“Never invest in a company without understanding its finances. The biggest losses in stocks come from companies with poor balance sheets.”

The ability to read a company’s financials, such as the income statement, balance sheets, and cash flow statement, is a key source of data for investors, both do-it-yourselfers and institutional investors.

As an investor, you don’t need to be an expert at deciphering financial statements and modeling, but at least being fluent in the accounting language will go a long way toward your success as an investor.

In our continuing series on understanding accounting and financial statements, we will unlock the secrets within the balance sheets.

The next focus is on the balance sheet and the components of the balance sheet. Every company, as a public entity, has to file a balance sheet, and the structure of the balance sheet helps inform investors about the financial strength of any company.

Aside from financials such as banks and insurance companies, reading the balance sheet of companies is fairly straightforward.

Analysis of the balance can uncover clues to the liquidity of a company and its ability to survive challenges such as businesses face today.

In today’s post, we will learn:

- Breaking Down the Balance Sheet Structure

- Asset Side of the Equation

- Liability Side of the Equation

- Equity Side of the Equation

Ok, let’s dive in and uncover more about the balance sheet structure.

Breaking Down the Balance Sheet Structure

The balance sheet remains one of the big three financial statements that all public companies must file. The others are the income statement and statements of cash flows.

The objective of the balance sheet (or statement of financial position) remains to provide, at a specific point in time, any information concerning the assets owned by a company and the equity interests.

Assets represent items of value the company owns and has in its possession. Or others that will be received and can be measured objectively.

Companies owe creditors, such as employees, suppliers, tax authorities, and liabilities. The liabilities are obligations with schedules, conditions, and time frames that govern when, how much, and how often the company pays the liabilities back.

Equity or shareholders’ equity consists of retained earnings and monies contributed by shareholders in exchange for ownership.

We can best express the balance sheet as a formula. The formula equals:

Assets = Liabilities + Equity

The balance sheet formula remains important, and we should consider it this way. As sales grow, the asset base will grow as well. All of these dictate higher inventories, receivables, and fixed assets, like plant, property, and equipment. As the company’s assets grow, the liabilities and equity grow in lockstep as the financial positions have to stay balanced concerning the equation.

How the assets are supported, either by financing or by the corresponding growth in payables, debt, and equity, tells us much about the company’s financial health.

When considering the financial health of any company, we must consider having a good mix of liabilities and equity supporting the assets is a sign of a financially healthy company.

A simple view of the balance sheet equation is having assets equal to a smaller portion of liabilities supporting those assets while having a larger portion of equity than liabilities supporting those assets—keeping in mind that equity-creating revenues are cheaper than debt-creating revenues.

We want to consider the balance sheet equation because debt financing at higher levels lends more risk to your investment; as a company struggles, the possibility of defaulting on the debt rises, and the risk of bankruptcy also increases.

The balance sheet is a snapshot in time of the financial condition of any public company. Every quarterly or annual report will contain a balance sheet, and we need to think of those results as frozen in time and depending on the day.

Standard accounting practices allow for presenting the balance sheet in two formats:

- Horizontal presentation

- Vertical presentation

Most companies use vertical presentations; I have never seen a horizontal presentation in a public company. The vertical presentation doesn’t allow for the “balancing” of the sheet as you don’t see the two sides balancing out like you would in accounting class.

Regardless of whether it is a horizontal or vertical presentation, all balance sheets conform to the presentation that presents the positions of account entries into five sections:

- Current assets

- Non-current assets

- Current liabilities

- Non-current liabilities

- Shareholders’ equity

Such that Assets equals:

- Current Assets

- Non-current assets

Liabilities: current liabilities + non-current liabilities + shareholders’ equity

As I mentioned above, the balance sheets for utilities, banks, insurance companies, brokerages, and investment banks remain significantly different. They require further analysis and understanding of the terminology used for those businesses.

Another note about balance sheets, there remains little normalization of the nomenclature or naming of said sheets. For example, one company may refer to its balance sheet as a “statement of financial condition” or “financial condition.” Unfortunately, this disorder also applies to the accounts of balance sheets, so there is no uniformity in labeling accounts for the balance sheet.

Ok, let’s uncover each section of the balance sheet and define the different components of each.

