When reading through any financial statements on annual reports, I always zoomed by the earnings statement because I didn’t know what it was. Or what retained earnings were on the balance sheet.

Until recently, when I started reading through the Berkshire Hathaway Letters to Shareholders, I discovered the importance of retained earnings and their meaning. I want to share what I have learned from my discoveries so we can learn together.

Buffett includes an “Owners Manual” in his annual reports, which you can find here. The owner’s manual doesn’t change much from year to year, and in the manual, there are many different principles; I am going to share principle #9 as it relates to retained earnings.

“We feel noble intentions should be checked periodically against results. We test the wisdom of retaining earnings by assessing whether retention, over time, delivers shareholders at least $1 of market value for each $1 retained. To date, this test has been met. We will continue to apply it on a five-year rolling basis. As our net worth grows, it is more difficult to use retained earnings wisely.”

To try to interpret what Buffett means, retained earnings must return at least $1 in market value to us, the shareholders, over the long-term for each dollar management retains.

In today’s post, we will learn:

- What is the Statement of Retained Earnings?

- What Are Retained Earnings?

- How to Calculate Retained Earnings

- Retained Earnings Ratios

What is the Statement of Retained Earnings?

According to our friends at Investopedia:

“The statement of retained earnings (retained earnings statement) is a financial statement that outlines the changes in retained earnings for a company over a specified period. This statement reconciles the beginning and ending retained earnings for the period, using information such as net income from the other financial statements, and is used by analysts to understand how corporate profits are utilized.”

Each public company must prepare four financial statements. We are familiar with the Big Three: Income Statement, Balance Sheet, and Cash Flow Statement. We will explore the fourth requirement, the Statement of Retained Earnings.

We also refer to it as the statement of owner’s equity, and accountants prepare them according to GAAP principles.

The statement of retained earnings can operate either as a standalone document or include it in the balance sheet or income statement. It includes items such as:

- Net income

- Retained earnings

- Dividends

The net income helps show what amount the company sets aside for dividend payments, plus any monies for any losses that might have occurred. The statement covers the period listed, coinciding with the balance sheet.

The main goal of the statement of retained earnings is to lay out the company’s plans for its capital allocation. The statement helps tell us how they plan to deploy the capital for growth, i.e., dividend payments, share repurchases, debt payments, etc.

The statement also shows how the retained earnings accumulated on the balance sheet.

The statement of retained earnings can show us how the company intends to use its profits; we can see quite easily how they use its earnings to grow the business. As we will see, the statement reveals whether the company will reward us with dividends, share repurchases, or by retaining the earnings for future opportunities.

Think of the heat Warren Buffett has received lately with the refusal to pay a dividend or lack of share repurchases. If you look at Berkshire’s retained earnings statement, you can see all those intentions, more on this later.

Let’s dive into retained earnings a bit more.

What Are Retained Earnings?

Retained earnings are the net income that differs from the income statement’s bottom line, less dividends paid to shareholders.

As we discussed earlier, the company can use retained earnings for any reinvestment, which could help the company. Examples include purchasing more equipment, building a new plant, buying more inventory, and so on.

When the big wigs at a company decide to retain the profits instead of paying them out as a dividend, they need to account for them on the balance sheet under shareholder’s equity. The reason for this disclosure is simple; retained earnings are monies that companies can use to better shareholder value.

We, as investors, can use retained earnings as an opportunity to decide how wisely management deploys its capital, especially when not distributed to the shareholders.

When analyzing a company’s financials, we can determine if it is allocating all of its money back to itself. Still, it doesn’t see high growth in financial metrics. Then, maybe paying dividends to shareholders might serve shareholders better.

The above statement remains one of the leading reasons that Warren Buffett has been under so much fire for holding so much cash on the balance sheet of Berkshire Hathaway. Buffett isn’t going to put that money to use by creating more value for the shareholders by buying more companies or investing in more businesses. Then shareholders would receive more value from a dividend or buybacks.

