A stock proxy is a document that public companies have to release every year. In it, investors will find details about management, the board of directors, and voting on major company matters.

Investors should know how to look up a stock proxy and skim through the important parts.

This guide will show you how, in these steps [Click to Skip Ahead].

- The Basics of the Proxy Statement

- How to Navigate the Stock Proxy: Ownership

- Why Does Stock Ownership (or Voting) Percentage Matter?

- How to Navigate the Stock Proxy: Management

- How to Navigate the Stock Proxy: Board of Directors

- How to Vote Your Shares in Your Brokerage Account

First, I’ll show you how to find the proxy document for a stock.

The Basics of the Proxy Statement

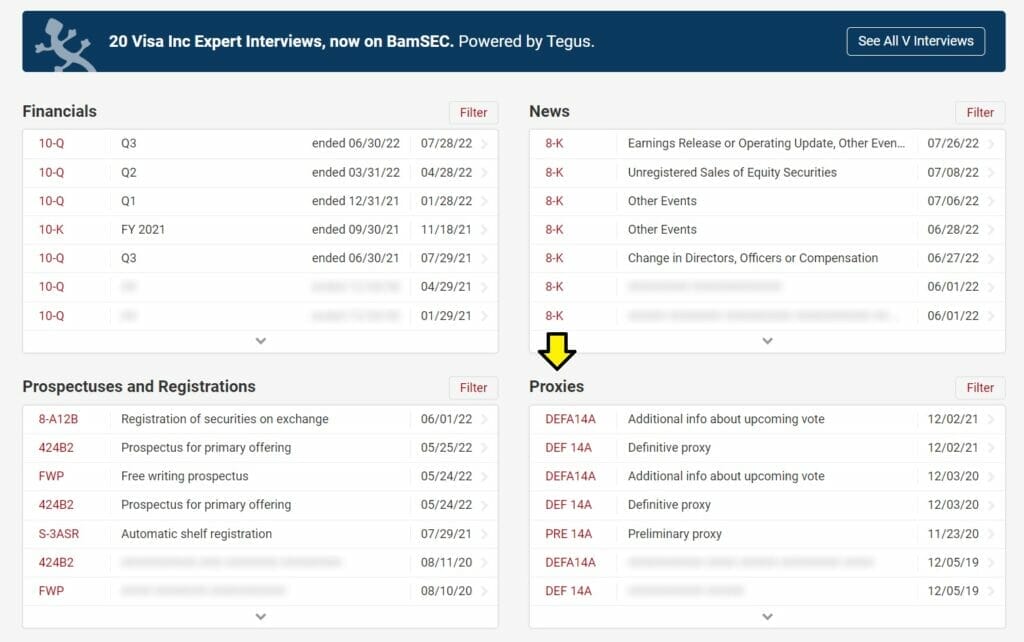

You can either go to sec.gov, or my favorite website with free SEC filings, bamsec.com. At BamSEC, put in the ticker of the company you want to look up. I’ll use Visa ($V), which is a company I am a shareholder of.

Here we can see 3 of the 4 key sections of SEC filings that I use regularly when researching and keeping up with a company. Look for the section titled “Proxies”, which will have the DEF 14A (stock proxy) and DEFA14A (voting proxy). Note that the company should have each filed at least once per year.

Clicking into the DEF 14A, the Definitive Proxy, we can see the document which tells us the following details:

- Who is management (CEO, CFO, etc)

- Who are the board of directors

- How is the board of directors structured

- Who are the major owners of the company

- How is management being compensated (stocks, cash salary and bonuses, or both)

- Details about the annual meeting, and voting matters

There’s more to the stock proxy than that, but these are among what I consider to be the most important details in the document for investors to consider.

How to Navigate the Stock Proxy: Ownership

The first thing I want to know about a company when I open its proxy statement is who the major shareholders are in the company.

