So, you’re ready to move up to the big leagues and become a stock picker? That’s what I like to hear! Honestly, it can be difficult to invest in individual companies. But I am here to help try to eliminate some of the stress of the unknown for you.

Click to jump to a section:

- The Fear of Investing

- Becoming a Stock Picker

- Jump In. The Water’s Fine

- Tips to Be a Successful Stock Picker

- Two-Step Process for Selling Stocks

The Fear of Investing

What do you think of when you hear the term stock picker? Maybe Leonardo DiCaprio from Wolf of Wall Street?

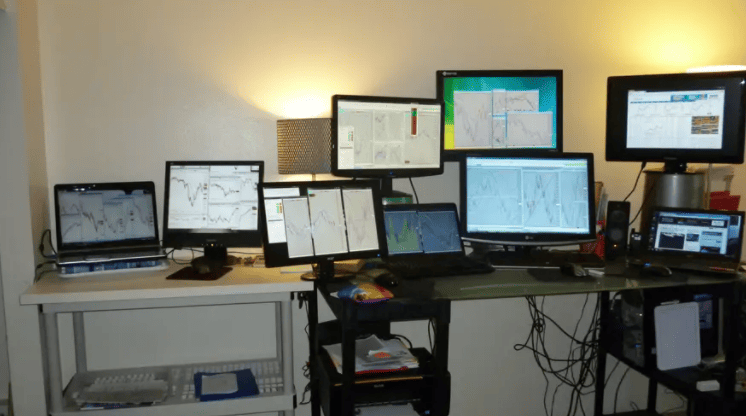

Or maybe you’re thinking of one of those day traders that have a desk that looks like this:

Honestly, when I first started investing in the stock market, that’s what I thought of. I even had the benefit of having a father that invested in the market. Even though he looked nothing like Leo and didn’t have a desk like the one above, he had been involved in finance his entire life. This was intimidating and scared me away from getting involved in investing.

I had a thousand reasons not to invest. They all boiled down to me being scared and not knowledgeable enough. But those were just excuses – ones that many other people will make as well.

I would always at least max out my employer match on my 401K, but that was the extent of my investing. It was managed by Fidelity so all I had to do was put the percentage contribution into the Fidelity website and the rest was done for me.

Becoming a Stock Picker

Then after one weekend in Chicago, where we did nothing but blow money, I realized that enough was enough. I decided to take things into my own hands and become a stock picker. What exactly did that mean for me specifically?

It meant that I was going to get fully leveraged on margin, borrow as much as I could, and only use options to trade penny stocks!

KIDDING. I literally did none of that.

I started the same exact way that Andrew talks about in his eLetter:

Investing $150/month. I set aside $75 from every paycheck to invest in the stock market to try to finally get ahead. Many people advised me to only buy ETFs because they were less risky, but I didn’t take that advice.

ETFs are great when you’re looking to gain exposure to a new sector/industry or want a hands-off approach, but I didn’t want either. I wanted to start investing and learning! So, I became a stock picker.

Jump In. The Water’s Fine

When I first picked the stocks I wanted to own, I did so with $500. I bought some shares of the company I work for, some shares of a Master Limited Partnership for the company I work for, and then a company called Sunrun.

I found Sunrun by googling “Best stocks under $10 to buy” (seriously) and then 5 minutes of reading on those companies. This sounds like a horrible investing strategy, right?

Well, it is. But do you know what it did? It took away that fear of just jumping in. I was in the pool. The decision was made to buy. So now I was just going to sit there and read more and more about the company to try to make educated investing decisions.

The stock I purchased for $7.93 rose to around $15 when I sold it. That’s a big boost for a beginner trader.

Tips to Be a Successful Stock Picker

But I am here for one reason and one reason only – being a stock picker doesn’t mean that you have to be smarter than everyone. It doesn’t mean you have to be spending 40 hours a week looking at stocks. It doesn’t involve anything at all that you’re not currently doing.

In my eyes, being a successful stock picker really comes down to just a few personal qualities and then a few tangible takeaways that you can implement:

1. Be Hungry for Knowledge

Honestly, this might be the most important trait when first starting. You don’t know anything, and you’re not supposed to. But if you want to be successful, you need to crave knowledge. Do anything and everything to learn about investing.

Personally, I am a huge podcast fan. I like to listen to podcasts while I work out, do chores, and obviously while I drive. This is just dead time where I could be learning something while completing a simple task.

The podcast hosted by Andrew and Dave and named after this website, Investing for Beginners, is the best option I have found. They cover everything from foundational stock market topics to deep dives into the financials of specific companies.

Along with podcasts, I like to read as many books as I can such as The Essays of Warren Buffett and What Works on Wall Street.

These books have tangible take-home lessons you can implement in your investing journey from day 1.

Finally, blogs like this one are fantastic resources. They are incredibly accessible and easy to search through. Just about any stock market topic you want to learn about can be found on this blog.

If you don’t have a genuine craving for knowledge, then being a stock picker might not be what’s best for you.

2. Be curious

This is very similar to being hungry for knowledge. The difference is that you seek out areas you might not know as well as you want to. Don’t just stick to what you know the best but expand your competence circle to become a better, more well-rounded investor.

I am a huge advocate of staying in your lane when you’re first getting started. But once you have a little experience under your belt, start to dabble a bit and look at other industries.

I work in the oil industry. So while energy was my first few investments, I quickly moved on to other things that really sparked my interest. To this day, this has primarily been the tech sector.

