Asset allocation is arguably more important than which stocks you pick. For most investors, focusing on your asset allocation is a lot more important than choosing between Microsoft and Facebook.

Asset allocation is a key area to focus on and get right, and it is an area where many investors hinder their returns. There are several methods of asset allocations, strategic and tactical, that investors have available.

As a do-it-yourself investor, what do we know about either of these strategies, and how can I put them to work for me?

When you start as an investor, we all focus on which stocks or funds to choose; that’s natural. But, along with those choices, we need to decide upon an asset allocation strategy.

Learning more about the asset allocation strategies available, particularly tactical asset allocation, is the focus of today’s post.

In today’s post, we will learn:

- What is Tactical Asset Allocation Strategy?

- What is the Difference Between Strategic and Tactical Asset Allocations?

- How Tactical Asset Allocation Works

- Examples of Tactical Asset Allocation Portfolios

Ok, let’s dive in and learn more about tactical asset allocation.

What is Tactical Asset Allocation Strategy?

The tactical asset allocation, according to Investopedia, is:

“Tactical asset allocation is an active management portfolio strategy that shifts the percentage of assets held in various categories to take advantage of market pricing anomalies or strong market sectors.”

The tactical asset allocation strategy allows anyone managing money, portfolio managers, or ourselves, to create extra value by taking advantage of different situations in the market.

It is an active portfolio strategy because money moves from one asset to another to take advantage of opportunities when they arise. But once achieving our desired results, we move back towards our desired allocation.

When constructing an asset allocation portfolio, some investors focus on the individual choices, but a tactical asset allocation focuses on keeping the mix of assets ideal to their desired risk level.

The tactical asset allocation, or TAA, requires actively watching how different assets perform and adjust our allocations as needed.

Before we dive into the weeds on tactical asset allocation, let’s talk briefly about asset allocation.

The Basics of Asset Allocation

Asset allocation generally means portfolio diversification. The main goal of asset allocation is to maximize your portfolio while lessening your portfolio’s risk. Further, it includes tailoring and adjusting the growth potential of your portfolio and the risks to each investor.

Only you can decide what kind of risk you are willing to withstand and how you can sleep at night.

The choices you make concerning your portfolio’s makeup goes a long way towards any diversification you want or need. Many focus on stocks, but this also applies to bonds, cash, and any funds you choose.

If you decide that going the route of using funds, either mutual, index, or ETFs, the same rules apply, and the idea of diversification applies to choosing assets not related to each other.

To use an easy example, stocks such as Microsoft and Walmart are not related to each other, and if one goes down because of weakness in retail, for example, it is not likely to affect Microsoft.

There are five different assets:

- Stocks or equities

- Fixed income

- Cash

- Real Estate

- Commodities

When setting up your portfolio, you might consider a typical allocation of:

- Stocks – 65%

- Fixed Income – 20%

- Real Estate – 8%

- Commodities – 5%

- Cash – 2%

That is a starting point of many portfolios, but of course, each asset class has sub-categories.

The above portfolio is a tad aggressive because of the large allocation to stocks, and of course, the assets are adjustable according to your needs.

For example, if you want to dive deeper into each asset class, there are multiple avenues of exploration, such as large and small-cap stocks, tech or industrial, dividends or not, and many more.

Not to mention domestic focus or international exposure, and all of the same breakdowns suggest above.

The same applies to fixed income, with opportunities in corporate, treasury, international, municipal, and junk bonds.

Finally, if all those choices make your head spin, you can also choose one index fund or ETF to cover each asset class and call it a day.

First, the bottom line decides what asset allocation works for your needs and what risks you can tolerate. Next, decide how much effort you want to exert to maintain your portfolio because that choice will help guide your asset choices. Finally, choose which assets to fill each class and of you go.

What is the Difference Between Strategic and Tactical Asset Allocations?

There two main asset allocation approaches:

- Strategic asset allocation

- Tactical asset allocation

Let’s look at each one.