Asset Side of the Equation

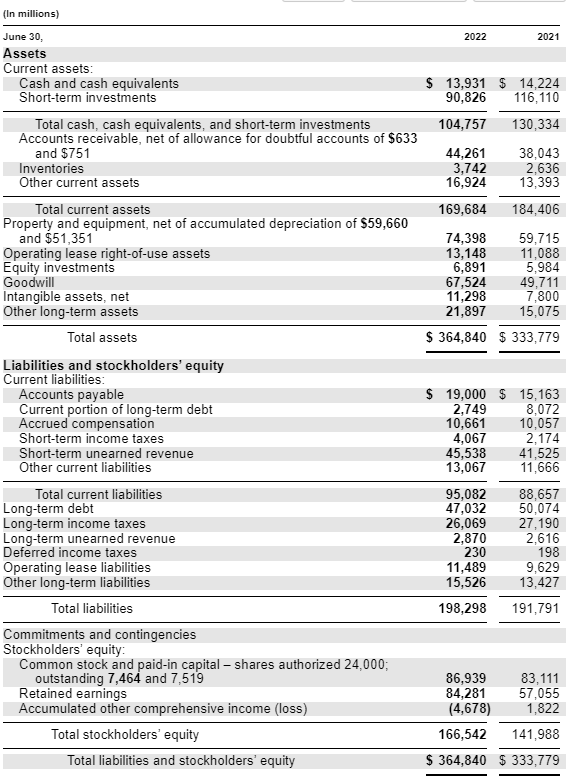

As we work through our balance sheet, we will use Microsoft’s (MSFT) as our example and their latest 10-k, dated June 30, 2022

A quick note on assets for our analysis, assets drive the economic resources of a company. The company must have acquired the rights of said assets, and they continue likely to contribute to Microsoft’s future net cash flows.

Items such as cash are unquestionably an asset because it has purchasing power that represents a future economic benefit to Microsoft.

Let’s start to look at each component of the asset side of the equation of the balance sheet structure.

A note about the order we find the assets listed in the asset section. The accounts list in the order of liquidity, or how quickly those assets can convert to cash. So accounts receivable is more liquid than inventories, for example. The above point is important to remember when you are analyzing the company’s ability to meet its liabilities obligation.

The asset section of the balance sheet breaks into two components, and we will break them down by line items.

- Current assets

- Non-current assets

Current Assets

Current assets are the most liquid assets owned by the business and are the accounts or line items listed in order of liquidity.

Current assets can be considered assets that a company can liquidate within one calendar year. Think of inventory as something used up within one calendar year, for example.

Current assets are important because they represent the funds that a business can use to fund day-to-day operations for the next calendar year. We can also think of it as the liquid assets of the business.

Let’s next look at the accounts associated with current assets.

Cash and Cash equivalents

These are the most liquid of all assets as they appear on the first line of the assets section. Cash equivalents are in this line item. Cash equivalents contain securities, among other items, that are extremely short-term, such as three months.

These securities are short-term bonds, money market accounts, or treasuries. The company uses this account to generate a small amount of income from monies not used for the immediate future and wants to create some income.

We can find More information regarding the cash equivalents in the notes section of the financials, typically listed as the marketable section or investment section.

Microsoft lists $13,576 million in cash and cash equivalents. The company also lists the short-term investments separately, for which we can see a total of $122,951 million. Keep in mind that these securities are very short-term in nature, and the ability of quick liquidity is paramount.

Accounts Receivable

The accounts receivable accounts for all amounts owed to the company by customers that the company has not yet collected. The bad debt accounts or customers are unlikely to pay to subtract from this account.

As Microsoft collects from its customers, this account decreases, and cash will increase by the same amount as collected.

Microsoft lists accounts receivable as $44,261 million.

Inventory

The inventory line item contains raw materials, work-in-progress goods, and finished goods. Think of inventories as goods waiting to be sold by the company, whether cars, computers, or phones.

In many companies, inventory might be the largest line item in the current asset section.

The costs associated with the production or acquisition of inventory list in the costs of goods sold line item of the income statement.

Microsoft lists inventories of $3,742 million under the current assets section.

Other current assets

Other current assets are typically smaller items listed under this catch-all section.

