The Federal Reserve, or the Fed, is America’s central bank. One could argue that makes it the most important factor in the U.S. economy, maybe the world. And with all the chaos today in the markets and the world due to the Coronavirus pandemic, we must understand how the Fed is structured.

It can be complicated, and some feel that ‘secret societies run it,” but it breaks into understandable parts. The Fed does manage the flow of money in the U.S., albeit the world, by its actions, but there is nothing secret about its operations.

Created in 1913, the Fed has “helped” guide us through two world wars, a few recessions, the Great Depression, and the Great Recession. I put parenthesis around the helped comment because more than a few disagree with the Fed’s actions.

There is tremendous criticism regarding the Fed’s actions and their overall effect on the world’s economy.

Are they correct?

I am not sure, but understanding the history of the Fed and its structure can go a long way towards helping us understand the impact on the markets and the economy and thus help us make decisions regarding our financial well-being.

The series about the Fed is timely because there is a lot of scrutiny of the Fed for clues about how they will try to stabilize the economy and markets during all the chaos.

Let’s take a look at how the Fed is setup:

- The Three Major Components of the Fed

- Federal Reserve Board of Governors

- Federal Reserve Banks (12)

- Federal Open Market Committee

What are the Three Major Parts of the Fed?

The writers of the Federal Reserve Act purposely avoided the concept of a central bank. Instead, they created a central banking “system” with three major characteristics.

- A central governing board

- A decentralized operation consisting of 12 Reserve Banks

- A combination of public and private characteristics.

Many parts of the Federal Reserve system mirror some characteristics of public banks; the Fed began as a way to serve the U.S. as a whole.

There are three key entities in the Fed:

- Board of Governors

- Federal Reserve Banks or Reserve Banks

- Federal Open Market Committee (FOMC)

Let’s break all of these down.

Federal Reserve Board of Governors

The first of the entities that make up the Federal Reserve System is the Board of Governors.

The Board “is an agency of the federal government that reports to and is directly accountable to Congress, provides general guidance for the System, and oversees the 12 Reserve Banks.”

The Board of Governors are chosen by the President and approved by the Senate. The Board shares certain responsibilities with the Reserve branches around the country. There are frequent communications between the Fed and the government, particularly the executive branch and Congress, but they are independent in making decisions on their own.

The Board of Governors, based in Washington, D.C., is the main governing body of the Federal Reserve. Seven members, nominated by the President of the United States, run the Board of governors and then approved by the Senate.

The election of the Board of Governors is one of the more crucial elements of becoming the President. The Board helps set the country’s monetary policy, controls many aspects of the economy, and plays a large role. Among many other reasons, control of this Board is why a president’s election remains so hotly contested. The election of the Board is a little-known power the President holds.

All governor’s board members also serve on the FOMC, in which the body sets monetary policy for the U.S.

All Board members serve a 14-year term, and once that term expires, they cannot seek reelection. The Chair and Vice-chair are chosen by the President and confirmed by the Senate; however, they only serve four-year terms.

To help political independence, the terms are staggered every two years. Also, there must be one governor from each district represented by the Reserve Banks. Recently, Congress mandated that at least one of the governors have experience in the commercial banking sector.

The Board of Governors has many responsibilities. I will list just a shortlist of some of them:

- Analyzes domestic and international economic developments

- Supervises the operations of the Federal Reserve Banks

- Responsibilities for payment systems

- Oversees most consumer credit protection laws

- Changes in reserve requirements

- A Federal Reserve Bank must initiate any change in the discount rate

Additionally, they must go before Congress to testify to committees concerning the economy, monetary policy, banking regulations and supervision, financial markets, and consumer credit protection.

And finally, the governors must approve all budgets and directors of the regional Federal banks.

All in all, a very busy bunch. Especially with all the craziness of today.

Federal Reserve Banks

The Federal Reserve Banks function similarly to commercial banks; they serve bankers, the U.S. Treasury and the public. The Fed banks operate independently but under the jurisdiction of the Board of Governors.

The Fed banks and their branches are located regionally around the country:

- San Francisco

- Minneapolis

- Kansas City

- Dallas

- St. Louis

- Chicago

- Cleveland

- Atlanta

- Richmond

- Boston

- New York

- Philadelphia

- Washington, D.C.

Here is a map courtesy of the Federal Bank

Each region’s bank works with local economists and other employees to provide a regional outlook and give perspective to the Board about regional economies.

The Fed banks are often referred to as the “banker’s banks” because they provide services to commercial banks, just as commercial banks provide to us. Hopefully, with better customer service! But I digress.