Strategic asset allocation

Strategic asset allocation is a method of holding a passive, diversified portfolio and not changing your asset allocations regardless of market conditions.

You stay put, add money regularly, and rebalance on an annual basis.

Simple, easy, and low maintenance.

Using this type of buy-and-hold passive investing is a great way to go for most people and is a great way to build wealth. In fact, Warren Buffett suggests most should follow this path.

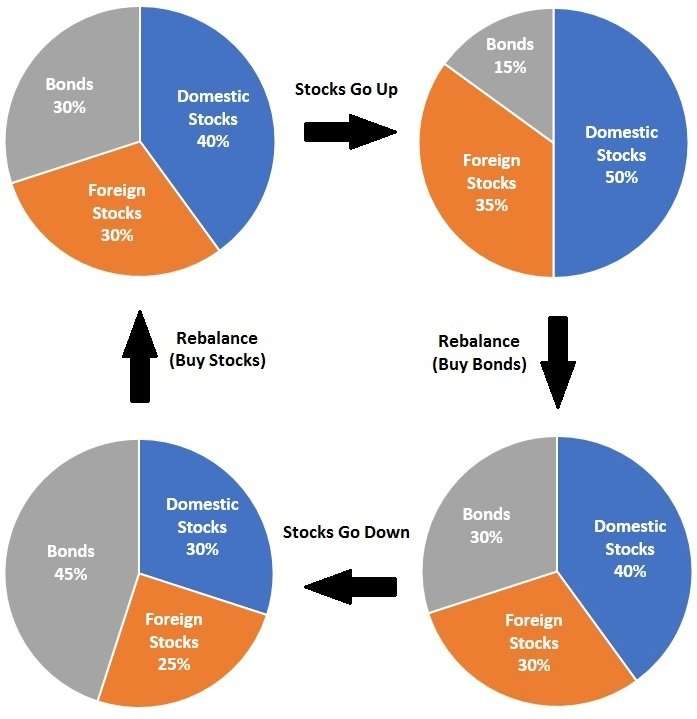

Charts courtesy of lynalden.com

The above charts best illustrate the evolution of a strategic asset allocation portfolio. When building a strategic asset portfolio, we create the portfolio built with index funds and ETFs, and we rebalance either quarterly, bi-annually, or annually.

Basically, we utilize the buy low and sell high strategy, which means that when one asset class rises, we sell portions of that asset to use those funds to purchase more of the lower assets.

Using this buying strategy or rebalancing allows for maintaining the desired asset mix and continued growth of the portfolio without increasing your risk tolerance.

Many young investors are encouraged to deploy an aggressive type of asset class mix, and as they age to adjust that mix to a more conservative mix as they approach retirement.

There are multiple avenues to get started with this type of strategy. Vanguard springs to mind, as they offer multiple asset allocation mixes you can choose. All of these allocations are pre-determined, and you choose and start adding money.

Others in this space include Betterment, Fidelity, Schwab, and Personal Capital. All the above offer pre-set asset allocations to choose from, plus they have available individual funds or ETFs for you to choose from if you want to go the do it yourself route.

Tactical Asset Allocation

On the other side of the equation, we have the tactical asset allocation. The main difference is this style of asset allocation is a far more hands-on type of approach.

We adjust our allocations to different asset classes in tactical asset allocation, depending on where we see an opportunity.

The advantage of this type of asset allocation is we can adjust our allocations when we see opportunities.

For example, if we see an asset class or sector with greater potential than normal, that is an opportunity. We can reduce our exposure in an asset class that is doing well, invest in undervalued assets, and take advantage of that weakness.

Once the troubled asset class or sector improves, we sell that position to return and reinvest at our previous allocation.

With the advent of no-fee trading among many brokerages, one of the many hindrances no longer remains, and it is even easier to utilize tactical asset allocation.

The advantages of both strategies enable you to mix and match any assets you choose.

Let’s take a look at how tactical asset allocation works.