His refusal to do either has led to some criticism of his decisions. I would argue that he has earned the right towards caution and to tread with care, especially in today’s frothy market. With the size and scope of Berkshire, finding a worthy investment remains much trickier.

Another point I would make in his defense: one could argue there is no better capital allocator in the history of investing and why you would question his decisions when he has done a fantastic job of allocating capital through the years is a better question.

How to Calculate Retained Earnings

Retained earnings are the portion of the profits not distributed to shareholders. Instead, companies hold back those earnings for investments in working capital or fixed assets.

The formula to calculate retained earnings:

+ Beginning retained earnings

+ Net income during the stated period

- Dividends paid out

= Ending retained earnings

That’s pretty simple; keep in mind that any changes in the income statement will be reflected in the retained earnings.

Examples of a Statement of Retained Earnings

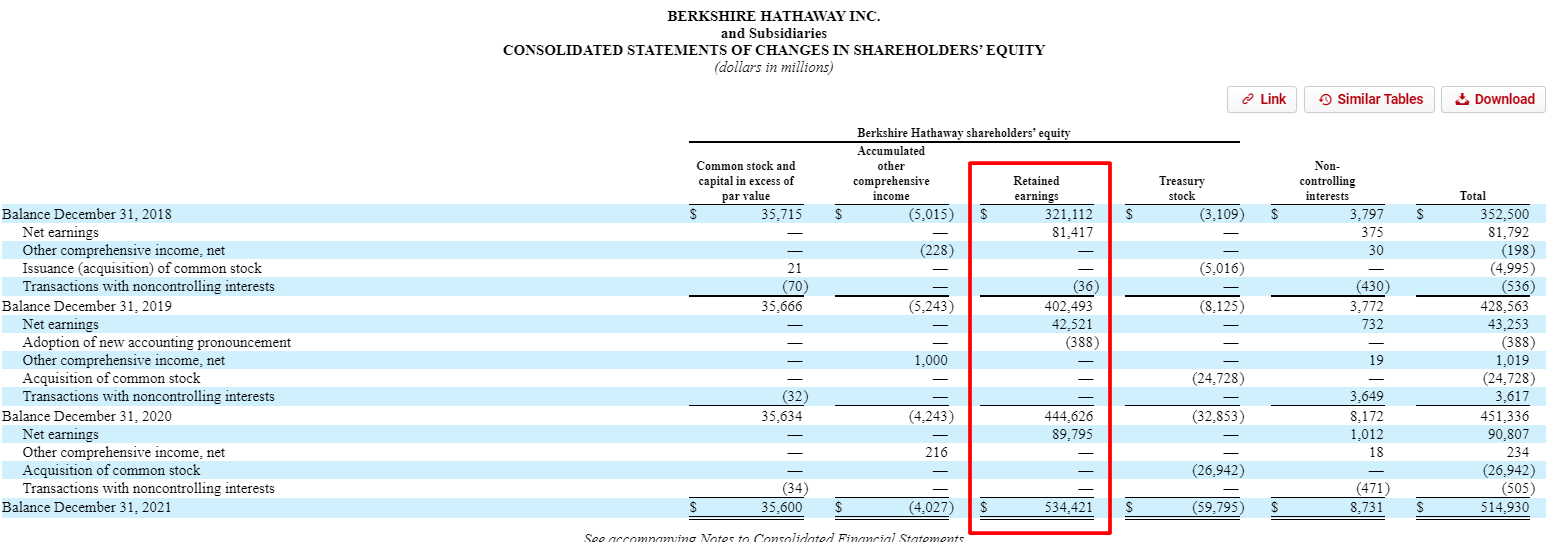

Let’s take a look at some actual statements of retained earnings. The first company we will take a look at is Berkshire Hathaway.

Notice several things; the ending balance is the total retained earnings. Next, notice Berkshire pays zero dividends and minimal deductions from the retained earnings from the previous quarter.

The above statement is from the latest 10-K, and all the dollars listed are in millions unless otherwise stated.