Items include advances paid to an employee, a piece of property listed for sale, or restricted cash or investments.

Microsoft is listing its balance sheet of $16,924 million of other current assets.

Non-Current Assets

These assets are items that the company uses for longer life, such as property, plant, and equipment or intangible assets.

The non-current assets have a longer life, typically longer than at least a year, and include goodwill, among others.

Plant, Property, and Equipment (PP&E)

The PP&E line item represents the fixed assets of the company. The line item doesn’t include depreciation, and some companies will list their PP&E on different line items, such as plants, as separate lines.

The PP&E account will vary from company to company, and for many companies, this will easily be the biggest line item under non-current assets.

Microsoft is listing the plant, property, and equipment of $74,398 million on the balance sheet.

Goodwill

Goodwill is probably one of the more controversial items on the balance sheet as it contains information that is not always the most transparent. It takes some sleuthing to determine what makes up the goodwill.

Typically, goodwill expresses the intangible amounts from an excess purchase of another company. Items contained in goodwill can be proprietary or intellectual property, or branding.

We can calculate goodwill by subtracting the market value of the assets and liabilities from the purchase price of the assets. Businesses are required to review the value of goodwill annually and record any impairments to the asset’s fair value.

The goodwill for Microsoft is $67,524 million for 2022.

Intangible Assets

The intangible asset line items include the company’s intangible fixed assets. Some of these items, such as patents, licenses, or a secret sauce or formula, may or may not be identifiable.

Microsoft lists intangible assets of $11,298 million on its balance sheet.

That concludes the asset section of Microsoft’s balance sheet; remember, the other side of the equation must balance the assets.

Let’s move on to the liability section of the balance sheet.

Liabilities Side of the Equation

Liabilities are the monies that the company owes to help support the assets of the company. Think of them as accounts that support the purchases of inventory to sell the items the company sells.

Or it could be financing those purchases for inventories, for example.

Remember that the accounting equation for the balance sheet means that the liabilities and shareholders’ equity must equal the assets for the financial statement to balance.

Let’s walk through some of the line items most commonly seen in the liability section of the balance sheet.

Current Liabilities

Current liabilities are the short-term obligations due within the calendar year or operating cycle. Current liabilities settle by using current assets, thus using ratios such as the current or quick ratio to determine companies’ liquidity.

Examples of current liabilities include items such as:

- Accounts payable

- Short-term debt

- Dividends

- Notes payable

- Income taxes owed

Ok, let’s look at some of the more common current liabilities.

Accounts Payable

Accounts payable is the amount the company owes its suppliers for the goods or services they have purchased on credit from its suppliers. Accounts payable expect to settle within the year of purchase and are considered the most liquid of all current liabilities.

Microsoft has an account payable of $19,000 million listed on its balance sheet.

Current Portion of Long-term Debt

The above line item refers to the short-term portion of long-term debt the company is due within the calendar or operating year. For example, if a company takes out a 10-year bank loan, the current portion of that loan is listed under this account.

The short-term debt of any bonds will list under this account for many companies; for example, any debt that is coming due for the current year on this line item.

It may also refer to short-term debt; again, there is no uniformity in the labeling of accounts, which can lead to some confusion.

Microsoft lists the current portion of long-term debt as $2,749 million.

The company lists this item as short-term unearned revenue on Microsoft’s balance sheet.

Think of it as revenue the company has earned but not recognized as the sale has not finalized according to accounting rules.

Microsoft lists short-term unearned revenue as $45,538 million on its balance sheet.

Non-current Liabilities

The non-current liabilities are longer-term liabilities having longer maturities over a year. Any long-term debt is listed under this line item and is a major source of investigation for investors.

Long-term debt

This account includes any long-term debt, except for the current portion due if it lists under the current liabilities. The long-term debt gets paid on a debt schedule, which outlines all of the company’s debt and indicates the schedule of payments, along with the interest expense, total debt due, and the schedule of the principal payments.

All information regarding long-term debt lists under the notes section of the financial reports: here, you will find everything you wish to know about the company’s long-term debt.

Of particular note in the notes section, we find the schedule for debt repayment; this item can go a long way to helping you determine how much debt the company owes and when the debt comes due on a cash flow basis.

