Updated 4/4/2024

Today’s marketplaces and finance industries are changing rapidly. The rise of eCommerce and Fintech disrupts how we buy and sell merchandise, car rides, banking, and groceries. With that rise come new terms that help us determine how profitable these companies are and how to define their pricing power.

The take rate has been around for a while, but the term has risen in popularity more recently with the rise of companies such as Paypal, Airbnb, Shopify, and Etsy. However, companies such as Visa, Mastercard, and American Express have used these terms to define their revenues for decades.

Defining the take rate and understanding its importance in Fintech and online marketplaces helps investors translate how these businesses, such as Amazon, eBay, and PayPal, generate revenues and grow their user bases.

For example, recognizing the strength of the online marketplaces, Paypal purchased Honey.com in 2019 to capture more take rates via the marketplaces and move beyond processing payments.

In today’s post, we will learn:

- What is a Take Rate?

- How is the Take Rate Calculated?

- The Importance of the Take Rate in eCommerce

- The Take Rate in Fintech

Okay, let’s dive in and learn more about the take rate.

What is a Take Rate?

A take rate is a fee a processor or merchant charges on a transaction, either by a third party like Amazon or a service provider like PayPal. Those take rates are the primary source of revenue for companies such as Paypal, Shopify, Etsy, eBay, and many more.

A simple formula for determining a company’s take rate is to divide the revenue generated from those fees by the total merchandise or transaction volume. More on this in a moment.

The take rate multiplied by the total volume transacted on the platform generates revenue for the company.

Take Rate * Total Volume = Revenue

For example, one of Shopify’s strengths is its ability to keep customers on its platform by allowing two-sided transactions. As a result, customers can shop and buy on Shopify’s platform, which generates revenue for the company from the fees to process the transaction and from the fees it generates from the merchants selling their wares on the platform.

The take rates differ across platforms. For example, Amazon and eBay charge anywhere between 5% and 20% on their marketplaces, fees they collect from their third-party sellers, which generate revenues for Amazon and eBay.

Service providers such as Airbnb and Uber charge 15-25% fees for their platforms, which they charge to the service provider, driver, or homeowner to generate revenues. These higher fees result from the lower transaction activities, compared to Shopify, for example.

The higher transaction frequencies, such as online merchants, Shopify, Amazon, and Etsy, can charge much lower take rates than Airbnb, which has far lower transaction frequencies.

Conventional businesses like Walmart don’t work with take rates; their revenues are more old-school. Instead, their income statements reflect buying inventory, stocking shelves, paying employees, and customers depleting the store’s inventories.

A company like Shopify is a different model. They sell and process their payments through an online portal that allows the customer and merchant to transact virtually, and all the fees from buying and selling flow to Shopify as their revenue.

To consider evaluating a company like Shopify, Etsy, Airbnb, Uber, or Paypal, we need to consider the Gross Merchant Volume (GMV) or Gross Payment Volume (GPV) to understand the generation of revenues. Considering both the GMV and GPV helps us understand how much activity occurs on their platforms, and the take rate tells us how much revenue they can capture from that volume.

The higher the volume on the platform, the greater the ability to grow revenues, which is why we need to look for GMV or GPV when searching the financial statements. Considering those metrics, take rates, and revenues will tell you how well the company performs.

How is the Take Rate Calculated?

The calculations to determine the take rate for service and merchant providers are simple divisions. The bigger challenge is finding the information in the company’s financials to make the calculations.