The Fed banks:

- Distribute currency and coin to banks

- Lend money to the banks

- Process electronic payments

At one point, all mortgages went through Federal Reserve banks, but that duty now falls on the Federal Reserve Bank of Atlanta, which handles all check processing for the Fed.

Reserve banks also function as monetary agents for the government; they maintain accounts for the Treasury, process government checks, and conduct auctions of securities for the government.

One of the more exciting aspects of the Reserve Banks is they research economies from around the world, including regional and national economies. They also prep the Reserve Bank presidents for their meetings with the FOMC and work to educate the public on matters of the economy via publications, speeches, and websites. All tremendously exciting stuff, at least it would be to a geek like me!

The Fed Reserve Banks put all paper money we use into circulation. Each bill has a number and letter that denotes which Bank accounts for that paper money. For example, a bill with the number eight on it will have the letter H ( which refers to the eighth letter in our alphabet ), which tells us that the dollar bill we see is on the balance sheet of the Federal Reserve Bank of St. Louis.

Kinda cool, huh?

On the more recently redesigned $5, $10, $20, $50, and $100 bills, the letter and number that help identify which Federal Reserve Bank are beneath the left serial number on the face of the bill.

So who owns these banks?

The Federal Reserve Banks are not part of the federal government; an act of Congress created them, and their function is to serve the public.

This leads you to ask the question, are they public or private?

The easy answer is both. The more complicated answer is that Federal Reserve Banks operate like private corporations; think JP Morgan. The member banks hold stock in the Reserve Banks and earn dividends, but holding this stock does not carry with it the rights and privileges of owning a stock with a for-profit company like JP Morgan. The member banks may not use the stock as collateral for loans or sold. And finally, member banks appoint six of the nine members of each Reserve Bank’s Board of directors.

Each Reserve bank has its Board of directors, of which six come from the member commercial banks, and the Board of Governors appoints the other three.

By appointing local leaders, the Reserve banks each reflect each region’s local business experience, leadership, and diverse interests. Among the three directors chosen by the Board of Governors are a chairman and a deputy chairman.

The Reserve Banks are the heavies for the Fed and carry out their policies at the local level. On a day-to-day basis, they execute the banking and consumer protection laws put into law by Congress, as well as the regulatory policies enacted by the Board of Governors.

The Reserve Banks also play a role in keeping the Fed up to date on regional activities that might affect the national economy. For example, one banker learns that there will be a shutdown or expansion of a large local business; if it is a national company, it might impact the country on a larger scale. With their ear to the ground, the Reserve Banks can help policymakers at the Fed make decisions based on this information.

Also, the Reserve Banks contribute to the national discussions regarding rates, effects on businesses, and monetary policy, which allows the Fed to make better policies.

The writers of the Federal Reserve Act had all of these roles in mind when they decided to create a decentralized national bank that could incorporate ideas from across all the country’s different regions.

Federal Open Market Committee

The Fed’s main monetary policy body is the Federal Open Market Committee or FOMC. The membership consists of the following:

- “seven members of the Board of Governors,

- the president of the Federal Reserve Bank of New York,

- and four other Reserve Bank presidents.”

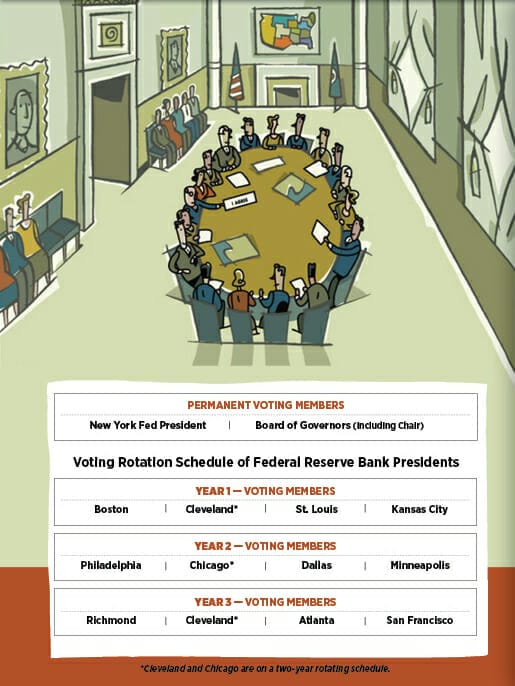

The four Reserve Bank presidents serve one-year terms on a rotating basis with others from the Reserve Banks.