Microsoft lists long-term debt of $47,032 on the balance sheet.

Long-term income taxes

This account lists the unpaid or carrying amount of income taxes due for longer than one year—also known as income taxes payable.

Microsoft records this item as $26,069 million on its balance sheet.

With that, we will wrap up our summary of the liabilities section of the balance sheet.

To ensure our balance sheet balances, we need the shareholders’ equity section to equal the difference between the assets and liabilities.

So far, Microsoft has:

- Total Assets – $364,840 million

- Total Liabilities – $198,298 million

Equity Side of Equation

Also referred to as shareholders’ equity or stockholders’ equity, we have the owners’ claims on any assets after paying the debts. Think of it as the percentage of ownership of any assets left over after paying the debt owed on those assets.

Equity is equal to the firm’s assets minus the liabilities.

Shareholders’ equity can be positive or negative, depending on whether the company has more or fewer assets than liabilities.

If the company owes more liabilities than assets, then the equity in the company will be negative. Many investors, including yours, consider negative equity a risky proposition because it means the company owes more money than assets created for the company.

Share Capital

The share capital line item indicates the number of money shareholders has invested in the company. Owners contributed this initial contribution when first creating the company.

They are also known as shareholders’ capital, equity capital, or common stock.

Microsoft lists this line item as $86,939 million on its balance sheet.

Retained earnings are the total amount of earnings that the company decides to keep after paying share repurchases, dividends, or paying down debt.

Every quarter, the company has decisions about what to do with the company’s earnings, whether it wants to return money to shareholders, pay down debt, or reinvest in projects to grow the company.

Any amount used to pay dividends, for example, deducts from the retained earnings, and any money left over adds to retained earnings.

Keep in mind this is not an actual bank account but an accounting ledger that indicates how much it has to use for dividend payments, for example. The actual paying of monies for dividends comes from the statement of cash flows, which is the business’s checking account.

We can find more information concerning the retained earnings in the stockholders’ equity statements, which also contain all the information regarding all items related to shareholders’ equity. That statement can give you more details on the dividend payments for the company, for example.

The retained earnings for Microsoft were $84,281 million for 2022.

That wraps up our summary of the shareholders’ equity section of the balance sheet.

To ensure we balance our statement, the shareholders’ equity section equals $166,542.

All of the sections then equal the following amounts:

- Total Assets – $364,840

- Liabilities – $198,298

- Shareholders’ Equity – $165,542

Liabilities ($198,298) + Equity ($166,542) = $364,840

Final Thoughts

Analyzing the balance sheet can give you great insight into the financial health of any company. Many investors focus on the balance sheets of businesses they buy because the balance sheet can tell you how strong the company is in the event of a downturn in the market.

Given the current condition of the stock market, studying balance sheets is paramount to determining the liquidity of the businesses. Please think of the balance sheet as the financial statement that will tell you how much money it has on hand to create more assets, how much those assets will cost, and how much equity the company is worth.

Many metrics are associated with the balance sheet to help determine the strength and health of the company. Among them are:

- Return on Assets

- Return on Equity

- Return on Invested Capital

- Current Ratio

- Quick Ratio

- Debt to Equity

- Debt to Assets

- Asset Turnover Ratio

By learning the balance sheet structure and language of the line items and studying the balance sheet utilizing the above-referenced metrics and ratios, you can learn a lot about the financial strength of any company.

That is going to wrap up our discussion on the balance sheet structure.

As always, thank you for taking the time to read this post, and I hope you find something of value on your investing journey.

If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- Changes in Working Capital: An Easy Walk Through Updated 3/6/2024 Changes in working capital help explain how a company uses its assets to generate growth. Some companies build inventories, pay down liabilities, or...

- Simple Income Statement Structure Breakdown (by Each Component) Updated 8/7/2023 The income statement is the first of the big three financial documents that all public companies must file. But what do we know...

- Balance Sheet Item: Book Value of Equity and Its Individual Components Updated 6/24/2023 “Price is what you pay; value is what you get.” A company’s evaluation involves determining the value of its assets, liabilities, and equity....

- How to Read the 10-k (Annual Report) If you want to learn more about a company or invest in a company, you can find a plethora of information on the company’s annual...