Updated 3/6/2024

In today’s market, share repurchases are the choice that most public companies use to return value to their shareholders. Investing giants such as Warren Buffett and Jamie Dimon applaud these efforts.

Warren has commented multiple times in his Berkshire Hathaway Letters to Shareholders on his fondness for share repurchases, also known as buybacks.

Buffett’s thoughts from his latest letter, 2019:

- “Repurchases will benefit both those shareholders leaving the company and those who stay.”

- “When stock can be bought below a business’s value, it probably is its best use of cash.”

Jamie Dimon, CEO of JP Morgan, has bought back 20% of their shares over five years to $55 billion, per its 2018 annual report.

Dimon’s thoughts about share repurchases:

- “We believe stock buybacks are an essential part of proper capital allocation.”

- “Buybacks…are an important tool businesses must have to reallocate excess capital.”

- “Buybacks should not be done at the expense of properly investing in our company.”

Share repurchases have been the main driver of shareholder value over the last bull market and will continue long into the future. According to the Wall Street Journal, total spending on share repurchase projects will reach $940 million in 2019.

Although share repurchases have become a popular practice in capital allocation among public companies, there has been some opposition to this practice.

The opposition comes mostly from the Democratic side of the aisle, leading candidates for the upcoming Presidential elections. Bernie Sanders and Elizabeth Warren have been highly critical of these practices—more on this topic.

Today’s post will discuss the following topics:

- What Are Share Repurchases?

- How Do Share Repurchases Work?

- Why Are Share Repurchases Done?

- How Share Repurchases Impact Financial Ratios

- Pros and Cons of Share Repurchases

What Are Share Repurchases or Buybacks?

There are three main ways that companies can return value to its shareholders.

- Share price appreciation

- Dividends

- Share repurchases

Rising share prices are one of the most common ways a company can reward us for investing our money in them. Over the years, dividends have also proven extremely valuable to shareholders. With the ability to DRIP your dividends and the power of compounding by your side, these two more traditional methods of shareholder value have long dominated the stock market.

But more recently, there has been a turn towards share repurchases as a source of capital allocation or a way to return value.

So what is a share repurchase, also known as a share buyback?

A share repurchase is what it sounds like; it is the process of a company buying its shares from the markets with its cash. The use of share repurchases is a method of re-investing in itself.

Once repurchased, the shares are absorbed back into the company, reducing the number of shares available in the market. The reduction benefits shareholders by increasing the value of each share they own.

How do Share Repurchases Work?

Unfortunately, they can’t go to their broker and buy the shares there; it is a bit more complicated than that. There are two ways that companies can execute share repurchases.

According to Investopedia:

- “Tender Offer: The company shareholders receive a tender offer that requests them to submit, or tender, a portion or all of their shares within a certain time frame. The offer will state the number of shares the company wants to repurchase and a price range. Investors who accept the offer will state how many shares they want to tender and the price they will accept. Once the company has received all the offers, it will find the right mix to buy the shares at the lowest cost.”

- “Open Market: A company can also buy its shares on the open market at the market price. It is often the case, however, that the announcement of a buyback causes the share price to shoot up because the market perceives it as a positive signal.”

It is important to note that word of a tender offer or the announcement of an intention to buy shares on the open market will typically cause the company’s share price to rise.

Each company must get approval from the board of directors to initiate a share repurchase program. For example, Brighthouse Financial (BHF) recently announced approval to repurchase up to $500 million of its common stock in addition to the $600 million it had previously approved. Through January 2020, Brighthouse Financial has repurchased approximately $570 million of its common stock.

The company announced that it was part of their plan to use share repurchases to return over $1.5 billion to its shareholders.

Why Are Share Repurchases Done?

The most common reason for share repurchases is that management feels this is the best way to allocate capital at the current time. After all, a company’s management’s number one job is to squeeze out the most value for its shareholders.

Buybacks typically increase value for shareholders, therefore why they continue to be in use.

