If you listened to the most recent episode of the Investing for Beginners Podcast with Andrew and Dave, then you heard them both GO IN on their opinions of whether you should take any extra money at the end of the month and pay off student loans or if you should invest that money.

Personally, I love this question so much for a few reasons:

- You’re budgeting! You know that you have extra money at the end of the month because you’re paying attention to your finances. Maybe you’re using Doctor Budget or maybe you have your own budget, but if you don’t know where to start with a budget, let me help you out.

- You’re asking the tricky question about investing or paying off debt, and that’s an experience question and means that you’re really, really taking personal finance by the horns!

We often talk about compound interest for investing, but student loan compound interest is a very real thing, too! Honestly, this is one of my favorite topics to talk about with people when it comes to their own personal finances and I feel like it comes up a lot in conversation.

In fact, it literally came up with a coworker of mine last week.

First off, take a second and pat yourself on the back. Most people that I know would take any “extra” money at the end of the month and go blow it on something stupid that they don’t need.

By asking that question or reading this article you are recognizing that there’s better, more effective ways to use that money to help you get ahead in life and get you one step closer to retirement, so again, congrats! No matter what you do, understand that you are making a good financial decision at this point!

The first thing that you need to do, in my eyes, is determine what percentage is the “tipping point” that will determine if you should invest or pay down student loan debt.

For starters, the Compound Annual Growth Rate, or CAGR, since 1950 is 11%. In other words, if you would invest in a S&P 500 index fund then the average year would provide you a 11& increase from the year prior. Unfortunately, this doesn’t mean that each and every year is a ratable 11% by any means.

For instance, since 1950, 18 years have been had a negative return (excluding dividends), so you’ve actually lost money those years! But, you’ve also had 34 years that have had returns over the 11% CAGR. So, the thing that you have to decide is this – what is the tipping point?

For me, the tipping point is 6%. I don’t have a real rhyme or reason for 6%, but I view that as a good conservative number. In other words, if my loan has an inters rate of 6% or higher, then I will choose to pay off the loan first instead of investing. A loan of 5.9% or less, then I will choose to invest that extra money.

“But Andy, you just said that the CAGR is 11%, so why would you make 6% be your tipping point?”

Yes, I did say that, but I also said that 18 years are negative returns! I am choosing a number that is below the average to be safe, because when I choose to pay off a loan it is a 100% guaranteed return.

If I pay an extra $500 on a 7% loan, then I just made 7% on that $500 by paying it off faster and avoiding the interest!

The simple math will tell you that you should invest anything under the CAGR, but sometimes the guaranteed return of paying off debt is better than the risk of investing. Not always, but sometimes. Let’s take a look at a few examples!

Example 1

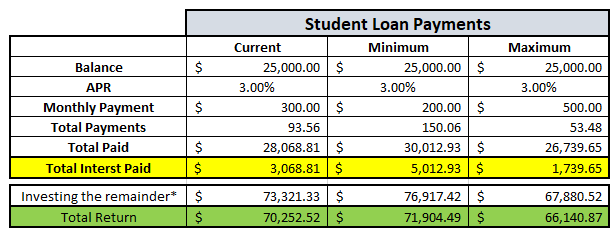

- Student Loans

- $25,000 remaining

- 3% APR

- Minimum Payment – $200/month

- You just got a raise and now will have an

additional $200/month to play with, in addition to the current $300 minimum

payment, for a total of $500. Your three

options are:

- Put all $500 on student loans

- Put $300 on the mortgage and invest $200

- Pay the minimum $200 and invest $300

So, what do you do? I know this likely seems complex, but it’s really not too hard if you have established your tipping point. Since my tipping point is 6%, then I should pay the minimum and invest the rest, right?

Well, let’s see..but first, let me explain a few assumptions:

- Investments were assumed to receive a ratable 8% gain YOY vs. the CAGR of 11% since 1950

- In other words, I am being conservative!

- Timeframe – this is over a 12.5-year period as that’s how long it would take to pay off the “minimum” option

- “Investing the Remainder”

- Current – this means I invested the remaining $200 until the student loans were paid off, then the entire $500/month for the remainder of the 12.5-year window

- Minimum – I invested the extra $300/month the entire time

- Maximum – I invested $0 until the student loans were paid off and then $500 for the remainder of the 12.5-year window

In my eyes, that is a pretty wide margin as to why you should pay the minimum! Paying the minimum would net you out over $1600 more than the current option and $5,700 more than the maximum option. This might not seem like a crazy amount of money, but let’s try to apply this to a mortgage:

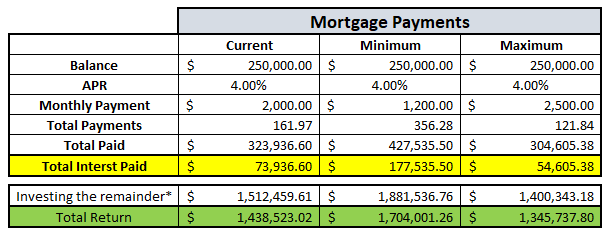

- Mortgage

- $250,000 remaining

- 4% APR

- Minimum Payment – $1200/month

- You just got a raise and now will have an

additional $1300/month to play with, in addition to the current $1200 minimum payment,

for a total of $2500. Your three options

are:

- Put all $2500 on the mortgage

- Put $2000 on the mortgage and invest $500

- Pay the minimum $1200 and invest $1300

But again, time for some of my assumptions!

- Investments were assumed to receive a ratable 8% gain YOY vs. the CAGR of 11% since 1950

- In other words, I am being conservative!

- Timeframe – this is over a 30-year period as that’s how long it would take to pay off the “minimum” option

- “Investing the Remainder”

- Current – this means I invested the remaining $500 until the mortgage was paid off, then the entire $2500/month for the remainder of the 30-year window

- Minimum – I invested the extra $1300/month the entire time

- Maximum – I invested $0 until the mortgage was paid off and then $2500 for the remainder of the 30-year window

As you can see, there is a pretty clear winner for the minimum option! You will have over $265K and $358K more than the current and maximum plans, respectively. That is the definition of a clear winner.

Again, paying the minimum is always better as long as you are investing return can beat your APR of the loan. I understand that the extra amount paid on the loan is a guaranteed return, but that’s why it all comes down to your risk tolerance and your own personal tipping point!

The younger that you are, the riskier that you can be without being too fearful that you won’t be able to recover from it. If time is on your side, then take some risks! Being risky can really pay off if it’s a smart, well-calculated risk!

Related posts:

- 5 Insane Compound Interest Examples to Keep You Motivated Compound Interest is one of the most amazing things in this world and is the reason that I got behind investing in the first place. ...

- Forget Me, Let Albert Einstein Explain Compound Interest and How You Can Master It! Albert Einstein – “Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” End of...

- This 401k Match Calculator Shows How Powerful Compound Interest Can Be There’s various compound interest calculators out there, but not many specific 401k match calculators that are easily manipulable to show how different contributions and employers...

- The Continuous Compound Interest Formula Excel Function for (Us) Nerds Ever wanted to illustrate exactly how powerful compound interest can be? Wanted to have an Excel function to do it for you? This post reveals...