How Tactical Asset Allocation Works

As an investor setting up a tactical asset allocation, we may arrive at a portfolio that matches our goals and risk tolerances. A moderate mix of assets for a starting portfolio might contain:

- 65% of stocks

- 30% of bonds

- 5% cash

The part of the allocation that makes this tactical is that the allocation will adjust depending on the current or expected market fluctuations or economic conditions.

Depending on these factors and our investment goals, allocating a specific asset (or more than one asset) can adjust over time. The assets may be structure like this:

- Neutral-weighted – perform at par with the market

- Overweighted – outperform the market

- Underweighted – underperforms the market

And depending on the allocation and its relation to the market, it goes a long way towards adjusting your allocations.

Let’s consider the following scenario. For example, we have a current asset allocation of 65/35/5 based on the above example.

That allocation is our target allocation and is “neutral-weighted.” Now let’s assume that the market conditions and economic situation changes and stocks rise in value, and the bull market appears to be maturing.

As investors, we think stocks are expensive, and a bear market is coming shortly. We may then decide to take steps to reduce our allocation to stocks and move away from the market risks and towards a more conservative allocation mix—for example, 50% stocks, 40% bonds, and 10% cash.

We have under-weighted stocks and over-weighted bonds and cash in the above scenario, all based on the target portfolio we created earlier.

We may choose to continue reducing our exposure to stocks and their risk as the bear market progresses, and a recession appears.

In fact, we may move to almost all bonds, and a reduced stock allocation as the bear market becomes more evident.

As the bear market progresses, we might slowly add to our stock positions as a tactical asset allocator as the opportunities present themselves. At the same time, doing all of this in anticipation of the next bull market.

Tactical Allocation vs Market Timing

An important note about tactical asset allocation, it is different from market timing in that it is a slow, methodical process that is done over longer periods. Where timing the market almost always entails more frequent trading or speculation.

Tactical asset allocation is an active investing style that utilizes both passive investing and buy and hold qualities. The investors using this style do not abandon asset types or investments; rather, they change their percentages or weightings to suit their needs.

Many investors or financial advisors use index funds or ETFs to achieve their goals, including those utilizing a tactical asset allocation strategy.

But these strategies allow for the use of individual stock purchases as well, especially if you are looking for values in different sectors or asset classes.

Undervaluation, trend following, or momentum investing are many of the different tools that investors can employ when using a tactical asset allocation strategy.

Depending on the style of investing you practice, you can bring those talents to bear on your investments. And with the elimination of trading fees, a major hurdle to this type of investment strategy is removed.

Ok, let’s look at some examples of the tactical asset allocation portfolios.

Examples of Tactical Asset Allocations Portfolios

As we mentioned earlier, many investors or financial advisors use index funds or ETFs for any asset allocation, strategic or tactical. The reason is the focus is on the asset allocation, not the particular investment itself.

For example, the index fund investor needs only to choose stock index funds, bond index funds, and money market funds. They are all set up where a stock investor has to pick a portfolio full of individual securities to build their portfolio.

The specific types of funds or securities can be broken into small components or made easier with categories such as:

- Large-cap stocks

- Foreign stocks

- Small-cap stocks

- Sector ETFs

Once choosing the sectors, the tactical asset allocator can now choose which sectors they believe will perform currently and in the near future.

For example, suppose we, as the investor, believe that real estate, technology, and healthcare will have superior returns than the other sectors in the coming years. In that case, we may buy ETFs focusing on those sectors.

Let’s look at an example using ETFs and index funds:

65% Stocks

- 25% S&P 500 Index

- 15% Foreign Stocks Index (MSCI)

- 5% Russell 2000 Index

- 5% Technology ETF

- 5% Real Estate ETF

- 5% Health ETF

30% Bonds

- 10% Short-term Treasuries

- 10% Municipal Bond Index

- 10% Long-term Corporate Bond Index

5% Cash

- 5% Money market fund

The above is a sample of a target asset allocation portfolio one could set up using different ETFs or index funds to meet the investor’s needs.