Why would management feel that repurchases are the best choice? One reason is that they feel the market has undervalued the company. In other words, they feel the price is less than they feel it is worth.

The market often beats up certain companies or sectors, such as financials. The circumstances surrounding the negative feelings in the market may be valid, such as negative earnings, a scandal, or a downturn in a company’s financials.

But, there are times when the downturn is for no real reason that can be determined.

When a company declares that it will repurchase its shares, this can signal to the market that management believes in the company and that they feel the market has gone too far in discounting the share prices. For example, in Brighthouse Financial’s above example, the announcement of the repurchase program caused a rise in share prices of over 2%.

Another less-than-positive reason for initiating a repurchase program would be to improve the company’s financial metrics. For example, reducing shares outstanding can improve any company’s earnings per share. With the reduced shares available, even with flat earnings, a company can report a growth in earnings per share.

Is this legal? Yes, it is, but the bigger question would be the motivation for the repurchase program as opposed to reinvesting in the assets of the company or a dividend increase.

With Wall Street’s obsession with earnings and growth, every quarter, each company on Wall Street is under the gun to report earnings growth. They run the risk of their share price falling if there is no growth in earnings, and most companies’ management has their compensation tied to the company’s stock.

And if the price goes down, they make less money, if the price rises they make more money.

It is important to be aware of management’s compensation when considering investing in any company; we need to understand their motives for allocating capital to our company.

Let’s examine how share repurchases can impact a company’s financial ratios.

How Share Repurchases Impact Finacial Ratios

Repurchasing shares reduces the number of shares available in the market. Once a company owns its shares, it has several options regarding what to do with them.

First, they can cancel them or keep them as treasury shares, both of which reduce the number of shares outstanding.

Besides earnings per share or EPS, other financial metrics that are affected are return on assets and return on equity. Return on assets increases because using cash to repurchase shares reduces the assets on the balance sheet. Likewise, return on equity increases because there is less equity on the balance sheet.

Increasing all of these metrics is viewed as a positive sign in the market and can give the stock price of any company a little extra juice.

Let’s look at a real company’s financials so we can see this in action.

Apple (AAPL) is the company I would like to use first for our deeper look into share repurchases. I am going to use the latest quarterly report (10q) for our deep dive. The report’s date is 12-28-19. We can use the annual (10k) as well, but I thought I would use a more recent financial report to illustrate.

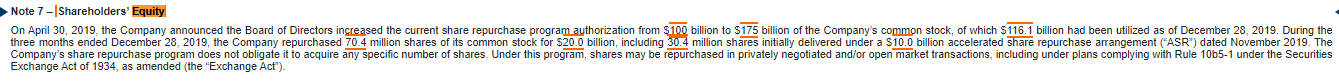

The first item we will look for is some notification of any share repurchases that might be authorized.

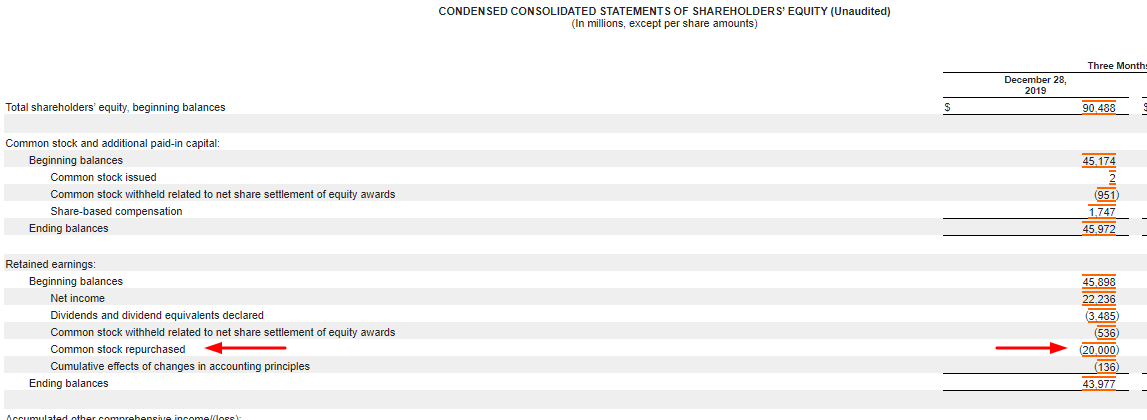

In the notes section of the 10q, share repurchases are notified as part of the shareholders’ equity.