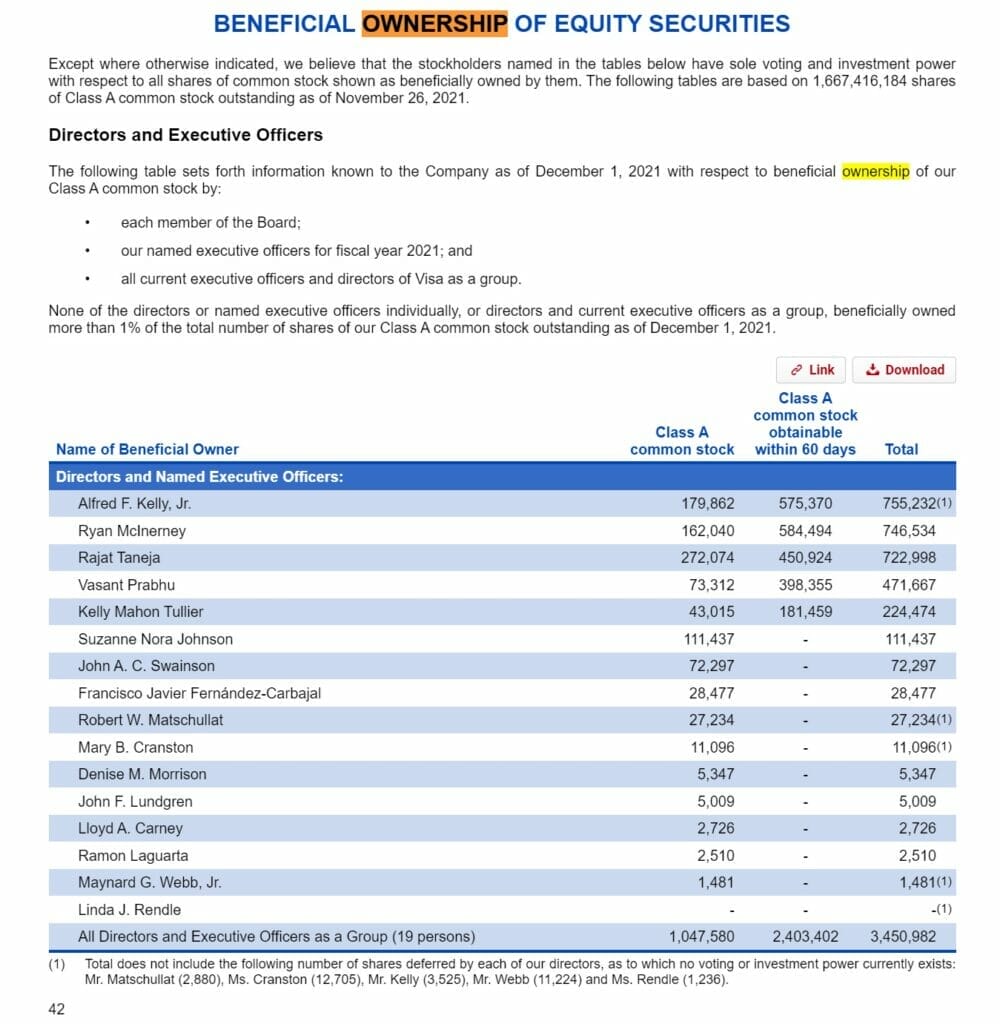

To do this quickly in the document, I like to use Ctrl+F to search for “ownership” until you see a section that looks similar to this:

In this table in particular, you can see how much stock each of the board of directors and/or executive managers own. This can help you determine how much “skin in the game” that these people at the top have.