I started with an ETF because I found that ETFs are great ways to get exposure to an industry, as I have talked about in my recent experience with Cloud Computing Stocks. Then, once I became confident, I bought some tech companies I liked a lot, such as Visa and Apple.

It started with me being curious and wanting to learn more about these companies that I was familiar with from a consumer standpoint. I really had no idea at all how they had performed as companies or as stocks.

It is honestly fun to learn more about how a company you know on the surface functions underneath. There is so much more to a company than its consumer-facing ads and branding.

3. Play Devil’s Advocate

Playing Devil’s Advocate is one of the best things you can do in many areas of life. Of course, you need to make sure that you’re doing so properly because the difference between being a devil’s advocate and a jerk can be a fine line.

If you’re doing so respectfully, you’re going to challenge the norm, question how things should be done, and identify unintended consequences before they arise. You will challenge yourself to find pitfalls and solutions before they occur.

When you do this with your investing you can identify obstacles that a company might need to overcome in the future, as well as identifying if you think the company is well-positioned to overcome those hurdles.

For instance, if you’re looking to invest in Mcdonald’s, you might think that the world is slowly moving away from fast food to healthier foods and even meatless options – can Mcdonald’s adapt? Have they shown signs of being able to adapt in the past? Can they adapt better than their competitors?

Answering these questions will make you more prepared than ever and give you the confidence to remain invested in the stock when the going gets tough.

4. Play Chess, not Checkers

This is an overused phrase, but I really do think it fits here. You’re not investing in a company because you think they can beat earnings (or at least I hope not). You’re not investing in companies for a short-term pop just because they might be on the verge of an acquisition. You’re not investing in a biotech company just because you think they might be the first to develop a coronavirus vaccine.

You’re looking for companies that will set you up for YEARS of success in the future. You should want to buy a company and have so much confidence in it that you don’t even start to evaluate its performance for years.

I am not saying to buy a company and never pay attention to them again until they declare bankruptcy a year later. I am saying that when you buy them, you will have confidence in them despite checking up on them. You’re not intending to sell but merely monitoring their performance.

Or, for instance, maybe you think the housing market will boom, right? But you already own a couple of REITs and use real estate crowdfunding and want to get exposure a different way – how do you do it?

This is something that Andrew talked about in his recent eLetter where he bought Whirlpool (he sold it recently, though, for a hefty, hefty gain, I might add) to try to get exposure. It was his way of thinking down the line and finding a premier appliance brand that would give him housing market exposure without directly being correlated, and it really paid off!

That’s the type of chess we like to play – the type that always has you thinking a couple of moves in advance of the market.

5. Be Patient and Not Impulsive

This is one of the hardest things you’ll have to learn. And truthfully, you’re probably going to fail – a lot. I know that I certainly did.

When I was first starting with my investing, I would do this analysis, have a ton of faith in the company, and then maybe they’d miss earnings, and the stock would drop 10%.

I would panic sell just for the company to rebound in the next few weeks. It was the absolute worst. I would not only lose money but also would lose out on the company’s future gains. All because I was not patient and I was impulsive.

I was playing checkers, not chess. Focused on the short term despite my long-term love for the company. Do you know what I should’ve done? Bought more!

Have you noticed that it seems like stocks are the only thing people won’t buy more of when they’re on sale?

If Apple misses their earnings and the stock drops 10%, is the company really 10% worse off than they were before? No!

They’re just 10% cheaper. And honestly, now they likely will have lower expectations going into their earnings the next quarter meaning it’ll be easier to get those gains right back.

This applies to investing during a recession, which we are likely entering. Stock prices don’t drop due to issues cropping up in companies. They drop due to mass fear and uncertainly about the U.S. as a whole. It is only a matter of time before it recovers, so it is best to continue to buy during the dip, lowering your average cost.

So why do we sell then?

Because we’re human. We make mistakes. When we lose money, we want to stop the bleeding. It’s natural. But it’s wrong.

Two-Step Process for Selling Stocks

What we should be doing is a 2-step process:

1 – Determine if anything has fundamentally changed with the business

Is the stock down because a new competitor is taking market share? Has something unethical or illegal been going on with Apple? Or are they maybe just having slower earnings because of COVID? Context is key.

2 – Act

If something has drastically changed for the negative, do not hesitate to sell and write that loss off. If it hasn’t, why not buy more? You’re buying this same great company but for a clearance deal of only 90%!

This was really hard for me to wrap my mind around, but I finally got there. You need to ensure that you’re not blindly buying stocks all the way down to $0, though. The way to do that is to have conviction in the company and trust that they’re poised for long-term success.

Continue to evaluate these companies and make sure that they’re still the same company you invested in in the first place.

Closing Thoughts

If you can implement these 5 tips into your investing journey, you’ll be a fantastic stock picker. If you feel like you have these under control and are ready for a more tangible list of things to look for, I highly recommend you develop your own investing checklist for finding companies.

Sound tough? It can be, but that’s why Dave shares his method with all of us so we can learn from the best!

Related posts:

- Can You Get Rich Only by Sector Investing? I feel like the debate of sector investing is one that has lasted ages and so many people have different opinions on the practicality of...

- Time to Settle the Debate – Are We In An ETF Bubble? One thing that I have heard many times before is that we are in an ETF bubble. Personally, I kinda see both sides of the...

- The Basics of Wall Street Explained – Is it a Place for Good? Updated 4/15/2024 So, you’re looking to start investing, but first, you want to know the basics of Wall Street. What is it? Why does it...

- Market Bottom Indicators Based on Past Bear Markets If you are a human, you’re likely wondering when the heck is, we going to get to the bottom of this bear market, and I...