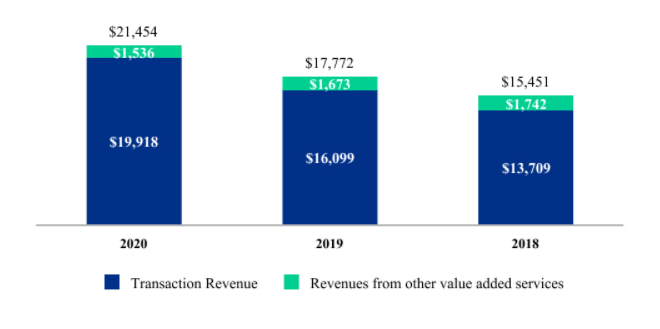

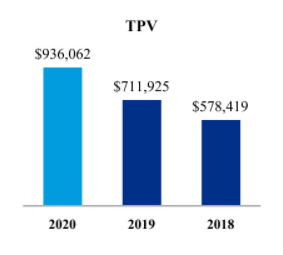

First, let’s look at Paypal’s take rate. I will use the data from the latest 10-k, dated December 31, 2020. I found the information using the “ctrl-f” function to search for Total Payment Volume (TPV). Both of these charts help us calculate the take rate.

Transaction revenues:

- 2020 = $21,454 million

- 2019 = $17,772 million

- 2018 = $15,451 million

Total payment volumes:

- $936,062 million

- $711,925 million

- $578,419 million

To determine the take rate for Paypal, we divide the net revenues by the total payment volume:

Take rate = net revenues / total payment volume.

Let’s look at Paypal’s take rate over the last three years:

|

Year |

Net revenue |

TPV |

Take Rate |

|

2020 |

21,454 |

936,062 |

2.29% |

|

2019 |

17,772 |

711,925 |

2.49% |

|

2018 |

15,451 |

578,419 |

2.67% |

Simple, huh?

Okay, let’s look at one from the merchant side. We will try Shopify next, and using their latest 6-f, dated April 28, 2021; we can determine Shopify’s take rate for their merchant processing segment.

The company lists the Gross Merchandise Volume by using our friend “ctrl-f” about 29 times in the filing. We find that Shopify facilitated over $37.3 billion in transactions on the site in the quarter, an increase of 114.4% over the year-ago quarter.

To determine Shopify’s take rate, we find that the company’s merchant revenues for the quarter were:

- $668 million

Gross Merchandise Volume = $37,346 million

- Take rate = 668 / 37,346 = 1.79%

That was an increase from the 1.62% take rate in the first quarter of 2020, which was:

- $282.4 million in merchant revenues

- 17,415 million in GMV

- Take rate = 282.4 / 17,415 = 1.62%

Now, let’s look at the take rate for Uber; we will use the numbers from the latest 10-k, dated March 1, 2021, and we will separate the main three drivers of revenue for the company by their take rates:

|

Segment |

Revenue |

Gross Bookings |

Take Rate |

|

Mobility |

$6,089 |

$26,614 |

22.87% |

|

Delivery |

$3,904 |

$21,314 |

18.32% |

|

Freight |

$1,011 |

$1,013 |

99.8% |

|

Total |

$11,139 |

$57,897 |

19.24% |

After all, we understand how to calculate the take rate for any merchant processor and service company. The biggest issue is determining the company’s metric to track the volume of transactions across its platform.

Keep in mind that the metrics, ratios, and numbers we are discussing are non-GAAP numbers, which means that no company is under any obligation to track these numbers to help investors determine profitability or growth drivers.

The Importance of the Take Rate in eCommerce

Online merchants like Amazon and eBay collect fees and commissions from third-party sellers, tracking their take rates. For example, eBay collects fees for listing products and services on its website, plus the final fees it collects from a successful sale.

The key issue with the take rate in online marketplaces is the yin and yang between maximizing profits and keeping customers on the network. If a company tries to increase its take rate, as eBay has done by increasing its take rates and final fees to gain a bigger piece of the pie. But doing so opened the door for companies like Etsy to move in, offer lower fees, and lure away the more cost-conscious customers.

When we examine the financial health of some of these online marketplaces, such as Amazon, Shopify, eBay, and Etsy, we should consider the gross merchandise volume and profitability of each segment.

Volume growth remains important because the more time the user spends on the platform, the greater the chances of revenue growth. If the company can create more user value, it can keep users on the platform.