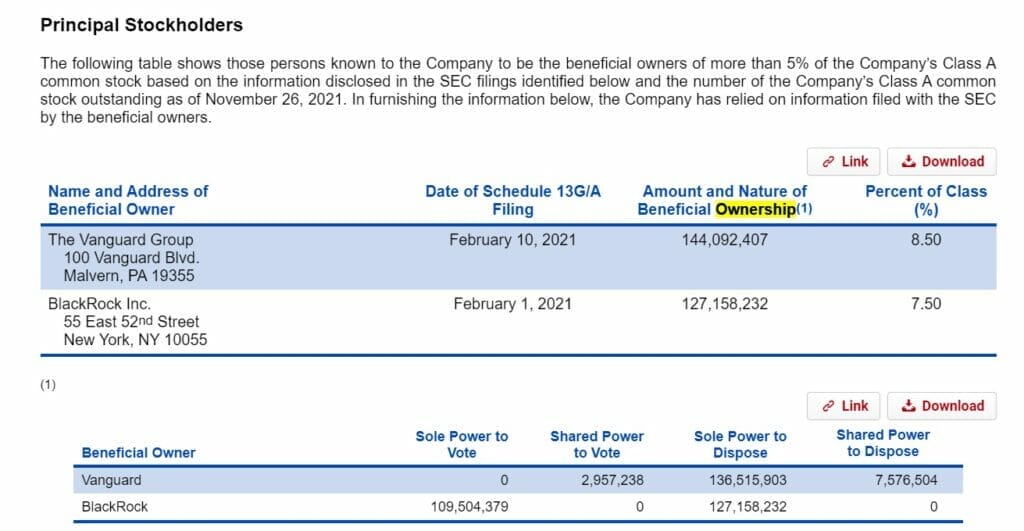

Usually a company will include Percent of Class or Voting Percentage statistics on the individuals or institutions that own the most shares in the company. For Visa, they’ve disclosed that in this table, under the Beneficial Ownership table above:

In this case, we can see that Vanguard and BlackRock are the biggest “beneficial owners” of the company.

Experience will tell you that much of Vanguard’s and BlackRock’s shares today are held on behalf of investors who own index funds. There is controversy brewing about how those votes are determined in today’s day and age; that’s a topic for another day.

What you should keep in mind is that most companies will have Vanguard and BlackRock as major shareholders, especially for companies in popular indexes like the S&P 500.

What should give you pause is if you see an individual or institution with much higher percent ownership of the company than an index provider like Vanguard or BlackRock. This person will have the potential to influence the company significantly, because large percent ownership of shares usually means high voting influence.

Example of Majority-Owned Company

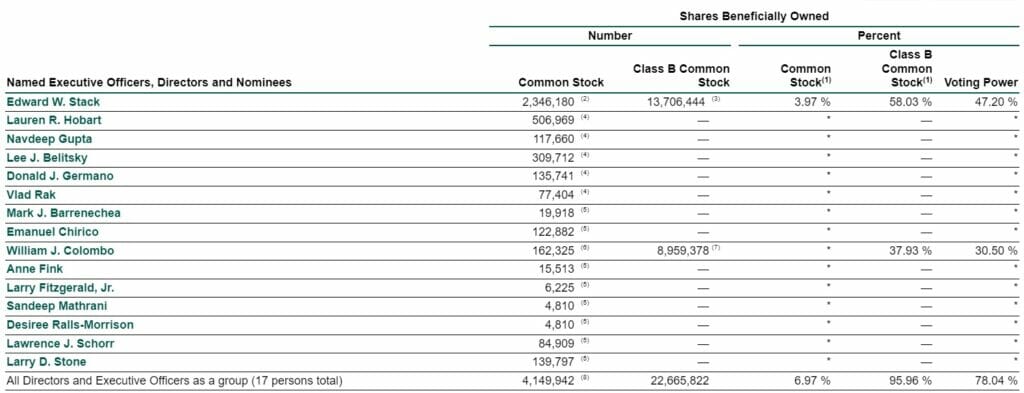

To see what I mean, let’s take a company that is majority-owned. I own a couple of these kinds of companies in my portfolio—I’ll use Dick’s Sporting Goods for this example.

Taking the same process to find the stock proxy, we can see that long-time directors Edward Stack and William Colombo, together, own a controlling interest (greater than 50%) of the company (77.7% combined).

