We live in a world where information is literally at our fingertips and you can consume it any point that your heart desires – but sometimes it’s just flat out overwhelming, right? Let me tell you my three favorite stock market movies that will not only give you a chance to relax but also are kinda helpful to your investing journey!

Wolf of Wall Street

This is my personal favorite by far and some of that likely has to do with the fact that I am a HUGE fan of Leonardo DiCaprio. The movie has a rating of 8.2 on IMDB which is really, really good. The movie is based on a true story of Jordan Belfort, a penny stockbroker as he worked his way through the ranks in the 1980s and 1990s.

Belfort worked for Stratton Oakmont, which is a notorious brokerage over-the-counter brokerage firm that defrauded shareholders throughout their long, extensive, 7-year existence (sarcasm). The firm took 35 companies to their IPO including Steve Madden as the most likely most well-known company.

They were heavily involved in “pump and dump” schemes where they would essentially fake financials about a company to create massive hype, take the company to IPO, and then dump all of their shares in that company.

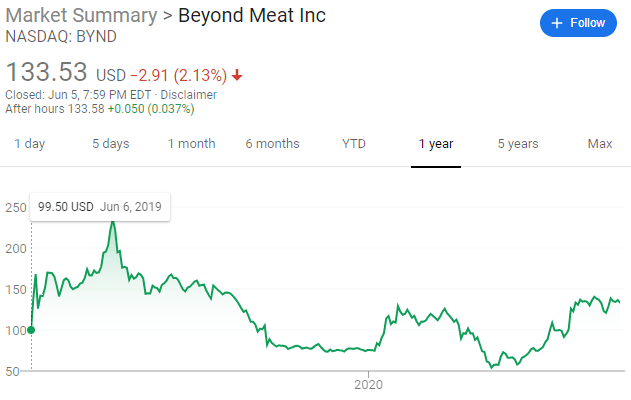

That strategy certainly sounds like it would work nowadays, right? I mean, look at the insane IPO’s last year such as BYND.

In addition to having Leo, the movie also features Jonah Hill and is directed by Martin Scorsese, so yeah, you could say that it’s a pretty legit film! And if you’re anything like me, and hate older films (with a few exceptions), then the fact that this was produced in 2013 should help ease any reservations that you might have.

So, what will you actually learn in this movie? I learned to be skeptical of companies that are about to IPO. Prior to that point in time, we have no idea what the financials actually looked like. Have things become more standardized and stricter, in regard to reporting, since the late 1990’s? Sure. But people also continue to get more advanced in their fraud and corruption!

The one thing that I am thinking of is Luckin coffee because this fraud was so recent where they were lying about their revenue numbers. This company had their IPO almost a year ago to the date and now they’re already delisted. Of course, there are different factors with Luckin since they are a Chinese company, but there was a lot of hype in America about the company and I personally know some people that were affected by this.

Key Takeaway – always get your eyes on the financials and be sure to trust management before investing!

The Big Short

I just recently watched this movie after being berated by my friend for not ever seeing it when he had seen it 6+ times, and I loved it. I’ll admit, the first time I watched the film, which is about 2 hours, it took me over 8 hours to finish it thanks to our newborn, so I forced myself to watch it again a week later and I got much more from it that time…lol.

This movie also is star studded with a cast including Ryan Gosling, Christian Bale, Brad Pitt and Steve Carrell. I loved Steve Carrell in this movie, but I also am the biggest fan of ‘The Office’ so it was very hard for me to take him in a serious role rather than Michael Scott, which honestly, is what Carrell should just change his name to.

The movie is about the housing market crash of 2007-2008 which is by far, one of the worst crashes that we have seen in the history of the US.

The movie focuses on three different viewpoints and their plans in anticipation of a major housing market crash. Admittedly, this is a movie that I think the more times that you watch, the more that will start to click with you because there are a lot of things that might be confusing to a brand-new investor.

Key Takeaway – the main thing that I take away from the movie is that these guys looked at the financials, understood the industry and what was really happening, and they took a contrarian viewpoint to the consensus of the market. By having this contrarian viewpoint, they were able to capitalize…BIG TIME…in a way that they never would’ve been able to if they just stayed with the consensus.

Having a contrarian mindset…does that sound like anyone else that I’ve talked about before?

Wall Street

The last movie to round out my Top 3 is ‘Wall Street’. I know that I said that I don’t like older movies, typically, but this movie is not one that falls into that category!

Wall Street is a lot of people’s favorite finance movie as it tells a story about a junior stockbroker trying to get in with his hero, a legendary stockbroker. Similar to the other movies, moral lines seem to be crossed in this movie as there is some very clear of share price manipulation that occurs in order to make themselves look like legendary investors.

At the end of the day, the police may or may not be involved and the there may be some sort of resentful relationship between the once aspiring junior stockbroker and his mentor.

IMDB has given this movie a ranking of 7.4 which again, is a very solid ranking. Charlie Sheen, Michael Douglas and Daryl Hannah round out the premier actors in this movie where Michael Douglas won an academy award for the best actor in a leading role in 1988.

Key Takeaway – I could go with something that I have said earlier, such as making sure that you do your due diligence, but I am going to say that “money never sleeps”. This is a very important lesson for an investor because I oftentimes will talk about the importance of learning how to make your money work for you, and until you learn that your money won’t ever sleep, it’s going to be hard to master this lesson!

Well, there you have it! I tried to give just a small enough description of the movie without any spoilers, so please go check out any of these movies if you haven’t seen them. I’m sure they’re all on Amazon Prime or anywhere else that you watch movies online nowadays!

Let me know when you’ve seen all of the movies! I’ll have one response for you….

Related posts:

- 3 Simple Steps to Use Stock Market Analysis Tools to Find Great Companies The most common question that I get from new investors is “how do I find stocks to invest in?” Unfortunately, that’s not a simple question...

- A Stock Market Basics PDF Written By a Self-Taught Investor [Free Download] Updated 4/21/2023 Starting anything new is scary, and investing is no different. We all have the same questions, where to start? It may seem overwhelming,...

- 8 Top Investing Books to Read If You Are Just Getting Started in the Market Your mind is the most important asset you own. If you focus on your investing education instead of the immediate results, you will see much bigger...

- The Best Free Value and Dividend Stock Screeners Compared: Example Screen The competition for which tool is the best stock screener is intense. Like brokers—there’s many to choose from. Because I’m a proud dividend value investor,...