To change our tactical allocation, we would merely adjust the weights in any sector we wish to meet our needs. There is also the ability to add or subtract assets as the needs or opportunities arise. For example, you could reduce some of your stock allocations to add commodities such as gold.

As you can see from the above example, you could create millions of different combinations to fill your needs. It could be as simple as three investments using:

- 65% VTI

- Vanguard Total Stock Market ETF covers the whole gamut of the stock market from tech, industrials, and real estate.

- 30% BND

- Vanguard Total Bond Market ETF – which covers the entire bond market

- 5%

- Money market fund from your bank or brokerage account

Or you could diversify to the nth degree and choose 100 different stocks, bonds, precious metals, futures, in any combination you choose.

For example, if I wanted to build a portfolio representing the technology sector, I might include stocks such as:

- Microsoft

- AMD or Intel

- Cisco

That may be a little old school, but it encompasses cloud computing, semiconductor chips, and hardware necessary to run all the above. These are not recommendations but rather examples to illustrate looking at a bigger picture than the best stocks.

Another example might be creating a portfolio of financial stocks that would include:

- JP Morgan

- Moody’s

- Prudential

By utilizing these stocks, I cover the waterfront as far as financials, with a bank that also encompasses lending, a bond rating agency, and a life insurance/retirement investment firm.

These are simple examples of the mixing and matching you could use to fit your needs. If you like and are good at picking stocks for specific niches, you can go with that and then use index funds or ETFs to fill in the holes.

In my tactical asset allocation newsletter, Fat Pitch Fundamentals, I like to work with these allocations to use individual stocks to fit the different sectors’ roles and build my allocations as I build to my ideal portfolio size, which is around 20 positions.

Any more than that, and it starts to get too much to keep track of for me. Plus, that allows me the freedom to increase position sizing in sectors or stocks that will benefit me in the long run.

And on the fixed income side, I prefer to use bond index funds or ETFs as I am not a high-roller with the liquidity to fund individual bonds. Bond funds work just as well and offer me the flexibility that works for me.

The bottom line, use whatever investment vehicle that works best for you, not me or anyone else. Investing is not a competition; it is a means to an end, building wealth for retirement or whatever your goals.

Final Thoughts

Using the different asset allocation strategies we discussed today is one of the keys to investing. Focusing on establishing your plan should be the first order of business. Once you put the plan in place, then it is a matter of filling in the spaces.

Choosing stocks, bonds, ETFs, money market funds is the fun part of investing. But creating the asset allocation plan is the glue that holds it all together.

Tactical asset allocation is one of the methods, and if you are someone who likes to do it yourself, an investor or someone who wants more control over your investments, the tactical asset allocation might be the strategy for you.

Remember that picking uncorrelated stocks is the best way to avoid large losses in the stock market. Putting all your eggs in one basket, unless you know everything there is to know about that investment, is a sure way to lose everything.

Better to diversify and choose assets not related to each other and let the market do all the work. Buying wonderful companies at reasonable prices and holding them for the long term is the key to success, along with choosing the right asset allocation for you.

With that, we are going to wrap up today’s discussion.

As always, thank you for taking the time to read today’s post, and I hope you found something of value on your investing journey.

If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- How a Tactical Asset Allocation Plan Can Earn You More for Retirement A Tactical Asset Allocation plan is a plan that can allow you the opportunity to have a ton of success if implemented properly, but it...

- Strategic Asset Allocation: Unique in Nature, Critical for an Uncertain Future “You should have a strategic asset allocation mix that assumes that you don’t know what the future is going to hold.” Ray Dalio Today we...

- Why Diversification is Important in Investing (Timeless Principle) Diversification is important in investing because you don’t want a single mistake to destroy your portfolio. Even the best investors (and businesses) make mistakes, it’s...

- Using Motif Investing to Build a Great Dividend Portfolio Motif Investing isn’t just a great tool for saving money investing but it can also help you find the best stocks for your needs. This...