This means that before buying this stock for the long term, I went and investigated Stack’s and Colombo’s track records, reputations, and anything else I could easily find online about the two gentlemen.

Why Does Stock Ownership (or Voting) Percentage Matter?

The reason why we want to see who owns what percentage of the company is because shareholders collectively can yield massive influence on a company.

Shareholders can vote on who sits on the board of directors. The board is responsible for making major decisions on behalf of shareholders—things like who gets elected and re-elected to the board, who gets to be CEO, and how the CEO should be compensated.

As the board of directors makes these decisions, shareholders will then vote YES or NO on many of these matters.

But a lot of the time, the details of major decisions are left to the board of directors to determine.

And a majority owner can basically create that board of directors at will, choosing people inside or outside of the company who the owner essentially trusts, or can even influence on a personal level.

Not only do shareholders vote on the Board of Directors, but they also vote on other critical matters such as:

- Whether to accept an acquisition offer or not

- Whether the compensation package the board of directors put together for management is approved

- How often should meetings (and special meetings) be held

Technically there’s an unlimited amount of proposals that shareholders can vote on, and there’s a few common ones I left out (that are more like housekeeping).

An example was certain shareholders for Exxon Mobil, a company I don’t own, made a proposal that the company “Report on Low Carbon Business Planning”. 10.5% voted FOR while 89.5% voted AGAINST.

How to Navigate the Stock Proxy: Management

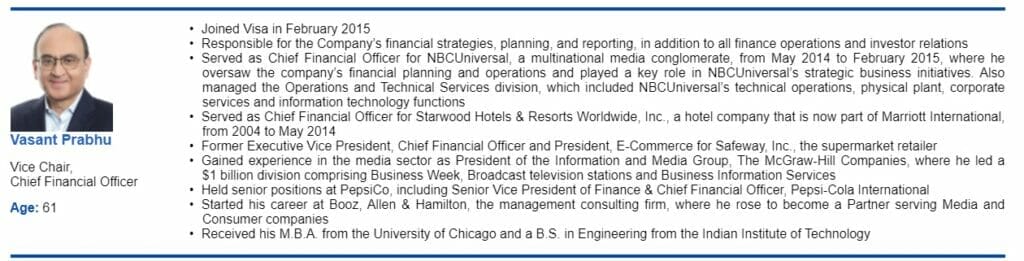

Next, we should use our stock proxy document as an opportunity to get to know management. Companies may display these sections in different ways; for Visa the company listed all Executive Officers and included a picture and bio of each, like so:

Along with general information about these executives, there’s also a section about how management will be compensated.

Usually, in pretty much any proxy, you’ll see boilerplate language about their philosophy, purpose, mission, ESG or any number of buzzwords.

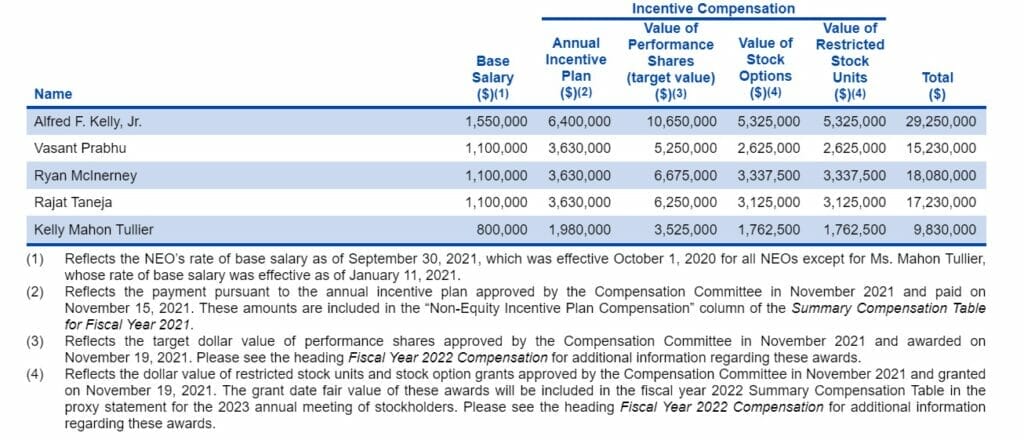

What we want to focus on are the facts. Somewhere in the document we should see actual total compensation that each of the managing executives received in a recent Fiscal Year. For Visa, we can find this in the Summary of Fiscal Year 2021 Base Salary and Incentive Compensation.