It states that Apple repurchased 70.4 million shares of its common stock for $20 billion and 30.4 million shares under an accelerated repurchase agreement. It also notes that the shares may be purchased in privately negotiated or open-market transactions.

The above statement shows the amount authorized and the method for repurchases.

Let’s track the money as it moves through the financial statements and how it affects the financial metrics.

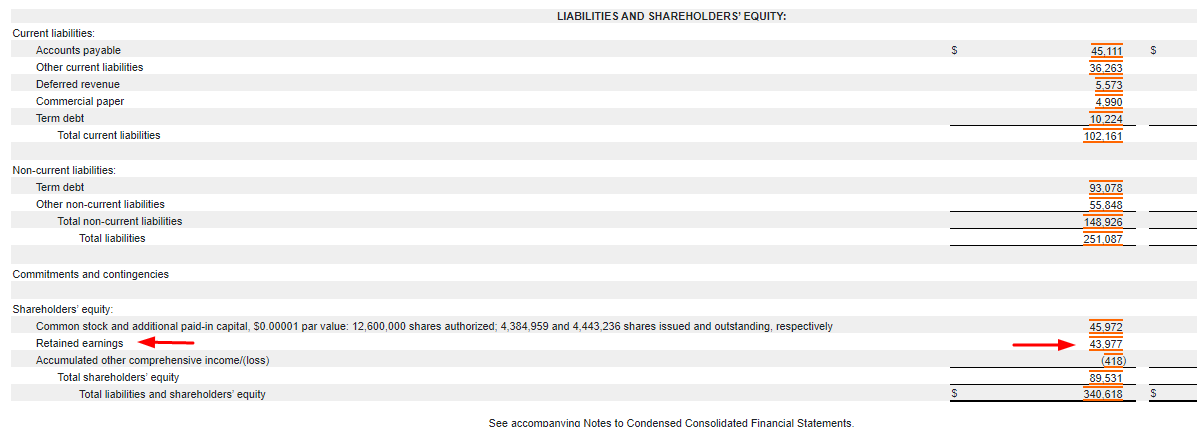

The first place we will look at is the balance sheet, which will be a two-step process.

Let’s look at the retained earnings on the balance sheet.

We can see from the balance sheet that the retained earnings for Apple are $43,977, now we are going to uncover what makes up the retained earnings.

And there we can see the $20 billion of common stock purchases that were authorized.

Now that we can see that share repurchases were authorized let’s look at some of the effects these repurchases can have on financial metrics.