One of Shopify and Etsy’s strengths is keeping users on the platform and deepening customer relationships by offering more products and functionality.

Focusing on volume growth helps monitor each company’s health, and tracking that volume growth will help you determine whether a platform remains healthy.

However, tracking the ratio of profits to the transaction volume figures is also directly proportionate to the take rate. By tracking the profit ratio, the company finds the right balance between income and revenue.

Keep in mind that there is a difference between types of online marketplaces. For example, Amazon, eBay, Shopify, and Etsy offer third-party transactions on their platforms, which allows all of these companies to generate revenues from both product buyers and sellers. These are two-sided marketplaces, and the platforms can grow their revenues quickly as the marketplace volumes grow.

That makes companies like Amazon and Shopify such strong business models, allowing them to grow rapidly. Shopify also generates revenues from its subscription services or recurring revenues from its merchants; it’s a brilliant business model.

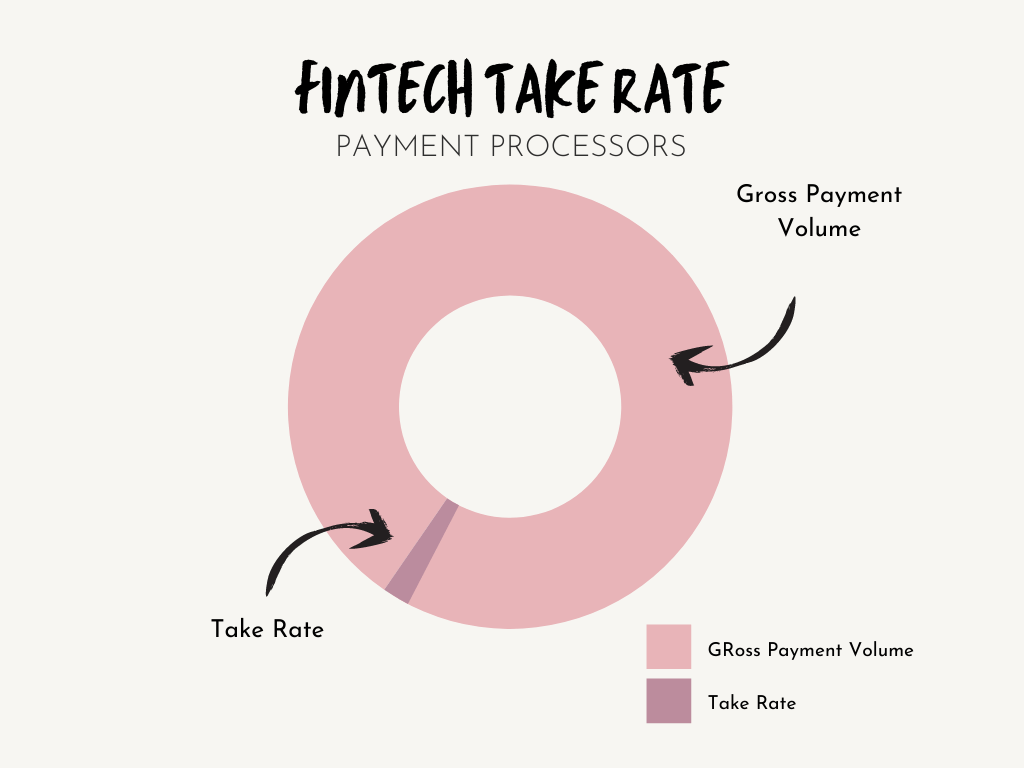

Take Rate and Fintech

The take rate idea is the same for Fintech. Companies such as Paypal, Square, Global Payments Network, Stripe, and Visa all take a percentage of each transaction to ease the transfer of money from a buyer to the seller.

