I’ve decided that I’m going to start a few “hot tip” type blogs and call them “Handy Andy’s Lessons.” This is likely to change because I kind of already hate the name, but oh well.

The first topic that I want to write about is starting a dividend portfolio. This topic came to me after listening to Episode 142 of the Investing for Beginner’s Podcast. In the episode, a listener had asked about starting a dividend portfolio. Dave and Andrew gave their thoughts, and I wanted to contribute to the conversation.

Click to jump to a section:

- Have the Right Mindset

- Dividend Reinvestment (DRIP)

- Why Have a Dividend Portfolio?

- Invest in Dividend Aristocrats

Have the Right Mindset

Personally, I think that there are two different thought processes you can have when starting a dividend portfolio:

1 – Create a portfolio of great great companies currently paying a dividend

2 – Create a portfolio of companies with the potential to pay a great dividend

Having the right money mindset is key to maximizing your gains in the market.

The difference here is whether you want a company that has already made it to the top or if you want to identify a company that will get there eventually.

If you’re looking for a steady source of income right now, option 1 is your best bet. You can rest assured that you will earn a solid income right away.

I have ~30 years until retirement, or hopefully less. So I want to find companies that are not great dividend payers currently but have the potential to be. This makes option 2 more appealing.

I can invest in them before they get that ‘dividend clout.’ Its price will likely soar at this point, and it won’t be as good of a deal. Getting in early maximizes my future gains.

In other words, I’m trying to beat the market to the punch of identifying some future Dividend Aristocrats. I wrote a blog that outlines how to build a dividend growth portfolio with tomorrow’s Dividend Aristocrats.

Don’t believe that this is something that I actually do? Check out one of my accounts on Fidelity:

See what I mean?

This is an active practice that I partake in currently, trying to find the Dividend Aristocrats of the Future, to set myself up for future success.

I call it ‘DAF’ for fun…and because I’m an idiot lol.

Dividend Reinvestment

The beauty of a dividend portfolio is that if you utilize DRIP, or dividend reinvestment plan, your stocks will continuously compound. With DRIP, when dividends are paid out, they are immediately used to buy more shares of that same company.

Think of dividend reinvestment as a second form of compounding. Even when the value of stocks fall, you are compounding gains through dividends. Plus, most long-term dividend stocks increase their dividend annually, effectively giving you a raise.

It really is a beautiful thing, to be honest. Plus, it hits on the major points of investing in dollar-cost averaging and compound interest, as well as selecting companies that will continue to provide you with wealth throughout your career.

While that’s all fine and dandy, Handy Andy is here to teach you how to do this.

Why Have a Dividend Portfolio?

So, first off, why would you even want to start a dividend portfolio? The beauty of a dividend-paying stock is that the company will continue to distribute a portion of its earnings each quarter to the shareholders as a dividend.

Many shareholders will use this to reinvest in the market, either back in that same stock via DRIP, or taking the cash and deciding where to allocate that money. Some people, however, will use the dividend as an income stream to live on. Let me show you an example:

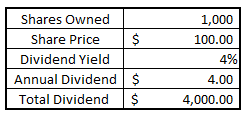

If a company were trading for $100/share on the stock market and had a dividend yield of 4%, you would make $4 off of every share as $100 * 4% = $4.

Let’s imagine that you decided to try to live off this money, and you owned 1,000 shares of this fake company:

As you can see, your ownership in this company would’ve given you $4,000 over the course of the year. Now, of course, that’s likely not enough for you to survive on. But the point is that these gains were generated from no additional input. The stock didn’t even have to go up. You simply had to own the stock and collect dividend payments.

It is important to know that a dividend is never guaranteed and can be revoked by the company at any time. So never rely on this for 100% of your income because you could be in bad shape.

Invest in Dividend Aristocrats

So, if you’re looking to create a dividend portfolio, I think Dave is spot on when he recommended that you check out the Dividend Aristocrats.

These companies are in the S&P 500 and have at least 25 years of consecutively growing their dividend, so they have a fantastic track record. I’d recommend checking some of them out and seeing if any catch your eye.

You don’t need to go this in-depth in your analysis necessarily, but you should have a solid understanding of the company, the industry, and the financials.

Of course, I have to plug values into the Value Trap Indicator. This is truly the best tool I’ve used to see if a company is undervalued compared to its intrinsic value and identify if you should buy the stock or not.

The beauty of the VTI is it teaches you to read a balance sheet at a very high level and understand the numbers. At the same time, it keeps you from getting too in the weeds.

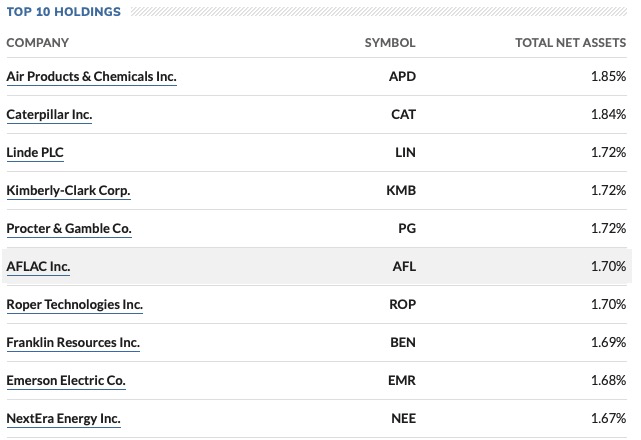

Normally, I am not the type of person to suggest buying an ETF. But in some cases, I think it can be a good decision. The ETF with the ticker NOBL is a Dividend Aristocrat ETF and could be a way for you to start your portfolio without getting overly specific into one company. Check out their top 10 holdings below from MarketWatch:

I think that anyone has the ability to beat the market, so I always recommend that you try to find individual stocks. But as you’re starting out, an ETF could be a great option for you until you become more comfortable and familiar with the market.

I mean, you’re trying to create a dividend portfolio – why not start out with a portfolio of Dividend Aristocrats?

Related posts:

- Dividend Reinvestment Calculator to Plan Your Expected Returns (Excel) One of the most powerful forces behind building wealth in the stock market comes from the compounding effects of reinvested dividends. As investors, it’s important...

- 7 Compelling Arguments for Dividend Reinvestment vs a Payout in Cash Is the income stream from dividend payouts the best part of dividend stocks? Not always. Taking that cash instead of reinvesting it leaves serious returns...

- Qualified Dividends are Your Way to Minimize Tax on Reinvested Dividends! Long story, short, the answer is yes – you are going to have to pay taxes on reinvested dividends. While there are a ton of...

- How to Find the ADR Dividend Tax Policy of a Company in Minutes An ADR, or American Depositary Receipt, is a simple type of share that allows U.S. investors to invest in companies headquartered outside the U.S. But...