The above group is the main voting membership of the FOMC. All Reserve Bank presidents attend the meetings, even if they are not voting members at that time. Tradition calls for the chairman of the FOMC to also be the Chair of the Board of Governors.

On another note, the president of the Federal Reserve Bank of New York and the Board of Governors are permanent voting members of the FOMC. Most Reserve Bank presidents serve one-year terms, with a three-year rotating schedule. To make it a little more complicated, the presidents of Chicago and Cleveland serve on two-year rotating schedules.

The FOMC meets eight times a year; everyone in the markets highly anticipates these meetings, with every word scrutinized for meaning. If the economy calls for more meetings, as in now, they will get together as needed.

The following items occur at each meeting:

“A senior official at the Federal Reserve Bank of New York discusses developments in the financial and foreign exchange markets, as well as activities of the New York Fed’s Trading Desk, where U.S. government securities are bought and sold.

• Staff from the Board of Governors then present their economic and financial forecasts.

• The Board’s Governors and all 12 Reserve Bank presidents—whether they are voting members that year or not—offer their views on the economic outlook.”

During these meetings, the FOMC will discuss the best options for promoting economic growth or stabilizing chaos.

Once they make any decisions, then those decisions are passed along to New York’s Fed Trading Desk. The Desk will then buy or sell U.S. securities to achieve this goal. The Desk will purchase the securities on the open market.

Picture courtesy of the St. Louis Fed

The “open market” defined by the FOMC means that they buy from certain securities brokers based on price, which they compete with other dealers for the right to buy or sell government securities.

The statement below is a biggie:

“The FOMC sets a target for the federal funds interest rate and attempts to hit the target by buying or selling government securities.”

The FOMC sets the Fed Funds Rate we discussed in our interest rate article. A quick refresher is a rate banks charge each other to borrow money from each other overnight.

The funds they borrow are necessary to meet the Federal Reserve System’s liquidity requirements. The importance of the Fed Funds Rate is that it sets the interest rates for the rest of the economy.

For example, if the Fed Funds rate changes, it alters the prime rates, home loans, car loans, and many more. If the rates rise, these rates rise over time; likewise, if the Fed Funds rate declines, then those rates also decline.

The Fed uses the open market to achieve the target rate by buying or selling government securities. Along with the Fed, other entities hold government securities, such as banks, brokerage companies, pensions, and individuals.

Think of the Fed’s buying and selling government securities as expansionary or contractionary monetary policies. More on this in another post, don’t worry; we will soon explore that.

A great example is the Fed’s use of the open market as either stepping on the gas or the gas pedal regarding monetary policy.

The Fed’s attempt at achieving its target of the Fed Funds rate is to provide monetary stimulus to get the economy humming.

At each meeting, the FOMC will announce the Fed Funds rate target; thus, all the attention to each meeting of the FOMC.

Final Thoughts

Keeping the economy healthy and strong is one of the most important jobs of the Federal Reserve, you might say its most important one.

The Fed was established in 1913 and has had a long and somewhat rocky road to where we are today. The structure of the Fed set back in 1913 has not changed much, and there is still a great debate on the effectiveness of the Fed.

The structure of decentralization has allowed it to maintain during times of crisis, such as the Great Depression and Great Recession, but the lack of a central leader and the fragmentation have led to some serious breakdowns of decision-making in times of crisis.

With all the chaos going on in the world, the Fed’s role in trying to stabilize the economy is crucial to the continued health of our economy.

Next week will continue our look at the Fed with a discussion of how the Fed conducts monetary policy that can impact the economy.

As always, thank you for taking the time to read this post, and I hope you find something of value on your investing journey.

If I can be of any further assistance, please let me know; I am here if you need me.

Take care and be safe out there,

Dave

Posted updated: 12/14/2022

Related posts:

- How Fed Economic Stimulus Works and Its Effect on the Economy The Central Bank of America is the Federal Reserve, responsible for deciding how much money is in the economy. To most people, that means that...

- Navigate the Federal Reserve Balance Sheet with This Simple Guide Updated 4/4/2024 With the recent announcement that the Fed will increase its balance sheet by about $4 trillion, I thought it might be a good...

- The History of the Federal Reserve: Its Creation and Role during Tough Times Is there a more controversial function in finance than the Federal Reserve Bank? From its beginnings, history, and purpose of a bank, there are tons...

- Common Indicators of Rising Interest Rates and Its Impact on the Economy How can you tell when interest rates might rise and what the impact would be on our lives? You can use simple tools to answer...