Generally, the fee is taken from the merchant, who pays the merchant acquirer, handles the transaction, and the take rate fee. As a product buyer for $100, we don’t see the fee in our transaction, but the product seller only receives $97 for the product as the fees are paid to Paypal, Visa, and any other company processing the transaction.

The transaction’s take rate is 3%, but not all of it goes to Paypal. Others enable transactions that cut that percentage.

Below is a great example of how the whole process works via PayPal.

Because of competition, the take rate payment processors such as Paypal can charge varies on the type of transaction. For example, PayPal’s net take rate will differ depending on the funding source. If the customer uses a debit or credit card, Paypal has to use the card network, Visa or Mastercard, and bear the costs of using that network, reducing Paypal’s take rate. Paypal considers that when transacting other payments, the company won’t charge anything if they use their Paypal account or a bank account to transact. However, if they use a debit or credit card, they charge the customer 2.9% plus a $0.30 transaction fee. On the seller side, they pay 2.9%, plus the $0.30 transaction fee, regardless of the funding source, which is extra profit for PayPal.

Visa and Mastercard are the two most dominant players in fintech payment processing. They operate the payment rails for all card processors, or they are the gateways for all processors.

Neither company has actual credit cards or bank accounts; instead, they created a network that allows all payments to flow across that network between buyers, merchant processors, banks, and sellers.

Of course, depending on the type of transaction, they charge a fee for this gateway. However, these take rates are generally stable across the network and allow for stable processing. As of 2021, the average take rates for credit card processing are between 1.3% and 3.5%, depending on the type of transaction and network.

Merchants must agree to interchange fees (Visa and Mastercard), assessment, and processing fees for accepting credit card payments. These fees get split between the card’s issuing bank, payment network, and payment processor.

Although small individually, those fees make up large amounts as the network grows. That is why payment processors such as Square and Paypal get so much attention. Processors like Square have started banks to help grow the unbanked and allow easier payment options.

For example, Paypal recently announced they would raise their take rates for merchant payments to 3.49% plus $0.49 per transaction, up from 2.9% plus $0.30 per transaction. The next move is up to competitors Square and Stripe to follow suit or go lower.

Investor Takeaway

As we discovered, diving into the take rates for online marketplaces, service providers, and payment processors tells us a lot about the profitability and growth of the companies.

The competition and demand for these products and services grew exponentially during the pandemic, and many think that demand will continue long after as habits and patterns become the norm.

The take rate calculation itself remains quite simple. The biggest issue remains determining what to compare that revenue to. It is important to analyze its profit margin because of the correlation of those ideas.

Keep in mind that take rate, gross payment volume, and gross merchandise volume remain non-GAAP numbers, so there is little standardization. It might take a little hunting to find what you want, but we will find it if we look deep enough.

The take rate is also a great metric to track the strength of the company’s website volume and pricing power. Paypal is a great example of a strong company with a growing base that relies on its platform to move money. As someone who worked in banking for a while, I know how sticky banking or money platforms can become, as moving is painful.

As Paypal via Venmo becomes more relevant, it will grow the ability to continue to raise prices incrementally, which will grow its revenues.

These are all ideas and metrics when analyzing online merchants, payment processors, service providers, or companies using online networks to conduct business.

And with that, we will wrap up our discussion on take rates.

Thank you for reading today’s post. I hope you find some value in your investing journey. If I can be of any further assistance, please don’t hesitate to let me know.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- What is ARPU and How Does it Affect My Investments? ARPU is a term that a lot of companies use nowadays to try to breakdown some of their financial reporting ratios on a per user...

- How to Use Net Profit Ratio to Find a Worthy Investment “If you do good valuation work, the market will eventually agree with you.” –Joel Greenblatt There are many methods for determining a company’s profitability. The...

- Understanding Run Rate and Applying it to Your Stock Investing Strategy The term “Run Rate” is one that you quite possibly might have heard before, but many people do not know what it means. It is...

- Buffett’s 3 Categories of the Return on Invested Capital Formula “Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital...