frugal tips, utilizing a place like Facebook Marketplace or having a garage sale can really add up quickly, especially if you have kid’s stuff. My wife and I had been talking for months about going on a nice vacation, and with everything else in our lives, we just felt like we couldn’t afford the vacation we wanted, so we didn’t go.

I didn’t pay much attention, but my wife started cleaning out the basement, cleaning out the closets, and cleaning out all the kids’ stuff. Then before I know it, people are showing up to our house at all hours of the day and are interested in buying all our stuff (I called it crap).

I figured she was giving this stuff away, but after about two weeks, she came into my office and handed me an envelope with over $1,000 in it and said “we need to go away for the weekend”. By taking the time and cleaning things up, taking pictures, and listing items for sale, she not only cleaned up our house substantially, but she also made a fortune in doing so.

We paid for a flight, and three nights of a hotel with this money and then only had to pay for food in a long weekend to Miami. This was literally the stuff that I would have thrown away had I got the chance, but instead I got a nice weekend away.

I’m telling you; one man’s trash is sometimes another man’s treasure. If I was cheap, I would have told you to cut out vacations, but a great frugal tip is helping you find a way to pay for that vacation we all deserve.

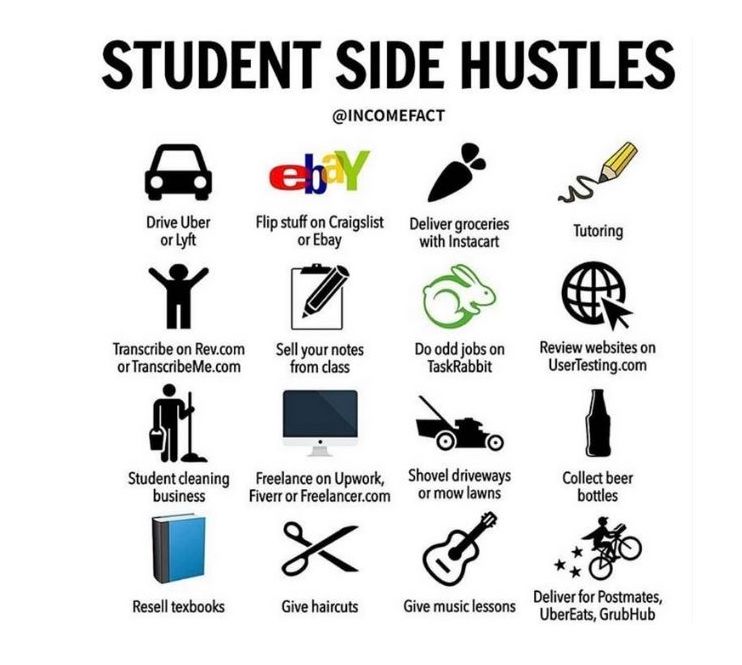

Start a Side Hustle:

Frugal tips don’t necessarily have to be ways of cutting costs, it can also be a way of increasing your income stream for the month. So, if you want to save money, one option is to cut your cost, and another is to increase your income.

I do not recommend just going to your boss and saying you need a raise (unless you truly feel undervalued), so often it’s easier to create a side hustle to increase monthly income.

For me, it’s side jobs. I enjoy writing these articles, I enjoy yard work, and I don’t mind painting. These are all things that some people despise doing and are willing to pay for. I have a 40-hour a week job already, so I’m not looking for another 15-20 hours of work, but I certainly don’t mind the side project here and there.

By doing the three items listed above, I was able to bring in nearly $1,000 a month on average of additional income per month. What I do with that money is put it right into the kid’s college accounts. The side hustle allows me to not have to pull from my standard monthly income to prepare for my kid’s college education, and I’m still able to put a good chunk of money away for them.

One thing I have learned: don’t start a side hustle to strictly make money. If you already have a full-time job, find something that you enjoy doing. One job is enough, anything else should be something fun, that you just happen to get paid for.

With daycare costs so high, my wife decided to stay home after our second child. We still wanted our oldest daughter to have some interaction with kids, so we send her to a playgroup once a week. My wife was sick at the thought of not working and paying for the playgroup, so she started baking cookies and decorating them for sale, in order to pay for the playgroup each week.

Remember these frugal tips don’t make you cheap, they make you smart for trying to save as much money as you possibly can. Happy savings people!

Related posts:

- Monthly Budget Busters: Saving Money by Cooking at Home Sometimes the smallest thing can make the biggest difference. See how saving money by cooking at home can have more than one positive effect. Have...

- Tips on Mastering the Art of Eating Out on a Budget Are you a person who has a hectic evening life? Are you constantly running around in the evenings and thinking about what you can eat?...

- Useful Tricks to Form Good Money Habits into Natural Decisions One thing is for certain, there are good money habits and there are bad. It seems like everyone has at least one bad habit (me...

- How to Use the Doctor Budget Tool to Set Your Finances Straight Recently, I was fortunate to be invited on the Investing for Beginners Podcast and talk about my personal finance experiences and introduce Doctor Budget to...

/what-makes-for-a-successful-budget-1289233_final-e4113f80d04442e18e3b6995561820c5.png)