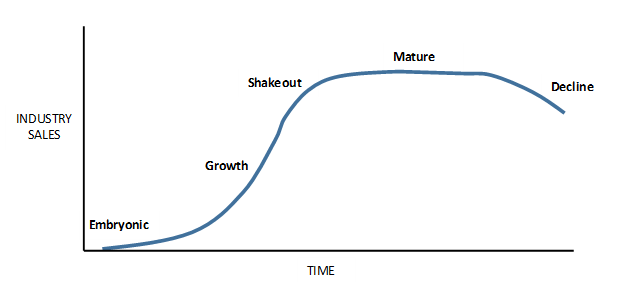

Understanding what stage of the life cycle an industry is in can help investors assess the valuations, risks, economics, and competitive forces that are being seen in individual companies and the industry as a whole.

Company growth prospects and valuations tend to be affected by the various animal spirits seen throughout the cycle which can all have a big effect on the risk return trade-off seen at different stages.

This article will discuss the stages of the industry life cycle while also using the cannabis industry as a real world example for some fun.

1) EMBRYONIC – During this pioneering stage in the industry life cycle, the industry’s product or service is in its infancy and just being introduced for sale or still being developed. As demand for the industry’s product or service is not yet fully established, economies of scale are weak and companies will be at their least profitable point. Revenues might be slowly ramping up or not yet meaningful at all.

The need for financing at the embryonic stage is probably at its highest and most risky as companies are scurrying to build out their operations as well as investing lots of money in research and development. Most of the capital being invested at this point tends to be private and businesses are still widely held by initial founders. Needless to say, the embryonic stage could be considered to be the riskiest stage for investors as companies, and even their product and services, are still unproven.

Merger Type for Embryonic: Larger businesses in mature or declining businesses seek out new innovative products and services to add to their offerings through horizontal or conglomerate type acquisitions. Smart young companies might combine to gain efficiencies by scaling resources and conserving capital towards growth opportunities.

Example with the Cannabis Industry: Most of the cannabis industry is still in its development stages and sales are next to non-existent apart from medical. Smart capital is building up the licenses and resources to be able to sell products come legalization. Some initial companies might start to IPO in order to raise capital and merge to scale up. Two great examples of an early mergers would be Canopy Growth’s $430 million acquisition of Mettrum Health back in 2016 and then Aurora’s $1.1 billion merger with CanniMed Therapeutics in January 2018 before full legalization.

2) GROWTH –Entering the growth stage, the industry’s new product or service is beginning to catch on with consumers. As the saying goes “a rising tide lifts all boats” and sales across all companies in the industry are generally growing at their fastest pace. With the growth in sales, economies of scale are finally starting to be achieved and profits can start to reach the bottom line.

During the growth stage, the general public not only starts to get interested in consuming the industry’s products but the investing public also starts to pour money into the new industry as well. At this point, some of the small private businesses which stayed private during their infancy will start to seek IPOs as the valuation of the business increases.

This inflow of new investor attention and money, combined with the current high growth rates seen in the industry, can lead to lofty and sometimes “bubbly” valuations. Investors tend to project the current high growth rates out into the distant future and assume mass adoption of the company’s products. The risk here for investors is that a bubble is being created due to all the new attention and that the growth forecasts are aggressive. Prices-to-earnings ratios seen can generally be at their highest of the cycle in the growth stage and can easily reach into 100x area.

The economies of scale that are being achieved and the new money flowing into the industry can also have the effect of allowing companies to lower prices across the industry. These declining prices can then further help generate consumption of the industry’s products or services which then amplifies the industry growth. However, the declining prices also instigate a need to have efficient operations. These changing competitive forces lead us to the next stage in the industry life cycle.

Merger Type for Growth: Interest in the industry from both retail and commercial players is building with private companies starting to IPO and conglomerates making growth acquisitions. Businesses selling similar products also start to feel the competition and make horizontal acquisitions to expand into new growing areas.

Example with the Cannabis Industry: The partial 38% acquisition of Canopy Growth by Constellations Brands is a great example of a horizontal merger where, as a big brewer, Constellation Brands would be expanding into a very similar business. Businesses raise a lot of money in this period and the abundance of capital flowing to the industry leads to large capital investments for production.

3) SHAKEOUT – The growth in demand for the industry’s products and services begins to slow and reaches saturation. The new investor capital that flowed into the industry during the growth stage has not only created economies of scale for some businesses but has also created the problem of industry overcapacity as businesses have invested too much capital by overestimating the industry’s growth and their company’s share of the pie. As growth and profit estimates come back to reality, so do company valuations. If there was a bubble created during the growth stage, it is now bursting in the shakeout stage.

In the shakeout stage, the economies of scale and overcapacity lead to a continued decrease in the price of the industry’s products or services. The companies which have put the most work into being efficient operators start to see their hard work show up in bottom line net income and positive cash flow from operations. Less efficient operators will struggle to generate positive cash flows in the new competitive environment.

The new investor capital that was flowing into the industry during the growth stage has dried up as the previously mentioned optimistic growth projections become obvious in the saturated market. The less efficient operators who are not able to generate positive cash flows, and are no longer able to raise new investor capital, will be forced to liquidate. The overcapacity that existed is slowly stabilizing as the weak businesses get weeded out.

Merger Type for Shakeout: The maturing but still young businesses participate in mergers and joint ventures to leverage fixed costs and become more efficient operators. Horizontal and conglomerate type purchases continue at what are probably better valuations. The weakest firms might go bankrupt with their assets bought at auction.