You will notice that Berkshire’s statement of retained earnings is fairly simple because they are added each quarter without much in the way of distributed earnings to shareholders.

Looking at the statement of retained earnings is a quick way to investigate the capital allocation of any company. In Buffett’s case, it appears he is keeping some dry powder in case he comes across a fantastic investment.

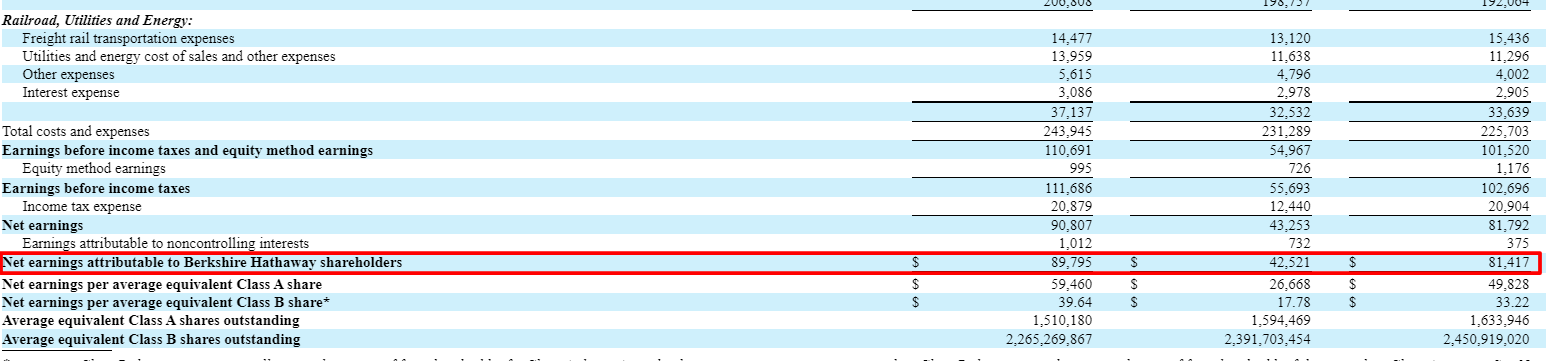

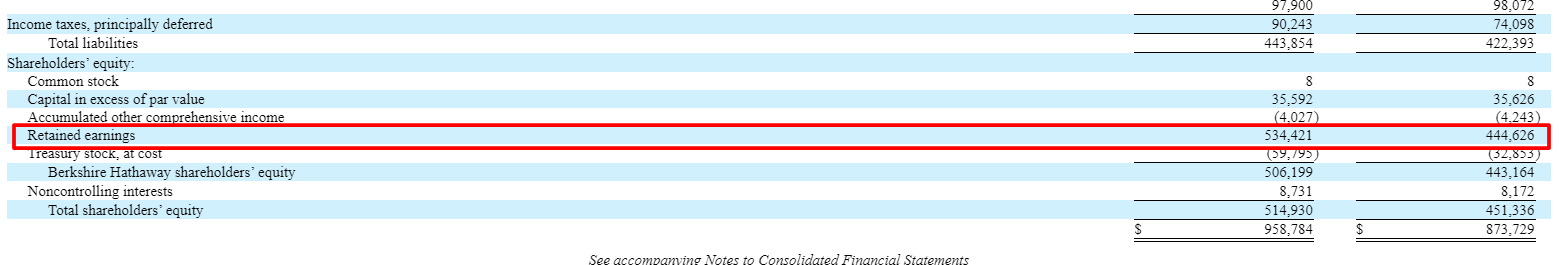

Let’s take a peek at the income statement and balance sheet to reinforce how the statement of retained earnings flows from the income statement into the balance sheet.

Notice the net earnings from the income statement and compare that to the statement of retained earnings; they are the same.

The balance sheet shows the shareholders’ equity equals our retained earnings from the statement of retained earnings.

The flow from each statement to each statement is fascinating and helps illustrate how each statement is connected, and the impact each line item can have on the entire outlook of a company.

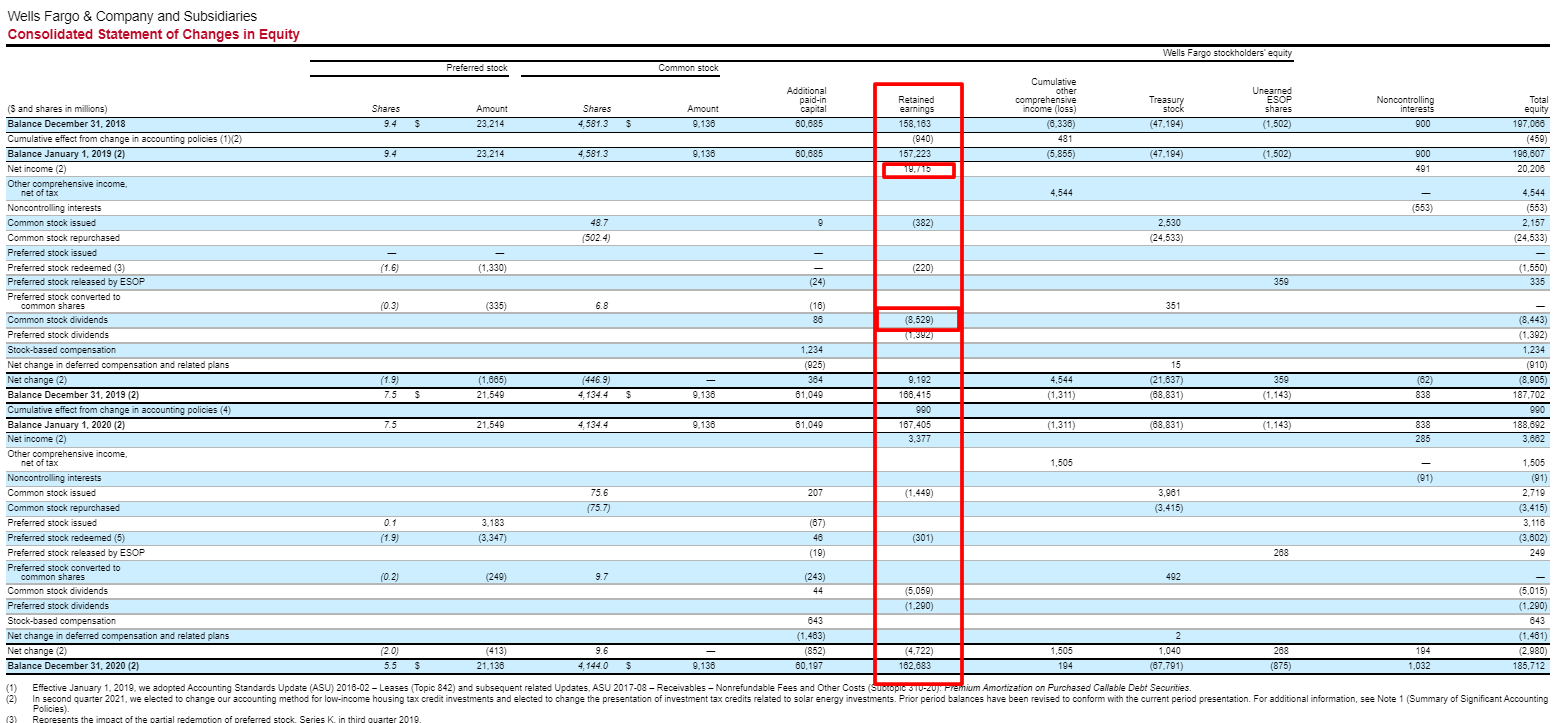

Let’s pull out another statement for a look. The next company we will take a look at will be Wells Fargo.

I would like you to notice a few things in this statement of retained earnings from Wells Fargo. First, notice they list common stock repurchased, which means share repurchases or buybacks to $14,464 million. So, we can see that Wells Fargo decided to use part of its accumulated net earnings to give back to the shareholders.

Next, notice that Wells Fargo has also paid out dividends to common and preferred stockholders.

It is amazing to see how revealing the statement of retained earnings is regarding the capital allocation of any company we are investigating.

We can see how Wells Fargo intends to give back to its shareholders via dividends or buybacks.

One thing to keep in mind when analyzing companies is the intention behind capital allocation. For example, Wells Fargo has requirements concerning its capital allocation. Because of how banks work, they must request approval to allocate their capital in different ways. Typically, banks will pay dividends and use buybacks to reward shareholders. Because of their restrictions, using their funds to purchase other banks or businesses is a little more complicated.

Contrastingly, Berkshire Hathaway has no such restrictions. With their board’s approval, their capital allocation is completely at the discretion of Buffett and Munger.

Ok, now we understand how to read the statement of retained earnings and where to find valuable information. Let’s look at a few ratios which can help us determine the effectiveness of retained earnings.

Retained Earnings Ratios

Now that we have examined retained earnings and how to read a statement of retained earnings, let’s look at some ratios, shall we?

First up is the retention ratio.

The retention ratio is the ratio of our company’s retained earnings to its net income. The ratio measures the percentage of our company’s profits and how they reinvest in the company, such as buying more assets, building a new plant, or buying more inventory, other than paying the earnings out as a dividend or share repurchase.

The formula is fairly simple, divide the company’s retained earnings by its net income minus the dividends.

Retention ratio = (net income – dividends) / net income

So let’s take the 2021 10-K statements from Oshkosh Corp as an example. In this case, I will include share repurchases in our formula, as they have become almost as important as dividends in paying back the shareholders.

- Net income = $472.7 million

- Dividends = $90.4 million

- Share repurchases = $107.8 million

I am plugging the above numbers into our formula.

Retention ratio = ( 472.7 – (90.4 + 107.8)) / 472.7

Retention ratio = 58.07%

That indicates that Oshkosh Corp retained 58.07% of its earnings to either put back into the business or to grow the retained earnings for some other purpose.

The interesting trick about the above formula is when using it on Johnson & Johnson, it shows they are paying out almost all of their net earnings in either dividends or share repurchases. The high payout ratio could indicate they are an older, more mature company and choose to return any excess cash to the shareholders instead of growing the retained earnings.

Keep in mind younger companies may have a higher retention rate because instead of growing dividends, they would be interested in the growth of the business. As we see from Johnson & Johnson, larger, more mature companies will post lower retention ratios because they are already profitable and don’t need to reinvest in the company as heavily.

Also, we can refer to the retention ratio as the plow-back ratio.

Retained earnings / Total Assets Ratio

Next up, we have the retained earnings over total assets. Ideally, we want to find a ratio of 1:1 or 100%. For most businesses, this will be impossible to achieve; a more realistic goal we should see is as close to 100% as possible.

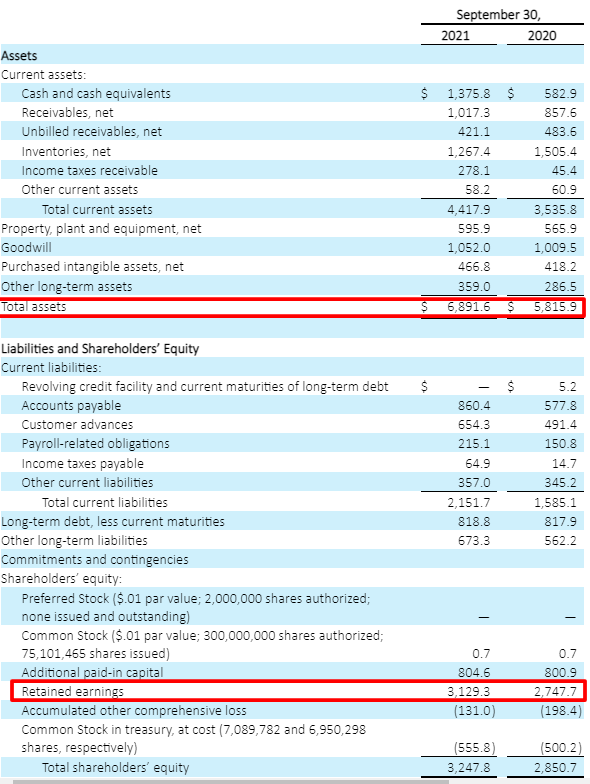

Let’s look at the latest balance sheet of Oshkosh Corp 2021, to keep it in the family. We can find the information we need there.

The retained earnings from the shareholder’s equity section are $3,129.3 million, and the total assets from the top of the balance sheet equal $6,891.6 million

To find our ratio, we divide each number by itself.

Retained earnings Total Assets = 3,129.3 / 6,891.6

Retained Earnings Total Assets = 45.4%

If we look at the previous year, 2020, we can run the same calculation.

Retained Earnings/Total Assets = 2747.7 / 5,815.9

Retained Earnings/Total Assets = 47.2%

We can see that Oshkosh Corp has decreased the ratio from year to year.

Interestingly, if you look at Berkshire Hathaway’s balance sheet, they have run with percentages similar to Oshkosh Corps for the last two years.

- 2020 = 50.88%

- 2021 = 55.74%

As you work through the retention ratio, remember a higher number means the company remains less reliant on other growth forms, such as taking on more debt to grow the business or pay out dividends.

Return on Retained Earnings

The return on retained earnings tells us how effectively the company uses profits from the previous years.

The ratio can relay to us whether the company is better investing in itself or paying back investors with a dividend or share repurchases.

The formula for return on retained earnings:

RORE = Net income / Retained Earnings from the previous year

We can use the retained earnings statement to find all our information. Let’s look at Apple for this example, their 2021 10-K.

Net income = $94,680 million

Retained Earnings 2020 = $14,966

RORE = 94,680 / 14,966

RORE = 6.32

The above answer tells us that Apple could generate $6.32 for every $1 retained earnings from the previous year. For giggles, I looked through the previous year’s numbers.

- 2019 = 1.25

- 2018 = 0.78

As we can tell from this small sample size, Apple appears to continue growing its return on its retained earnings. Using the RORE offers a fun exercise to run when analyzing your company, and it is an item that I have added to my checklist.

Final Thoughts

Digging into this fourth financial statement has proven interesting, as it offers quite a bit of information to uncover when looking deeper into the statement of retained earnings.

You can determine quite a lot about management, their growth plans, and how shareholder-friendly they are.

And there are several simple ratios we can use to compare our company to others to give us a better comparison of the effectiveness of a company using its funds to better the company.

Think about any business we want to analyze; we must determine how they make money, if they make money, and also what they do with their money.

Remember to include this statement of retained earnings in your analysis of any company and try to use that info to help you find your story regarding that company.

As always, I appreciate you taking the time to read this post, and I hope you find some value in your investing journey.

If you have any questions or if I can be of any further help, please don’t hesitate to reach out.

Take care,

Dave

Related posts:

- How to Find Negative Retained Earnings in a 10-K – Does it Indicate Distress? Stockholders’ equity, also called book value, is the company’s assets minus its liabilities. We talk about tangible book value when we value investors discuss shareholders’...

- 5 Key Metrics: Balance Sheet vs Income Statement (Example with $AAPL) Financial statements can look intimidating. There can be many line items. To learn how to navigate a company’s balance sheet and income statement– break it...

- Everything to Know on ROA, with Average ROA by Industry Data Post updated: 5/5/2023 The return on assets remains a useful measure for investors to understand. The formula offers a great way to measure the performance...

- How the Piotroski Score Identifies Strong Businesses in the Stock Market Updated 4/28/2023 One of the biggest challenges when determining whether or not to invest in a company is determining each company’s financial strength. Enter the...