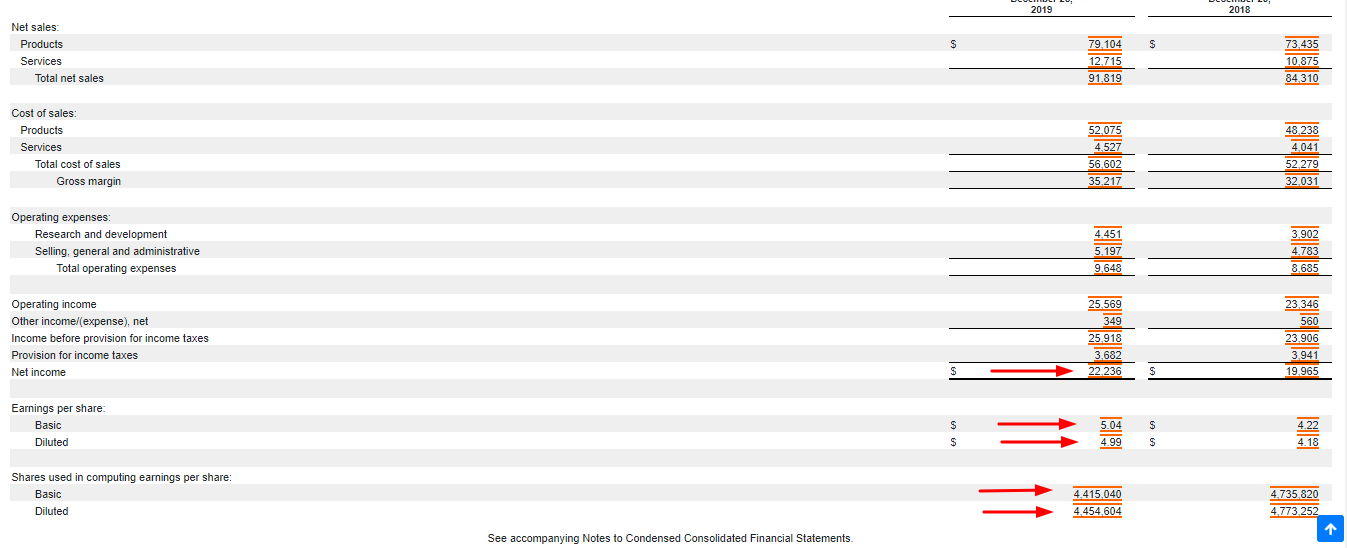

Before we do that, let’s look at the income statement.

Notice that the earnings per share improved from the previous year’s 10q and that you can see a decrease in shares, as was discussed in the repurchase program. If we want to see the decrease in share repurchases by each quarter, we would look at the previous quarter’s 10q and subtract the resulting difference in shares.

We can see from the income statement that there is an increase in earnings per share by dividing the net earnings by the diluted shares available.

EPS = 22,236,000 / 4,454,604

EPS = $4.99

If you take a closer look at Apple, you can see that its net sales and net earnings increased year over year. Add in the reduction in shares, and you get a boost in earnings, which Wall Street loves.

In addition to the increase in earnings per share, we also get a reduction in price to earnings. A price reduction in earnings is also a good sign, making the company more attractive with a lower price to earnings.

Price to Earnings = Quarter End price / TTM EPS

Price to Earnings = $293.65 / $12.66

Price to Earnings = 23.20

Also, we see an increase in the return on assets; with the reduction in cash to repurchase the shares, assets are reduced.

If you look at the return on Apple’s assets over the last five years, it has seen a steady increase, partially due to the strength of Apple’s performance but also due to the continual repurchasing of shares.

Return on Assets = Net income Q4 2019 / ( Total Assets Q3 2019 + Total Assets Q4 2019)/2

Return on Assets = 88944 / ( 338516 + 340618)) / 2)

Return on Assets = 26.19%

The final metric we will discuss is the increase in return on equity. With the reduction in equity from the repurchasing of shares, we get an increase in return on equity—also a very attractive metric to entice more purchases of Apple stock.

Return on Equity = Net income Q4 2019 / ( Total equity Q3 2019 + Total equity Q4 2019)) / 2)

Return on Equity = 88944 / ( 90488 + 89531))/2

Return on Equity = 98.82%

Now, Apple’s return on equity is ridiculous, but you can see that equity decreases from one quarter to the next, but net income remains the same.

The examples apply for both the ROA and ROE, and I hope it helps illustrate the effect that share repurchases can have on the financials of a company.

Okay, we have discussed the financials. Now, let’s look at a few more benefits of share repurchases and some possible negative benefits.

Pros and Cons of Share Repurchases

Pros

One of the pros we have not discussed so far is that it allows a company to benefit from the undervaluation of shares. Suppose the company trades below its intrinsic value and conducts share repurchases. This will unlock tremendous shareholder value as the stock price eventually rises toward fair value.

Another benefit of share repurchases is the tax benefit you receive from the repurchases. When a company repurchases shares, those taxes are lower capital gains, as opposed to dividends, which are taxed as ordinary income when the dividends are received.

