The word tapering is getting mentioned a lot in the news these days as central banks are starting to tighten monetary policy. What does it mean when a central bank discusses tapering and how might it affect markets? What was the Taper Tantrum of 2013 I keep hearing being mentioned? This article will take a look at the meaning of tapering in finance and the story behind the saying “Taper Tantrum”.

Tapering in Finance

The word tapering has been used outside of finance to describe situations such as lightening a running routine before a marathon or slowly reducing the watering frequency of new grass. Tapering in general can be thought of as a word used to describe slowly withdrawing from a beneficial arrangement.

In finance, tapering has come to be associated with the removal of monetary policy. Stimulative monetary policy can take place in a number of ways and the Fed is always thinking up new creative ways to accomplish their goals. As the example on the Taper Tantrum of 2013 will discuss, the term first started being used to refer to the reduction in Treasury bond purchases which provided liquidity and financing to the economy.

How Tapering Effects Markets

Tapering of stimulative monetary policy is usually taking place because favorable economic trends are causing the economy to overheat. Tapering is being done to remove liquidity and lower both the availability and rates at which money can be borrowed. This will affect certain companies and industries more which are highly leveraged such as utilities, infrastructure, and real estate.

The effect tapering will have on markets depends on how markets are currently priced and what they are expecting. Higher risk-free interest rates from central banks directly affect valuations through higher cost of capital rates being used in discounted cash flow valuations.

Now that we know the meaning of the word taper in finance, let’s look back at the market reaction during the Taper Tantrum of 2013.

The “Taper Tantrum” of 2013

The saying “taper tantrum” was established in reference to the extreme reaction of investors to the U.S. Federal Reserve reducing the amount of Treasury bond purchases it was making which feed money into the economy. These bond purchases began after the 2008 financial crisis and weaning the economy off of their support was going to be hard to stomach.

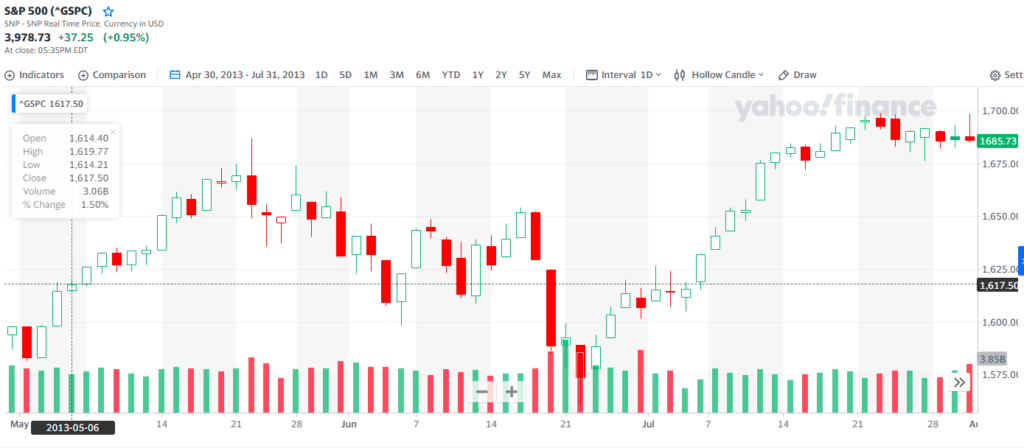

Upon discussions of the beginning reduction in monthly purchases, which was first mentioned by Bernanke on May 22, 2013 during questioning from the Congressional Joint Economic Committee, investors and market participants sent bond yields soaring and stock markets fell 5.6%. The market later recovered as the Fed calmed markets down by reassuring them that any decrease would be data-dependent.

Sourced from Yahoo Finance

Over the years of support, the Fed’s balance sheet grew to $3.04 trillion and was continuing to grow by $85 billion per month when the discussions of tapering began in May 2013. The Fed finally went on to taper its asset purchases during the December 17-18 policy meeting to $75 billion per month when its balance sheet was now a whopping $3.75 trillion.

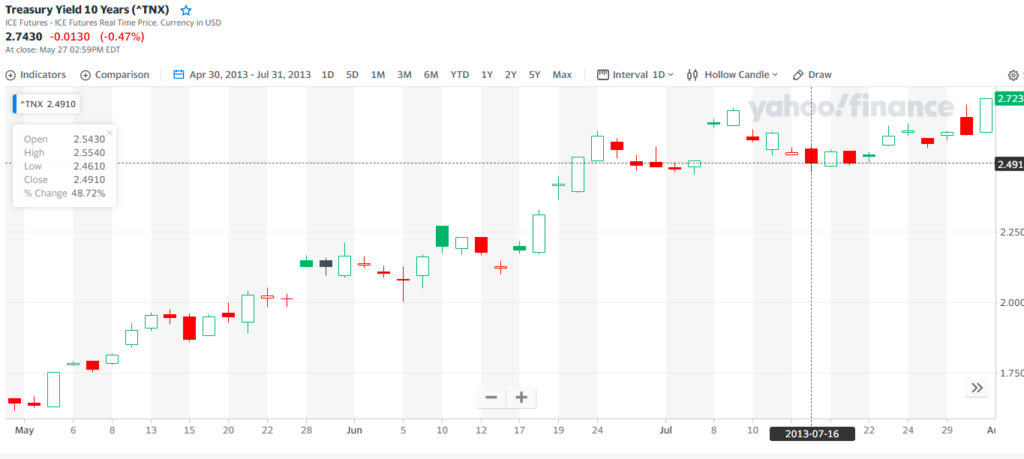

While the stock market had a relatively quick fall and recovery from the Taper Tantrum of 2013, the bond market tells a different story. The U.S. 10-year Treasury yields rose from 1.63% on May 1 to 2.72% as of July 31, as can be seen in the below graph. What’s interesting from this look back is that the bond market was already signaling less stimulative monetary policy.

Sourced from Yahoo Finance

Takeaway for Investors

Tapering in finance is associated with a reduction in monetary stimulus, particularly when it comes to the central bank reducing bond purchases. The effect of tapering on markets depends on what the market is currently priced for and expecting. Tapering will generally lead to higher risk-free interest rates which will drive down valuations across markets. Keep in mind that tapering is probably happening because the economy is strong and business is booming.

For investors interested in a pre-built financial model where they can punch in the financial data of any company of interest and update for a changing cost of capital, readers can check out our financial model and valuation template called the IFB Equity Model available on our Products page!

Related posts:

- The Best Way to Invest in Insurance Companies: How to Analyze Their Stocks Insurance, one of the necessary evils of today’s world, right? We all have to have it in case of that one day you will need...

- Understanding the Commercial Banking Industry – A Simple Guide Updated 1/5/2024 “Banking is a very good business if you don’t do anything dumb.” Warren Buffett The banking industry is an unknown entity to most...

- Embedded Finance: The Services Revolutionizing the Financial Industry Updated 9/27/2023 The coronavirus pandemic accelerated businesses’ decisions about payments and how they would accept payments easily for both consumers and the business. These decisions...

- Fintech 101: Intro to Financial Technology Updated 12/19/2023 Fintech or financial technology describes new tech that seeks to enable and improve financial services. Despite the uptick in fintech and how we...