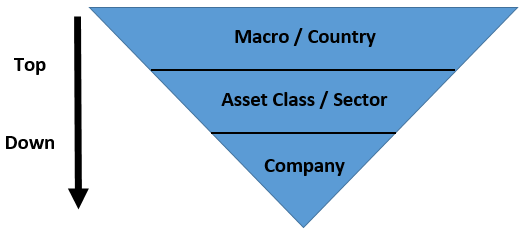

Top-down analysis is an investing approach that examines the big picture of macro factors in the economy such as interest rates, GDP growth, inflation, employment, default rates, and taxes.

These macroeconomic factors are critical to choosing which countries, asset classes, and industries to allocate investments to. It is important for investors to be aware of top-down investment factors and their implications on valuations.

Country economies and industries will be affected differently by various macroeconomic factors so it is important for investors to understand their various implications.

It is hard to gain an informational advantage by only using top-down analysis as many large institutional investors are looking at the same factors, so their effects are largely already priced into the market. That being said, long-term consistent returns are hard to achieve without taking into account top-down macro factors because they are just so important to overall market returns.

When we talk about individual company profitability, fundamental metrics, and valuations, this is referred to as bottom-up analysis. Such bottom-up company-specific fundamentals are hugely important to investing too, but if top-down macro headwinds are running against the business, this can have limiting effects for future company performance.

Both bottom-up and top-down analysis are necessary to long-term investing success. Let’s look at what some of the important top-down factors are and how they can affect broad valuations in the stock market.

The Big Picture with Top-Down Investing Strategies

A top-down investing strategy will first consider macroeconomic factors and which countries, asset classes, and industries will be positive or negatively affected. Investors will then allocate their portfolio towards these assets in broad securities such as exchange-traded funds (ETFs) or options on general indexes.

There is also such a thing as a top-down, bottom-up investing strategy. Here, investors will first consider the same macroeconomic factors mentioned earlier, but then instead of, or as a complement to ETFs, investors will then use a bottom-up investing approach to analyze which companies will outperform in the countries, asset classes, and industries that were first identified in the top-down analysis.

Example: The protective put option strategy I discussed in another article would be considered a top-down, bottom-up strategy. In this protective put option strategy, the top-down analysis indicated that the overall stock market is expensive due to high valuations driven by low interest rates and cheap money. This top-down analysis leads to buying put options on the main market index. The bottom-up aspect of the approach would then be identifying which individual companies are undervalued and potentially set to outperform the broader stock market.

Important Factors in a Top-Down Analysis

Gross Domestic Product (GDP)

By analyzing GDP growth across various countries, investors can understand which countries are growing the fastest and which sectors of the economy are driving that growth.

The total value of goods and services can change because of changes in price, or changes in quantity. Increases in quantity are associated with higher growth and standards of living while increases in price are due to inflation and do not mean growth has taken place. Because of this, economists focus on real GDP which does not take into account price changes.

Interest Rates & Inflation

Higher inflation ultimately leads to higher interest rates. Higher interest rates affect company valuations by raising the weighted average cost of capital (WACC) used in discounted cash flow valuations. Also, the level of interest rates has a negative effect on highly financially leveraged companies by raising the interest expense paid on their floating rate debt outstanding.

Inflation is closely related to a country’s GDP so one can be used to help forecast the other. The difference between a country’s potential or trend GDP and actual GDP is referred to as the “output gap”, which measures the slack in the economy.

A positive output gap opens during times of recession and is associated with declining inflation as productive resources are sitting idle. A negative output gap occurs during times of fast GDP expansion and is associated with rising inflation, as productive resources are becoming strained leading to wage and price inflation.

Taxes

Higher taxes mean less operating profits are reaching the bottom line. The level of taxes has a direct effect on net income. Expected higher tax rates in the future will lead to lower valuations in the current market environment even before they come into effect due to market participants starting to price them in.

Trump’s generous corporate tax cut from 35% to 21% can go a long way to explaining the S&P 500’s 29.3% return from July 2016 to June 2018. Likewise, Biden’s campaigned 28% corporate tax cut could see net income fall by 8.9% for companies paying the highest corporate tax rate.

Population Growth & Immigration

One of the main factors in GDP growth is labor force growth. Much of the western world is currently experiencing negative headwinds in labor force and GDP due to the aging baby boomer population leaving the workforce. This labor force issue is partially being made up for by rising immigration.

While population growth might not lead to rising real GDP and standards of living by itself, it can still have an important effect on certain sectors of a country’s economy by increasing overall demand. In my home country of Canada, population growth and rising immigration have had enormous effects on the housing market, which has seen prices increase 70% since 2015 to 2021. Between 2015 and 2019, immigration to Canada has averaged approximately 303,000 per year. This is a significant 0.8% of the total population of 35.9 million in 2015 and has driven increased demand not only in housing prices but also in other directly related areas such as financial services through the rising demand for mortgages.

The Takeaway for Investors on Top-Down Investing

Considering top-down investment factors is critical to achieving long-term investment returns. Top-down macroeconomic factors are central to choosing which countries, asset classes, and industries to allocate investments to. Company fundamentals always play the most important part in investing success, but top-down factors can be a big tailwind help things.

Related posts:

- The Top Down Investing Strategy: Pros, Cons, Pitfalls, and a Hybrid Approach Updated 5/5/2023 Fundamental investing can take two paths: “bottom up” or “top down.” One style of evaluating stocks is not better than the other. In...

- 3 Simple Tips for Managing Interest Rate Risk in an Ever Changing World Updated: 5/23/2023 For investors, basic interest rate risk management means that your portfolio should still earn a decent return even if interest rates were to...

- The Growth/Value Barbell Portfolio Explained: Pros and Cons As the growth stocks vs value stocks debate rages on, and value investing undergoes an almost two decade run of underperformance to growth, a new...

- 8 Major Stock Market Factor ETFs and Their Differences Updated – 11/3/23 A factor in the stock market is a set of characteristics, or style, of a group of stocks. Factor ETFs allow investors...