Staying with the dividend theme, there are additional benefits related to dividends. Paying regular dividends is important to any company, and the dividend must be proportionate to its free cash flow. This can’t be ever-increasing and constant; it will naturally fluctuate.

The dividend is preferred to be constant. Tying it to the ebbs and flows of free cash flow, it would naturally rise with increases in cash flow and decrease with downturns in free cash flow. No company or shareholder would accept this situation; it is far better to be constant and grow steadily.

How does this relate, you ask? Well, companies prefer to keep the dividend payouts steady and hopefully grow at a reasonable rate. But when a company’s free cash flow increases dramatically, it is far more preferable to offer a share repurchase program as a means of returning more shareholder value.

Using excess cash to repay shareholders with repurchases is a better option than large increases in dividends; plus, the tax benefit also matches the shareholders’ needs.

Companies can repurchase shares from the market to offset the increase in equity compensation for management or the dilution of equity with the exercising of options to liquidate shares.

Cons

Ok, now let’s explore some possible negative benefits of share repurchases.

First up is an obvious one. If repurchases are done to prop up a company to make it appear more successful than it is, it can be extremely harmful.

For example, say the revenue is falling or flat, but the company buys back its shares, which in turn makes the net income or bottom line look better than it is by offering a rising EPS compared to a declining top line or bottom line.

Or if there was another option to utilize the cash to advance the company better, say, purchasing additional assets to grow revenue or possibly acquiring another company that could add additional long-term value.

Another example of poor capital use is the repurchasing of shares when the company’s intrinsic value is such that the shareholders overpay for the shares with little to no gain.

These are all examples of management using the tool of share repurchases to increase their value for their gain. One of the troubles concerning management compensation, tying itself to stock options, is that it can create the desire to enrich themselves instead of the shareholders.

The final downside is the potential political backlash from repurchases in today’s political environment, which has been hyper-focused on CEO compensation and corporate actions. Many of the Democratic challengers for President have challenged the decisions to repurchase shares. Bernie Sanders and Elizabeth Warren have been extremely critical of these decisions, feeling that the money would benefit the employees more by increasing employee compensation before compensating the shareholders.

Final Thoughts

Share repurchases have benefits and drawbacks; like most things in finance, there is no finite answer.

We have seen that buybacks reduce the number of shares outstanding and the company’s total assets. Both of which can affect the company and shareholders in multiple ways.

First, the reduction in shares helps boost the earnings per share, price to earnings, return on equity, and return on assets. The increase in all the financial metrics can help give the share price a nice boost, especially with Wall Street putting so much emphasis on earnings, and growth in earnings.

The stock market will always reward share repurchases by increasing the shareholder’s value with an increase in the share price. However, investors need to ask whether the buybacks are merely a way to prop up ratios and provide short-term relief to a struggling company.

Or are the repurchases done for another purpose, say, to help increase management pay or boost the share price before shares are redeemed?

These are all ideas that must be kept in mind when considering the reasons for any share repurchases.

As always, thank you so much for reading this post. I hope you found some value in it and that it contains items that you can use on your investing journey.

Please let me know if you have any questions or if I can be of any further assistance.

Take care,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- The Big Guide to Little Dividends Dividends are one of the best ways companies can return value to shareholders. Share buybacks have become all the rage in the investing world, pushing...

- The 7 Types of Capital Allocation and What They Mean for Shareholders Updated 9/3/2023 “Capital allocation is a senior management team’s most fundamental responsibility. The problem is that many CEOs don’t know how to allocate capital effectively....

- Here’s the Optimal Dividend Policy According to Warren Buffett As I continue to read (and fall in love with) The Essays of Warren Buffett I can’t help but urge you to buy this book...

- What Buybacks King, Henry Singleton, Can Teach Us About Capital Allocation Before Warren Buffett and his special conglomerate, the compounding machine Berkshire Hathaway, there was a CEO of Teledyne called Henry Singleton—who pioneered prudent capital allocation...