Here we can see each officer’s base salary, bonuses, and various stock options that were granted based on various goals, often mentioned somewhere in the boilerplate language.

Keep in mind that high executive compensation is not always a bad thing. In fact, I’ve seen studies and heard investors say that high compensation is not tied to poor stock performance, and often it’s actually the opposite.

That said, overly egregious executive compensation in light of poor business performance should be examined much more closely.

Comparing a CEO’s total compensation to the size of the company (in revenues or cash flows), or other peers in its industry can be a way to get context on whether those millions of dollars in compensation are in-fact high or not.

Also, looking at the financial targets which set bonus compensation can be enlightening for investors.

If you know what the executive team is financially incentivized to focus on, you can sometimes see how those managers are likely to run the business and what strategies they are likely to take. If management is taking the company in a direction you don’t like, it can sometimes be informational to see what their incentives are.

As an example, an executive whose bonuses are tied to revenue growth and not profits or Return on Invested Capital might be much more eager to make an expensive acquisition that ends up destroying value for shareholders.

Ownership of Stock by Management

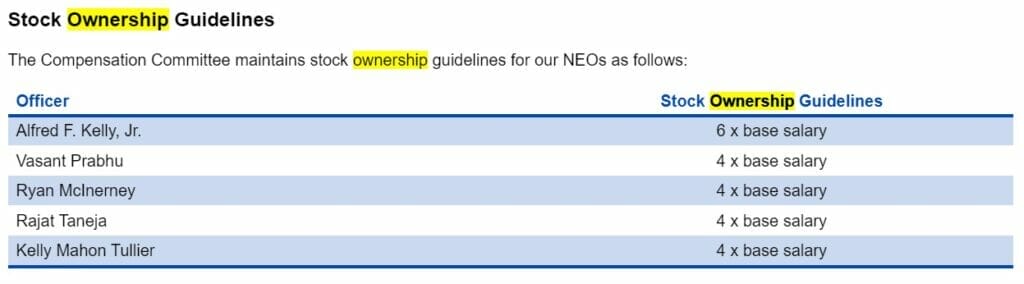

Usually, the board of directors will want management to have “skin in the game”. They want managers who have a stake in the company through share ownership so that management will be incentivized to take care of the company for the good of shareholders.

Companies might have minimum guidelines for managers to follow; as an example, Visa wants their CEO Alfred Kelly to hold at least 6x his base salary in Visa stock:

Investors tend to like to see CEOs with high stock ownership in the company, because it makes sense that the CEO will be less likely to shoot the company in the foot if it hurts their own pocketbook as well.

There’s been a special preference for “owner-operators” as of late, which are CEOs which own a significant (usually majority) ownership of the company and are expected to perform better than a company with a CEO with little stake.

I would say take this idea with a grain of salt, however.

I have personally owned companies with owner-operators who made decisions with the company’s capital which worked to strengthen the longevity of the company and its CEO rather than provide a satisfactory return on capital for the shareholders themselves.

Keep in mind that an owner-operator with millions of dollars in company stock might have different goals than you, and care more about preservation rather than optimization, even as majority owner.

How to Navigate the Stock Proxy: Board of Directors

Next in line to pay attention to would be the Board of Directors.

You usually can’t miss this section because it is highlighted every year as directors go up for election or re-election.