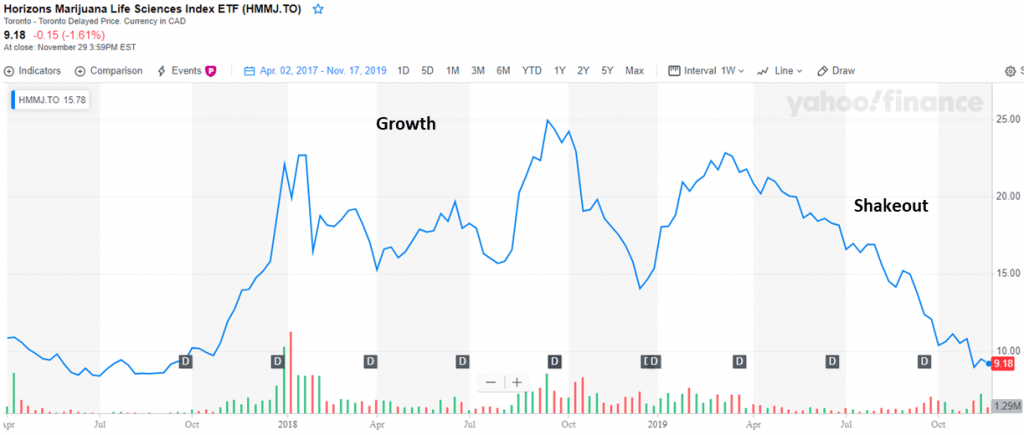

Example with the Cannabis Industry: This is the stage that we probably sit in the cannabis industry as of the writing of this article. December 1st, 2019. Valuations across the industry have crashed as can be seen in the graph of a cannabis ETF below. Investors have woken up to the fact that sales are stagnating and new countries and states are not legalizing as quickly as one might hope. The flood of capital in the growth stage has also created overcapacity in production which has brought prices down, such as Hexo drastically cutting prices recently.

Sources from Yahoo Finance

4) MATURE – The drama, and sometimes carnage, seen in the shakeout stage has made way for an overall more efficient industry. The industry has seen consolidation among competitors with inefficient operators being acquired on the cheap during the shakeout stage. More economies of scale have been achieved and brands are created that are able to allow for some marketing power. The overcapacity issue has been resolved and businesses are now making a healthy profit.

Competition is still alive and active with businesses competing for market share and relevance. A sustainable research and development budget is key so that core products can have different versions to ride innovative waves within the industry. There is no easy recipe for long-term success but focusing on the businesses key competencies is among my personal favourite. Without putting a timeline on all the stages, the maturity stage should, hopefully, be the longest and most prosperous.

Merger Type for Mature: The merger and other shakeout type activity seen in the prior stage have resulted in a more efficient market but competitors continue to seek economies of scale and brand power in mergers to further consolidate the industry. The quest for more efficient operations makes some businesses experiment by moving forward or back in the value chain with vertical acquisitions.

Example with the Cannabis Industry: The best capitalized and most efficient companies have survived the shakeout stage and start to make acceptable profits in a more efficient market. There will start to be stable return on capital as with other consumer staple and sin stocks. Brand recognition will help cannabis overcome its commodity type properties. Companies will also move vertically in the value chain such as having their own retail shops or cafes. Growth will be sporadic but above GDP over the long term as legalization slowly continues to spread. Competition from new entrants downstream will continue to be a reoccurring theme due to low barriers to entry on the production side.

5) DECLINE – Consumer tastes or technology are starting to change and the business or industry in general has not been able to keep up. Companies and the industry are still profitable as a whole but are starting to be squeezed among shrinking revenues. The importance of becoming an efficient operator with brand power increases greatly as the pie is shrinking.

Products might be getting irrelevant or certain businesses might have been left behind the times. Profitability in the industry slowly dies off and share prices suffer in the markets. Efficient operators still with a healthy and profitable business, albeit shrinking, might slip back into the hands of private capital to be leveraged up or slowly chug out earnings to the public for years to come.

Merger Type for Decline: Vertical integration will continue to play out as companies try to squeeze every dollar out of the value chain. The life cycle comes full circle and our now declining business are looking to invest in the hot new start-ups to diversify out of their industry. This reallocation of the capital budget towards acquiring new businesses could be in the form of either horizontal or conglomerate. Additionally, founding shareholders might try to take their old company private again at with low valuations hoping to squeeze more out of the business.

Example with the Cannabis Industry: The cannabis industry could be one of those long lasting consumer staples businesses. However, that does not mean an encroachment similar to that we are seeing from craft brewers pressuring the powerful brewers will not take place in the cannabis industry. Long-term growth once the market is saturated could probably be considered to be population growth plus inflation.

Related posts:

- Business Moat: Essential for the Consumer Goods Industry in a Price War With the emergence of Amazon as the dominant eCommerce retailer, the companies in the consumer goods industry have never needed a business moat more than...

- The Meaning of a Cyclical Industry Explained for Beginners The economy moves in cycles. Good times and bad. Because of this, the stock market also tends to move in cycles. A cyclical industry is...

- Industry Breakdown: 3PL Logistics “The amateurs discuss tactics: the professionals discuss logistics.” –Napoleon Bonaparte Military leaders understand that without logistics, successful campaigns would never win the wars. In World...

- Industry Map of the S&P 500: 11 Major Sectors and 50 Businesses Creating an industry map shouldn’t be an arduous task with some basic research, especially with all of the tools available on the internet today. Here’s...