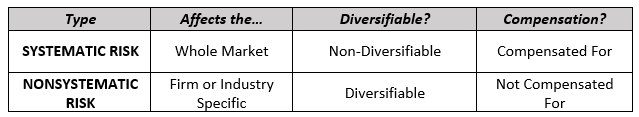

Systematic and nonsystematic risks are pervasive concepts in the CFA curriculum and understanding them is critical to portfolio management concepts. The take away from this article should be that while certain risks are unavoidable, others can be diversified away through proper portfolio diversification. Below is a quick summary for reference before we get into the explanations and examples for each.

Systematic Risk

Systematic risk is always present in the market and is attributable to natural and general risks that affect the economy and the prices of all securities in the market. Any factor that affects the prices of all securities in the market could be considered a systematic risk.

These systematic risks can range from economic to political and as can be seen in the list as examples below, they all focus on the big macro picture. This is by no means an exhaustive list of all the systematic risk possibilities and it is important to remember that any macro factor that affects the prices of all securities in the market could be considered a systematic risk.

Examples of Systematic Risk: interest rate hikes, inflation, economic cycle downturns, foreign currency exchange rates, tax reform, foreign trade policy, war, and large natural disasters.

Nonsystematic Risk

Nonsystematic risk is company or industry specific. Because of its focus on the unique risks involved with a security, it is also commonly referred to as idiosyncratic risk. The potential risks that could be considered nonsystematic are numerous ranging from general risks to any business, such as weak management, operational issues, or a lawsuit, to risks that are more industry specific such as the price of an important raw material or other input.

Some more potential example are given in the list below. What is important to remember here is that nonsystematic risks are firm or industry specific and will not affect the broader economy and asset prices in general.

Examples of Unsystematic Risk: increased competition, reduced consumer demand, industry cycle downturn, labor strike, raw material price change, operational issues, lawsuits, IT breach, product recall, fraud, poor management decisions, nationalization of assets, local natural disasters, and weather.

Can An Investor Diversify These Risks Away?

As systematic risk is always present in the markets, it cannot be diversified away by adding more securities to the portfolio. This is because each security added will be subject to the same inherent market risks. For these reasons, systematic risk is also commonly referred to as non-diversifiable risk or market risk.

Systemic risk can be increased by the use of leverage or reduced by increasing cash holdings and/or including assets that are not highly correlated with the current portfolio. Looking for uncorrelated assets could mean looking outside of the current portfolio’s asset classes/market to include new types of securities such as alternative asset classes or foreign stocks and bonds.

Side Note: I know we have said that systematic risk is non-diversifiable, but this is only in the context of a single market/asset class (such as U.S. Stocks) and moving outside of that market or asset class, investors can attempt to find assets that are uncorrelated with the current portfolio. However, some systematic risks are global (such as foreign trade policy and economic cycles) and will still cause strong positive correlations between different markets thus making them non-diversifiable.

On the other hand, unsystematic risk can be diversified away by adding more securities to the portfolio. This is because the unsystematic risk is firm specific and the potential risks in one security can be mitigated by potential strengths in another security.

If we think back to poor management being a potential unsystematic risk, then we might be able to mitigate this risk by investing in one or more of the company’s competitors. Some competitors will have stronger management than others and by investing in multiple competitors, the diversified portfolio now represents the average talent of management in the industry.

For an example of diversification across industries, we can look at the nonsystematic risk of the price of oil and its effect on a portfolio investment in an airline company. If oil prices were to increase, the airline company would see their profit margins and stock price suffer as the jet fuel needed to run their operations has increased. An investor would be able to diversify this risk away by being invested in uncorrelated assets or, even better, negatively correlated assets. A great choice here to diversify away the nonsystematic risk of the price of oil on the portfolio’s holding in an airline company would be to invest in an oil producer who would benefit from the rising price of oil.

Which Risk Are Investors Compensated For?

Since nonsystematic risks can be diversified away, investors cannot expect to be compensated for them. This aligns with efficient market theory as any perceived greater return in a security would quickly be priced away if an investor was able to diversify and eliminate the added risk. On the other hand, as systematic risks are unavoidable, investors can expect to be compensated for taking them on. This theory forms part of the argument for investing in passive ETFs and avoiding the uncompensated nonsystematic risks that come with holding an undiversified portfolio.

Related posts:

- How to Make Money with Stocks by Understanding Risk vs. Reward Myth #8 that Tony Robbins outlines in his book is that “You gotta take huge risks to get big rewards”. I’m sure that many of...

- Franchise Risk: Two Public Failures Explain the Two Sides of the Story When it comes to franchise risk, there are two sides to the coin—risk for the franchisee and risk for the franchisor. Whether considering operating as...

- Comparing the Bull and Bear Market In a nutshell, a bull is seen as someone who is optimistic and believes that stocks will rally. This is a bullish outlook. On the...

- Four Things to Know About the Potential Disadvantages of ETFs There’s no denying that ETFs, or Exchange Traded Funds, have revolutionized the world of investing and made it cheaper, easier, and safer than before. While...