You should be able to find a bio about each director or prospective director just like you should for the executive officers. You should also be able to see what “committees” each director is a part of, if any. And there should be information on whether a director is “independent” or not.

Whether a director is independent should be determined by the person’s relationship to the company.

The CEO is an obvious example of a director who is not “independent”; they work directly inside the company and its operations.

The value of independent directors is that they can often provide a more dispassionate opinion about the company, being more removed from the day-to-day. They can also bring insights from other companies or industries, to give fresh ideas and perspectives and help keep executives afloat of current business trends and conditions.

An independent director is also expected to be more likely to hold an executive accountable.

Executives can all become emotionally invested with each other, and the independent director can work as a third party to either mitigate disagreements, or break up bad decisions that were made from “buddy, buddy” group thinking.

Like with the other facts contained in the proxy statement, the composition of the board is a subjective matter. There is often no good, or bad, just different ways to run a company.

As investors, we should make decisions by considering multiple different facts, which help us learn the story of the company and if we like its direction or not.

How to Vote Your Shares in Your Brokerage Account

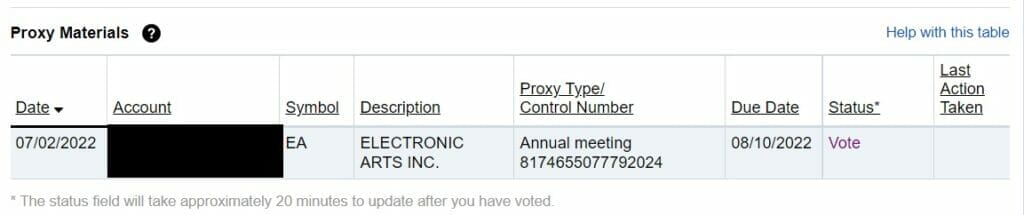

If you want to participate in voting on the proposals you see in a stock proxy, it’s important to know that your broker should automatically collect any Proxy Materials for you.

I use Fidelity and it has fast become one of my favorite brokers.

To find your Proxy Materials on Fidelity’s brokerage website, go to the Accounts & Trade tab > click on Statements > click on Proxy Materials.

We can see here that there is currently one proxy which I can vote on, a company I own called Electronic Arts.

Clicking on the vote button sends me to a specific page on ProxyVote.com, and I can vote on each Election of Director with the three options: “For”, “Against”, or “Abstain”. I can also vote on the compensation package, the auditor, their Equity Incentive Plan, and others.

There’s also the Board Recommendation of how you should vote for each proposal below each.

I submitted my votes, and ProxyVote automatically voted all of the shares which I hold through Fidelity for this account and company.

Investor Takeaway

Hopefully this post has been helpful in showing you how to quickly skim a company’s stock proxy to find the key details about the checks and balances for a company and how it is run.

The more investors that start to take proxy voting into their own hands, the more influence the average individual investor can start to impose on the investments they put their hard-earned money in.

That should be a good thing, as long as we are reasonable and rational about our decisions.

Remember that the proxy statement is just one tool out of many that investors should use when evaluating a company. The next place I’d recommend would be the annual report. Luckily, we created a simple guide on annual reports to navigate that (sometimes tough) document too.

Related posts:

- The Roles, Levels, and Salaries of C Level Management Explained C level management, or the C-suite, includes all the top managers of any company such as Microsoft, Berkshire Hathaway, and Tesla. The C level management...

- How to Find Acquisition Candidates – Two Perfect Real Life Examples M&A can be a huge value driver for both the acquiror and acquired if it unlocks larger future growth or leads to synergistic cost efficiencies....

- Assessing The Capital Allocation Skills of Management Updated 9/15/2023 Capital allocation is job number one for any management team. The problem is that most CEOs lack this skill, intending to build long-term...

- Stock Repurchases: How They Work and Their Effect on Earnings Updated 3/6/2024 In today’s market, share repurchases are the choice that most public companies use to return value to their shareholders. Investing giants such as...